IRS Form 8994, officially titled “Employer Credit for Paid Family and Medical Leave,” is a federal tax form that allows eligible employers to claim a valuable tax credit for providing paid family and medical leave to their employees. Established under the Tax Cuts and Jobs Act, this credit is designed to incentivize businesses to offer at least two weeks of paid leave annually to qualifying employees, covering events like the birth of a child, serious health conditions, or family emergencies. To qualify, the employer must have a written policy that meets specific requirements, such as providing at least 50% of normal wages during the leave period. Completing Form 8994 accurately is crucial, as it not only helps you reduce your tax liability but also demonstrates your commitment to supporting work-life balance for your team. The form must be attached to your annual tax return, and only employers who meet the criteria set by the IRS are eligible to claim this credit.

How to File Form 8994

- Download the latest Form 8994 from the IRS website or use the official PDF.

- Complete the form using the detailed instructions below.

- Attach Form 8994 to your annual federal tax return.

- Maintain supporting documentation, such as your written leave policy and payroll records, in case of IRS review.

How to Complete Form 8994

Header Information

- Name(s) shown on return:

Enter the name of your business or the individual as it appears on your tax return. - Identifying number:

Enter your Employer Identification Number (EIN) or Social Security Number (SSN), as applicable.

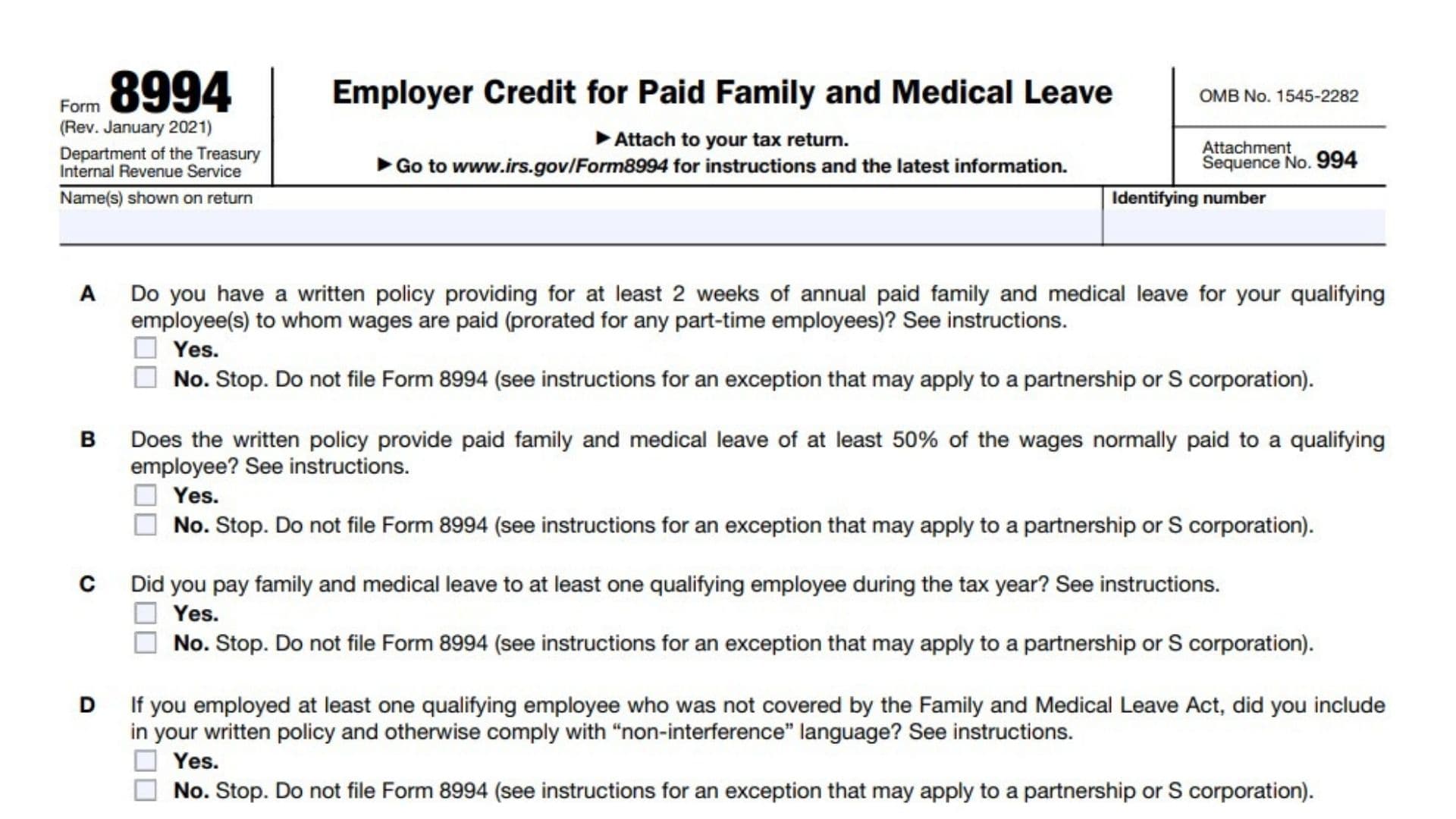

Eligibility Questions (A–D)

Before you proceed, you must answer all four eligibility questions. If you answer “No” to any, you generally cannot file Form 8994 (with some exceptions for partnerships or S corporations).

A. Written Policy for Paid Family and Medical Leave

Do you have a written policy providing at least 2 weeks of annual paid family and medical leave for qualifying employees (prorated for part-timers)?

- Check “Yes” if your policy meets this requirement; otherwise, check “No” and stop here.

B. Wage Percentage Requirement

Does your written policy provide paid family and medical leave of at least 50% of the wages normally paid to a qualifying employee?

- Check “Yes” if your policy meets this; otherwise, check “No” and stop here.

C. Payment of Leave During Tax Year

Did you pay family and medical leave to at least one qualifying employee during the tax year?

- Check “Yes” if you did; otherwise, check “No” and stop here.

D. Non-Interference Language (if applicable)

If you employed at least one qualifying employee not covered by the Family and Medical Leave Act (FMLA), did you include and comply with “non-interference” language in your written policy?

- Check “Yes” if this applies; otherwise, check “No” and stop here.

Line 1: Total Paid Family and Medical Leave Credit

- What to Enter:

Enter the total paid family and medical leave credit figured for wages paid during your tax year to qualifying employees while on family and medical leave. - How to Calculate:

If you used the Paid Family and Medical Leave Credit Worksheet (see IRS instructions), enter the total from column (d) of that worksheet. - Note:

See the official instructions for the adjustment you must make to your deduction for salaries and wages. You cannot deduct the same wages used to calculate this credit.

Line 2: Employer Credit from Partnerships and S Corporations

- What to Enter:

Enter the employer credit for paid family and medical leave that you received from partnerships and S corporations, if applicable. - Instructions:

See the IRS instructions for more details on how to report these credits.

Line 3: Total Credit

- What to Enter:

Add lines 1 and 2. This is your total Employer Credit for Paid Family and Medical Leave. - Reporting:

- If you’re a partnership or S corporation, report this amount on Schedule K.

- All other filers should report this amount on Form 3800, Part III, line 4j.

FAQs

Who can file IRS Form 8994?

Employers with a written policy providing at least two weeks of paid family and medical leave at 50% or more of normal wages.

Where do I report the credit from Form 8994?

On Form 3800, Part III, line 4j, or Schedule K for partnerships and S corporations.

What if I answer “No” to any eligibility question?

You generally cannot file Form 8994 unless you qualify for an exception as a partnership or S corporation.