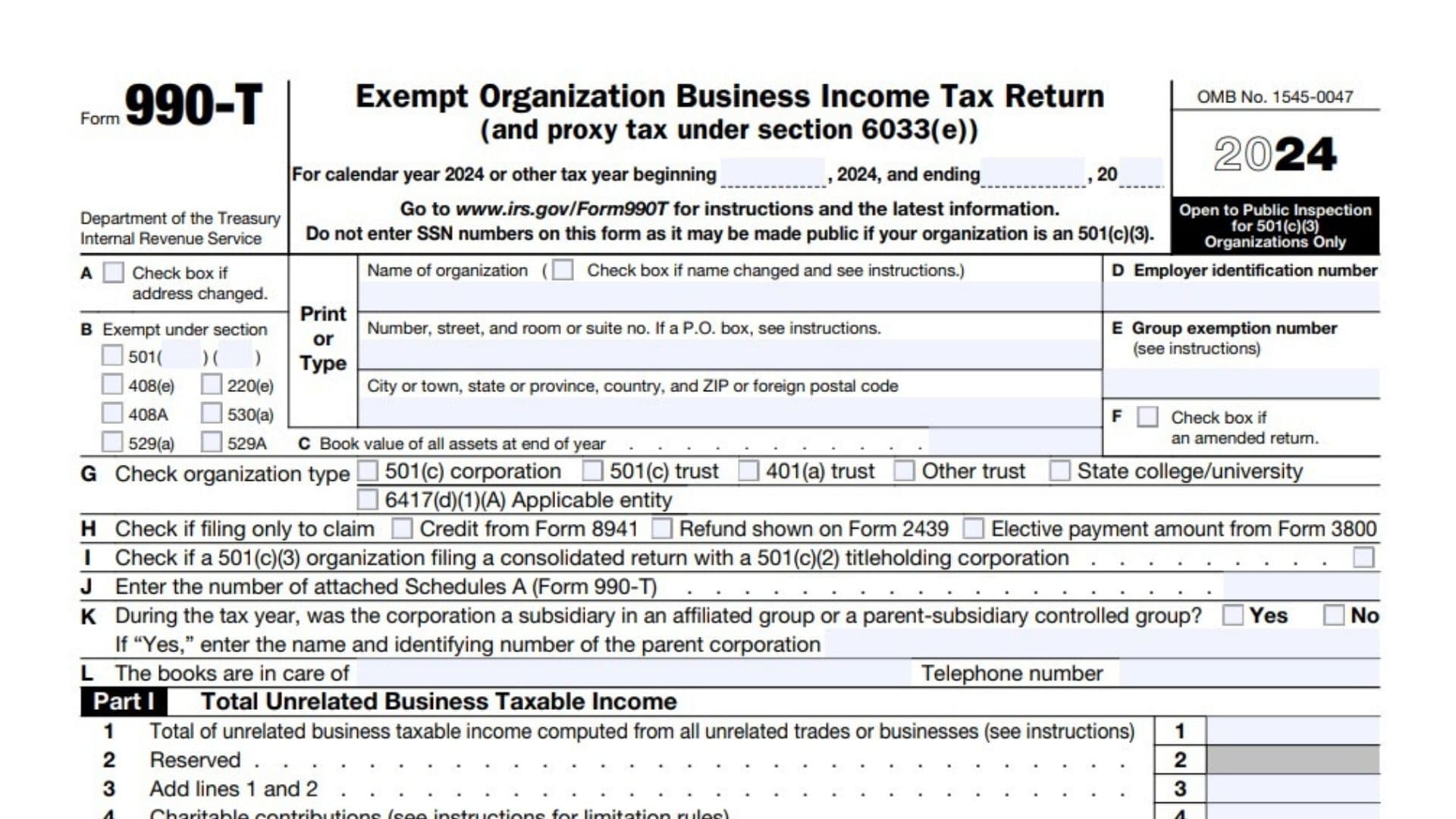

IRS Form 990-T—formally titled “Exempt Organization Business Income Tax Return”—is the return that tax-exempt organizations use to report and pay tax on income earned from activities not substantially related to their exempt purpose (unrelated business income). This includes income from things like advertising, rental properties, or business ventures not directly tied to their main mission. Filing Form 990-T is crucial for organizations like charities, pension funds, trusts, and certain colleges—any group that maintains tax-exempt status under IRS rules but still earns money from outside commercial activities. The form is also used to report “proxy tax” obligations and claim certain credits and refunds. Properly completing Form 990-T ensures that you remain in compliance and avoid penalties, while giving transparency to the IRS and the public about your nonprofit’s unrelated business operations.

How to File Form 990-T

- Organizations typically file electronically (required for most filers).

- File by the 15th day of the 5th month after the end of your tax year (e.g., May 15 for a calendar-year filer).

- Access the latest fillable PDF and instructions from the IRS website.

- Gather all supporting schedules (e.g., 990-T Schedules A, 3800, 1116/1118, etc.), payment confirmations, and backup documentation.

How to Complete Form 990-T

Follow these detailed instructions for every box, checkbox, and line as presented on the official PDF:

Header Section

- Name of organization:

Enter the full legal name of your exempt organization. - Check box if name changed and see instructions:

Check if you changed your organization’s name since last filing. - Number, street, and room or suite no.

Input the organization’s complete mailing address (street, room/suite). If a P.O. box, follow the IRS guidelines. - City, state, ZIP code (or foreign postal code, country):

Fill in your organization’s city, state, and postal code. Add country if filing from abroad. - A. Check box if address changed:

Mark this box if your mailing address is new. - B. Exempt under section:

Select the appropriate section of the tax code granting your exemption (e.g., 501(c)(3), 408(e)). - C. Book value of all assets at end of year:

Enter your total book asset value at year’s end. - D. Employer identification number:

Provide your EIN (never your SSN). - E. Group exemption number (GEN):

List your GEN if you’re part of a group exemption. - F. Check box if amended return:

Tick if this is an amended (corrected) 990-T. - G. Check organization type:

Mark the relevant type: 501(c) corporation, trust, 401(a) trust, other trust, state college/university, or applicable entity under section 6417(d)(1)(A). - H. Check if filing only to claim:

Mark the box(es) for: - I. 501(c)(3) consolidated return:

Check if filing a consolidated return with a 501(c)(2) entity. - J. Enter the number of attached Schedules A (Form 990-T):

Write the number of separate Schedules A attached (one for each UBI activity). - K. Corporation subsidiary/parent-subsidiary group:

Check Yes/No and provide parent’s name/EIN if “Yes.” - L. Books are in care of:

Name the person responsible for financial records; provide phone number.

- Total of unrelated business taxable income computed from all unrelated trades or businesses

Enter the sum of UBTI from all Schedules A activities. - Reserved

(Leave blank; reserved by IRS for future use.) - Add lines 1 and 2

Add amounts on lines 1 and 2; typically, just carry down from line 1. - Charitable contributions

Enter allowable charitable contributions (refer to IRS limits and instructions). - Total unrelated business taxable income before net operating losses

Subtract line 4 from line 3. - Deduction for net operating loss

Enter your organization’s allowable NOL deduction (see instructions for carryover/carryback rules). - Total UBTI before specific deduction and section 199A deduction

Subtract line 6 from line 5. - Specific deduction (generally $1,000; see instructions for exceptions)

Enter $1,000 (or amount per the instructions if exception applies). - Trusts. Section 199A deduction

Trusts only: Enter allowable section 199A (qualified business income) deduction. - Total deductions. Add lines 8 and 9

Combine lines 8 and 9 for total deductions. - Unrelated business taxable income

Subtract line 10 from line 7. If negative, enter zero.

Part II: Tax Computation

- Organizations taxable as corporations:

Multiply line 11 (Part I) by 21% (0.21) and enter result. - Trusts taxable at trust rates:

Use trust rate schedule or Schedule D (Form 1041) to compute and enter the income tax on line 11, if applicable. - Proxy tax. See instructions

If reporting proxy tax under section 6033(e), enter the tax here.

4a. Amount from Form 4255, Part I, line 3, column (q)

Transfer the specified recapture tax amount, if applicable.

4b. Other tax amounts. See instructions

Report any other additional taxes not otherwise itemized.

- Alternative minimum tax

Enter any AMT due (see instructions). - Tax on noncompliant facility income

For 501(c)(3) filers with noncompliant facility income. - Total. Add lines 3 through 6 to line 1 or 2, whichever applies

Sum the relevant lines for your total tax due.

Part III: Tax and Payments

1a. Foreign tax credit:

Corporations: Attach Form 1118; trusts: Attach Form 1116. Enter credit.

1b. Other credits (see instructions):

List all other credits here.

1c. General business credit:

Attach Form 3800 (see instructions).

1d. Credit for prior-year minimum tax (attach Form 8801 or 8827):

Enter credit amount.

1e. Total credits. Add lines 1a through 1d:

Total the above credits.

- Subtract line 1e from Part II, line 7:

Calculate tax due after subtracting credits.

3a. Amount from Form 4255, Part I, line 3, column (r):

Include the relevant recapture amount, if applicable.

3b. Amount due from Form 8611:

Enter any amounts due from this form.

3c. Amount due from Form 8697:

Enter any amounts due from this form.

3d. Amount due from Form 8866:

Enter if applicable.

3e. Other amounts due (see instructions):

List any other amount due.

3f. Total amounts due. Add lines 3a through 3e:

Total all above lines.

- Total tax. Add lines 2 and 3f:

If tax previously deferred under section 1294 is included, check the box and enter here. - Current net 965 tax liability paid from Form 965-A, Part II, column (k):

Enter this special payment if applicable.

6a. Payments: Preceding year’s overpayment credited to current year:

Enter the amount.

6b. Current year’s estimated tax payments:

Enter amount; check if section 643(g) election applies.

6c. Tax deposited with Form 8868:

Enter if you paid with your extension.

6d. Foreign organizations: Tax paid/withheld at source:

Enter as needed.

6e. Backup withholding (see instructions):

Enter amount.

6f. Credit for small employer health insurance premiums (attach Form 8941):

Enter if eligible.

6g. Elective payment election amount from Form 3800:

Enter if applies.

6h. Payment from Form 2439:

Enter if you have this credit.

6i. Credit from Form 4136:

Enter the amount, if applicable.

6j. Other (see instructions):

List any other credits or payments.

- Total payments. Add lines 6a through 6j:

Total all payments and credits. - Estimated tax penalty (see instructions):

If owed, enter penalty. If attaching Form 2220, check box. - Tax due:

If line 7 is less than the total of lines 4, 5, and 8, enter amount owed. - Overpayment:

If line 7 is greater than the total of lines 4, 5, and 8, enter overpaid amount. - Enter amount of line 10 you want: Credited to 2025 estimated tax / Refunded:

Split overpayment as needed.

Part IV: Statements Regarding Certain Activities & Other Information

- Interest in/authority over foreign accounts:

Check Yes/No. If yes, list the country. - Distribution from / transfer to a foreign trust:

Check Yes/No and follow further filing instructions if Yes. - Tax-exempt interest received/accrued:

Enter the amount for the tax year. - Pre-2018 NOL carryovers:

Enter any available amounts (do not include post-2017 carryovers). - Post-2017 NOL carryovers:

List the business activity code and available NOL carryover for each business.

6a/b. Reserved for future use:

Leave these blank.

Part V: Supplemental Information

- Provide any additional information

Use this space for explanations, continuation statements, or clarifying information. Reference the relevant lines or items.

Signature & Paid Preparer Section

- Officer/authorized signer:

Sign, date, and list your title—attesting under penalty of perjury that the return is correct. - Paid preparer details:

Preparer prints and signs name, date, PTIN, firm info, EIN, and phone number. Check self-employed if applicable. - May the IRS discuss with preparer:

Check Yes/No as desired.