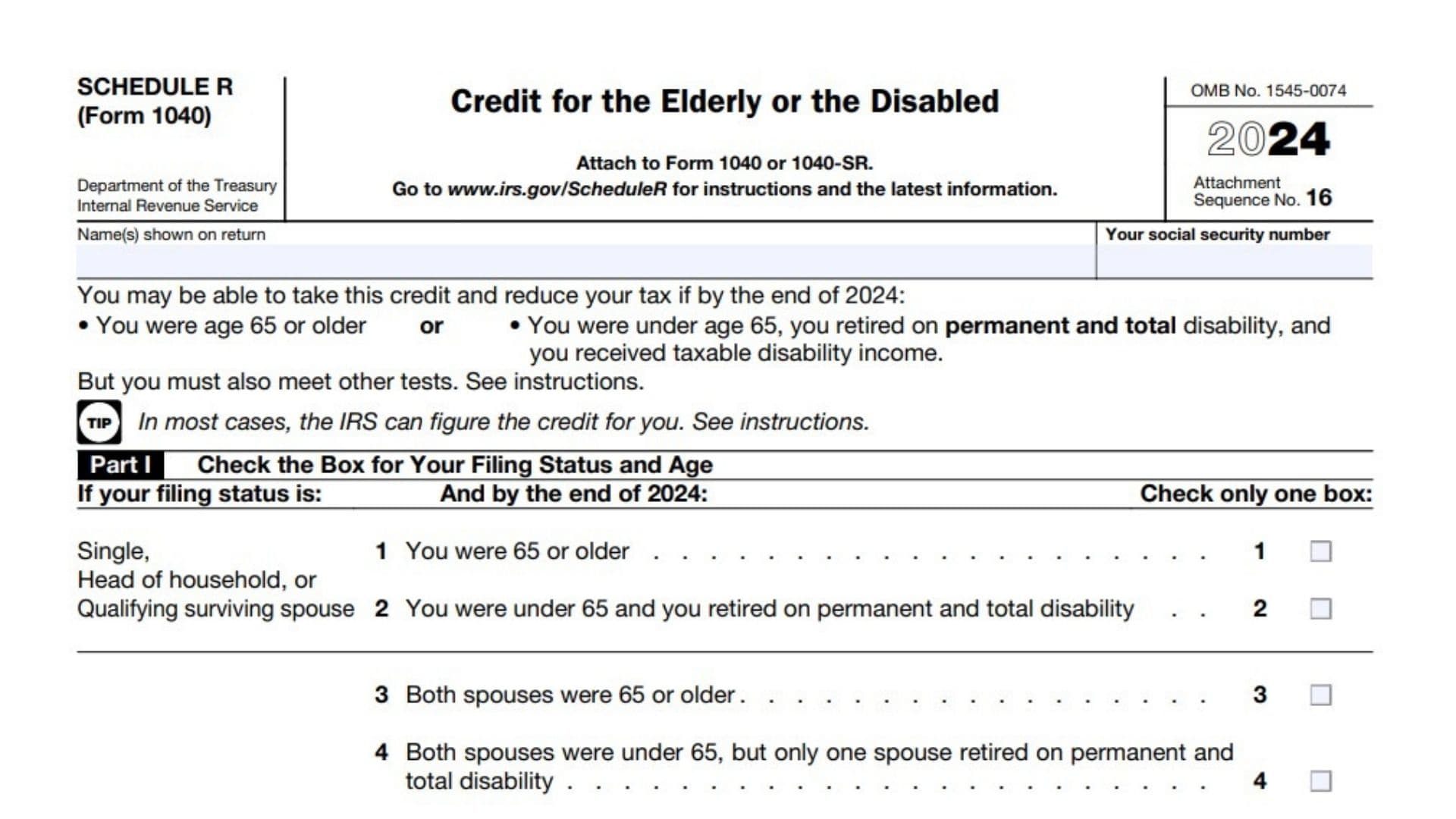

Schedule R (Form 1040) is a tax form used to calculate and claim the Credit for the Elderly or Disabled, a special tax benefit designed to reduce the tax burden for qualifying seniors aged 65 or older and permanently disabled individuals who receive taxable disability income. This credit helps eligible taxpayers reduce their tax liability based on their filing status, age, disability status, and income levels. The form consists of three main parts that help determine eligibility, verify disability status if applicable, and calculate the actual credit amount.

Filing Requirements

- Attach Schedule R to Form 1040 or 1040-SR

- File if you’re age 65 or older OR

- File if you’re under 65 but permanently disabled with taxable disability income

How to Complete Schedule R (Form 1040)?

Part I – Filing Status and Age (Check only one box that matches your situation)

- Box 1: Single, age 65 or older

- Box 2: Single, under 65 and disabled

- Boxes 3-7: Married filing jointly with various age/disability combinations

- Boxes 8-9: Married filing separately with specific conditions

Part II – Disability Statement (Complete only if you checked box 2, 4, 5, 6, or 9:)

- Check the box if you have a previously filed physician’s statement

- If not checked, obtain new physician’s statement

Part III – Credit Calculation

- Line 10: Enter base amount:

- $5,000 for boxes 1, 2, 4, or 7

- $7,500 for boxes 3, 5, or 6

- $3,750 for boxes 8 or 9

- Line 11: Enter taxable disability income if applicable

- Line 12: Enter smaller amount from line 10 or 11

- Line 13: Enter nontaxable benefits:

- 13a: Social security and railroad retirement benefits

- 13b: Veterans’ pensions and other excluded benefits

- 13c: Add lines 13a and 13b

- Line 14: Enter amount from Form 1040 line 11

- Line 15: Enter income limit based on filing status:

- $7,500 for boxes 1 or 2

- $10,000 for boxes 3, 4, 5, 6, or 7

- $5,000 for boxes 8 or 9

- Line 16: Subtract line 15 from line 14

- Line 17: Calculate one-half of line 16

- Line 18: Add lines 13c and 17

- Line 19: Subtract line 18 from line 12

- Line 20: Multiply line 19 by 15% (0.15)

- Line 21: Enter the amount from the Credit Limit Worksheet in the instructions

- Line 22: Credit for the elderly or the disabled. Enter the smaller of line 20 or line 21. Also enter this amount on Schedule 3 (Form 1040), line 6d