Unlike the regular Form 1040, this special form is meant for seniors with poor vision. You can use this form if you’re over 65, but if you’re under 65, you can still use the standard 1040. If you think you need this form, however, you should make sure you have a legitimate reason for needing it. Form 1040 and Form 1040-SR actually have the same purpose. However, Form 1040-SR is designed for elderly taxpayers with vision problems. The form has larger boxes and fonts. It also has a table that lists the standard deduction amounts. Senior citizens can use these forms to report their income. They can also claim the recovery rebate credit on their 2021 coronavirus stimulus checks.

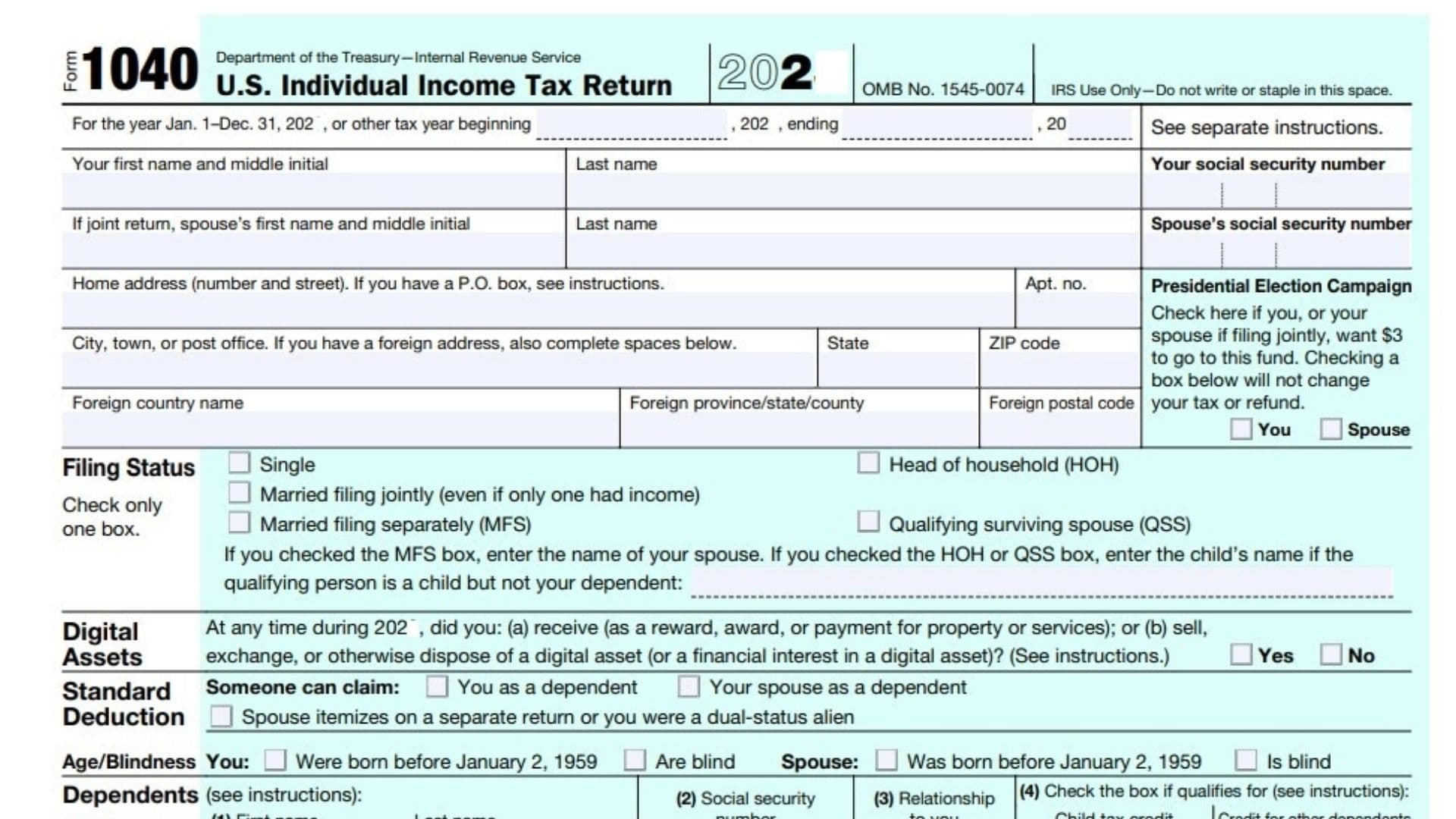

How to Complete Form 1040?

The first part of completing Form 1040 is to calculate your AGI. To do this, subtract your non-taxable income from your taxable income. The adjusted gross income must be less than $156,900 or more than $4,050. Here is every step you should take when you fill out Form 1040:

- Filing Status: Single, Married Filing Jointly, Married Filing Separately, Head of Household, Qualifying Widow(er)

- Primary taxpayer area: Enter your name and Social Security Number here

- If your child is not seen as your dependent by the IRS, enter your child’s name and SSN in the area given above your last name and SSN.

- Address: Enter your address

- Presidential Election Campaign: You may skip this part. You may only check the Spouse box if you are filing a joint return.

- Virtual Currency Question: A YES or NO question.

- Standard Deduction: Check the appropriate boxes. If you’re married filing separately, don’t touch any of the last three boxes.

- Dependent Information: Complete Columns 1,2 and 3 for each dependent. Press the “Add” button to enter your Identity Protection PIN ( IP PIN ) if your dependents have IP PINs.

- Column 1: Enter dependent name

- Column 2: Enter Social Security Number of your dependent

- Column 3: Relationship selection

- Column 4: Credits. You can leave the boxes unchecked for each dependent you list or check one of the two checkboxes. Review Form 1040 Instructions for details.

- Line 1: Manual Entry: Enter your wages, salaries, tips, etc., in the column area for Line 1

- Line 2: Manual entry

- Line 2b: Manual entry with an “Add” button for Schedule B

- Line 3a: Manual entry, Enter your total Qualified Dividends into the area. Leave areas (1) and (2) blank if you don’t have Form 8814

- Line 3b: Manual entry, Enter your total Ordinary Dividends. Leave areas (1) and (2) blank if you don’t have Form 8814.

- Line 4a: Enter your total distributions

- Line 4b: Enter your taxable distributions in the right column

- Line 5a: Enter your total pensions and annuities

- Line 5b: Enter your taxable Pensions and Annuities.

- Line 6a: Enter your total Social Security benefit amount

- Line 6b: Enter your taxable Social Security benefits. Review the form instructions regarding line 6b codes.

- Line 7: Entering the Form 8814 amount. If you are not required to attach Schedule D, check the box to the right of the column. If entering a loss, precede your number with a minus (-) sign.

- Line 8: Calculates the amount from Schedule 1, line 10. Clicking the “Add” button will result in opening Schedule 1.

- Line 9: Calculates lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8.

- Line 10: Calculates the amount from Schedule 1, line 26. The “Add” button will open Schedule 1.

- Line 11: Subtracts line 10 from line 9.

- Line 12: Manual entry

- Line 12b: Manual entry

- Line 12c: An “Add” button for Schedule A and adds lines 12a and 12b.

- Line 13: Makes some calculations of the process.

- Line 14: Makes some calculations of the process.

- Line 15:Makes some calculations of the process.

- Line 16: Manual entering of tax. Don’t check anything here unless you’re told to.

- Checkbox 1 means you have tax associated with Form 8814. Click the Add” button for Form 8814 and enter the tax associated with Form 8814.

- Checkbox 2 means you have tax associated with Form 4972. the Add” button for Form 4972 and enter the tax associated with Form 8814. There are separate sections for both TAXPAYER and SPOUSE.

- Checkbox 3 means you have specific and additional tax to declare. Enter this additional tax amount here.

- Line 17: Makes some calculations of the process.

- Line 18: Makes some calculations of the process.

- Line 19: Enter the amount for Child Tax Credit ( CTC ) and Credit for Other Dependents.

- Line 20: Makes some calculations of the process.

- Line 21: Makes some calculations of the process.

- Line 22: Makes some calculations of the process.

- Line 23: Makes some calculations of the process.

- Line 24: Makes some calculations of the process.

- Line 25a: Manual Entry

- Line 25b: Manual Entry

- Line 25c: Manual Entry

- Line 25d: Makes some calculations of the process.

- Line 26: Manual entry. Enter your Social Security Number associated with the DIV code after you click on “DIV” before that column.

- Line 27a: Manual entry or a “NO” or “CLERGY” selection.

- Line 27b: Manual Entry

- Line 27c: Manual Entry

- Line 28: Select “PYEI” and Prior Year Earned Income (PYEI) amount.

- Line 29: Makes some calculations of the process.

- Line 30: Manual entry.

- Line 31: Makes some calculations of the process.

- Line 32: Makes some calculations of the process.

- Line 33: Makes some calculations of the process. If you add Form 8689, leave these two areas blank. Once you enter the amount, the calculation will be added to Line 33 calculation.

- Line 34: Makes some calculations of the process.

- Line 35a: Makes some calculations of the process. A possible Estimated Tax Penalty amount is deducted as part of the calculation here. Don’t check any boxes here unless you want to split your refund to purchase U.S. Savings Bonds and/or direct your refund into more than one financial institution.

- Line 35b: Enter the routing number correctly.

- Line 35c: Select checking or savings.

- Line 35d: Enter your account number.

- Line 36: Select “Do the Math,” The refund amount you want to be applied to estimated taxes for the following tax year will be added to line 35a calculation.

- Line 37: Some calculations.

- Line 38: Some and final calculations.

Signature Section

- Enter the occupation area for the Primary Taxpayer

- If you have received a six-digit Identity Protection PIN from the IRS through the mail, enter it here.

- When you have completed your tax return, select the STEP 2 Tab at the top of the page

- Review Sections 1 – 5 in STEP 2 before attempting to e-file (Transmit) your return.