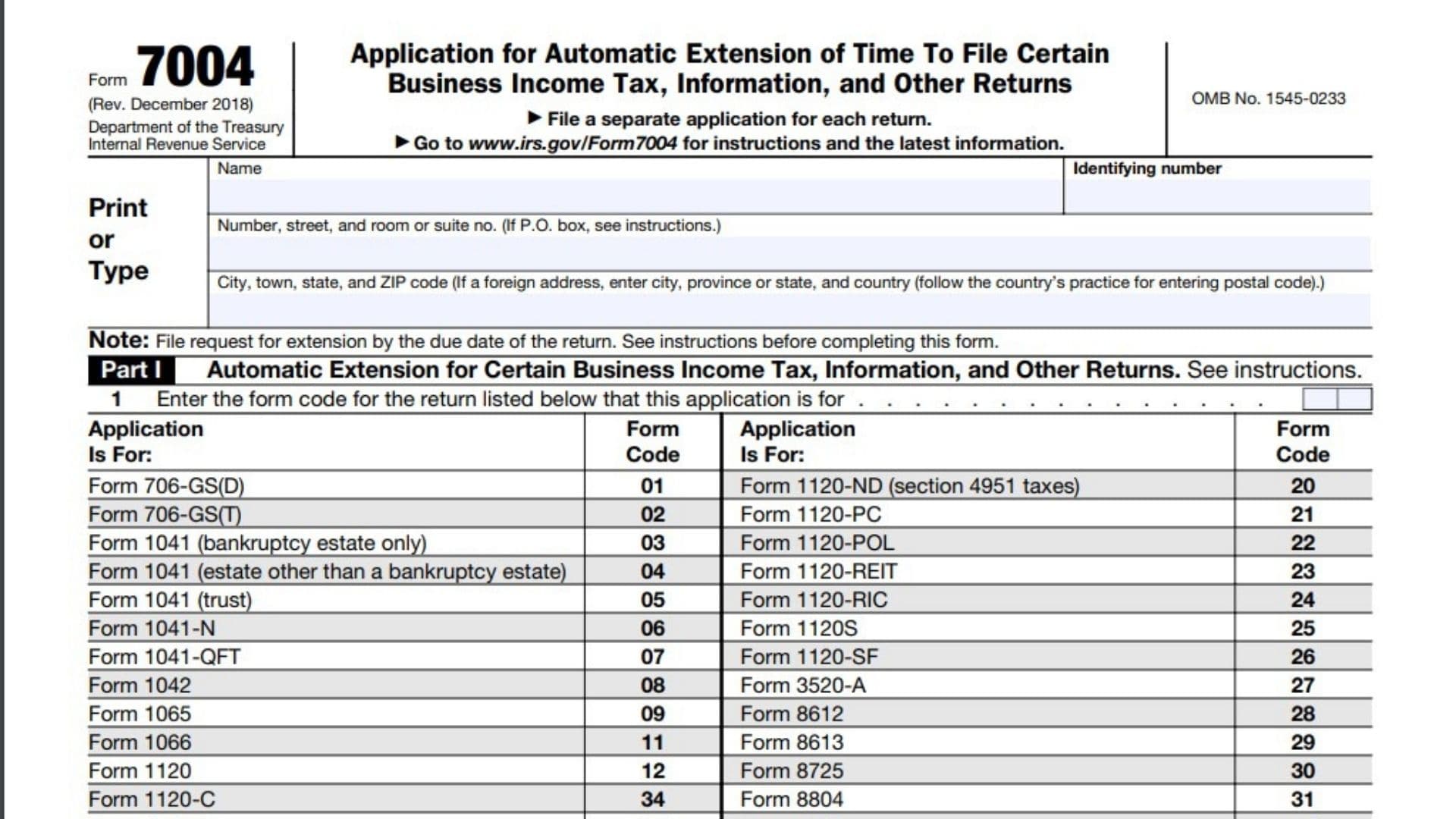

IRS Form 7004, titled “Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns,” is a form used by businesses and other entities to request a filing extension. This form provides an automatic 6-month extension for most business tax returns (5 months for specific returns, like partnerships filing Form 1065). Filing Form 7004 does not extend the time to pay taxes owed; it only extends the deadline for submitting the return. Form 7004 must be filed by the original due date of the return to be valid.

How to File Form 7004?

- Check Filing Eligibility:

- Determine if your tax return qualifies for an extension under Form 7004. Eligible forms include various business income tax and information returns such as Forms 1120, 1065, and 1041.

- Submit by the Deadline:

- File Form 7004 by the original due date of the return you are requesting an extension for. For example, if your corporate tax return is due March 15, you must file Form 7004 by that date.

- File Electronically or by Mail:

- E-file Form 7004 using IRS-approved software or mail a paper copy to the appropriate IRS address listed in the instructions.

- Pay Any Tax Due:

- Although the form extends the filing deadline, taxes must be paid by the original due date to avoid penalties or interest.

How to Complete Form 7004?

- Part I: Automatic Extension for Certain Business Returns:

- Part II: General Information:

- Line 2: Check this box if your organization is a foreign corporation without a U.S. office or place of business.

- Line 3: Check this box if your organization is a corporation intending to file a consolidated return. Attach a statement listing the name, address, and EIN of all members included in the application.

- Line 4: Check this box if your organization qualifies for an extension under regulations section 1.6081-5.

- Tax Year Details:

- Line 5a: Enter the calendar year or fiscal year for which you are requesting an extension.

- Line 5b: If the tax year is less than 12 months, indicate the reason (e.g., initial return, final return, or change in accounting period). Attach an explanation if required.

- Tax and Payment Details:

- Line 6: Enter the tentative total tax liability expected for the tax year. Estimate this amount as accurately as possible.

- Line 7: Report total payments and credits, including any prepayments, estimated tax payments, or overpayments from prior years applied to this year.

- Line 8: Calculate the balance due by subtracting Line 7 from Line 6. If Line 7 exceeds Line 6, enter zero.

- Personal and Business Information:

- Fill in your business name, employer identification number (EIN), and complete mailing address.

- Signature and Submission:

- The form does not require a signature. Ensure all details are correct and file it electronically or by mail before the original tax return due date.