Form 8941 indirectly incentivizes small businesses to offer health insurance to their employees. Using Form 8941 correctly can reduce your tax bill, incentivize your employees to receive health insurance, and help you retain top talent. Using Form 8941 correctly could save you thousands of dollars in federal taxes. Providing health insurance for employees is a big cost to a business. Fortunately, the IRS offers tax relief to small businesses that provide health care benefits. The tax credit helps to reduce the business tax bill by 50% of the employee health insurance premiums.

The maximum credit is:

- 50 percent of premiums paid for small business employers and

- 35 percent of premiums paid for small tax-exempt employers

- The credit is available to eligible employers for two consecutive taxable years

How to Qualify For Credit for Small Employer Health Insurance Premiums?

There are two types of small business healthcare tax credit. The first is a credit based on the percentage of total premiums paid by a small business. The credit is only available for two tax year credit periods. The credit is only available for insurance plans that do not have age restrictions.

The IRS also allows small businesses to claim a credit for the first two tax years they qualify. This credit is also available in areas where there are no SHOP plans. The credit is not available if you have more than 25 full-time equivalent employees.

The IRS also considers small businesses that pay for health insurance premiums using a composite billing method. This method is also referred to as the “composite bill.” The credit is only available for the tax year you are eligible for, but you can carry it over to the next tax year.

The credit is calculated by multiplying the percentage of total premiums paid by the small business by the average annual wages. The credit will increase for small employers with average annual wages under $56,000 in the tax year 2020. For 2022, the credit will increase by more than $1,000.

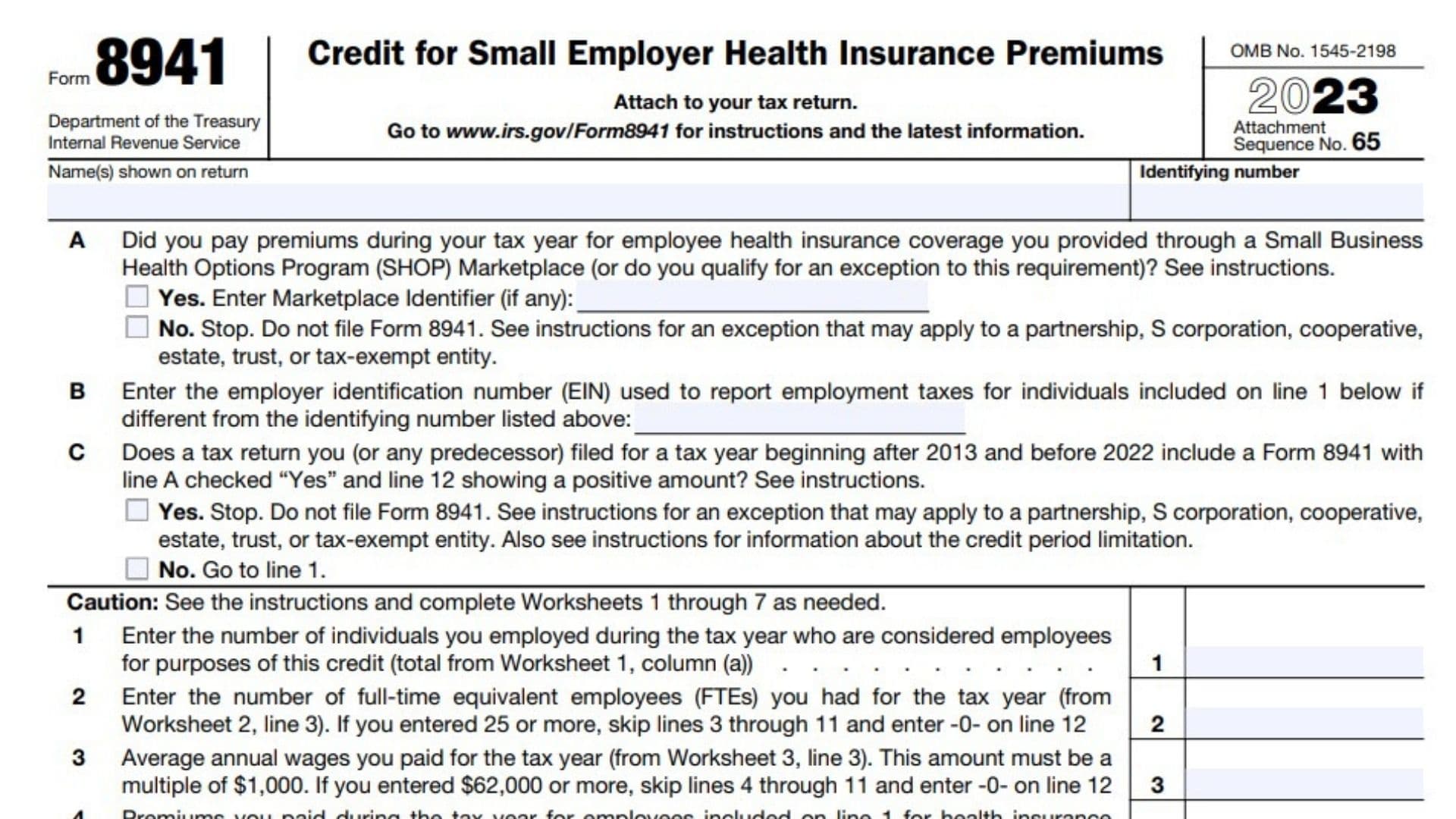

How to Complete Form 8941?

You will need to provide information on your business on Form 8941. You must also include information on Form 3800. The credit can be applied against your regular tax liabilities or alternative minimum taxes. Here are the line-by-line instructions for Form 8941:

A: Did you pay premiums during your tax year for employee health insurance coverage you provided through

B: Enter the employer identification number (EIN) used to report employment taxes for individuals included on line 1 below if different from the identifying number listed above

C: Does a tax return you (or any predecessor) filed for a tax year beginning after 2013 and before 2020 include a Form 8941 with line A checked “Yes” and line 12 showing a positive amount?

- If your answer is ” YES, “stop filing Form 8941.

- If your answer is ” NO, “go to line 1.

Note: You must complete the Worksheets provided in the IRS’s Form 8941 instructions to properly complete lines 1-7 in Form 8941.

Line 1: Enter the number of individuals you employed during the tax year who are considered employees for purposes of this credit (total from Worksheet 1, column (a)).

Line 2: Enter the number of full-time equivalent employees (FTEs) you had for the tax year (from Worksheet 2, line 3). If you entered 25 or more, skip lines 3 through 11 and enter -0- on line 12

Line 3: Average annual wages you paid for the tax year (from Worksheet 3, line 3). This amount must be a multiple of $1,000. If you entered $56,000 or more, skip lines 4 through 11 and enter -0- on line 12

Line 4: Premiums you paid during the tax year for employees included on line 1 for health insurance coverage under a qualifying arrangement (total from Worksheet 4, column (b)

Line 5: Premiums you would have entered on line 4 if the total premium for each employee equaled the average premium for the small group market in which the employee enrolls in health insurance coverage (total from Worksheet 4, column (c))

Line 6: Enter the smaller of line 4 or line 5

Line 7: Multiply line 6 by the applicable percentage

- Tax-exempt small employers, multiply line 6 by 35% (0.35)

- All other small employers, multiply line 6 by 50% (0.50)

Line 8: If line 2 is 10 or less, enter the amount from line 7. Otherwise, enter the amount from Worksheet 5, line 6

Line 9: If line 3 is $27,000 or less, enter the amount from line 8. Otherwise, enter the amount from Worksheet 6, line 7

Line 10: Enter the total amount of any state premium subsidies paid and any state tax credits available for premiums included in line 4.

Line 11: Subtract line 10 from line 4. If zero or less, enter -0-.

Line 12: Enter the smaller of line 9 or line 11

Line 13: If line 12 is zero, skip lines 13 and 14 and go to line 15. Otherwise, enter the number of employees included on line 1 for whom you paid premiums during the tax year for health insurance coverage under a qualifying arrangement (total from Worksheet 4, column (a)).

Line 14: Enter the number of FTEs you would have entered on line 2 if you only included employees included on line 13 (from Worksheet 7, line 3).

Line 15: Credit for small employer health insurance premiums from partnerships, S corporations, cooperatives, estates, and trusts.

Line 16: Add lines 12 and 15. Cooperatives, estates, and trusts go to line 17. Tax-exempt small employers skip lines 17 and 18 and go to line 19. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, stop here and report this amount on Form 3800, Part III, line 4h

Line 17: Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust

Line 18: Cooperatives, estates, and trusts. Subtract line 17 from line 16. Stop here and report this amount on Form 3800, Part III, line 4h

Line 19: Enter the amount you paid in 2021 for taxes considered payroll taxes for purposes of this credit.

Line 20: Tax-exempt small employers, enter the smaller of line 16 or line 19 here and on Form 990-T, Part III, line 6f