Credits and Other Specific Purpose Forms

These forms are used to claim various tax credits or to report specific financial activities that don’t fall neatly into other standard categories. These forms help taxpayers take advantage of certain tax benefits, such as credits for specific energy investments, educational expenses, or business incentives.

-

Form 8874-A

IRS Form 8874-A, “Notice of Qualified Equity Investment for New Markets Credit,” is used by qualified community development entities (CDEs)…

-

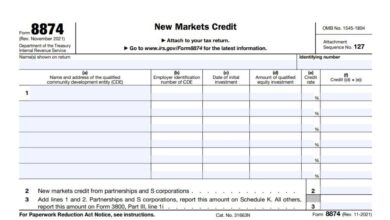

Form 8874

If you’re looking to claim the New Markets Credit for investments in qualified community development entities, understanding IRS Form 8874…

-

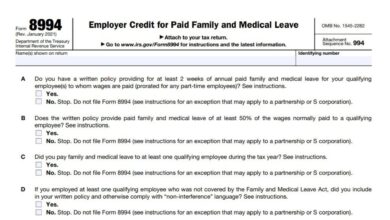

Form 8994

IRS Form 8994, officially titled “Employer Credit for Paid Family and Medical Leave,” is a federal tax form that allows…

-

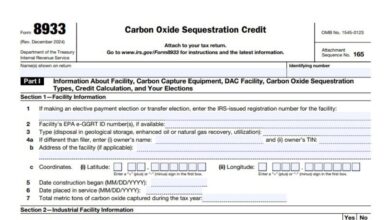

Form 8933

IRS Form 8933, officially titled “Carbon Oxide Sequestration Credit,” is a federal tax form used by businesses and individuals to…

-

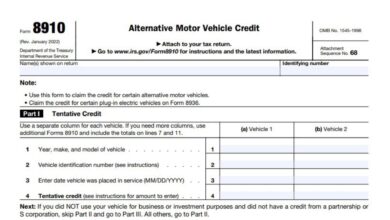

Form 8910

IRS Form 8910, “Alternative Motor Vehicle Credit,” is used by taxpayers to claim a federal tax credit for purchasing or…

-

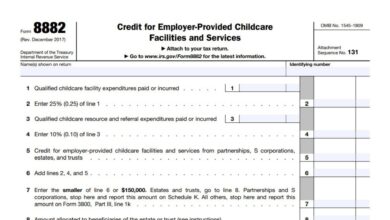

Form 8882

Form 8882, also known as the Credit for Employer-Provided Childcare Facilities and Services, is a tax form used by employers…

-

Form 8885

IRS Form 8885 is used to claim the Health Coverage Tax Credit (HCTC), which provides financial assistance to eligible individuals…

-

Form 8609

IRS Form 8609, Low-Income Housing Credit Allocation and Certification, is used by property owners to claim the Low-Income Housing Tax…

-

Form 8586

IRS Form 8586, Low-Income Housing Credit, is used to claim tax credits for qualified low-income housing projects. This credit is…

-

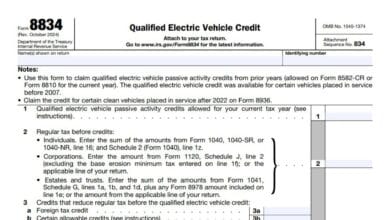

Form 8834

IRS Form 8834, officially known as the Qualified Electric Vehicle Credit form, is used by taxpayers to claim tax credits…