IRS Form 1120-RIC is a specialized tax form used by regulated investment companies (RICs), such as mutual funds, to report income, gains, losses, deductions, credits, and to calculate federal tax liability. If your company is classified as a RIC, you must complete this form annually to maintain favorable tax treatment and satisfy IRS compliance. RICs use this form to declare investment company taxable income and keep their regulated tax status. Filing Form 1120-RIC ensures the IRS scrutinizes distributed or undistributed income, capital gains, dividends paid, and all relevant corporate events affecting tax obligations.

How to File Form 1120-RIC?

- Prepare all necessary information: Collect financial records, shareholder details, income statements, and deduction schedules for the year.

- Complete the form line by line (see below for full instructions).

- Attach required supporting schedules and forms as referenced throughout the form.

- Review for completeness: Double-check figures and ensure all fields are filled.

- Sign and date the form: Make sure an authorized officer signs it.

- Send the completed form to the IRS by the deadline, which is the 15th day of the third month after the end of your RIC’s tax year.

How to Complete Form 1120-RIC?

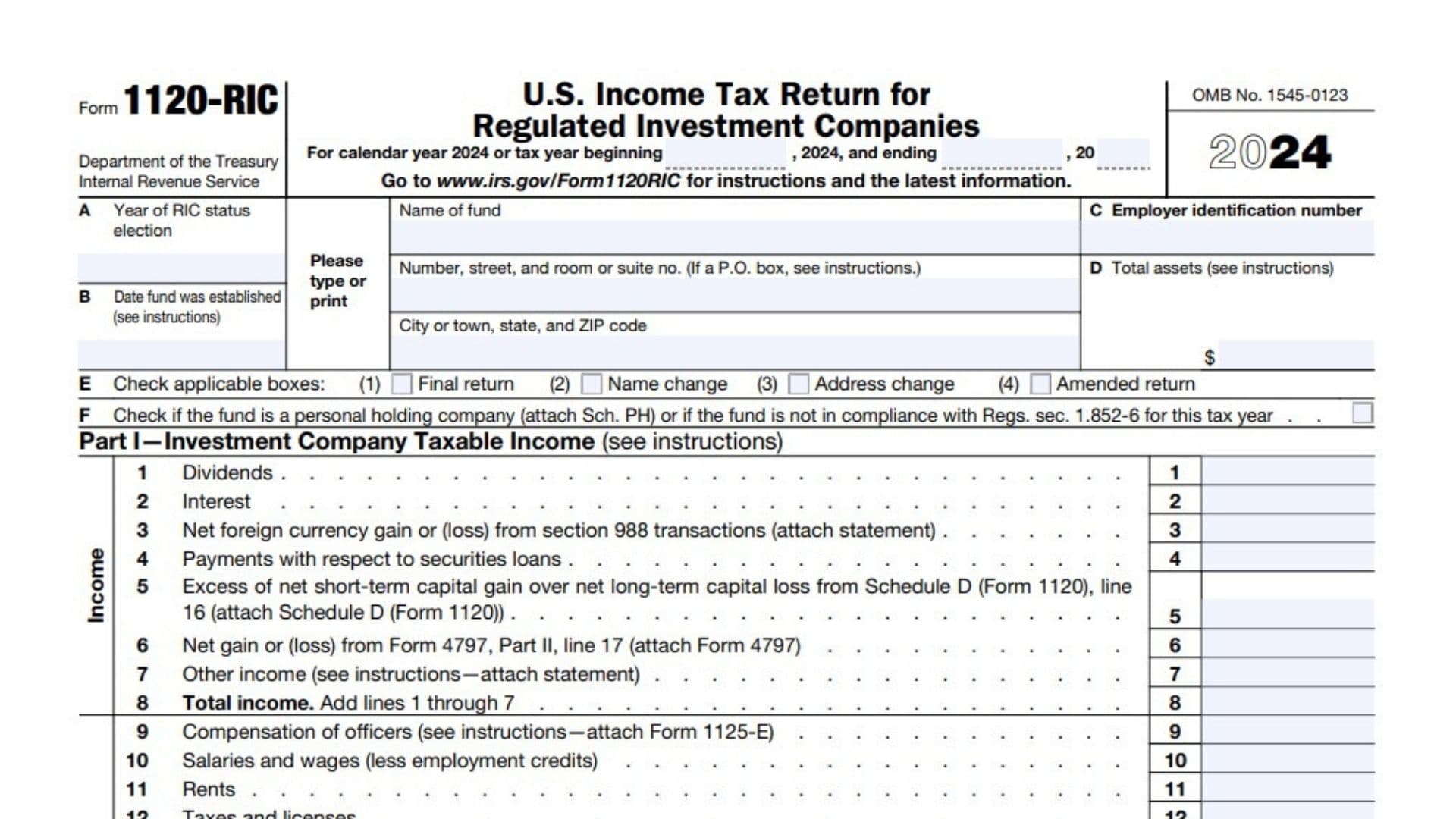

Top Section

- Name of Fund: Enter the exact legal name of your regulated investment company.

- Address Details: Include street, room or suite number, city, state, and ZIP code. If you use a P.O. box, follow the IRS guidance.

- A. Year of RIC Status Election: State the year your fund elected RIC status.

- B. Date Fund Was Established: Enter the date the fund was set up according to your organizational documents.

- C. Employer Identification Number: Fill in your unique nine-digit EIN issued by the IRS.

- D. Total Assets: Disclose the value of all assets at the end of the tax year.

- E. Check Boxes:

- (1) Final return: Select if this is your last filing.

- (2) Name change: Select if there’s a legal name change.

- (3) Address change: Select if your address changed.

- (4) Amended return: Check if correcting a prior filing.

- F. Special Status: Indicate if your fund is a personal holding company (attach Sch. PH), or if it didn’t comply with Regs. section 1.852-6.

Part I — Investment Company Taxable Income

Income

- Dividends: Report total dividend income received.

- Interest: Report all interest income earned.

- Net Foreign Currency Gain/Loss (Section 988): Enter the net gain or loss from foreign currency transactions (must attach a statement).

- Payments for Securities Loans: Include any compensation from securities lending.

- Excess Net Short-Term Capital Gain over Net Long-Term Capital Loss (Schedule D, line 16): Attach Schedule D (Form 1120) and enter the calculated excess.

- Net Gain/Loss from Form 4797 (Part II, line 17): Attach completed Form 4797.

- Other Income: Specify any additional income and attach supporting statements.

- Total Income: Add lines 1 through 7.

Deductions

- Compensation of Officers: Attach Form 1125-E and input the total.

- Salaries and Wages: Enter total wages less employment credits.

- Rents: Fill in all rent expenses.

- Taxes and Licenses: Total all tax and license payments.

- Interest: Write the interest expense amount.

- Depreciation: Attach Form 4562 and input total depreciation.

- Advertising: Enter overall advertising costs.

- Registration Fees: Input all registration fees paid.

- Insurance: State total insurance expenses.

- Accounting and Legal Services: Include professional service fees.

- Management and Investment Advisory Fees: Enter fees paid for management or investment advice.

- Transfer Agency, Shareholder Servicing, Custodian Fees: Total all such fees/expenses.

- Reports to Shareholders: Input costs for shareholder communications.

- Other Deductions: Attach explanation for all other deductions.

- Total Deductions: Sum lines 9 to 22.

- Taxable Income Before Dividends Paid and Section 851 Deductions: Subtract line 23 from line 8.

- Less Deductions:

- a) Deduction for Dividends Paid (Schedule A, line 8a)

- b) Deductions for tax under sections 851(d)(2) and 851(i) (Schedule J, lines 1c & 1d)

- c) Total: Add 25a and 25b.

- Investment Company Taxable Income: Subtract line 25c from line 24.

Sign Here

- Signature of Officer: The fund’s authorized officer must sign.

- Date: Insert the date signed.

- Title: Officer’s formal title.

- Authorization for IRS Discussion: Check “Yes” or “No” for third-party designee.

Paid Preparer Section

- Enter preparer’s name, signature, date, PTIN, firm name/address/EIN, phone, and check if self-employed.

Part I — Tax and Payments

- Total Tax: Enter amount from Schedule J, line 9.

- Payments and Credits:

- a) Preceding year’s overpayment credited.

- b) This year’s estimated tax payments.

- c) Current year’s refund applied on Form 4466.

- d) Tax deposited with Form 7004.

- e) Credit for tax paid on undistributed capital gains (attach Form 2439).

- f) Credit for federal tax paid on fuels (attach Form 4136).

- g) Elective payment election (Form 3800).

- z) Any other credits (attach statement).

- Total Payments and Credits: Add 28a through 28z.

- Estimated Tax Penalty: Check if attaching Form 2220.

- Amount Owed: If line 29 is less than lines 27+30, enter the difference.

- Overpayment: If line 29 exceeds lines 27+30, show the excess.

- Overpayment Allocation: Split line 32 between credit to 2025 and refund.

Part II — Tax on Undistributed Net Capital Gain

- Net Capital Gain (Schedule D, line 17): Attach Schedule D.

- Capital Gain Dividends (Schedule A, line 8b)

- Subtract Line 2 from Line 1

- Capital Gains Tax: Multiply result by 21% (0.21), enter here and on Schedule J, line 1b.

Schedule A — Deduction for Dividends Paid

- Dividends Paid (ordinary/capital gain)

- Dividends Paid/Elect to Treat as Paid under Section 855(a)

- Dividends Deemed Paid under Section 852(b)(7)

- Consent Dividends (attach Forms 972 & 973)

- Deficiency Dividends (attach Form 976)

- Foreign Tax Paid Deduction (section 853(b)(1)(B))

- Tax Credit Bond Credits Distributed

- Deduction for Dividends Paid:

- a) Sum of lines 1-7, column (a): Enter on Part I, line 25a.

- b) Sum of column (b), lines 1-5: Enter on Part II, line 2.

Schedule B — Income from Tax-Exempt Obligations

- Qualification under Section 852(b)(5) or 852(g): Yes/No.

- Interest Excludable from Gross Income

- Amounts Disallowed as Deductions (sections 265 & 171(a)(2))

- Net Income from Tax-Exempt Obligations

- Exempt-Interest Dividends Designated

Schedule J — Tax Computation

- Taxes

- a) Tax on investment company taxable income.

- b) Tax on undistributed net capital gain (from Part II, line 4).

- c) Tax imposed under section 851(d)(2).

- d) Tax imposed under section 851(i).

- e) Section 1291 tax (Form 8621).

- f) Additional tax under section 197(f).

- g) Amount from Form 4255, Part I, line 3 (column q).

- z) Other chapter 1 tax.

- Total Income Tax: Add all above.

- Credits

- Total Credits: Add 3a to 3d.

- Net Tax: Subtract line 4 from line 2.

- Additional Taxes

- a) Personal holding company tax (attach Schedule PH).

- b) Deferred tax interest (section 453A(c)).

- c) Deferred tax interest (section 453(l)(3)).

- d) Amount from Form 4255, Part I, line 3 (column r).

- z) Other (attach statement).

- Total Additional Taxes: Add 6a through 6z.

- Total Tax Before Deferred Taxes: Add lines 5 and 7.

- b) Deferred tax on undistributed earnings of a qualified electing fund.

- Total Tax: Subtract 8b from 8a; transfer to line 27.

Schedule K — Other Information

- Accounting Method: Choose cash, accrual, or other (specify).

2-5. Ownership Questions:- Indicate if the RIC or any owner holds 50%+ of another entity, or a foreign entity owns 25%+ of the fund.

- Excess Dividend Payments?: If yes, file Form 5452.

- Publicly Offered Debt with OID?: If yes, consider Form 8281.

8-9. Tax-Exempt Interest & Fund Series: Report as requested.

10-12. Foreign Tax/Section 853/853A/852(g)/852(b)(8) Elections?: Check if applicable; follow special instructions.

13-14. Section 163(j) Real Property/Farming Election: Report as required. - Qualified Opportunity Fund?: If yes, see Form 8996.

- Controlled Group Membership: If yes, attach Schedule O.

Schedule L — Balance Sheets per Books

Complete Schedule L by providing figures for both the beginning and end of the tax year for every listed line. Here’s how to do each item:

Assets:

- Line 1: Enter the amount of cash on hand at the start and end of the year.

- Line 2a: Report the total of trade notes and accounts receivable.

- Line 2b: Deduct any allowance for bad debts.

- Line 3: List the value of U.S. government obligations.

- Line 4: State the amount of tax-exempt securities.

- Line 5: Include any other current assets and, if more detail is needed, attach a statement.

- Line 6: Enter the amount of loans made to shareholders.

- Line 7: Add the value of mortgage and real estate loans.

- Line 8: Report other investments (attach a statement if applicable).

- Line 9a: Provide the value of buildings and other fixed depreciable assets.

- Line 9b: Subtract accumulated depreciation here.

- Line 10: Report the value of land (net of any amortization).

- Line 11a: Enter the value of amortizable intangible assets.

- Line 11b: Deduct accumulated amortization.

- Line 12: List other assets and attach a supporting statement if required.

- Line 13: Add all asset lines above for the total assets.

Liabilities and Shareholders’ Equity:

- Line 14: State the amount of accounts payable.

- Line 15: List mortgages, notes, and bonds payable in less than one year.

- Line 16: Add other current liabilities, attaching a statement for itemization if necessary.

- Line 17: Report loans received from shareholders.

- Line 18: List mortgages, notes, and bonds payable in one year or more.

- Line 19: State other liabilities and attach a statement if needed.

- Line 20: Enter the amount of capital stock.

- Line 21: Report additional paid-in capital.

- Line 22: Specify retained earnings that are appropriated, attach a supporting statement if applicable.

- Line 23: Enter unappropriated retained earnings (this will be detailed in Schedule M-2).

- Line 24: Show any adjustments to shareholders’ equity and attach explanation if needed.

- Line 25: Subtract the cost of any treasury stock.

- Line 26: Add lines 14 through 25 for the total liabilities and shareholders’ equity.

Note: If total assets on line 13 (end of year column) are less than $25,000, Schedules M-1 and M-2 are not required.

Schedule M-1 — Reconciliation of Income (Loss) per Books With Income per Return

- Line 1: Enter net income (or loss) per the company’s books for the tax year.

- Line 2: Report federal income tax expense (excluding built-in gains tax).

- Line 3: Enter the excess of capital losses over capital gains.

- Line 4: Report any income subject to tax not recorded on the books for this year. Detail each item.

- Line 5: Include expenses recorded on books this year but not deducted on this return (list each item separately), including:

- a) Depreciation

- b) Expenses allocable to tax-exempt interest income

- c) Section 4982 tax

- d) Travel and entertainment expenses

- Line 6: Add lines 1 through 5 for subtotal.

- Line 7: Record any income included in book income this year that is not taxable (such as tax-exempt interest). List each item.

- Line 8: Enter deductions on this return not charged against book income this year, including:

- a) Depreciation

- b) Deduction for dividends paid (from Part I, line 25a)

- Line 9: Include net capital gain from Form 2438, line 9a.

- Line 10: If Form 2438 was not filed, enter the net capital gain from Schedule D (Form 1120), line 17; otherwise, enter zero.

- Line 11: Add lines 7 through 10.

- Line 12: Subtract line 11 from line 6 to get investment company taxable income (this should match Part I, line 26).

Schedule M-2 — Analysis of Unappropriated Retained Earnings per Books

- Line 1: Report the balance at the beginning of the year.

- Line 2: Enter net income (or loss) per books for the year.

- Line 3: Add any other increases (itemize in detail as appropriate).

- Line 4: Add lines 1, 2, and 3 to get subtotal.

- Line 5: Report total distributions for the year, divided by type:

- a) Distributions in cash

- b) Distributions in stock

- c) Distributions in property

- Line 6: Enter any other decreases (itemize with explanations).

- Line 7: Add lines 5 and 6.

- Line 8: Subtract line 7 from line 4 to get the balance at year end (this figure should also be shown on Schedule L, line 23, “Retained earnings—Unappropriated”).

Carefully complete every line, attach required statements where indicated, and make sure all figures reconcile between the Schedules and the accounts listed elsewhere on Form 1120-RIC.