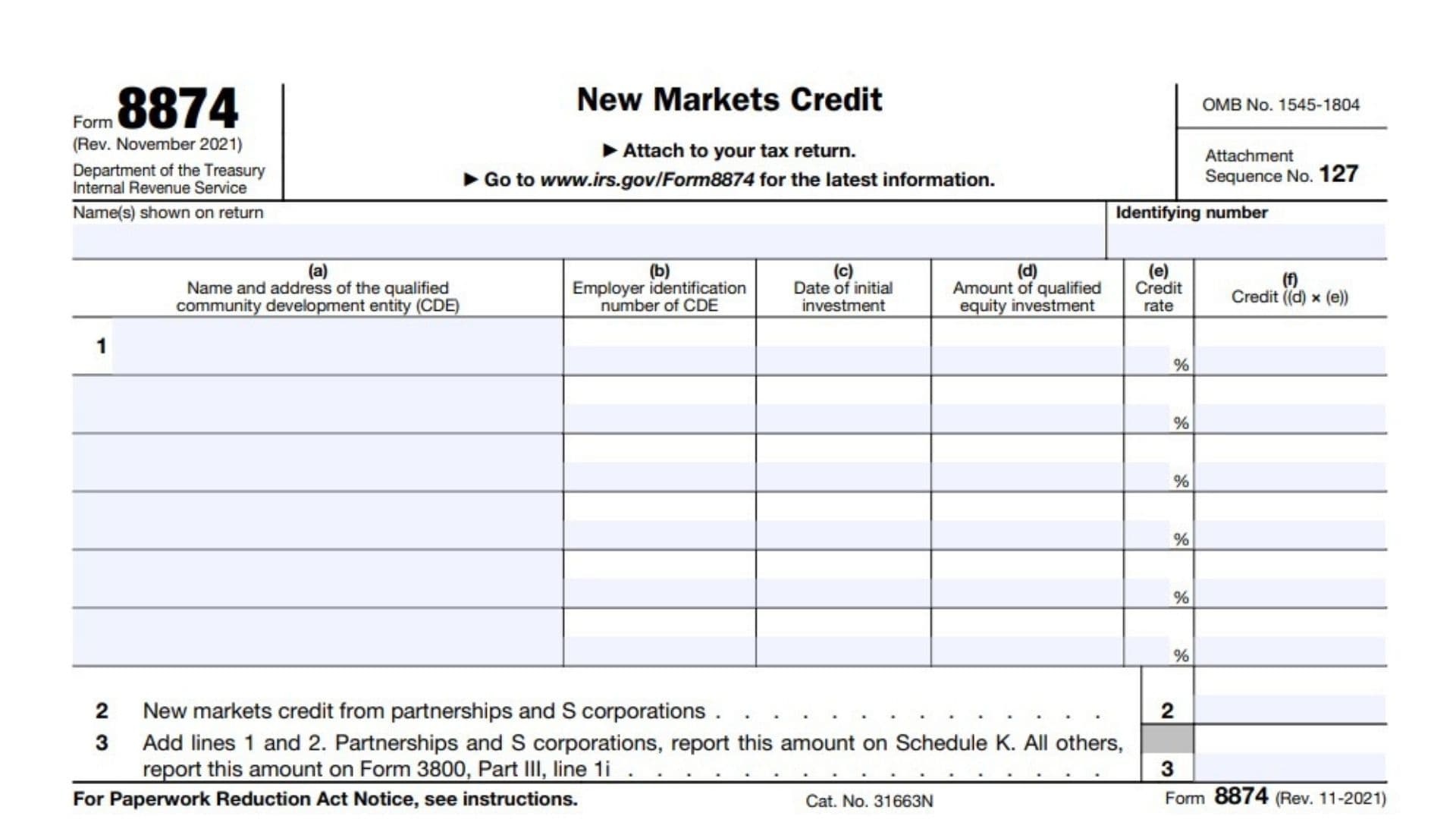

If you’re looking to claim the New Markets Credit for investments in qualified community development entities, understanding IRS Form 8874 is essential. Form 8874 is used by taxpayers to claim the federal New Markets Credit, a valuable incentive for investing in low-income communities through qualified community development entities (CDEs). The credit is part of the general business credit and is available to individuals, corporations, partnerships, and S corporations that make qualified equity investments in CDEs certified by the Community Development Financial Institutions (CDFI) Fund. The form requires detailed information about each investment, including the CDE’s name, employer identification number, date of investment, amount, and the applicable credit rate. The New Markets Credit is calculated based on the amount of the qualified equity investment and the number of years the investment has been held, with different credit rates applying in different years. Filing Form 8874 correctly ensures you get the maximum credit and stay compliant with IRS rules, while mistakes can delay your refund or trigger audits. This article will walk you through what Form 8874 is, how to file it, and provide step-by-step, line-by-line instructions for completing every part of the form.

What is Form 8874?

IRS Form 8874 is the official tax form used to claim the New Markets Credit for qualified equity investments in certified community development entities (CDEs). The credit encourages private investment in low-income communities by offering a federal tax credit over a seven-year period. To qualify, your investment must be in a CDE certified by the CDFI Fund, and the CDE must use the funds primarily for qualified low-income community investments. The credit is calculated as a percentage of your investment, with 5% for each of the first three years and 6% for each of the next four years. You must attach Form 8874 to your tax return (individual, corporate, or partnership) for the year you are claiming the credit. If your only source of the credit is from a partnership or S corporation, you may not need to file this form yourself and can report the credit directly on IRS Form 3800, Part III, line 1i1.

How to File Form 8874

- Attach Form 8874 to your annual federal tax return (Form 1040, 1120, etc.).

- If you are a partnership or S corporation, report the total credit on Schedule K.

- All other filers report the credit on Form 3800, Part III, line 1i.

- Keep supporting documentation (such as Form 8874-A from the CDE) for your records.

How to Complete Form 8874

Top Section

- Name(s) shown on return:

Enter the name(s) as shown on your tax return. - Identifying number:

Enter your Social Security Number (SSN), Employer Identification Number (EIN), or other taxpayer identification number as used on your tax return.

Line 1: Qualified Equity Investments Held Directly

For each qualified equity investment, fill out columns (a) through (f):

- (a) Name and address of the qualified community development entity (CDE):

Enter the full legal name and address of each CDE in which you made a qualified equity investment. - (b) Employer identification number of CDE:

Enter the EIN of the CDE from your investment documentation or Form 8874-A provided by the CDE. - (c) Date of initial investment:

Enter the date you made the original qualified equity investment in the CDE. - (d) Amount of qualified equity investment:

Enter the dollar amount of your investment in the CDE for which you are claiming the credit. - (e) Credit rate:

Enter “5” for investments in the first, second, or third credit allowance year. Enter “6” for the fourth through seventh years. - (f) Credit ((d) × (e)):

Multiply the amount in column (d) by the credit rate in column (e) (as a percentage: 5% or 6%) and enter the result. This is your allowable credit for this investment for the year.

If you have more investments than fit on the form, attach a statement with the same columns and enter “See attached” in column (a) of the last row. Add the total credit from the attachment in column (f) of the last row.

Line 2: New Markets Credit from Partnerships and S Corporations

- Line 2:

Enter the total New Markets Credit passed through to you from partnerships or S corporations (as reported on Schedule K-1 or other supporting statement).

Line 3: Total Credit

- Line 3:

Add the amounts from line 1 (column (f) total) and line 2.- If you are a partnership or S corporation, report this amount on Schedule K.

- All other filers, report this amount on Form 3800, Part III, line 1i.

Additional Notes and Tips

- Supporting Documentation:

Retain Form 8874-A from the CDE for each investment and any additional statements you attach. - Recapture:

If a recapture event occurs (such as the CDE ceasing to qualify or redeeming your investment), you may need to file Form 8874-B and increase your tax by the recapture amount. Report recapture on your tax return as instructed. - Basis Reduction:

You must reduce your basis in the investment by the amount of credit allowed. - Paperwork Reduction Act Notice:

The IRS estimates it takes about 6 hours to keep records, 1 hour to learn the law, and 1 hour to prepare and send the form.

Summary Table: IRS Form 8874

| Line/Column | What to Enter |

|---|---|

| Name/ID | Your name and taxpayer ID as on your tax return |

| 1(a) | Name and address of CDE |

| 1(b) | EIN of CDE |

| 1(c) | Date of initial investment |

| 1(d) | Amount of qualified equity investment |

| 1(e) | Credit rate (5 or 6) |

| 1(f) | Credit (multiply 1(d) by 5% or 6%) |

| 2 | Credit from partnerships/S corps (Schedule K-1) |

| 3 | Total credit (add line 1(f) and line 2) |