Individual Taxpayer Forms

This category includes forms for individuals filing personal income taxes, covering everything from the basic 1040 to forms for claiming deductions and filing amendments. These forms help taxpayers report income, claim credits, and comply with federal tax obligations. Examples include Form 1040, W-2, and 1040-X.

-

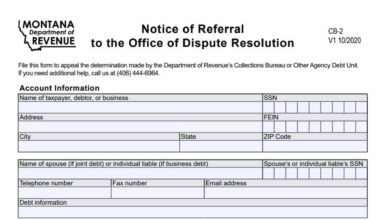

Montana Form CB-2

Montana Form CB-2 is the Notice of Referral to the Office of Dispute Resolution. This form is used to appeal…

-

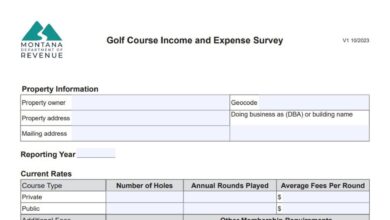

Montana Form IE-GOLF

Montana Form IE-GOLF is the Golf Course Rental Income and Expense Survey used by the Montana Department of Revenue to…

-

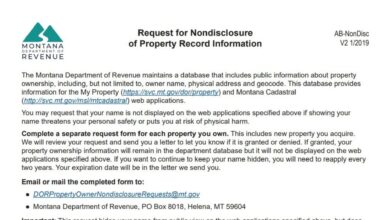

Montana Form AB-NonDisc

In an age where digital privacy is increasingly scarce, Montana property owners have a specific tool to help protect their…

-

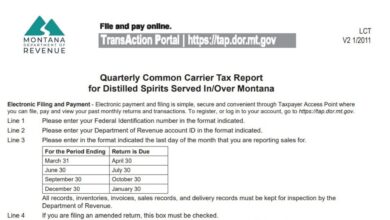

Montana Form LCT

For airlines, railroads, and other common carriers, serving a drink to a passenger while crossing state lines involves specific tax…

-

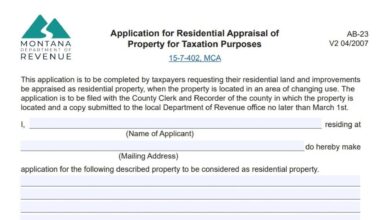

Montana Form AB-23

Montana Form AB-23 is a specialized property tax application used by homeowners whose residential property is located in an area…

-

Montana Form RTC

Montana Form RTC (Realty Transfer Certificate) is a required, confidential tax document used to report a transfer of real property…

-

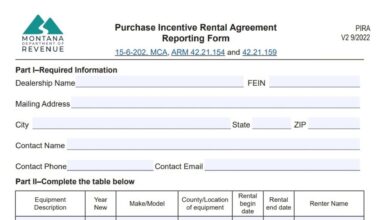

Montana Form PIRA

Montana Form PIRA is an annual report required under Montana law for farm implement and construction equipment dealers who rent…

-

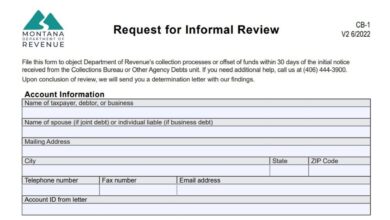

Montana Form CB-1

Montana Form CB-1, or “Request for Informal Review,” is the official document used to formally object to the collection actions…

-

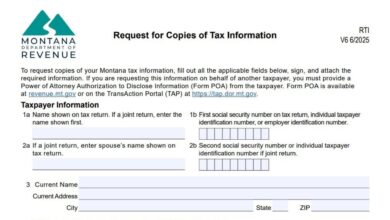

Montana Form RTI

Montana Form RTI is a formal request document submitted to the Montana Department of Revenue by individuals or their authorized…

-

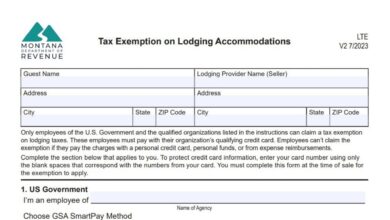

Montana Form LTE

Montana Form LTE, “Tax Exemption on Lodging Accommodations,” is a specialized certificate used by hotel and lodging operators to validate…