Montana Form TP-103 is used for claiming a tax credit for tobacco products that have been returned to the manufacturer or destroyed, and therefore, are eligible for a refund of tobacco product taxes previously paid. This form allows businesses to reconcile tobacco taxes on products that were either returned due to damage, spoilage, or other reasons or destroyed in a manner that prohibits them from being resold. It is important to note that all claims for the tax credit must be substantiated by supporting documentation, such as credit memos from the manufacturer or an affidavit from the business owner or principal. This form must be filed with the Montana Department of Revenue to receive the credit.

How to File Montana Form TP-103

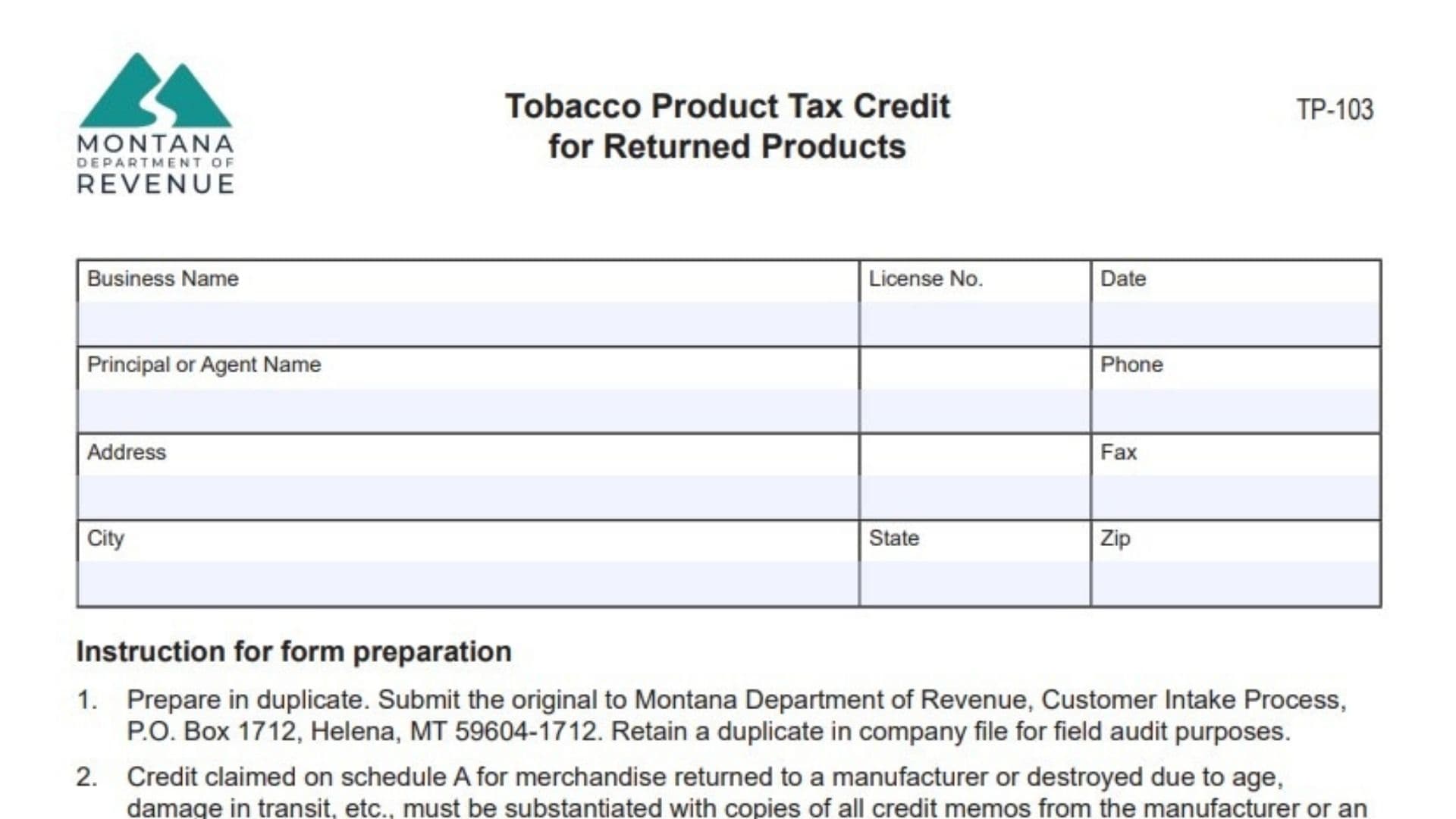

Filing Montana Form TP-103 is a straightforward process that requires you to carefully complete the form and submit it to the Montana Department of Revenue. The form needs to be submitted in duplicate, with the original going to the Department of Revenue at the provided address and the duplicate retained for your records. This helps maintain transparency and provides necessary documentation in case of a future audit.

Ensure that you include the required supporting documentation for the returned or destroyed tobacco products. This could include credit memos or an affidavit, as specified in the instructions.

How to Complete Montana Form TP-103

Section 1 – Tobacco Product Tax Credit Reconciliation

- Total tobacco products tax from manufacturer credit memos (total line 3, column A, schedule A)

In this line, you will enter the total tobacco product tax credit amount from the credit memos you received from the manufacturer. This total should be calculated by adding up the figures from Schedule A, Column A, Line 3.

Example: If you have multiple credit memos, sum the tax credits from each memo. - Total moist snuff products tax from manufacturer credit memos (total line 3, column B, schedule A)

Similarly, for moist snuff products, calculate the total tax credit from the credit memos as you did for tobacco products. This amount should be recorded from Schedule A, Column B, Line 3.

Example: Add up the amounts listed for moist snuff products from the credit memos. - Total (add line 1 and line 2)

Add the amounts from Line 1 and Line 2 to get the total tobacco and moist snuff product taxes. This value will be used in further calculations for the credit. - Discount rate

The discount rate for this form is set at 0.015 (1.5%). This figure is fixed and does not need to be altered unless instructed by the department in future updates. - Total tobacco product tax discount (multiply line 3 by line 4)

Multiply the total amount from Line 3 by the discount rate (1.5%) to calculate your total tobacco product tax discount. - Tobacco product tax credit (subtract line 5 from line 3)

To find the final credit amount, subtract the amount from Line 5 (tax discount) from the total in Line 3. This figure represents the total credit you are eligible to claim for returned or destroyed tobacco products.

Signature Section

- Print Name of Principal or Agent

Enter the printed name of the principal or agent who is authorized to sign the form on behalf of the business. - Date

Include the date the form is being signed. - Signature of Principal or Agent

The authorized person should sign the form here to certify that the information provided is accurate.

Schedule A – Tobacco Products Returned to Manufacturer or Destroyed

- Total manufacturer refund credit value

In this section, list the total value of refunds you have received from manufacturers for tobacco products returned or destroyed. This will be based on the credit memos provided by the manufacturer. - Tobacco products tax rates

The tobacco products tax rates are provided as fixed values, which are 0.50 (50%) for regular tobacco products, and $0.85 per ounce for moist snuff products. - Total manufacturer refund credit tobacco products tax (multiply line 1 with line 2)

To calculate the total tax credit for the manufacturer refund, multiply the value from Line 1 by the corresponding tobacco tax rate from Line 2. This value is used to calculate the amount of tax credit you will be claiming.