The Montana Form IUFC (Infrastructure User Fee Credit) is a specific tax document designed for businesses that have expanded or launched due to a loan from the Montana Board of Investments. If your business pays fees to use infrastructure created through these loans—aimed at boosting economic development and creating jobs in basic economic sectors—you may be eligible to claim this credit against your state tax liability. Essentially, the form allows you to recover portions of the interest and principal paid on these infrastructure loans. Whether you are a sole proprietor, a partner in a partnership, a shareholder in an S corporation, or a C corporation, this form is the mechanism to calculate and report your credit. The form is divided into sections depending on your entity type, ensuring that everyone from individual investors to large corporations can properly document their allowable credit, including provisions for carrying unused credits back three years or forward seven years.

Before You Start: Required Documents

To successfully file this form, you cannot just rely on your own records. You must attach a copy of the official letter from the Montana Board of Investments. This letter details the specific principal and interest paid during the tax year, which is the basis for your credit calculation. If you are claiming a carryover from previous years, you must also attach a detailed schedule showing those amounts.

How to Complete Montana Form IUFC

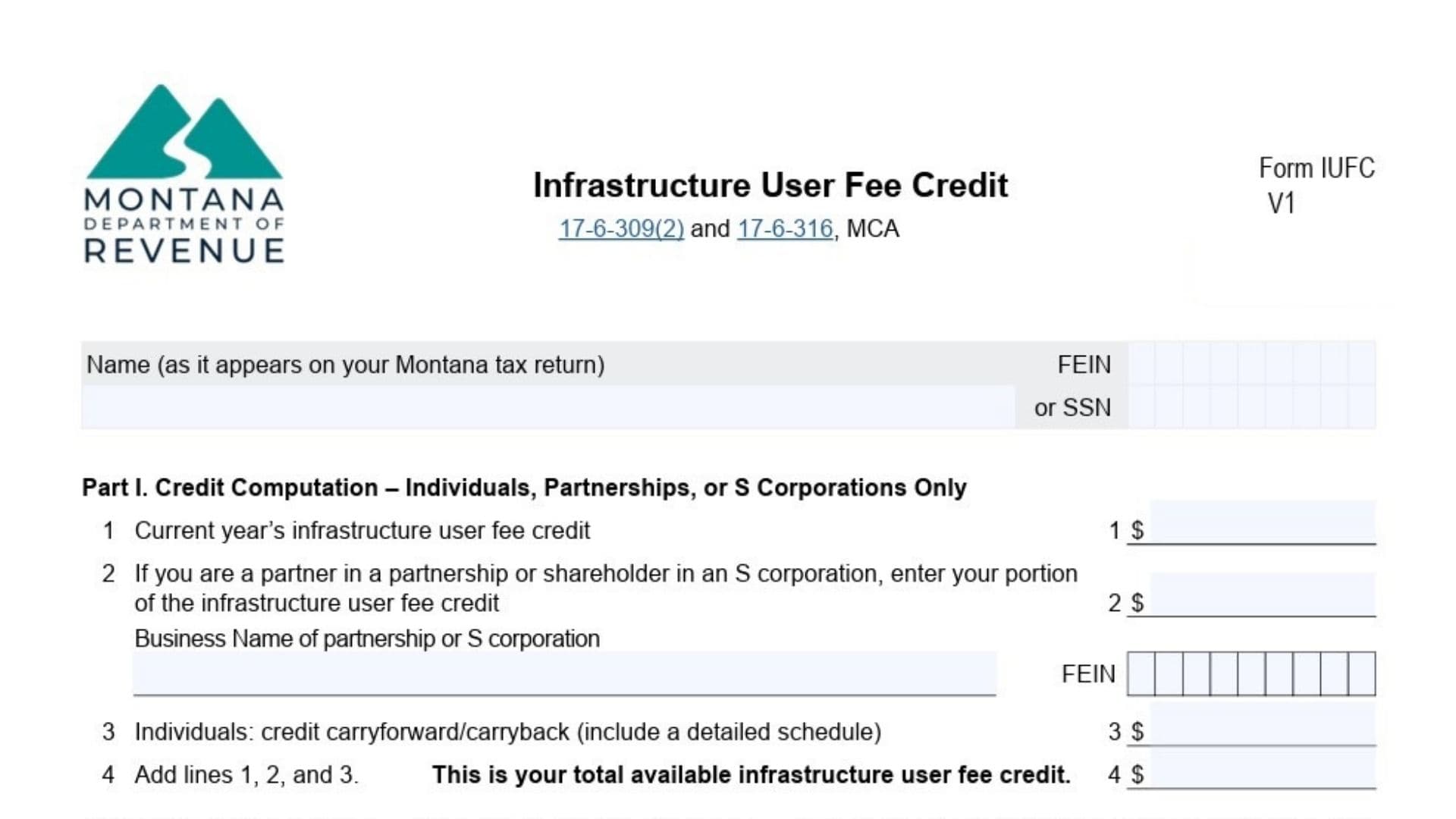

Part I: Instructions For Individuals, Partnerships, And S Corporations

If you are filing as an individual, a partnership, or an S corporation, this is the only section you need to complete for the calculation. C corporations should skip this and go straight to Part II.

Line 1: Enter the total amount of the infrastructure user fee credit for the current year. This figure comes directly from the total interest and principal paid, as stated in the letter you received from the Montana Board of Investments. Remember to attach that letter to your return.

Line 2: This line is for partners, shareholders, or members of an S corporation or partnership. Enter the specific portion of the credit that was allocated to you. You can find this amount on your Montana Schedule K-1 (PTE). You must also write down the name and Federal Employer Identification Number (FEIN) of the entity. If you received credits from more than one entity, add them all up, enter the total here, and include a separate statement listing each entity and the amount they distributed to you.

Line 3: Individuals only: Enter any credit carryforward (from previous years) or carryback (from future years) here. If you are a partnership or S corporation, leave this blank. You must attach a schedule detailing how you calculated these carryover amounts. Note that prior-year credits should be calculated using the same method as the current year.

Line 4: Add the amounts from Line 1, Line 2, and Line 3 together. Enter the total here. This figure represents your total available infrastructure user fee credit. Individuals transfer this amount to Form 2, Schedule III, while partnerships and S corporations transfer it to Form PTE, Schedule II.

Part II: Instructions For C Corporations Only

This section is exclusively for C corporations. If you have multiple entities with loan agreements, you must complete a separate column (A, B, C) for each one. Use additional sheets if you have more than three entities.

- Line 1: Enter the full legal name of the entity that is paying the fees to use the infrastructure.

- Line 2: Enter the Federal Employer Identification Number (FEIN) corresponding to the entity listed in Line 1.

- Line 3: Input your current year credit. This is equal to the total interest and principal paid by the entity, exactly as reported in the letter from the Montana Board of Investments. If your business operates on a fiscal year rather than a calendar year, you will need to prorate this credit based on the number of months in your tax year.

- Line 4: Enter any separate entity credit carryforward or carryback amounts here. Just like in Part I, you must include a detailed schedule showing your carryover calculations. These should be computed in the same manner as the current year’s credit.

- Line 5: Add the amounts from Line 3 and Line 4. Enter the result here. This figure is your total available infrastructure user fee credit for that specific entity.

- Line 6: Enter your Montana tax liability. You can find this amount on Montana Form CIT, Page 3, Line 10. If you are filing a combined return with multiple entities active in Montana, use the amount from Line 7n of Schedule K-Combined for this specific entity.

- Line 7: Compare Line 5 and Line 6. Enter the smaller of the two amounts here. This is your allowable separate entity credit. Note that you must use your current year’s credit to offset tax liability before you can dip into any carryover credits.

- Line 8: Add up the amounts from Line 7 for all columns (A, B, C, and any additional pages). Enter the grand total here. This is your final allowable infrastructure user fee credit. You will report this amount on Form CIT, Schedule C.

Important Limitations To Remember

- Tax Liability Limit: You cannot claim a credit larger than your tax liability for the year.

- Loan Amount Limit: The total tax credits claimed over time cannot exceed the original amount of the loan.

- Carryover Rules: You can carry unused credits back for three years or forward for seven years.