Schedule 2 (Form 1040), officially titled “Additional Taxes,” is an important component of the U.S. federal income tax return that some taxpayers must complete alongside their main Form 1040. This supplementary form, introduced as part of the Tax Cuts and Jobs Act of 2017’s effort to streamline tax filing, serves as a detailed breakdown of various additional taxes that don’t have a dedicated line on the simplified Form 1040. Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on Form 1040, such as self-employment tax, household employment taxes, and additional taxes on IRAs and other qualified retirement plans. By segregating these additional tax items on a separate form, the IRS aims to maintain a cleaner, more straightforward main Form 1040 while still allowing taxpayers to report all necessary tax liabilities accurately. Purpose of Schedule 2 (Form 1040):

Schedule 2 serves to report various additional taxes that a taxpayer may owe, including:

- Self-employment tax

- Unreported Social Security and Medicare tax

- Additional tax on IRAs, other qualified retirement plans, and other tax-favored accounts

- Household employment taxes

- Repayment of first-time homebuyer credit

- Additional Medicare Tax

- Net Investment Income Tax

- Excess advance premium tax credit repayment

When to File Schedule 2?

You must complete Schedule 2 if you owe any of the additional taxes listed on the form. Even if you only have one item to report, you’re required to use Schedule 2 and attach it to your Form 1040.

Here are instructions for completing Schedule 2 (Form 1040) based on the provided IRS form:

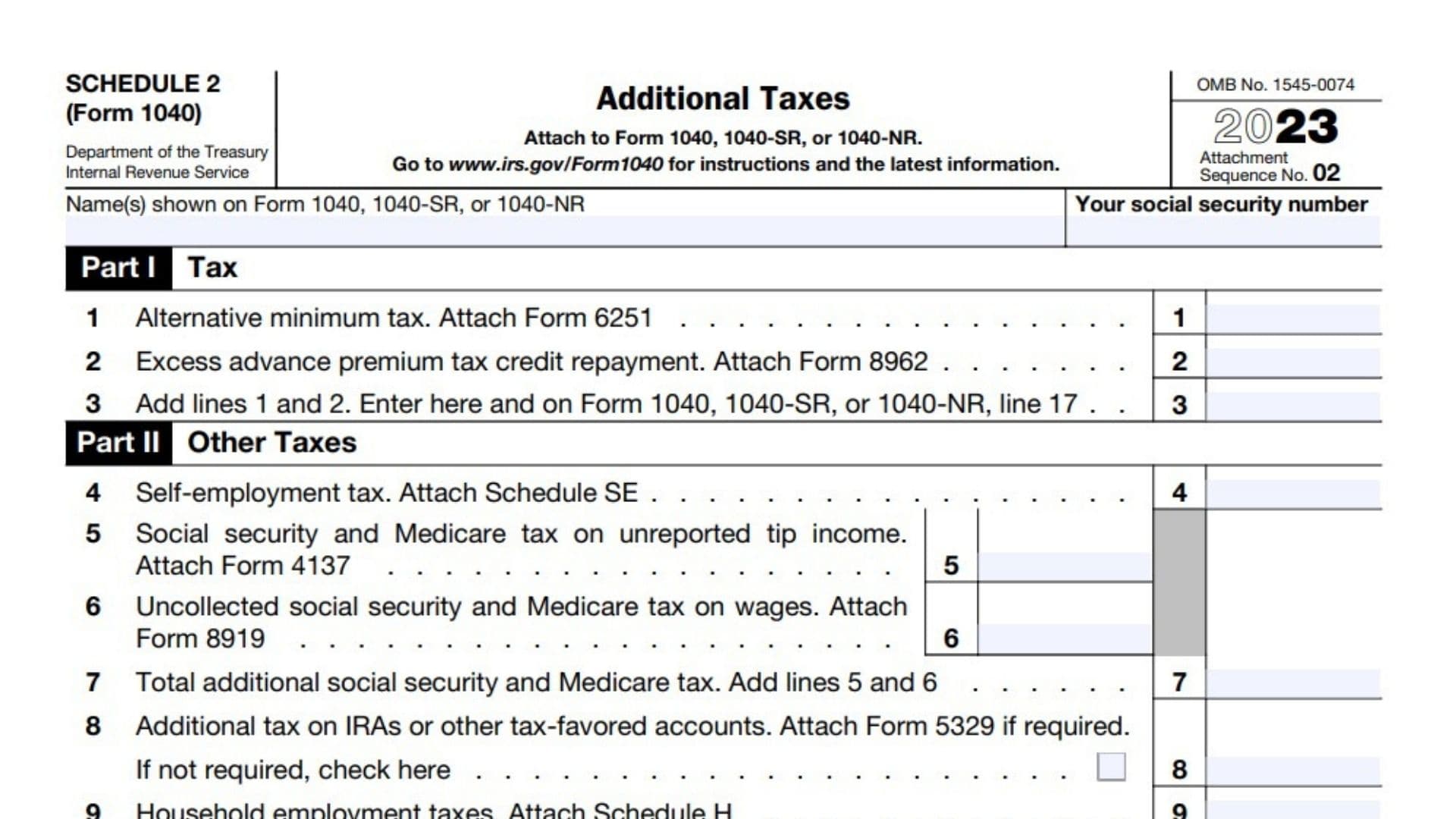

Part I: Tax

- Calculate your Alternative Minimum Tax using Form 6251 and enter the amount on line 1.

Part II: Other Taxes

- Enter your self-employment tax from Schedule SE on line 4.

- Report any unreported tip income social security and Medicare tax using Form 4137 on line 5.

- Enter uncollected social security and Medicare tax on wages from Form 8919 on line 6.

- Add lines 5 and 6 and enter the total on line 7.

- Report additional tax on IRAs or other tax-favored accounts using Form 5329 on line 8. If not required, check the box provided.

- Enter household employment taxes from Schedule H on line 9.

- If applicable, report repayment of first-time homebuyer credit using Form 5405 on line 10.

- Calculate Additional Medicare Tax using Form 8959 and enter on line 11.

- Report Net Investment Income Tax from Form 8960 on line 12.

- Enter any uncollected social security, Medicare, or RRTA tax on tips or group-term life insurance from Form W-2, box 12 on line 13.

- Report interest on tax due on installment income from certain residential lots and timeshares on line 14.

- Enter interest on deferred tax on gain from certain installment sales over $150,000 on line 15.

- Report recapture of low-income housing credit using Form 8611 on line 16.

Other Additional Taxes

- Complete lines 17a through 17z for various additional taxes, including:

- Recapture of other credits

- Recapture of federal mortgage subsidy

- Additional tax on HSA and MSA distributions

- Recapture of charitable contribution deductions

- Taxes related to nonqualified deferred compensation plans

- Excise taxes and look-back interest

- Taxes for nonresident aliens

- Interest from Form 8621

- Add lines 17a through 17z and enter the total on line 18.

- Enter any Section 965 net tax liability installment from Form 965-A on line 20.

- Add lines 4, 7 through 16, and 18 to calculate your total other taxes. Enter this amount on line 21 and on Form 1040, 1040-SR, or 1040-NR as indicated.

- Report other additional taxes on lines 17a through 17z:a. Enter any recapture of other credits, listing the type, form number, and amount.

b. Report recapture of federal mortgage subsidy if you sold your home.

c. Enter additional tax on HSA distributions using Form 8889.

d. Report additional tax on HSA for not remaining an eligible individual using Form 8889.

e. Enter additional tax on Archer MSA distributions using Form 8853.

f. Report additional tax on Medicare Advantage MSA distributions using Form 8853.

g. Enter recapture of charitable contribution deduction related to fractional interest in tangible personal property.

h. Report income from nonqualified deferred compensation plans failing to meet section 409A requirements.

i. Enter compensation from nonqualified deferred compensation plans described in section 457A.

j. Report section 72(m)(5) excess benefits tax.

k. Enter tax on golden parachute payments.

l. Report tax on accumulation distribution of trusts.

m. Enter excise tax on insider stock compensation from an expatriated corporation.

n. Report look-back interest under section 167(g) or 460(b) from Form 8697 or 8866.

o. Enter tax on non-effectively connected income for nonresident aliens from Form 1040-NR.

p. Report interest from Form 8621, line 16f, relating to distributions from and dispositions of stock of a section 1291 fund.

q. Enter interest from Form 8621, line 24.

r. Report any other taxes, listing the type and amount. - Add lines 17a through 17z and enter the total on line 18.

- Line 19 is reserved for future use.

- Enter any Section 965 net tax liability installment from Form 965-A on line 20.

- Add lines 4, 7 through 16, and 18. This is your total other taxes. Enter this amount on line 21 and on Form 1040, 1040-SR, line 23, or Form 1040-NR, line 23b.