Tax-Exempt Organizations Tax Forms

Forms for tax-exempt entities help organizations apply for and maintain their tax-exempt status. They ensure compliance with IRS rules and include annual financial reporting. Key forms include Form 990, 1023, and Schedule A.

-

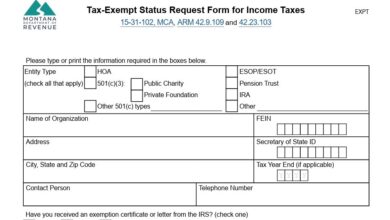

Montana Form EXPT

The Montana Form EXPT, officially titled the “Tax-Exempt Status Request Form for Income Taxes,” is a critical document used by…

-

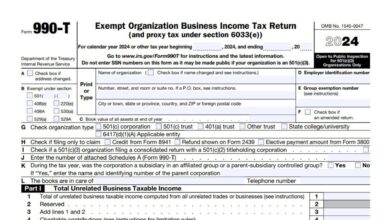

Form 990-T

IRS Form 990-T—formally titled “Exempt Organization Business Income Tax Return”—is the return that tax-exempt organizations use to report and pay…

-

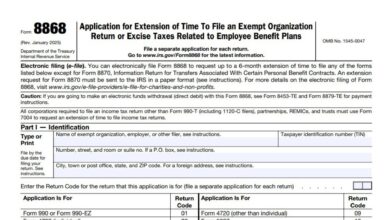

Form 8868

IRS Form 8868, officially titled “Application for Extension of Time To File an Exempt Organization Return or Excise Taxes Related…

-

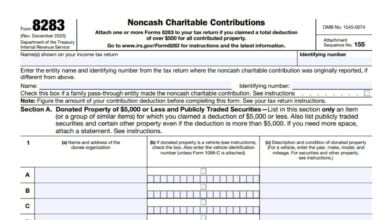

Form 8283

Form 8283 is used to report noncash charitable contributions valued at more than $500. This form helps taxpayers claim a…

-

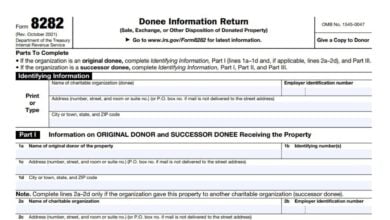

Form 8282

Form 8282, Donee Information Return, is used by charitable organizations to report information about the sale, exchange, or other disposition…

-

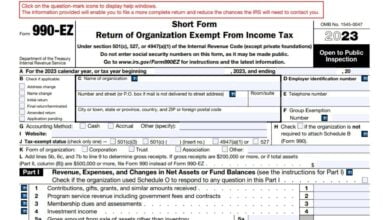

Form 990-EZ

Form 990-EZ, Short Form Return of Organization Exempt From Income Tax, is used by tax-exempt organizations to provide the IRS…

-

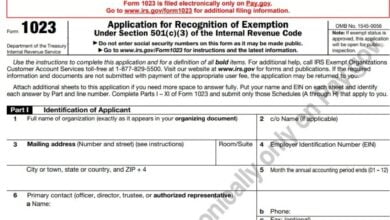

Form 1023

Form 1023, or Application for Recognition of Exemption Under the 501 Internal Revenue Code, is a form that nonprofits file…

-

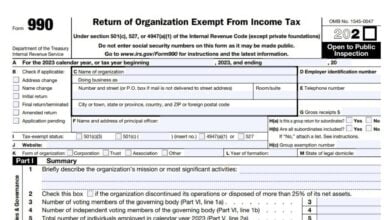

Form 990

Form 990 is an annual information return filed by tax-exempt organizations with the Internal Revenue Service (IRS). The purpose of…