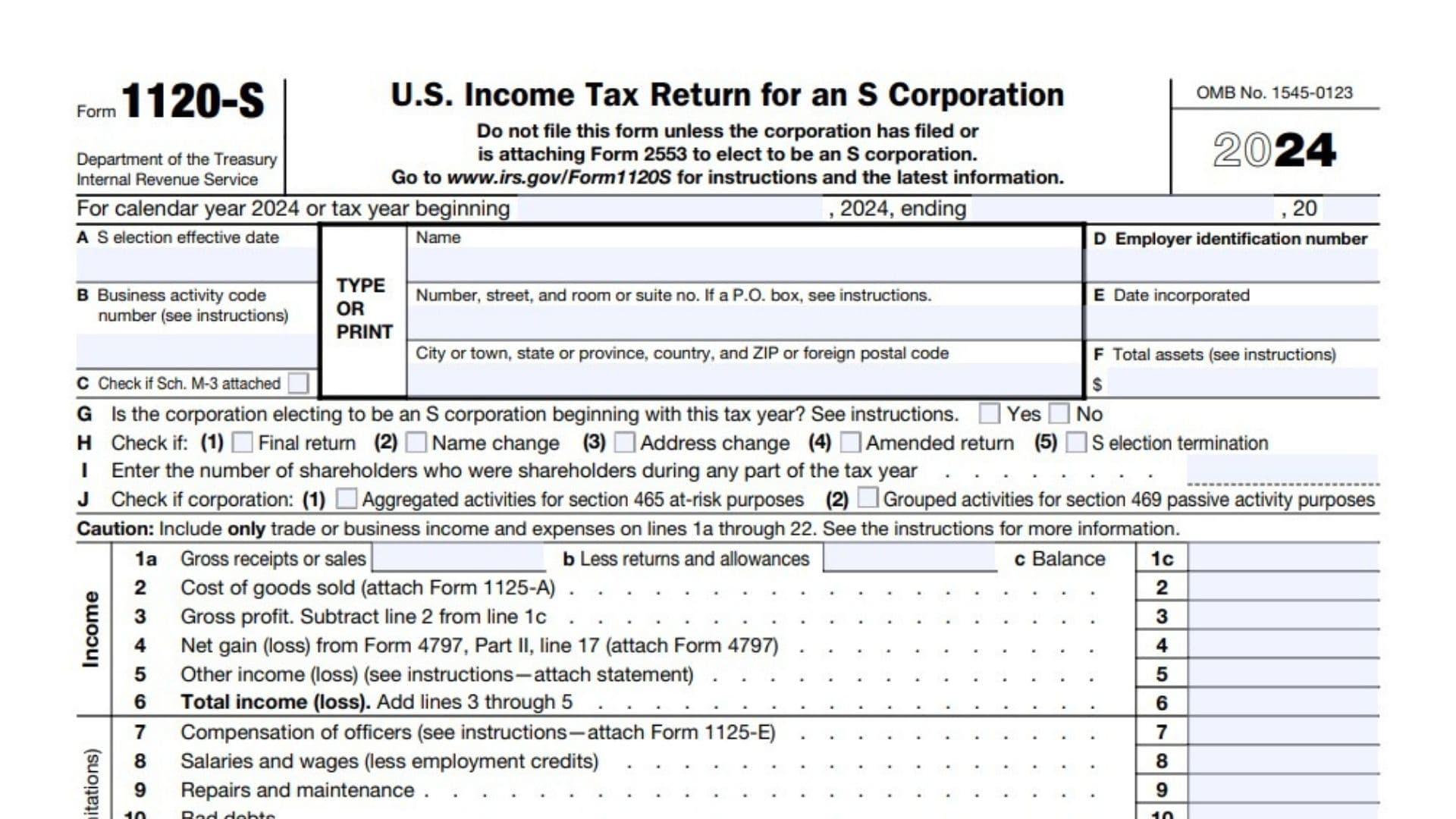

IRS Form 1120S, also known as the U.S. Income Tax Return for an S Corporation, is a federal tax document used by S corporations to report income, deductions, gains, losses, and other financial information. An S corporation is a special type of corporation that passes corporate income, losses, deductions, and credits to its shareholders for federal tax purposes, avoiding the double taxation that traditional C corporations face. This form is critical for ensuring compliance with U.S. tax laws and for informing shareholders of their individual tax responsibilities.

S corporations are required to file Form 1120S annually if they have elected S corporation status by filing Form 2553 and have received IRS approval. The form provides detailed information about the corporation’s financial activities for the tax year and calculates the income or loss that will be allocated to each shareholder. It is also used to report certain taxes and payments, ensuring transparency and proper distribution of tax responsibilities.

How to File Form 1120S?

- Ensure Eligibility:

- Confirm the business has S corporation status by filing Form 2553.

- Ensure that the corporation’s tax year aligns with the calendar year unless a fiscal year has been approved by the IRS.

- Gather Necessary Information:

- Employer Identification Number (EIN)

- Business activity code

- Total assets

- Detailed records of income, expenses, and distributions

- Download the Form:

- Visit the IRS website at www.irs.gov/Form1120S to access the latest form and instructions.

- Prepare Financial Statements:

- Compile a balance sheet, income statement, and cash flow statement to ensure accurate reporting.

- Attach Required Schedules:

- Schedule K-1: Reports each shareholder’s share of income, deductions, and credits.

- Other schedules (e.g., Schedule D for capital gains and losses) as required.

- File on Time:

- File by March 15 if operating on a calendar year.

- Use Form 7004 to request a six-month extension if needed.

How to Complete Form 1120S?

Page 1: Income and Deductions

- Line 1a: Enter the corporation’s gross receipts or sales.

- Line 1b: Subtract returns and allowances.

- Line 1c: Calculate the balance (Line 1a minus Line 1b).

- Line 2: Enter the cost of goods sold (attach Form 1125-A if applicable).

- Line 3: Compute the gross profit (Line 1c minus Line 2).

- Line 4: Report any net gains or losses from Form 4797 (attach supporting documentation).

- Line 5: Add other income or losses (attach a detailed statement).

- Line 6: Calculate total income (sum Lines 3 through 5).

Deductions (Lines 7–22):

- Line 7: Report compensation of officers (attach Form 1125-E if required).

- Line 8: Enter salaries and wages.

- Line 9: Include repairs and maintenance expenses.

- Line 10: Deduct bad debts.

- Line 11: Report rent expenses.

- Line 12: Include taxes and licenses.

- Line 13: Deduct interest expenses (see instructions for limitations).

- Line 14: Enter depreciation expenses from Form 4562.

- Line 15: Report depletion costs (excluding oil and gas depletion).

- Line 16: Deduct advertising expenses.

- Line 17: Report contributions to pension and profit-sharing plans.

- Line 18: Enter costs for employee benefit programs.

- Line 19: Deduct energy-efficient building expenses (attach Form 7205).

- Line 20: Add any other deductions (attach a detailed statement).

- Line 21: Sum all deductions (Lines 7 through 20).

- Line 22: Calculate ordinary business income or loss (Line 6 minus Line 21).

Tax and Payments Section (Lines 23–28)

- Line 23: Calculate taxes on excess net passive income or LIFO recapture (if applicable).

- Line 24: Enter estimated tax payments and credits from previous years.

- Line 25: Check if an estimated tax penalty applies and attach Form 2220 if required.

- Lines 26–28: Determine the amount owed or overpaid. Specify if overpayments should be refunded or credited.

Schedules and Attachments

- Schedule B: Answer other informational questions about the corporation’s activities.

- Schedule K: Report shareholders’ pro-rata share of income, deductions, credits, and other items.

- Schedule L: Complete the balance sheet section using the corporation’s financial records.

- Schedule M-1: Reconcile income (loss) per books with income (loss) per the return.

- Schedule M-2: Analyze changes in retained earnings and shareholder equity.