IRS Schedule I (Form 1041) is used by estates and trusts to determine their liability under the Alternative Minimum Tax (AMT). The AMT ensures that entities with significant deductions, exemptions, or tax preferences pay a minimum tax. This form adjusts taxable income by adding back certain deductions (e.g., tax-exempt interest from private activity bonds, excess depreciation) and applying a two-tier tax rate (26% or 28%). Estates and trusts must file Schedule I if their alternative minimum taxable income (AMTI) exceeds $29,900 (2024 threshold). Special rules apply for Electing Small Business Trusts (ESBTs) and charitable trusts.

How to File Schedule I (Form 1041)?

- Attach to Form 1041: File Schedule I with the estate’s or trust’s annual income tax return (Form 1041).

- Deadline: Submit by April 15, 2025, or the extended deadline if applicable.

- Who Must File:

- Estates/trusts with AMTI exceeding $29,900 (2024).

- Entities with AMT adjustments (e.g., tax-exempt private activity bond interest, excess depreciation).

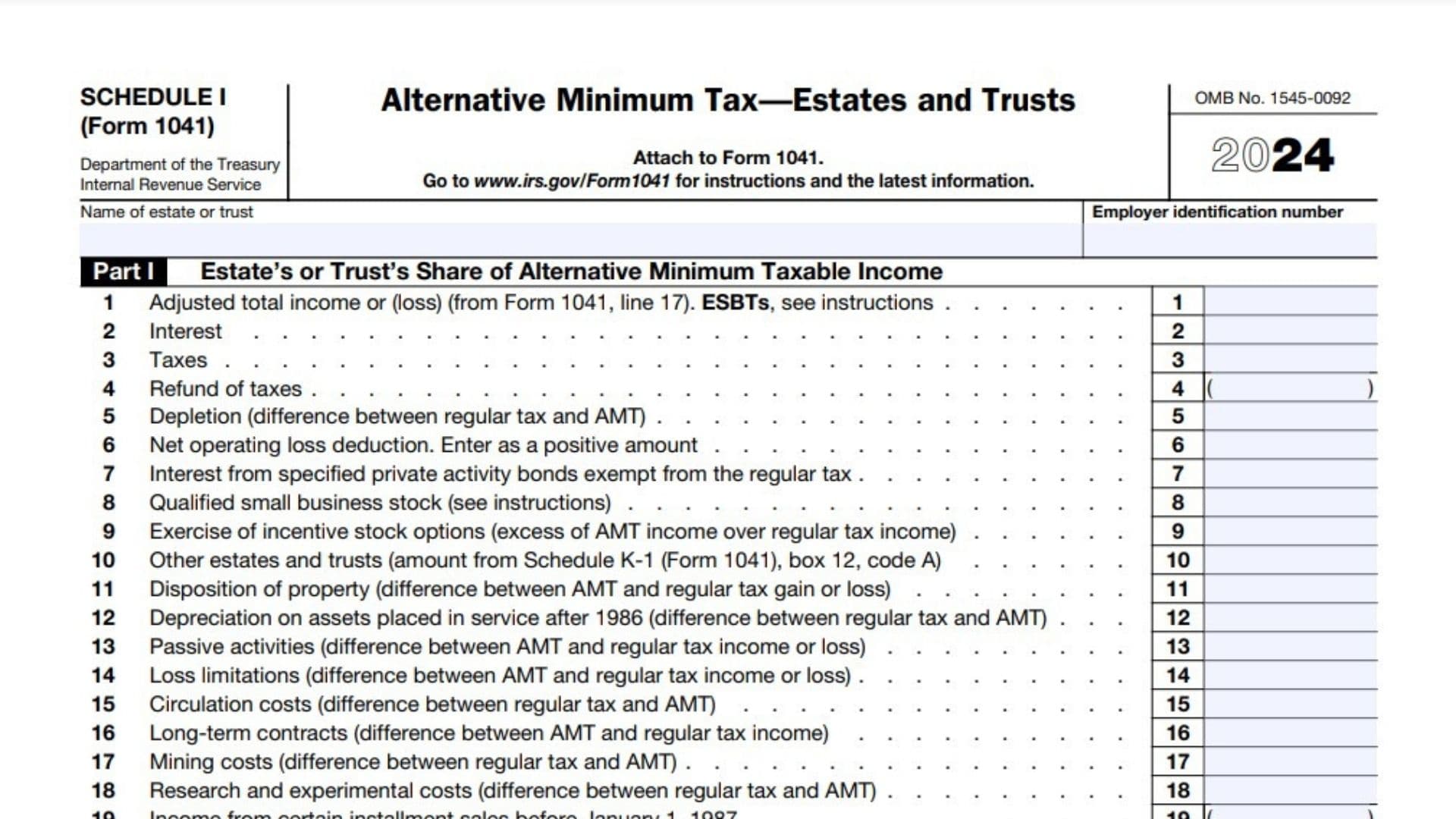

How to Complete Schedule I (Form 1041)?

Line 1: Enter the adjusted total income or loss from Form 1041, line 17. For Electing Small Business Trusts (ESBTs), follow specific instructions.

Line 2: Add tax-exempt interest excluded from regular tax (e.g., private activity bonds).

Line 3: Include state/local taxes deducted on Form 1041.

Line 4: Subtract refunds of taxes included in income.

Line 5: Enter the difference between regular tax and AMT depletion methods.

Line 6: Report net operating loss deduction as a positive amount.

Line 7: Include tax-exempt private activity bond interest excluded from regular tax.

Line 8: Adjust for qualified small business stock (see IRS instructions).

Line 9: Report excess AMT income over regular tax income from incentive stock options.

Line 10: Enter amounts from Schedule K-1 (Form 1041), box 12, code A.

Line 11: Adjust for property disposition differences (AMT vs. regular tax gains/losses).

Line 12: Adjust depreciation for assets placed in service after 1986.

Line 13: Account for passive activity income/loss differences (AMT vs. regular tax).

Line 14: Adjust for loss limitations under AMT rules.

Line 15: Adjust circulation costs (difference between AMT and regular tax).

Line 16: Adjust long-term contract income recognition methods.

Line 17: Adjust mining costs under AMT rules.

Line 18: Adjust research/experimental costs for AMT.

Line 19: Include income from pre-1987 installment sales deferred under regular tax.

Line 20: Report intangible drilling costs exceeding AMT limits.

Line 21: Include other adjustments (e.g., income-based adjustments).

Line 22: Apply alternative tax net operating loss deduction (see IRS limitations).

Line 23: Total adjusted AMTI = Lines 1–22 combined.

Complete Part II before proceeding to line 24.

Line 24: Enter income distribution deduction from Part II, line 42.

Line 25: Enter estate tax deduction from Form 1041, line 19.

Line 26: Add lines 24 and 25.

Line 27: Subtract line 26 from line 23.

- If ≤$29,900: Enter $0 on Form 1041, Schedule G, line 1c.

- If $29,901–$219,299: Proceed to Part III, line 43.

- If ≥$219,300: Enter line 27 on Part IV, line 49.

Part II: Income Distribution Deduction on a Minimum Tax Basis (Lines 28–42)

Line 28: Enter adjusted AMTI (from instructions).

Line 29: Enter adjusted tax-exempt interest (excluding line 7).

Line 30: Enter total net gain from Schedule D (Form 1041), line 19, column (1). If a loss, enter $0.

Line 31: Enter charitable capital gains from Form 1041, Schedule A, line 4.

Line 32: Enter charitable gross income gains (see instructions).

Line 33: Enter capital gains included in line 23.

Line 34: Enter capital losses (as a positive amount).

Line 35: DNAMTI = Lines 28–34 combined. If ≤$0, enter $0.

Line 36: Enter income required to be distributed (Form 1041, Schedule B, line 9).

Line 37: Enter other distributions (Form 1041, Schedule B, line 10).

Line 38: Total distributions = Lines 36 + 37.

Line 39: Subtract tax-exempt income (excluding line 7) from line 38.

Line 40: Tentative deduction = Line 38 – line 39.

Line 41: Tentative deduction limit = Line 35 – line 29.

Line 42: Final deduction = Smaller of line 40 or 41. Enter here and on Part I, line 24.

Part III: Alternative Minimum Tax (Lines 43–54)

Line 43: Enter exemption amount ($29,900 for 2024).

Line 44: Enter AMTI from line 27.

Line 45: Phase-out calculation:

- If line 44 > $219,300: Subtract $219,300 and multiply by 25%.

- Else, enter $0.

Line 46: Subtract line 45 from line 44. If ≤$0, enter $0.

Line 47: Multiply line 46 by 25% (0.25).

Line 48: Exemption after phase-out = Line 43 – line 47. If ≤$0, enter $0.

Line 49: Taxable AMTI = Line 44 – line 48.

Line 50: Tax calculation: - If line 49 ≤$232,600: Multiply by 26% (0.26).

- If line 49 >$232,600: Multiply by 28% (0.28) and subtract $4,652.

Line 51: Enter AMT foreign tax credit (see instructions).

Line 52: Tentative AMT = Line 50 – line 51.

Line 53: Enter regular tax from Form 1041, Schedule G, line 1a.

Line 54: AMT owed = Line 52 – line 53. Enter on Form 1041, Schedule G, line 1c.

Part IV: Line 50 Computation Using Maximum Capital Gains Rates (Lines 55–83)

Line 55: Enter taxable AMTI from line 49.

Line 56: Enter capital gains from Schedule D (Form 1041), line 26, or related worksheets (AMT-adjusted).

Line 57: Enter unrecaptured Section 1250 gain from Schedule D, line 18b (AMT-adjusted).

Line 58: Adjusted gains = Smaller of (line 56 + line 57) or Schedule D Tax Worksheet, line 10.

Line 59: Enter smaller of line 55 or line 58.

Line 60: Subtract line 59 from line 55.

Line 61: Tax on remaining AMTI:

- If line 60 ≤$232,600: Multiply by 26%.

- If line 60 >$232,600: Multiply by 28% and subtract $4,652.

Line 62: 0% rate threshold = $63,450 (2024).

Line 63: Enter qualified dividends/gains from regular tax worksheets.

Line 64: Subtract line 63 from line 62. If ≤$0, enter $0.

Line 65: Enter smaller of line 55 or line 56.

Line 66: Enter smaller of line 64 or line 65 (0% taxed amount).

Line 67: Subtract line 66 from line 65.

Line 68: 15% rate threshold = $15,450 (2024).

Line 69: Enter line 64.

Line 70: Enter gains taxed at lower rates from regular tax.

Line 71: Add lines 69 and 70.

Line 72: Subtract line 71 from line 68. If ≤$0, enter $0.

Line 73: Enter smaller of line 67 or line 72.

Line 74: Multiply line 73 by 15%.

Line 75: Add lines 66 and 73.

Line 76: Subtract line 75 from line 65.

Line 77: Multiply line 76 by 20%.

Line 78: Add lines 60, 75, and 76.

Line 79: Subtract line 78 from line 55.

Line 80: Multiply line 79 by 25%.

Line 81: Total capital gains tax = Lines 61 + 74 + 77 + 80.

Line 82: Alternative tax = Line 55 × 26% (or 28% if >$232,600).

Line 83: Enter smaller of line 81 or line 82 on Part III, line 50.

Final Steps

Attach Schedule I to Form 1041 and submit by the tax deadline. Double-check calculations for AMT adjustments and capital gains rates to ensure compliance.