Individual Taxpayer Forms

This category includes forms for individuals filing personal income taxes, covering everything from the basic 1040 to forms for claiming deductions and filing amendments. These forms help taxpayers report income, claim credits, and comply with federal tax obligations. Examples include Form 1040, W-2, and 1040-X.

-

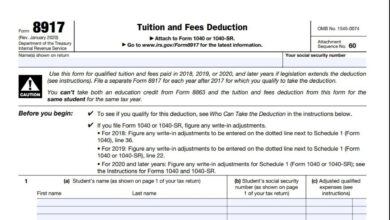

Form 8917

IRS Form 8917, officially titled “Tuition and Fees Deduction,” is a tax form that allows eligible taxpayers to deduct qualified…

-

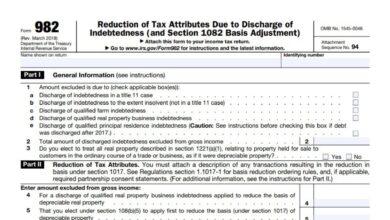

Form 982

IRS Form 982, “Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment),” is a specialized…

-

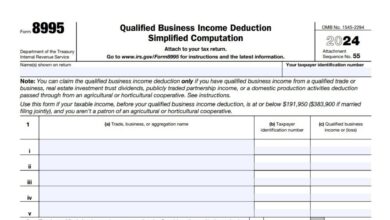

Form 8995

IRS Form 8995, titled “Qualified Business Income Deduction Simplified Computation,” is a tax form used by eligible taxpayers to calculate…

-

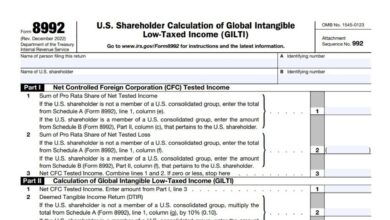

Form 8992

IRS Form 8992, titled “U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI),” is a tax form required for U.S.…

-

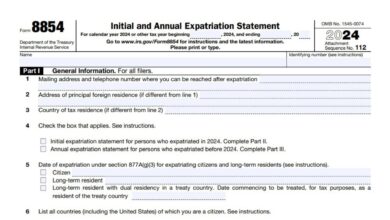

Form 8854

IRS Form 8854, officially titled the “Initial and Annual Expatriation Statement,” is a mandatory tax form for U.S. citizens who…

-

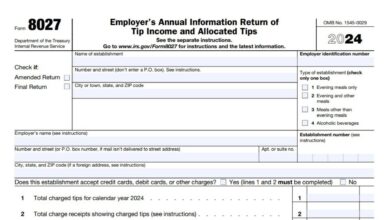

Form 8027

IRS Form 8027 is an annual information return filed by employers in the food and beverage industry to report tip…

-

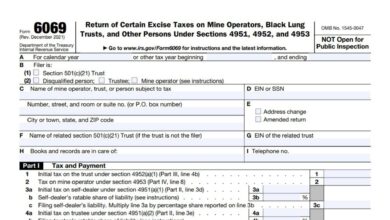

Form 6069

IRS Form 6069, officially titled “Return of Certain Excise Taxes on Mine Operators, Black Lung Trusts, and Other Persons Under…

-

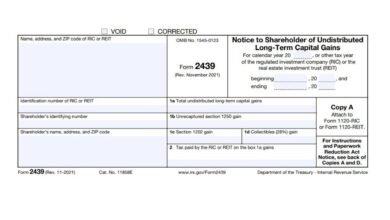

Form 2439

IRS Form 2439, titled Notice to Shareholder of Undistributed Long-Term Capital Gains, is a tax form used by Regulated Investment…

-

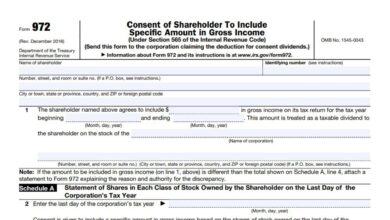

Form 972

IRS Form 972, “Consent of Shareholder To Include Specific Amount in Gross Income,” is a tax form used by shareholders…

-

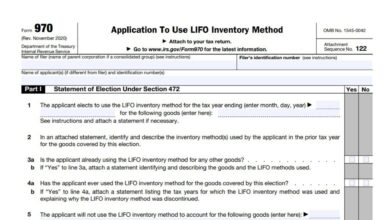

Form 970

IRS Form 970, “Application To Use LIFO Inventory Method,” is used by businesses and individuals to formally elect the Last-In,…