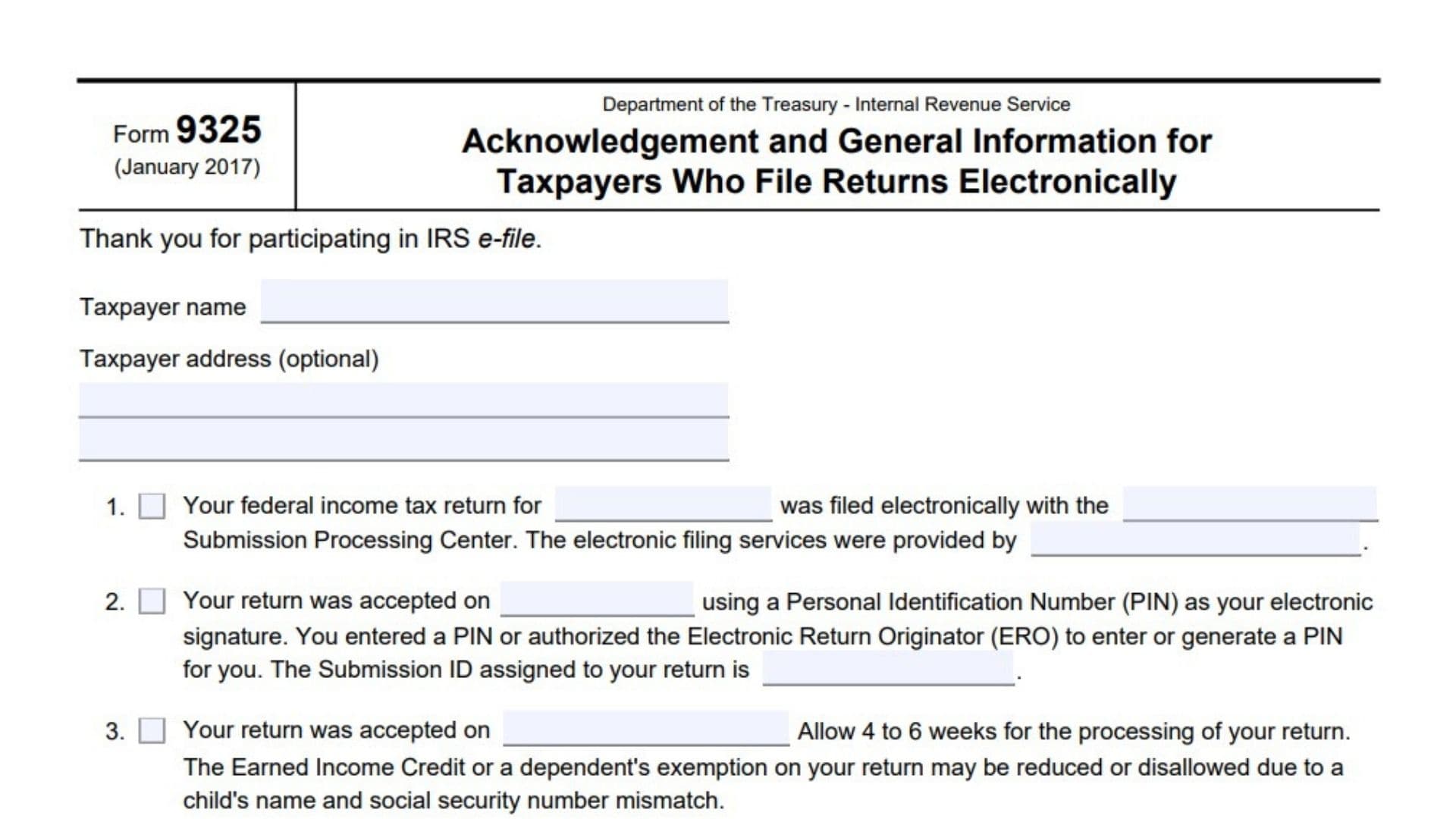

IRS Form 9325 is a confirmation and general information document issued by the Internal Revenue Service (IRS) to taxpayers who submit their federal income tax returns electronically through the IRS e-file system. When you file your tax return online, the IRS verifies the information and sends this form as proof that your submission has been received and accepted or rejected. This form helps taxpayers track their filing status, understand if their payment requests were processed, and provides important notices about refunds, payments owed, or issues such as discrepancies with dependent information. Form 9325 also instructs taxpayers on the next steps if changes are needed or if additional tax payment arrangements are required. Importantly, this document informs taxpayers to avoid sending paper copies of their electronically filed returns, as doing so causes processing delays. It serves as an official reference for both taxpayers and Electronic Return Originators (EROs) to confirm the status of electronic tax return submissions, payments, and extensions.

How To File IRS Form 9325

You do not file Form 9325 yourself; it is automatically generated by the IRS after you have electronically filed your federal income tax return through an authorized Electronic Return Originator (ERO) or tax software. Once you submit your tax return electronically, the IRS reviews it and then sends Form 9325 as an acknowledgment to you and your ERO. There is no need to mail this form back to the IRS or submit it separately.

If you need to make corrections to your electronically filed return after receiving Form 9325, you must file Form 1040X, Amended U.S. Individual Income Tax Return, by mail. The address for mailing Form 1040X depends on your location and can be found on the IRS website.

How To Complete Form 9325

The IRS issues Form 9325, so taxpayers do not fill it out. However, understanding each line is crucial for interpreting the information correctly.

Taxpayer Name

- The full name of the taxpayer or the primary filer as it appears on the tax return.

Taxpayer Address (Optional)

- The address on file for the taxpayer; optional and may not always be present.

Line 1

- Indicates the federal income tax year for which the return was filed electronically.

- Shows that your return was submitted to the IRS Submission Processing Center.

- Names the service provider (such as the tax software or Electronic Return Originator) that handled the electronic filing.

Line 2

- States the date your return was accepted by the IRS after validation checks.

- Confirms that the return was signed electronically using a Personal Identification Number (PIN). The PIN could have been self-selected by you or generated by the ERO.

- Shows the Submission ID number assigned to your tax return, which is a unique identifier for your electronic filing.

Line 3

- Repeats the acceptance date of your return.

- Advises you to expect 4 to 6 weeks for IRS processing to complete.

- Warns that Earned Income Credit or dependent exemptions may be reduced or disallowed due to mismatches between a child’s name and Social Security number.

Line 4

- Indicates if your electronic funds withdrawal (direct debit payment) request was accepted for processing by the IRS.

Line 5

- Indicates if your electronic funds withdrawal payment request was NOT accepted for processing.

- Advises you to refer to the “If You Owe Tax” section for alternative payment instructions.

Line 6

- Shows if your application for an automatic extension of time to file (Form 4868) was accepted by the IRS.

- Provides the submission date and Submission ID number for the extension.

Important note

- The form instructs not to send a paper copy of the return if it was electronically filed, as it delays processing.

If You Need To Make A Change To Your Return

- If corrections or changes are necessary, file Form 1040X, Amended U.S. Individual Income Tax Return, by mail using the IRS Submission Processing Center address for paper returns in your area.

- Contact the IRS website or call 1-800-829-1040 for the correct address.

If You Need To Ask About Your Refund

- The IRS usually notifies your ERO within 48 hours of acceptance.

- If the IRS rejected your return, the ERO will be notified of the reasons for rejection.

- If 3 weeks have passed since acceptance and you have not received your refund, check status at www.irs.gov under “Where’s My Refund?“

- If your return acceptance shows a child name/SSN mismatch (box 3 checked), allow 4 to 6 weeks for processing.

- The IRS may send a notice regarding changes to your return.

- You can call the TeleTax refund information line at 1-800-829-4477; have your Social Security number, filing status, and refund amount available.

- The IRS issues refunds by mail or direct deposit approximately within 30 days of the TeleTax date provided.

Offsets And Refunds

- Refunds may be reduced or offset by overdue child support, federal agency debts such as student loans, or state income tax obligations.

- If an offset applies, the Fiscal Service sends a notice with details.

- Call Treasury Offset Program at 1-800-304-3107 for questions related to offsets.

If You Owe Tax

- Pay the amount due by the deadline.

- Electronic funds withdrawal or credit card payments do not require separate vouchers.

- Convenience fees apply to credit/debit card payments, disclosed during the transaction.

- For electronic payments, visit www.irs.gov/e-pay.

- If paying by mail, use Form 1040-V Payment Voucher available from your ERO.

- If unable to pay in full, file Form 9465 to request an installment agreement online or by mail.

- A user fee applies to installment agreements.

If You Need To Inquire About Your Electronic Funds Withdrawal Payment

- Call 1-888-353-4537 to check payment status or cancel a scheduled payment.

- Cancellation requests must be made by 11:59 p.m. Eastern Time two business days before the payment date.

- Have the Social Security number, payment amount, and bank account number ready.

Tax Refund Related Financial Products

- Financial product contracts related to refunds are between you and the financial institution, not the IRS.

- Contact your ERO or lender for questions about financial products like refund anticipation loans.

Instructions For Electronic Return Originators (EROs)

- Line 2: Check if the taxpayer entered or authorized the use of a PIN to sign the return.

- Line 3: Check if the return was rejected due to invalid data during submission.

- Line 4: Check if the electronic payment request was accepted.

- Line 5: Check if the electronic payment request was not accepted and inform the taxpayer to pay by other methods.

- EROs use the acknowledgment file to complete Form 9325 appropriately.