Information Reporting Forms

Information reporting forms are used by businesses and institutions to report income and payments to the IRS. These forms ensure accurate income reporting by taxpayers. Examples include Forms 1099-INT, 1099-MISC, and 5498.

-

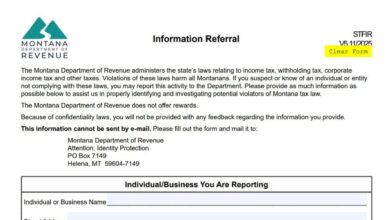

Montana Form STFIR

Tax laws are the foundation of public services, and when individuals or businesses evade them, it harms everyone in the…

-

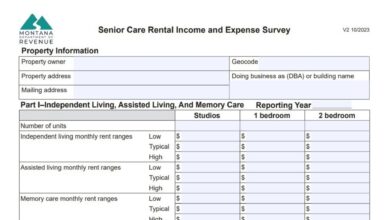

Montana Form IE-NH

For owners of senior care facilities in Montana, ensuring your property is accurately assessed requires transparent reporting of your financial…

-

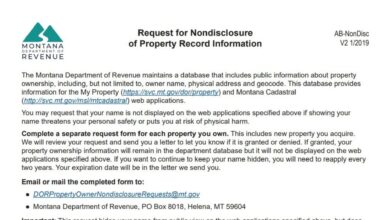

Montana Form AB-NonDisc

In an age where digital privacy is increasingly scarce, Montana property owners have a specific tool to help protect their…

-

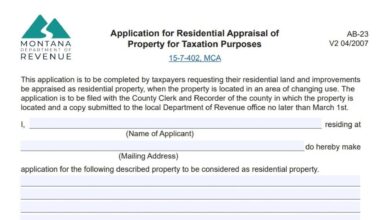

Montana Form AB-23

Montana Form AB-23 is a specialized property tax application used by homeowners whose residential property is located in an area…

-

Montana Form RTC

Montana Form RTC (Realty Transfer Certificate) is a required, confidential tax document used to report a transfer of real property…

-

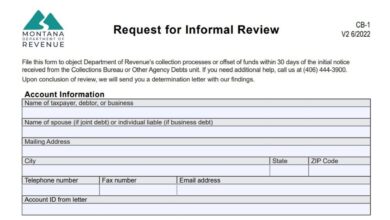

Montana Form CB-1

Montana Form CB-1, or “Request for Informal Review,” is the official document used to formally object to the collection actions…

-

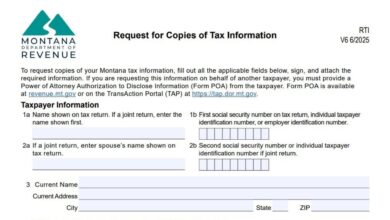

Montana Form RTI

Montana Form RTI is a formal request document submitted to the Montana Department of Revenue by individuals or their authorized…

-

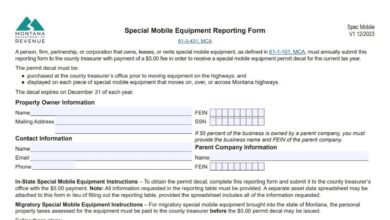

Montana Special Mobile Equipment Reporting Form

The Montana Special Mobile Equipment Reporting Form is a mandatory declaration filed annually by individuals or businesses that own, lease,…

-

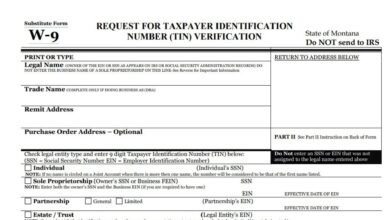

Montana Substitute Form W-9

The Montana Substitute Form W-9 is a specific tax document used by the State of Montana to request and verify…

-

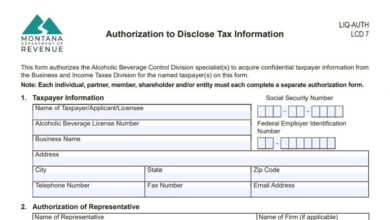

Montana Authorization to Disclose Tax Information Form

The Montana Authorization to Disclose Tax Information Form allows the Alcoholic Beverage Control Division (ABCD) to access confidential taxpayer information…