IRS Schedule Forms

IRS Schedule Forms are supplementary forms that taxpayers attach to their main tax returns (such as Form 1040) to provide additional information, calculate specific types of income, deductions, or credits, or report other financial activities.

-

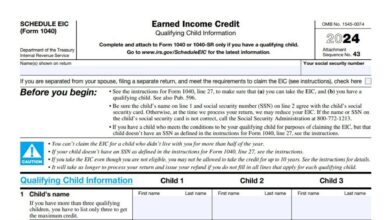

Schedule EIC (Form 1040)

IRS Schedule EIC (Form 1040) is used to claim the Earned Income Credit (EIC) for qualifying children. The EIC is…

-

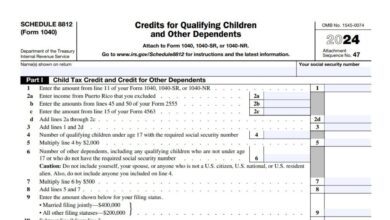

Schedule 8812 (Form 1040)

IRS Schedule 8812 (Form 1040) is a crucial tax form used to calculate the Child Tax Credit (CTC), the Credit…

-

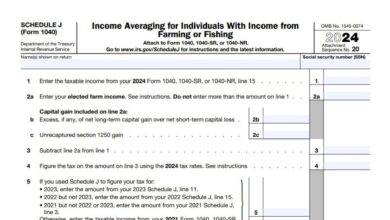

Schedule J (Form 1040)

IRS Schedule J (Form 1040), titled “Income Averaging for Individuals With Income from Farming or Fishing,” is a tax form…

-

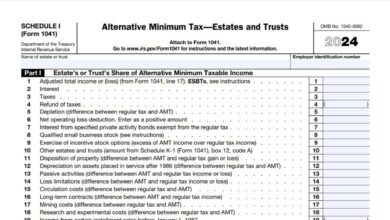

Schedule I (Form 1041)

IRS Schedule I (Form 1041) is used by estates and trusts to determine their liability under the Alternative Minimum Tax…

-

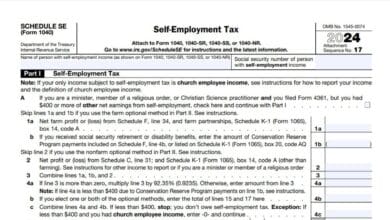

Schedule SE (Form 1040)

IRS Schedule SE (Form 1040) is used by self-employed individuals, freelancers, and independent contractors to calculate and report Social Security…

-

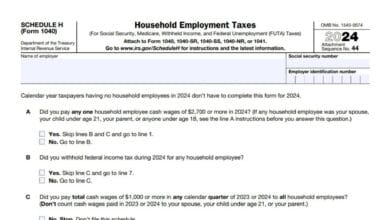

Schedule H (Form 1040)

IRS Schedule H (Form 1040) is a tax form used by taxpayers who employ household workers, such as nannies, housekeepers,…

-

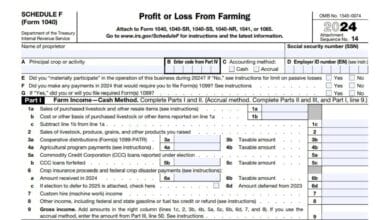

Schedule F (Form 1040)

Schedule F (Form 1040) is used by farmers to report their income and expenses related to farming activities. This form…

-

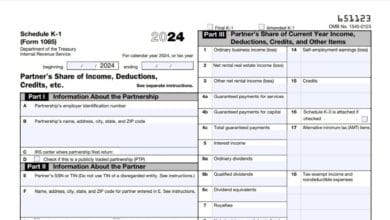

Schedule K-1 (Form 1065)

IRS Schedule K-1 (Form 1065) is used by partnerships to report a partner’s share of income, deductions, credits, and other…

-

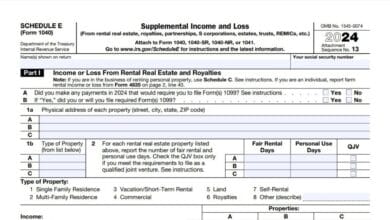

Schedule E (Form 1040)

IRS Schedule E, titled “Supplemental Income and Loss,” is a tax form attached to Form 1040, 1040-SR, or 1040-NR. It…

-

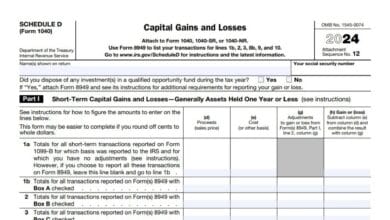

Schedule D (Form 1040)

IRS Schedule D (Form 1040) is a tax form used by individuals to report capital gains and losses from the…