-

State Tax Forms

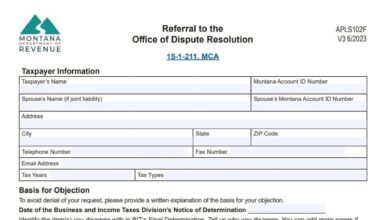

Montana Form AC-101

Montana Form AC-101 is an official document utilized by taxpayers to formally appeal a final determination made by the Department…

-

Individual Taxpayer Forms

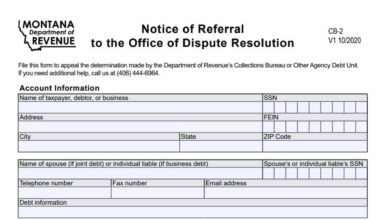

Montana Form CB-2

Montana Form CB-2 is the Notice of Referral to the Office of Dispute Resolution. This form is used to appeal…

-

State Tax Forms

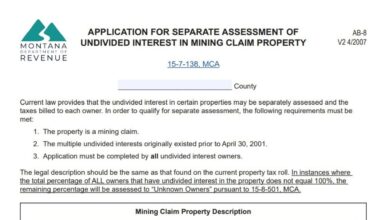

Montana Form AB-8

Montana Form AB-8 is the Application for Separate Assessment of Undivided Interest in Mining Claim Property. This form allows owners…

-

State Tax Forms

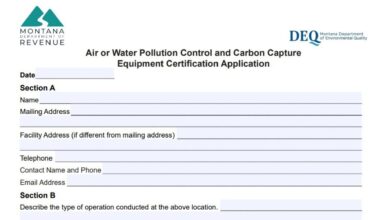

Montana Form CAB-2

Montana Form CAB-2 is the Air or Water Pollution Control and Carbon Capture Equipment Certification Application. This form is used…

-

State Tax Forms

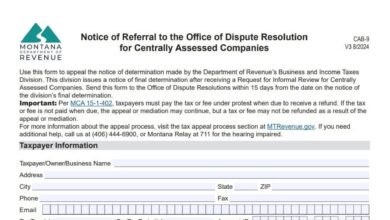

Montana Form CAB-9

Montana Form CAB-9 functions as the official Notice of Referral to the Office of Dispute Resolution specifically tailored for centrally…

-

State Tax Forms

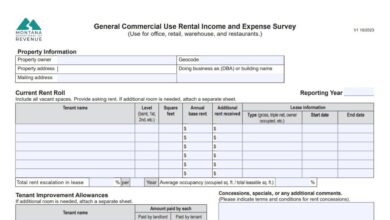

Montana Form IE-GEN

Montana Form IE-GEN serves as the General Commercial Use Rental Income and Expense Survey, designed specifically for income-producing commercial properties…

Business Tax Forms

-

Business Tax Forms

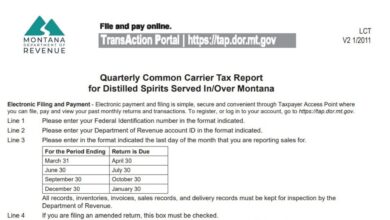

Montana Form LCT

For airlines, railroads, and other common carriers, serving a drink to a passenger while crossing state lines involves specific tax…

-

Business Tax Forms

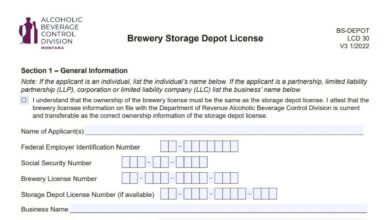

Montana Form BS-DEPOT

Form BS-DEPOT, the “Brewery Storage Depot License Application,” is a state document used by licensed Montana breweries to apply for…

-

Business Tax Forms

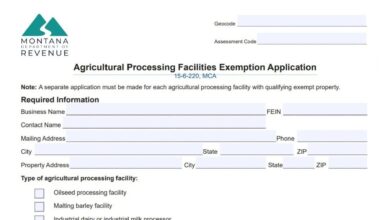

Montana Agricultural Processing Facilities Exemption Form

The Agricultural Processing Facilities Exemption Application is a specialized tax form administered by the Montana Department of Revenue. It allows…

Individual Taxpayer Forms

-

Individual Taxpayer Forms

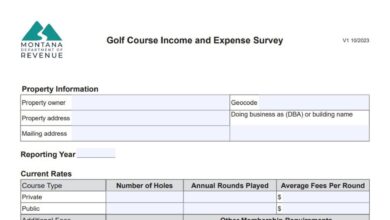

Montana Form IE-GOLF

Montana Form IE-GOLF is the Golf Course Rental Income and Expense Survey used by the Montana Department of Revenue to…

-

Individual Taxpayer Forms

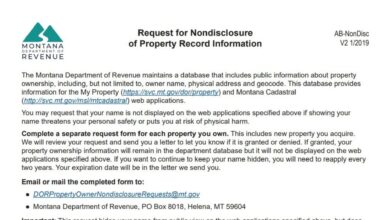

Montana Form AB-NonDisc

In an age where digital privacy is increasingly scarce, Montana property owners have a specific tool to help protect their…

-

Individual Taxpayer Forms

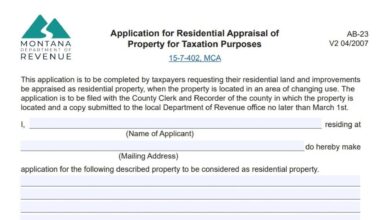

Montana Form AB-23

Montana Form AB-23 is a specialized property tax application used by homeowners whose residential property is located in an area…

-

Individual Taxpayer Forms

Montana Form RTC

Montana Form RTC (Realty Transfer Certificate) is a required, confidential tax document used to report a transfer of real property…

-

Business Tax Forms

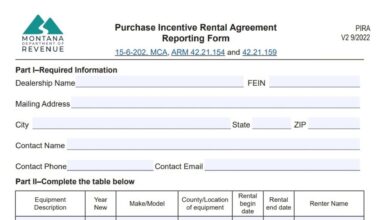

Montana Form PIRA

Montana Form PIRA is an annual report required under Montana law for farm implement and construction equipment dealers who rent…

-

Individual Taxpayer Forms

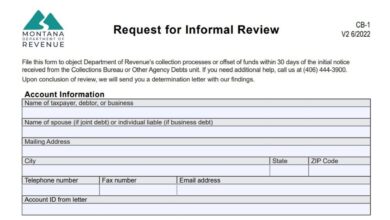

Montana Form CB-1

Montana Form CB-1, or “Request for Informal Review,” is the official document used to formally object to the collection actions…

-

Individual Taxpayer Forms

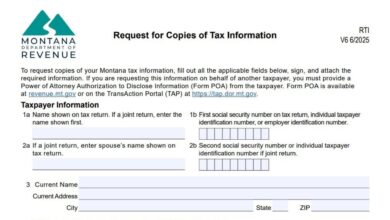

Montana Form RTI

Montana Form RTI is a formal request document submitted to the Montana Department of Revenue by individuals or their authorized…

-

Business Tax Forms

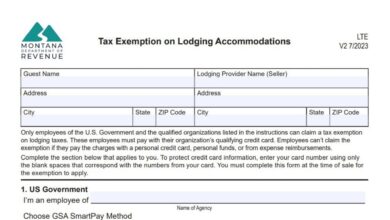

Montana Form LTE

Montana Form LTE, “Tax Exemption on Lodging Accommodations,” is a specialized certificate used by hotel and lodging operators to validate…

-

Individual Taxpayer Forms

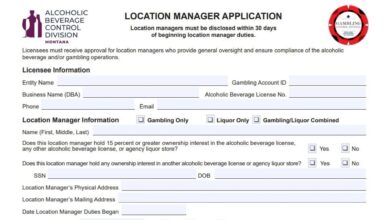

Montana Location Manager Application Form 30A

If you operate a licensed establishment in Montana that sells alcoholic beverages or offers gambling, obtaining approval for your location…

-

Individual Taxpayer Forms

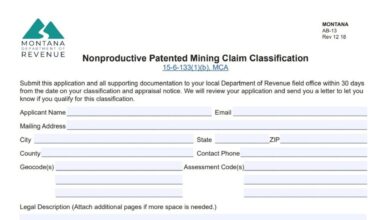

Montana Form AB-13

The Montana Department of Revenue uses Form AB-13, officially titled the Nonproductive Patented Mining Claim Classification (Rev 12 18), to…

-

Individual Taxpayer Forms

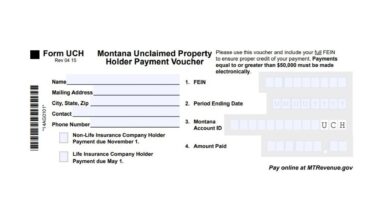

Montana Form UCH

If you are a business holding unclaimed property—such as dormant bank accounts, uncashed payroll checks, or forgotten insurance policies—you have…

-

Business Tax Forms

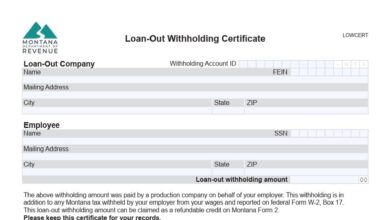

Montana Form LOWCERT

The Montana Loan-Out Withholding Certificate, often referred to as Form LOWCERT, is a critical tax document used in the film…

-

Individual Taxpayer Forms

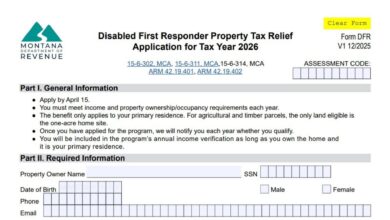

Montana Form DFR

Montana Form DFR, officially the Disabled First Responder Property Tax Relief Application, is the form used to apply for a…

-

Individual Taxpayer Forms

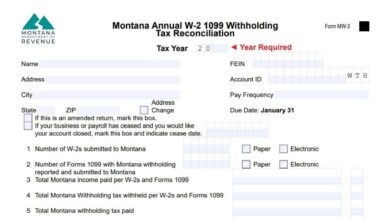

Montana Form MW-3

Montana Form MW-3, titled the Annual W-2 1099 Withholding Tax Reconciliation (Version V4 11/2025), is the state’s mandatory end-of-year “true…

-

Business Tax Forms

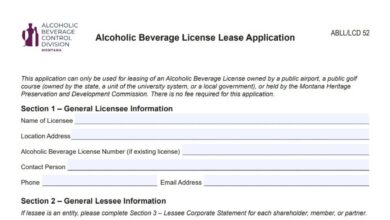

Montana Alcoholic Beverage License Lease Application Form

The Montana Alcoholic Beverage License Lease Application, identified as form ABLL/LCD 52, is a specialized document utilized for leasing liquor…

-

Individual Taxpayer Forms

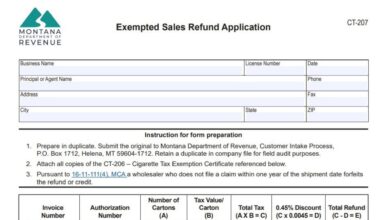

Montana Form CT-207

The Montana Exempted Sales Refund Application (CT-207) is used by wholesalers who want to claim a refund for taxes paid…

-

Individual Taxpayer Forms

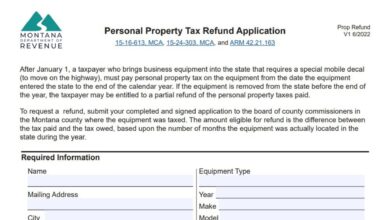

Montana Personal Property Tax Refund Application Form

The Montana Personal Property Tax Refund Application is for taxpayers who have paid personal property tax on equipment brought into…

-

Individual Taxpayer Forms

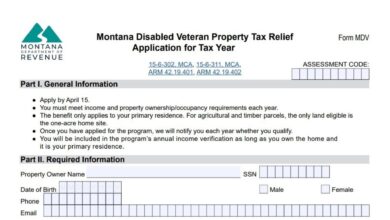

Montana Disabled Veteran Property Tax Relief Application Form

The Montana Disabled Veteran Property Tax Relief Application Form is used by disabled veterans or the surviving spouses of deceased…

-

Individual Taxpayer Forms

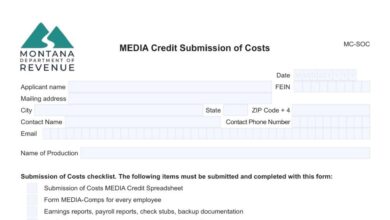

Montana MC-SOC Form

Form MC-SOC serves as the essential checklist and cover sheet for submitting detailed cost documentation when applying for Montana’s MEDIA…

-

Individual Taxpayer Forms

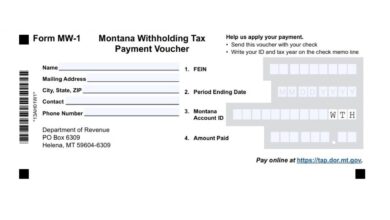

Montana Form MW-1

Montana Form MW-1 (Montana Withholding Tax Payment Voucher) is a simple remittance form used by employers and other withholding agents…

-

Individual Taxpayer Forms

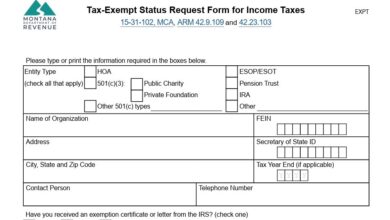

Montana Form EXPT

The Montana Form EXPT, officially titled the “Tax-Exempt Status Request Form for Income Taxes,” is a critical document used by…

-

Individual Taxpayer Forms

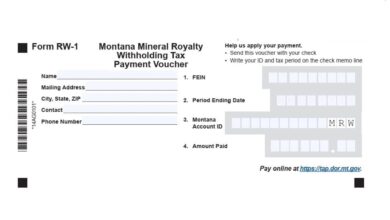

Montana Form RW-1

The Montana Mineral Royalty Withholding Tax Payment Voucher Form RW-1 is an essential form used by taxpayers who are required…

-

Individual Taxpayer Forms

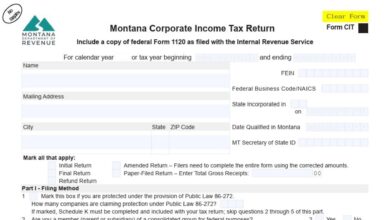

Montana Form CIT

The Montana Corporate Income Tax Return (Form CIT) is a state-level tax form required for corporations conducting business in Montana.…

-

Individual Taxpayer Forms

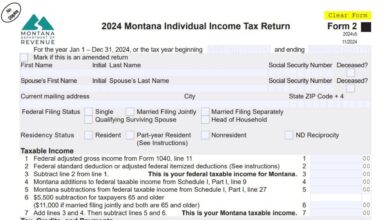

Montana Form 2

Montana Form 2, officially titled the Montana Individual Income Tax Return, is the primary state tax form used by Montana…

-

Individual Taxpayer Forms

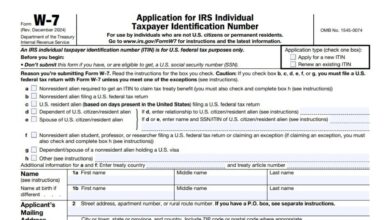

Form W-7

The IRS Form W-7, officially titled Application for IRS Individual Taxpayer Identification Number (ITIN), is used by individuals who are…

-

Individual Taxpayer Forms

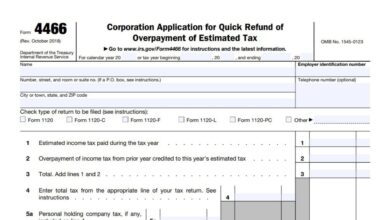

Form 4466

Form 4466 allows corporations that overpaid their estimated income tax during a tax year to apply for a quick refund…

-

Individual Taxpayer Forms

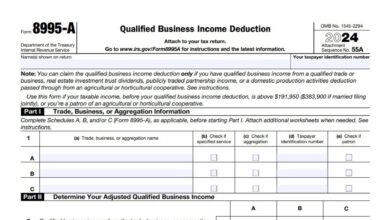

Form 8995-A

Form 8995-A, “Qualified Business Income Deduction,” is used to determine the QBI deduction for taxpayers whose taxable income exceeds certain…

-

Individual Taxpayer Forms

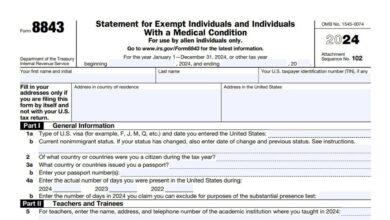

Form 8843

IRS Form 8843 is an important U.S. tax document required for certain alien individuals present in the United States. The…

-

Individual Taxpayer Forms

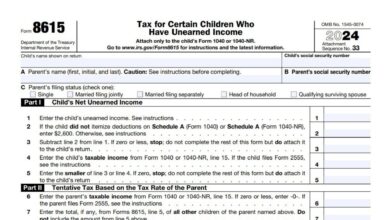

Form 8615

IRS Form 8615, known as the “Kiddie Tax” form, applies to children who have unearned income above a certain threshold.…

-

Individual Taxpayer Forms

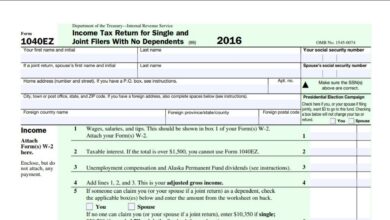

Form 1040-EZ

IRS Form 1040-EZ is the simplest federal income tax return form designed for taxpayers with straightforward tax situations. It’s ideal…

-

Individual Taxpayer Forms

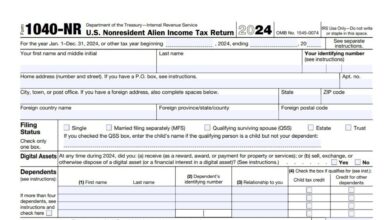

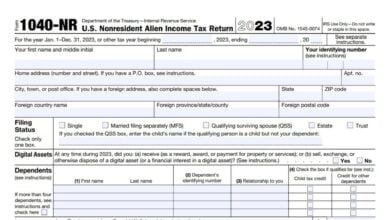

Form 1040-NR

IRS Form 1040-NR, U.S. Nonresident Alien Income Tax Return, is the official document used by nonresident aliens who have received…

-

Individual Taxpayer Forms

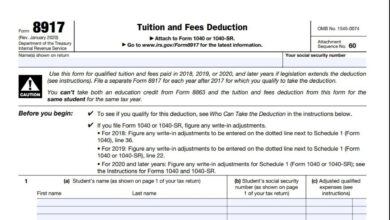

Form 8917

IRS Form 8917, officially titled “Tuition and Fees Deduction,” is a tax form that allows eligible taxpayers to deduct qualified…

-

Individual Taxpayer Forms

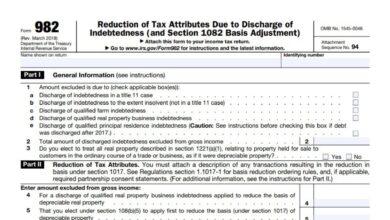

Form 982

IRS Form 982, “Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment),” is a specialized…

-

Individual Taxpayer Forms

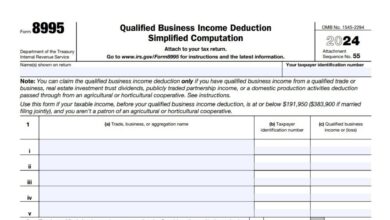

Form 8995

IRS Form 8995, titled “Qualified Business Income Deduction Simplified Computation,” is a tax form used by eligible taxpayers to calculate…

-

Individual Taxpayer Forms

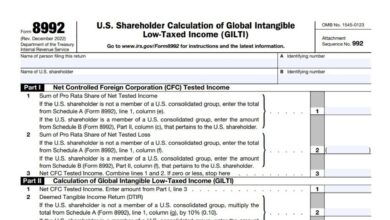

Form 8992

IRS Form 8992, titled “U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI),” is a tax form required for U.S.…

-

Individual Taxpayer Forms

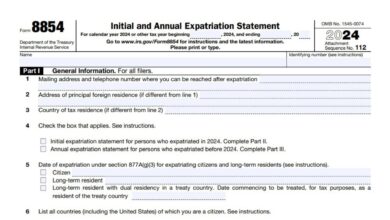

Form 8854

IRS Form 8854, officially titled the “Initial and Annual Expatriation Statement,” is a mandatory tax form for U.S. citizens who…

-

Individual Taxpayer Forms

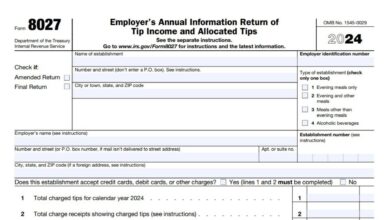

Form 8027

IRS Form 8027 is an annual information return filed by employers in the food and beverage industry to report tip…

-

Individual Taxpayer Forms

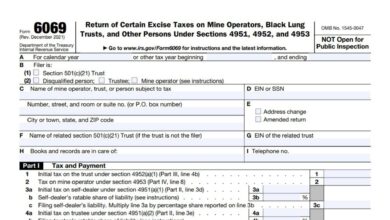

Form 6069

IRS Form 6069, officially titled “Return of Certain Excise Taxes on Mine Operators, Black Lung Trusts, and Other Persons Under…

-

Individual Taxpayer Forms

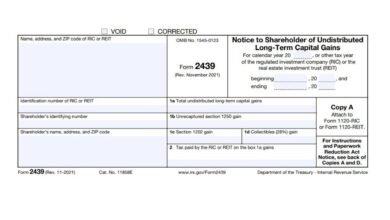

Form 2439

IRS Form 2439, titled Notice to Shareholder of Undistributed Long-Term Capital Gains, is a tax form used by Regulated Investment…

-

Individual Taxpayer Forms

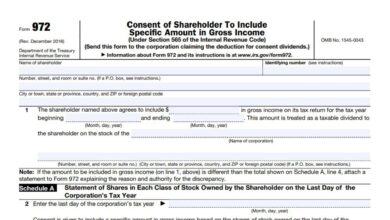

Form 972

IRS Form 972, “Consent of Shareholder To Include Specific Amount in Gross Income,” is a tax form used by shareholders…

-

Individual Taxpayer Forms

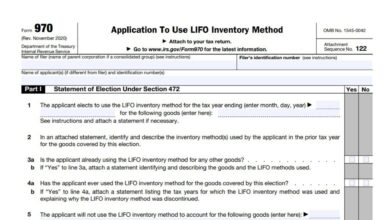

Form 970

IRS Form 970, “Application To Use LIFO Inventory Method,” is used by businesses and individuals to formally elect the Last-In,…

-

Individual Taxpayer Forms

Form 8288-A

IRS Form 8288-A is a mandatory attachment to Form 8288 that documents federal income tax withheld under sections 1445 (FIRPTA…

-

Individual Taxpayer Forms

Form 8288

IRS Form 8288, officially titled “U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests,” is…

-

Individual Taxpayer Forms

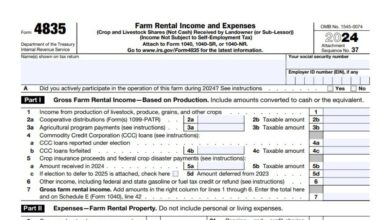

Form 4835

IRS Form 4835 is used by landowners or sub-lessors who receive farm rental income from crops or livestock produced by…

-

Individual Taxpayer Forms

Form 6781

IRS Form 6781, titled “Gains and Losses from Section 1256 Contracts and Straddles,” is a tax form used by investors…

Employment and Payroll Tax Forms

-

Employment and Payroll Tax Forms

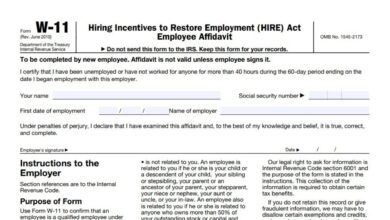

Form W-11

IRS Form W-11, also known as the Employee Affidavit under the Hiring Incentives to Restore Employment (HIRE) Act, is a…

-

Employment and Payroll Tax Forms

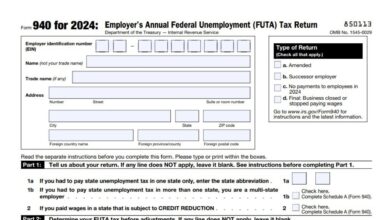

Form 940

IRS Form 940, officially titled “Employer’s Annual Federal Unemployment (FUTA) Tax Return,” is used by employers to report and pay…

-

Employment and Payroll Tax Forms

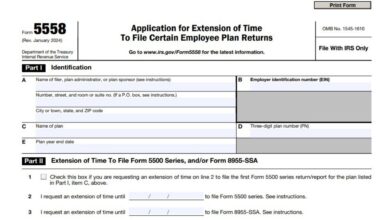

Form 5558

Form 5558, Application for Extension of Time to File Certain Employee Plan Returns, is used by plan administrators and certain…

-

Employment and Payroll Tax Forms

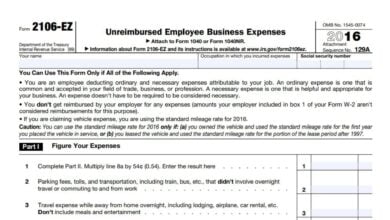

Form 2106-EZ

Form 2106-EZ, Unreimbursed Employee Business Expenses, is an essential document for employees who incur work-related expenses that are not reimbursed…

-

Business Tax Forms

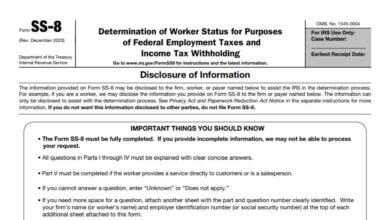

Form SS-8

Worker classification—whether a worker is an employee or an independent contractor—has significant tax implications for both the worker and the…

-

Employment and Payroll Tax Forms

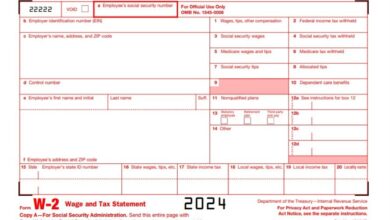

Form W-2

IRS Form W-2, Wage and Tax Statement, is a form that employers provide to employees and the IRS to report…

-

Employment and Payroll Tax Forms

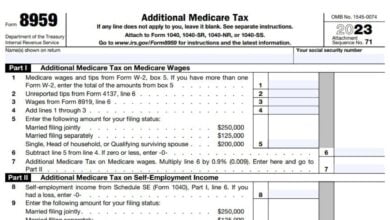

Form 8959

IRS Form 8959, Additional Medicare Tax, is used by taxpayers to calculate and report the additional 0.9% Medicare tax on…

-

Employment and Payroll Tax Forms

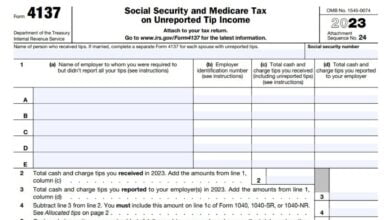

Form 4137

Form 4137 is a tax form you must complete along with your federal income tax return. It should be submitted by…

-

Employment and Payroll Tax Forms

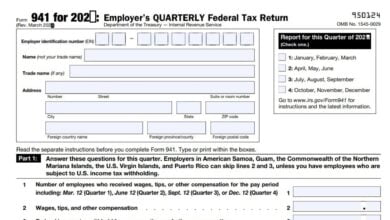

Form 941

Form 941, also known as the Employer’s Quarterly Federal Tax Return, is a tax form that is required to be…

Estate, Gift, and Trust Tax Forms

-

Estate, Gift, and Trust Tax Forms

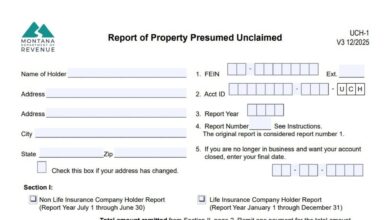

Montana Form UCH-1

Form UCH-1 is used by holders to report unclaimed property—any financial asset where an owner hasn’t generated activity during a…

-

Estate, Gift, and Trust Tax Forms

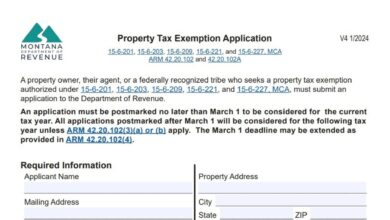

Montana Property Tax Exemption Application Form

Applying for a property tax exemption in Montana can significantly reduce the financial burden on qualifying organizations, but the process…

-

Estate, Gift, and Trust Tax Forms

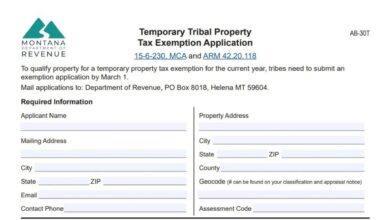

Montana Form AB-30T

Montana Form AB-30T is the state’s application a tribe uses to request a temporary property tax exemption for the current…

-

Estate, Gift, and Trust Tax Forms

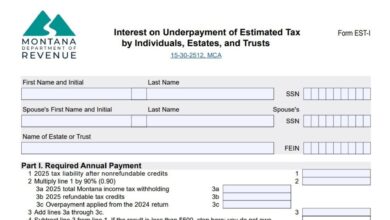

Montana Form EST-I

Montana Form EST-I, formally known as the Estate Tax Information Form, is an essential document required by the Montana Department…

-

Estate, Gift, and Trust Tax Forms

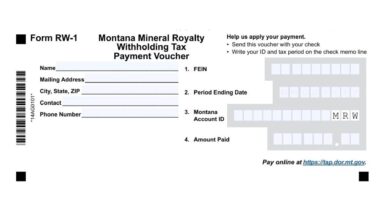

Montana Form RW-1

Montana Form RW-1, officially titled the Mineral Royalty Withholding Tax Payment Voucher, is a specific remittance document used by remitters…

-

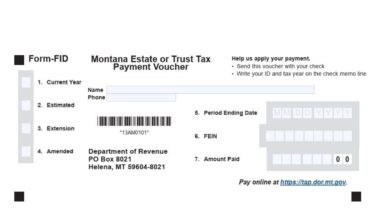

Estate, Gift, and Trust Tax Forms

Montana Form FID

The Montana Estate or Trust Tax Payment Voucher Form FID is a document used by taxpayers to submit payments for…

-

Estate, Gift, and Trust Tax Forms

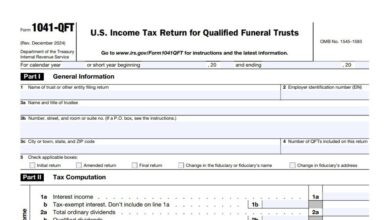

Form 1041-QFT

IRS Form 1041-QFT is the U.S. Income Tax Return for Qualified Funeral Trusts. This special tax form is designed specifically…

-

Estate, Gift, and Trust Tax Forms

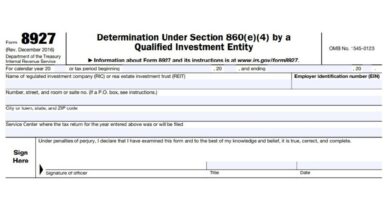

Form 8927

IRS Form 8927, officially titled “Determination Under Section 860(e)(4) by a Qualified Investment Entity,” is a tax document used by…

-

Estate, Gift, and Trust Tax Forms

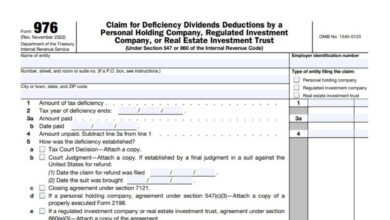

Form 976

IRS Form 976 is used by personal holding companies (PHCs), regulated investment companies (RICs), and real estate investment trusts (REITs)…

-

Estate, Gift, and Trust Tax Forms

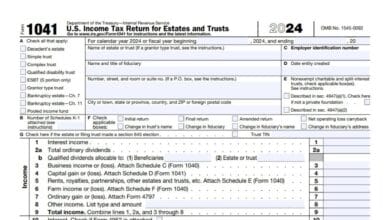

Form 1041

IRS Form 1041 is the U.S. Income Tax Return for Estates and Trusts. This form is used to report income,…

-

Estate, Gift, and Trust Tax Forms

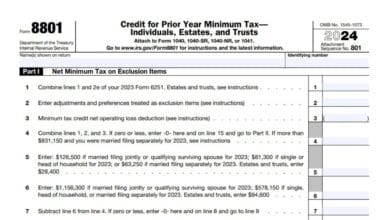

Form 8801

IRS Form 8801 is designed for individuals, estates, and trusts to claim a credit for the prior year’s Alternative Minimum…

-

Estate, Gift, and Trust Tax Forms

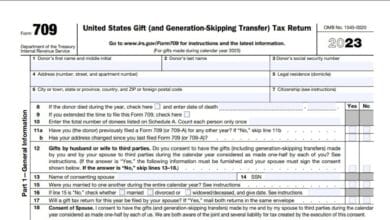

Form 709

Form 709 must be filed by individuals who make taxable gifts that exceed the annual exclusion amount or who make…

-

Estate, Gift, and Trust Tax Forms

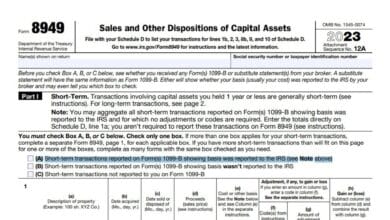

Form 8949

Form 8949 is used to report the sale or exchange of capital assets, including stocks, bonds, real estate, and other…

-

Estate, Gift, and Trust Tax Forms

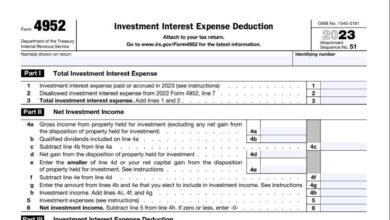

Form 4952

Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this…

-

Estate, Gift, and Trust Tax Forms

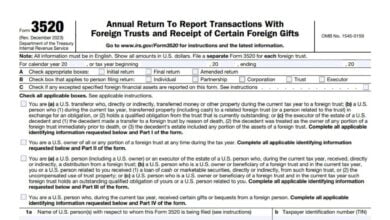

Form 3520

Form 3520 is used to report various transactions with foreign trusts and large foreign gifts, providing the IRS with information…

-

Estate, Gift, and Trust Tax Forms

Form 1098

Form 1098, Mortgage Interest Statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders.…

-

Estate, Gift, and Trust Tax Forms

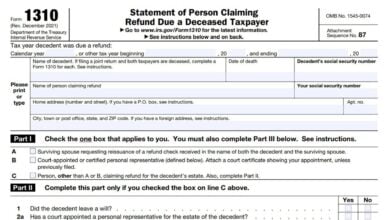

Form 1310

When someone dies, many things need to be handled, including their estate and any taxes that may have been withheld.…

Information Reporting Forms

-

Information Reporting Forms

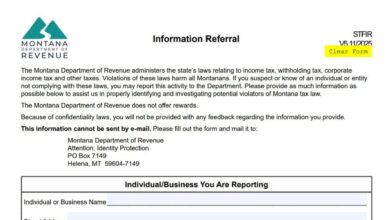

Montana Form STFIR

Tax laws are the foundation of public services, and when individuals or businesses evade them, it harms everyone in the…

-

Information Reporting Forms

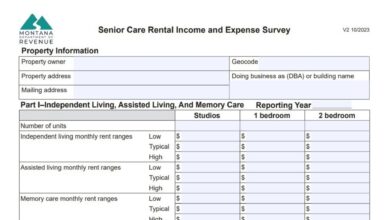

Montana Form IE-NH

For owners of senior care facilities in Montana, ensuring your property is accurately assessed requires transparent reporting of your financial…

-

Information Reporting Forms

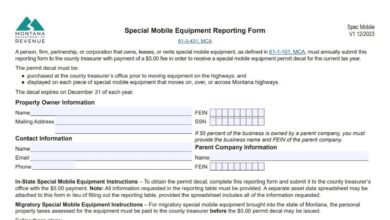

Montana Special Mobile Equipment Reporting Form

The Montana Special Mobile Equipment Reporting Form is a mandatory declaration filed annually by individuals or businesses that own, lease,…

-

Information Reporting Forms

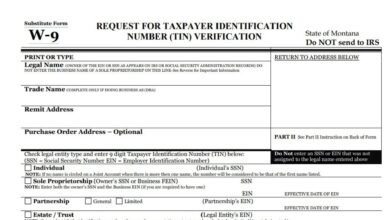

Montana Substitute Form W-9

The Montana Substitute Form W-9 is a specific tax document used by the State of Montana to request and verify…

-

Information Reporting Forms

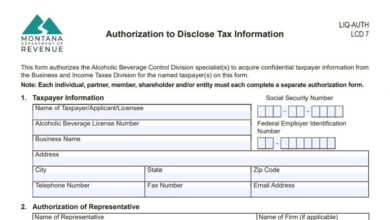

Montana Authorization to Disclose Tax Information Form

The Montana Authorization to Disclose Tax Information Form allows the Alcoholic Beverage Control Division (ABCD) to access confidential taxpayer information…

-

Information Reporting Forms

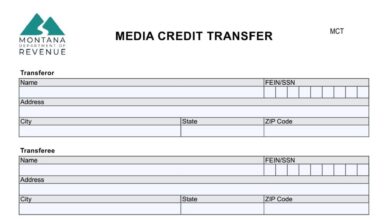

Montana MCT Form

Form MCT, or Media Credit Transfer form, is a mandatory notification document used by the Montana Department of Revenue to…

-

Information Reporting Forms

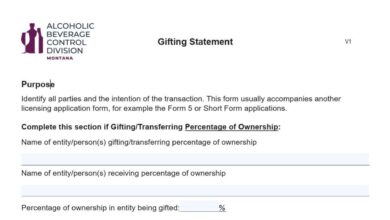

Montana Gifting Statement Form

The Montana Gifting Statement Form is an official document issued by the Montana Department of Revenue’s Alcoholic Beverage Control Division…

-

Information Reporting Forms

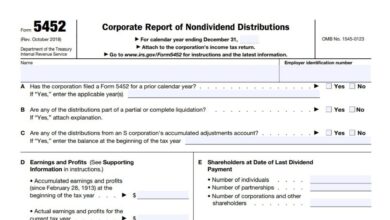

Form 5452

Form 5452 is used by corporations to report nondividend distributions made to shareholders during the tax year. Nondividend distributions occur…

-

Information Reporting Forms

Form 2220

IRS Form 2220, titled “Underpayment of Estimated Tax by Corporations,” is a form used by corporations to calculate and report…

-

Information Reporting Forms

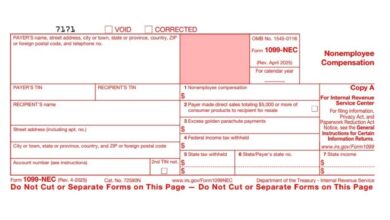

Form 1099-NEC

IRS Form 1099-NEC reports nonemployee compensation paid during the calendar year to independent contractors, freelancers, sole proprietors, partnerships, attorneys, and…

-

Information Reporting Forms

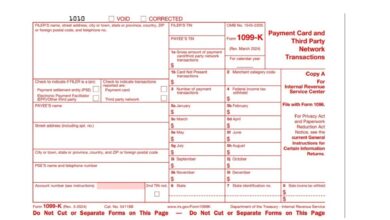

Form 1099-K

IRS Form 1099-K, Payment Card and Third Party Network Transactions, is an information return used by payment settlement entities such…

-

Information Reporting Forms

Form 1099-DIV

IRS Form 1099-DIV reports dividends and other distributions paid to investors, including ordinary dividends, qualified dividends, capital gain distributions, nondividend…

-

Information Reporting Forms

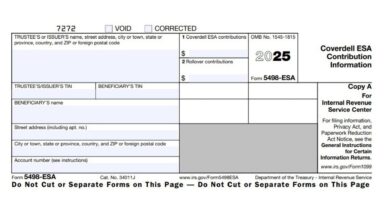

Form 5498-ESA

Form 5498-ESA, titled “Coverdell ESA Contribution Information,” is an IRS form used by trustees or issuers of Coverdell Education Savings Accounts (ESAs) to report contributions and rollover contributions made to these accounts during the…

-

Information Reporting Forms

Form 1099-OID

Form 1099-OID, or Original Issue Discount Statement, is an IRS information return used to report original issue discount (OID) income…

-

Information Reporting Forms

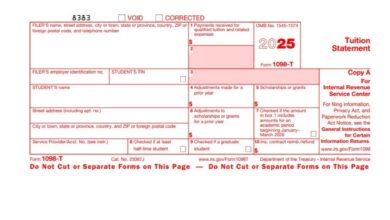

Form 1098-T

Form 1098-T, also known as the Tuition Statement, is an IRS information return issued by eligible educational institutions to report…

-

Information Reporting Forms

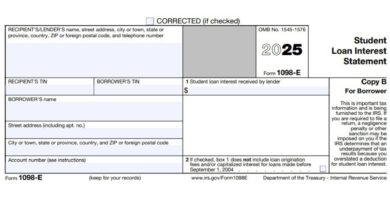

Form 1098-E

Form 1098-E, titled “Student Loan Interest Statement,” is an official IRS document used by lenders to report the amount of…

-

Information Reporting Forms

Form W-12

IRS Form W-12 is the official form used to apply for or renew a Paid Preparer Tax Identification Number (PTIN).…

-

Information Reporting Forms

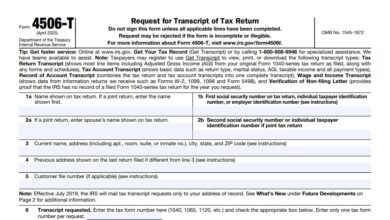

Form 4506-T

IRS Form 4506-T, also known as the Request for Transcript of Tax Return, allows individuals and businesses to request tax…

-

Information Reporting Forms

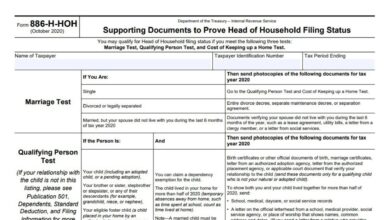

Form 886-H-HOH

IRS Form 886-H-HOH, titled “Supporting Documents to Prove Head of Household Filing Status,” is a supplemental form that the IRS…

-

Information Reporting Forms

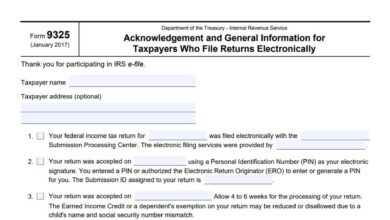

Form 9325

IRS Form 9325 is a confirmation and general information document issued by the Internal Revenue Service (IRS) to taxpayers who…

-

Information Reporting Forms

Form 8891

IRS Form 8891, U.S. Information Return for Beneficiaries of Certain Canadian Registered Retirement Plans, is a disclosure and tax reporting…

-

Information Reporting Forms

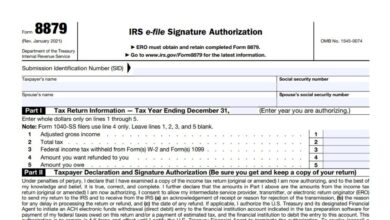

Form 8879

IRS Form 8879, IRS e-file Signature Authorization, is the declaration and signature authorization taxpayers use to approve the electronic filing…

-

Information Reporting Forms

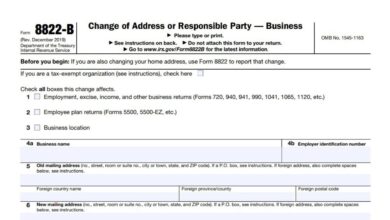

Form 8822-B

IRS Form 8822-B, titled “Change Of Address Or Responsible Party — Business,” is an important form used to notify the…

-

Information Reporting Forms

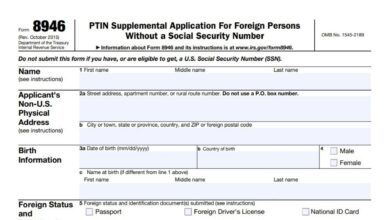

Form 8946

IRS Form 8946, officially titled “PTIN Supplemental Application For Foreign Persons Without a Social Security Number,” is a specialized tax…

-

Information Reporting Forms

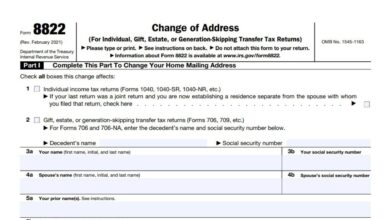

Form 8822

IRS Form 8822 is the official “Change of Address” form that taxpayers use to notify the Internal Revenue Service when…

-

Information Reporting Forms

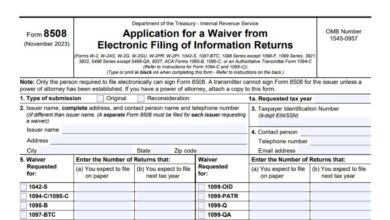

Form 8508

IRS Form 8508, “Application for a Waiver from Electronic Filing of Information Returns,” is a critical form for businesses and…

-

Information Reporting Forms

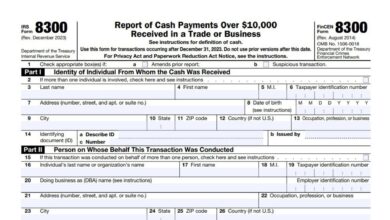

Form 8300

IRS Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business, is a joint IRS/FinCEN reporting…

-

Information Reporting Forms

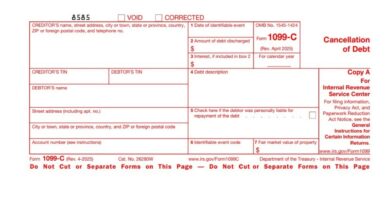

Form 1099-C

IRS Form 1099-C, Cancellation of Debt, is a federal tax document issued by lenders or financial entities to report canceled…

-

Information Reporting Forms

Form 12661

IRS Form 12661, officially titled “Disputed Issue Verification,” is used by taxpayers to formally contest specific findings of an IRS…

-

Information Reporting Forms

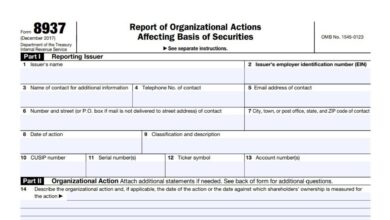

Form 8937

IRS Form 8937, “Report of Organizational Actions Affecting Basis of Securities,” is an official document required by the Internal Revenue…

-

Information Reporting Forms

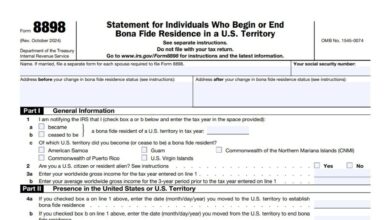

Form 8898

Form 8898 is a statement for individuals who begin or end bona fide residence in a U.S. territory. This form…

-

Information Reporting Forms

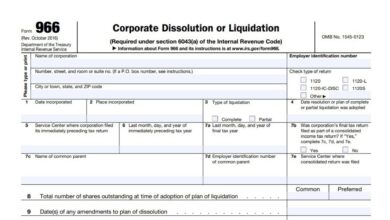

Form 966

IRS Form 966, officially titled “Corporate Dissolution or Liquidation,” is a mandatory document that corporations (including certain LLCs taxed as…

-

Information Reporting Forms

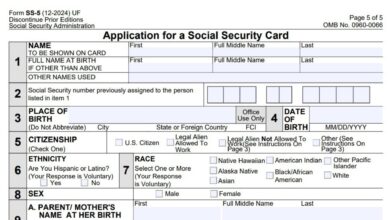

Form SS-5

Form SS-5, officially titled the Application for a Social Security Card, is the form you must use to apply for…

-

Information Reporting Forms

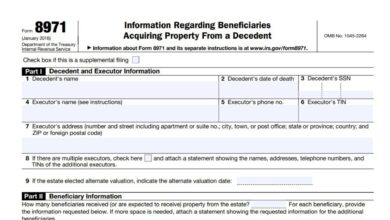

Form 8971

IRS Form 8971, Information Regarding Beneficiaries Acquiring Property From a Decedent, is a critical tax document for estates required to…

-

Information Reporting Forms

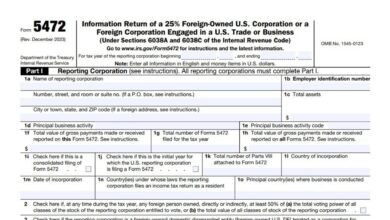

Form 5472

IRS Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade…

-

Information Reporting Forms

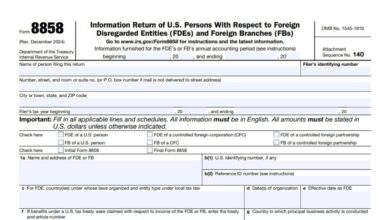

Form 8858

IRS Form 8858, “Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs),” is…

-

Information Reporting Forms

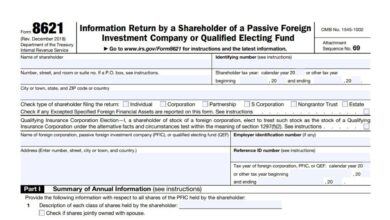

Form 8621

IRS Form 8621, officially titled “Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund,”…

-

Information Reporting Forms

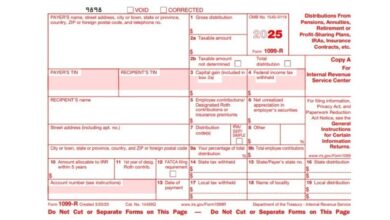

Form 1099-R

IRS Form 1099-R is a critical tax form used to report distributions from retirement accounts, pensions, annuities, profit-sharing plans, IRAs,…

-

Information Reporting Forms

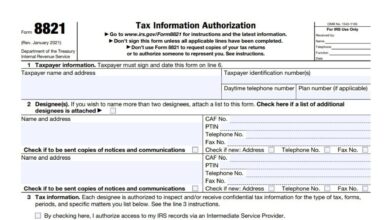

Form 8821

IRS Form 8821, also known as Tax Information Authorization, allows you to designate an individual, corporation, firm, or organization to…

-

Information Reporting Forms

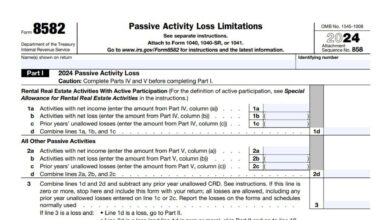

Form 8582

IRS Form 8582, Passive Activity Loss Limitations, is used by noncorporate taxpayers to calculate and report losses from passive activities…

-

Information Reporting Forms

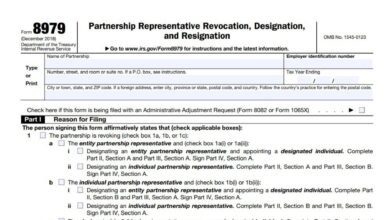

Form 8979

IRS Form 8979, officially titled Partnership Representative Revocation, Designation, and Resignation, is a crucial form used by partnerships to manage…

International Tax Forms

-

Individual Taxpayer Forms

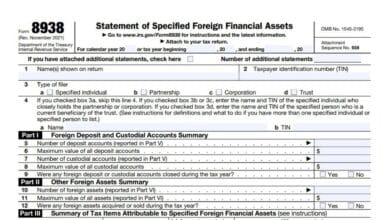

Form 8938

Form 8938 is an IRS form that U.S. taxpayers use to report specified foreign financial assets if their total value…

-

Information Reporting Forms

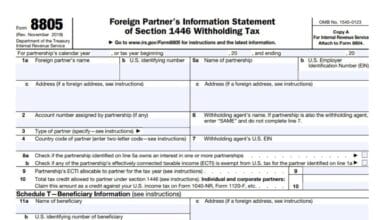

Form 8805

Form 8805, titled “Foreign Partner’s Information Statement of Section 1446 Withholding Tax,” is an IRS form used by partnerships to…

-

Information Reporting Forms

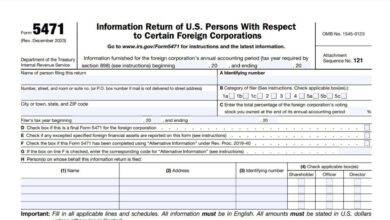

Form 5471

Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, is a critical tax form required by…

-

Business Tax Forms

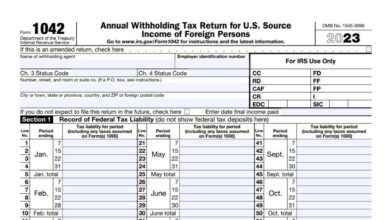

Form 1042

IRS Form 1042 is the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. This form is required to…

-

International Tax Forms

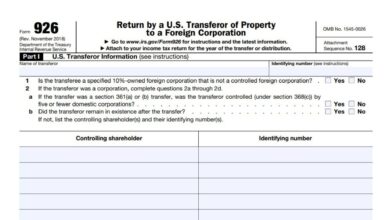

Form 926

Form 926, officially titled “Return by a U.S. Transferor of Property to a Foreign Corporation,” is a U.S. Internal Revenue…

-

Individual Taxpayer Forms

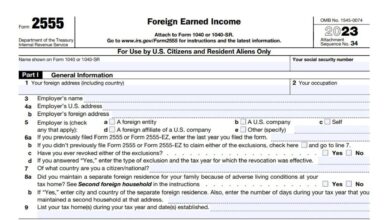

Form 2555

Form 2555, known as the Foreign Earned Income form, is designed to help U.S. citizens and resident aliens who meet…

-

Individual Taxpayer Forms

Form 1040-NR

Form 1040-NR, known as the U.S. Nonresident Alien Income Tax Return, is used by nonresident aliens who have U.S. source…

Penalties, Adjustments, and Appeals

-

Penalties, Adjustments, and Appeals

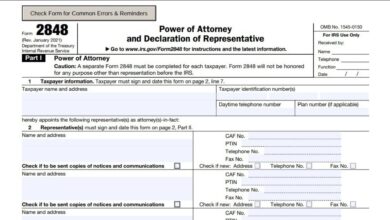

Form 2848

IRS Form 2848, officially titled Power of Attorney and Declaration of Representative, is a critical document that allows taxpayers to…

-

Penalties, Adjustments, and Appeals

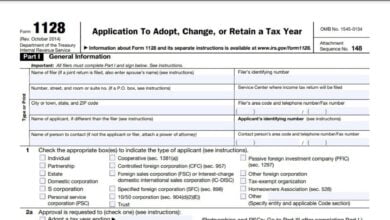

Form 1128

Form 1128, Application to Adopt, Change, or Retain a Tax Year, is used by taxpayers to request IRS approval for…

-

Penalties, Adjustments, and Appeals

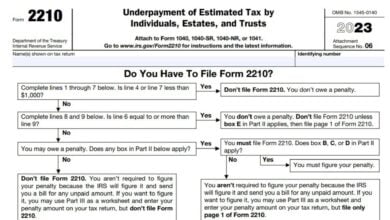

Form 2210

Form 2210, also known as the “Underpayment of Estimated Tax by Individuals, Estates, and Trusts” form, is used by taxpayers…

-

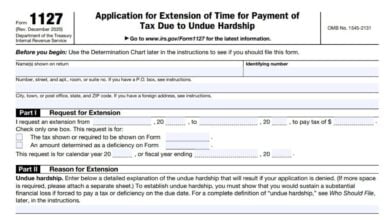

Penalties, Adjustments, and Appeals

Form 1127

The main function of Form 1127 is to provide a taxpayer additional time to pay taxes, avoiding the usual late…

Retirement and Investment Tax Forms

-

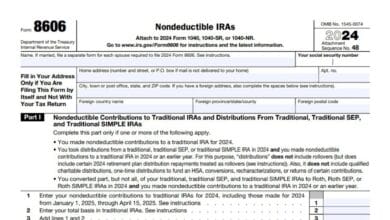

Retirement and Investment Tax Forms

Form 8606

IRS Form 8606, Nondeductible IRAs, is used to report nondeductible contributions to traditional IRAs, distributions from traditional IRAs, and conversions…

-

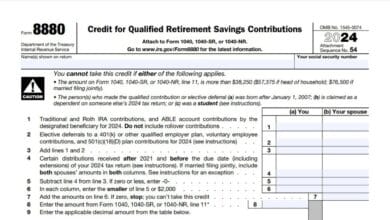

Credits and Other Specific Purpose Forms

Form 8880

The IRS Form 8880 is used to calculate and claim the Saver’s Credit, which rewards eligible taxpayers for contributing to…

-

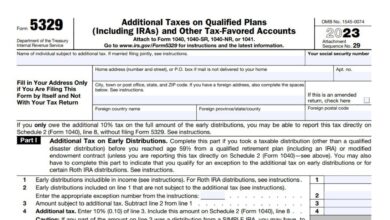

Retirement and Investment Tax Forms

Form 5329

Form 5329, issued by the IRS, is used by taxpayers to report and calculate additional taxes on early distributions, excess…

Self-Employed and Freelancers Tax Forms

-

Business Tax Forms

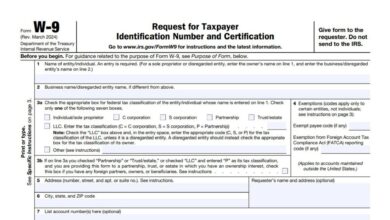

Form W-9

W-9 Form, also known as the Request for Taxpayer Identification Number and Certification, is a tax document used in the…

-

Self-Employed and Freelancers Tax Forms

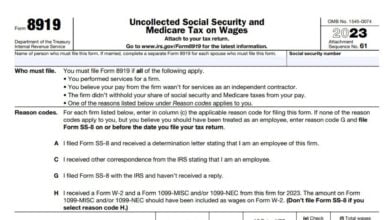

Form 8919

Form 8919 calculates how much of a worker’s wages are due to the government in the form of unpaid social security…

-

Self-Employed and Freelancers Tax Forms

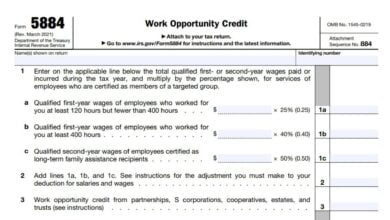

Form 5884

The purpose of Form 5884 is to calculate and claim the Work Opportunity Credit. This credit allows employers to reduce their…

State Tax Forms

-

State Tax Forms

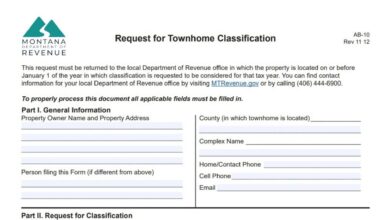

Montana Form AB-10

Montana Form AB-10 — the Request for Townhome Classification — is the official application property owners submit to the Montana…

-

State Tax Forms

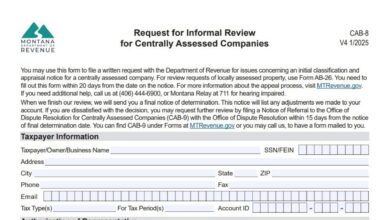

Montana Form CAB-8

Montana Form CAB-8 — officially titled the Request for Informal Review for Centrally Assessed Companies — is the form used…

-

State Tax Forms

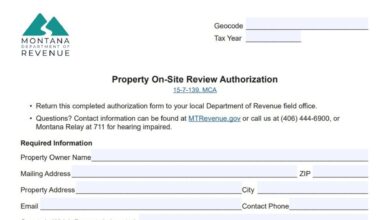

Montana Form AB-27

Montana Form AB-27 is an authorization form used to grant or deny the Department of Revenue’s property valuation staff access…

-

State Tax Forms

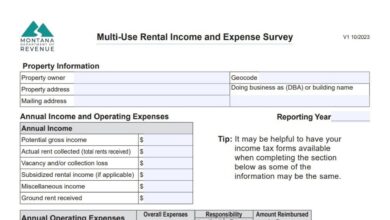

Montana Form IE-MU

When the Montana Department of Revenue assesses property values, it relies on accurate market data, and for owners of diverse…

Tax-Exempt Organizations Tax Forms

-

Tax-Exempt Organizations Tax Forms

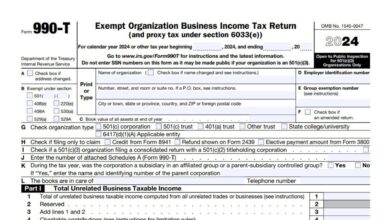

Form 990-T

IRS Form 990-T—formally titled “Exempt Organization Business Income Tax Return”—is the return that tax-exempt organizations use to report and pay…

-

Tax-Exempt Organizations Tax Forms

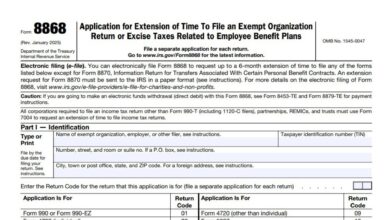

Form 8868

IRS Form 8868, officially titled “Application for Extension of Time To File an Exempt Organization Return or Excise Taxes Related…

-

Tax-Exempt Organizations Tax Forms

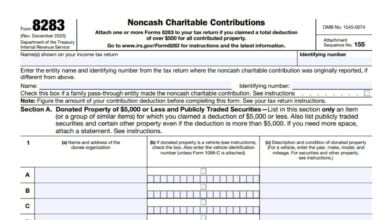

Form 8283

Form 8283 is used to report noncash charitable contributions valued at more than $500. This form helps taxpayers claim a…

-

Tax-Exempt Organizations Tax Forms

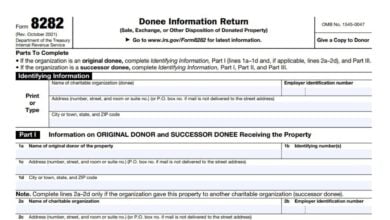

Form 8282

Form 8282, Donee Information Return, is used by charitable organizations to report information about the sale, exchange, or other disposition…

-

Tax-Exempt Organizations Tax Forms

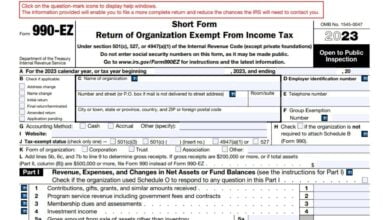

Form 990-EZ

Form 990-EZ, Short Form Return of Organization Exempt From Income Tax, is used by tax-exempt organizations to provide the IRS…

-

Tax-Exempt Organizations Tax Forms

Form 1023

Form 1023, or Application for Recognition of Exemption Under the 501 Internal Revenue Code, is a form that nonprofits file…

-

Tax-Exempt Organizations Tax Forms

Form 990

Form 990 is an annual information return filed by tax-exempt organizations with the Internal Revenue Service (IRS). The purpose of…