IRS Form 8936, also known as the “Clean Vehicle Credits” form, allows taxpayers to claim a credit for purchasing clean vehicles, such as electric cars or vehicles using other qualified alternative energy sources. This tax credit is part of an initiative to promote environmentally friendly transportation solutions. The form covers credits for:

- New Clean Vehicles: Credits for new clean vehicles used for personal or business purposes.

- Previously Owned Clean Vehicles: Credits for eligible second-hand clean vehicles.

- Qualified Commercial Clean Vehicles: Credits for vehicles used commercially.

The credit amounts vary based on vehicle type, year, and individual or business eligibility. Taxpayers need to meet specific income thresholds and provide supporting documentation to qualify for these credits.

How to File Form 8936?

- Verify Eligibility:

- Confirm that the vehicle qualifies for the clean vehicle credit based on IRS guidelines.

- Check income thresholds for eligibility, as exceeding the Modified Adjusted Gross Income (MAGI) limits may disqualify you.

- Gather Necessary Information:

- Obtain details about the vehicle, such as make, model, and Vehicle Identification Number (VIN).

- Keep documentation of the purchase or lease agreement.

- Complete Schedule A:

- For each vehicle, you must complete a Schedule A of Form 8936 and attach it to your tax return.

- Attach Form 8936:

How to Complete Form 8936?

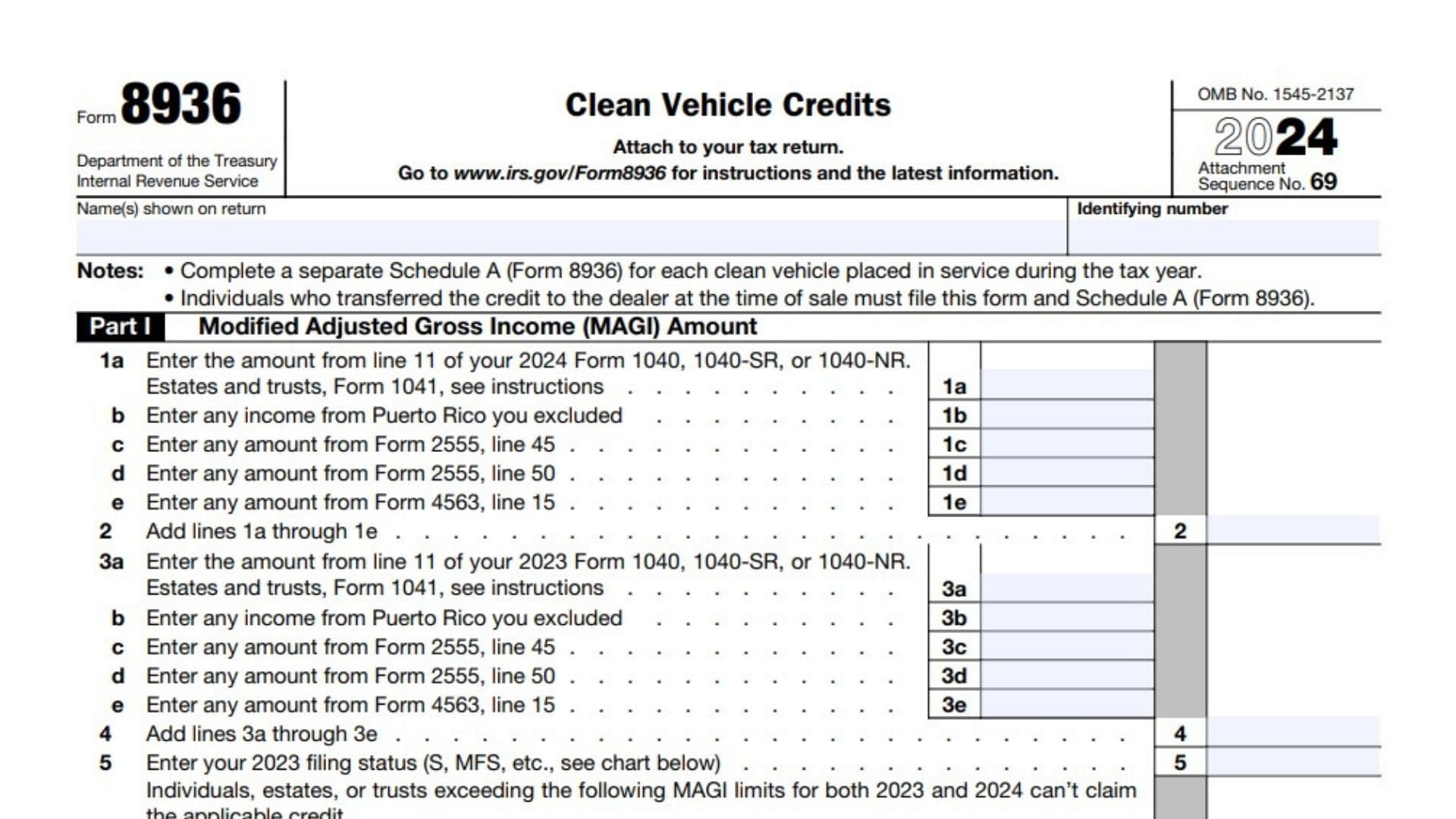

Part I: Modified Adjusted Gross Income (MAGI) Amount

- Line 1a: Enter your MAGI from line 11 of Form 1040, 1040-SR, or 1040-NR.

- Line 1b to 1e: Add any excluded income from Puerto Rico, Forms 2555, or 4563.

- Line 2: Add lines 1a through 1e to calculate your total MAGI for 2024.

- Line 3a to 3e: Repeat steps for your MAGI from 2023.

- Line 4: Add lines 3a through 3e to calculate your total MAGI for 2023.

- Line 5: Enter your filing status (e.g., Single, MFJ, HOH) and check the limits table to verify eligibility.

Part II: Credit for Business/Investment Use Part of New Clean Vehicles

- Line 6: Enter the total credit amount from Part II of Schedule A.

- Line 7: Include credits from partnerships or S corporations, if applicable.

- Line 8: Add lines 6 and 7 to calculate the credit amount. Report this on Form 3800, Part III, line 1y.

Part III: Credit for Personal Use Part of New Clean Vehicles

- Line 9: Enter the total credit amount from Part III of Schedule A.

- Line 10: Enter the amount from Form 1040, line 18.

- Line 11: Deduct any personal credits from your Form 1040.

- Line 12: Subtract line 11 from line 10. If zero or less, you cannot claim the credit.

- Line 13: Enter the smaller value between lines 9 and 12.

Part IV: Credit for Previously Owned Clean Vehicles

- Line 14: Enter the total credit from Part IV of Schedule A.

- Line 15: Enter the amount from Form 1040, line 18.

- Line 16: Deduct any personal credits from your Form 1040.

- Line 17: Subtract line 16 from line 15. If zero or less, you cannot claim the credit.

- Line 18: Enter the smaller value between lines 14 and 17.

Part V: Credit for Qualified Commercial Clean Vehicles

- Line 19: Enter the total credit from Part V of Schedule A.

- Line 20: Include credits from partnerships or S corporations.

- Line 21: Add lines 19 and 20. Report this amount on Form 3800, Part III, line 1aa.