IRS Form 966, officially titled “Corporate Dissolution or Liquidation,” is a mandatory document that corporations (including certain LLCs taxed as corporations and farmer’s cooperatives) must file with the Internal Revenue Service when they adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. The primary purpose of Form 966 is to notify the IRS of the corporation’s intent to cease operations, distribute assets, and settle all tax obligations, ensuring that the IRS is aware of the company’s closure and can track the final tax return. Filing this form is a legal requirement under section 6043(a) of the Internal Revenue Code and must be completed within 30 days of adopting the dissolution or liquidation plan. Form 966 is not required for sole proprietorships, partnerships, or certain exempt organizations. It is also not used for deemed liquidations, such as those resulting from a section 338 election or disregarded entity status.

How to File Form 966?

- Timing: File Form 966 within 30 days after the corporation adopts a resolution or plan to dissolve or liquidate.

- Attachments: Attach a certified copy of the resolution or plan of dissolution (and any amendments or supplements not previously filed).

- Where to File: Send Form 966 to the IRS Service Center where the corporation files its income tax return.

- Who Must Sign: The form must be signed and dated by an authorized corporate officer, such as the president, vice president, treasurer, chief accounting officer, or a fiduciary if applicable.

- Subsequent Amendments: If the plan is amended after the initial filing, submit an additional Form 966 within 30 days of the amendment, referencing the original filing date and attaching the certified amendment.

How to Complete Form 966?

Below is a detailed, line-by-line guide to completing every section of Form 966 based on the official IRS PDF:

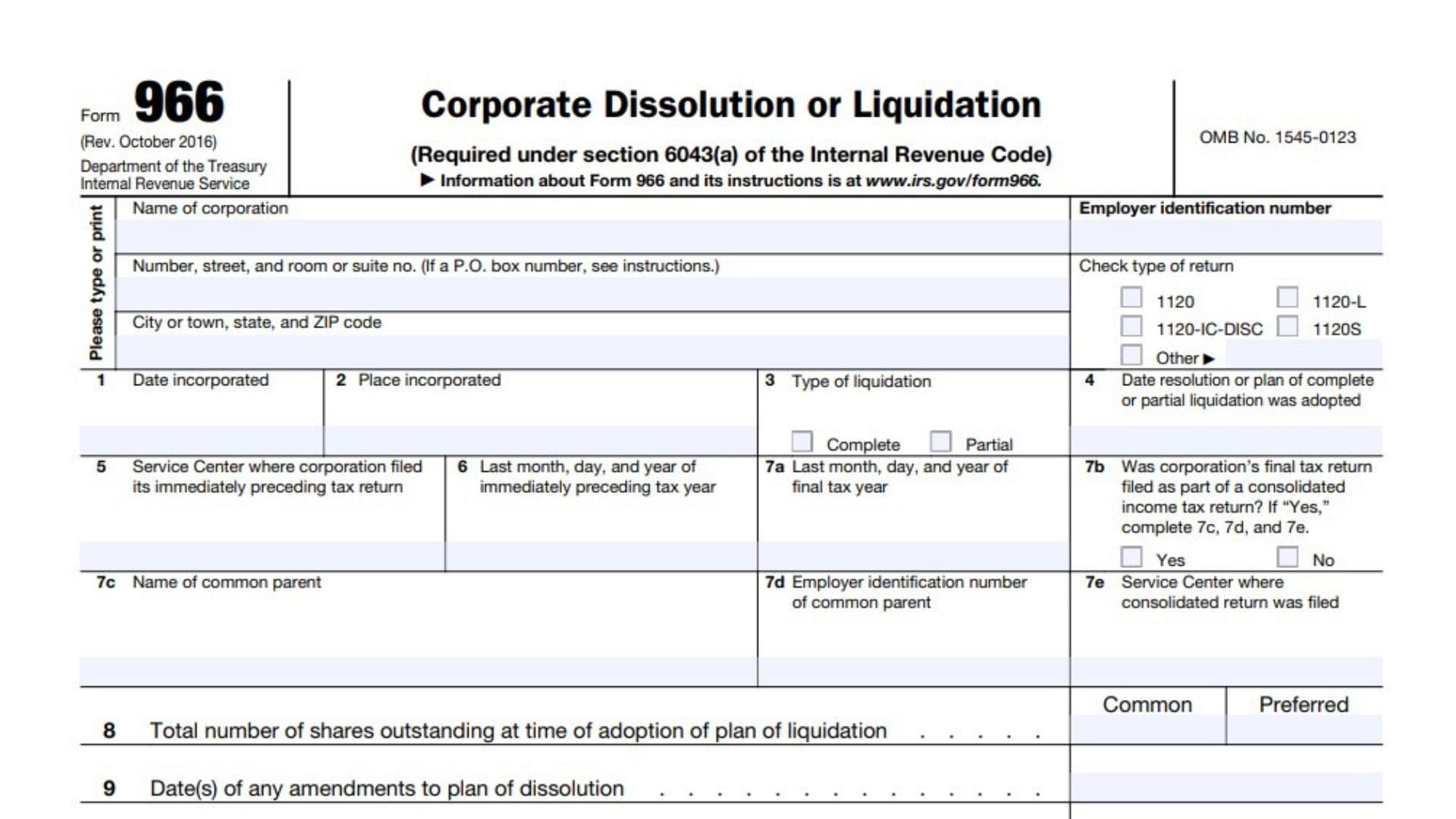

Header Section

- Name of Corporation: Enter the full legal name of the corporation.

- Employer Identification Number (EIN): Provide the corporation’s EIN.

- Address: Enter the complete mailing address, including suite or room number. If mail is not delivered to the street address, use the P.O. box.

- Type of Return: Check the box for the type of last tax return filed (e.g., 1120, 1120-L, 1120-IC-DISC, 1120S, or Other).

Line 1: Date Incorporated

- Enter the exact date the corporation was originally incorporated.

Line 2: Place Incorporated

- Specify the state (or foreign country) where the corporation was incorporated.

Line 3: Type of Liquidation

- Indicate whether the liquidation is “Complete” or “Partial” by checking the appropriate box.

Line 4: Date Resolution or Plan of Complete or Partial Liquidation Was Adopted

- Enter the date the board of directors or shareholders adopted the resolution or plan to dissolve or liquidate the corporation.

Line 5: Service Center Where Corporation Filed Its Immediately Preceding Tax Return

- Write the name of the IRS Service Center where the corporation filed its most recent tax return. If the return was e-filed, enter “e-file” instead.

Line 6: Last Month, Day, and Year of Immediately Preceding Tax Year

- Provide the ending date (month, day, year) of the corporation’s last completed tax year before the dissolution or liquidation.

Line 7a: Last Month, Day, and Year of Final Tax Year

- Enter the ending date of the corporation’s final tax year.

Line 7b: Was Corporation’s Final Tax Return Filed as Part of a Consolidated Income Tax Return?

- Check “Yes” or “No.”

- If “Yes,” complete lines 7c, 7d, and 7e.

Line 7c: Name of Common Parent

- If the final return was part of a consolidated return, enter the name of the common parent corporation.

Line 7d: Employer Identification Number of Common Parent

- Enter the EIN of the common parent corporation.

Line 7e: Service Center Where Consolidated Return Was Filed

- State the IRS Service Center where the consolidated return was filed. If e-filed, enter “e-file.”

Line 8: Total Number of Shares Outstanding at Time of Adoption of Plan of Liquidation

- Enter the total number of shares (both common and preferred) outstanding when the plan of liquidation was adopted. Specify the number of common and preferred shares.

Line 9: Date(s) of Any Amendments to Plan of Dissolution

- List the date(s) of any amendments or supplements to the original plan of dissolution.

Line 10: Section of the Code Under Which the Corporation is to be Dissolved or Liquidated

- Identify the relevant section of the Internal Revenue Code (e.g., “section 331” for a complete or partial liquidation, or “section 332” for liquidation of a subsidiary meeting section 332(b) requirements).

Line 11: If This Form Concerns an Amendment or Supplement to a Resolution or Plan, Enter the Date the Previous Form 966 Was Filed

- If you are filing this form due to an amendment or supplement, enter the date the previous Form 966 was filed.

Signature Section

- The form must be signed and dated by an authorized officer of the corporation or a fiduciary, certifying the accuracy and completeness of the information provided.

Attachment Reminder

- Attach a certified copy of the resolution or plan of dissolution and all amendments or supplements not previously filed with the IRS.