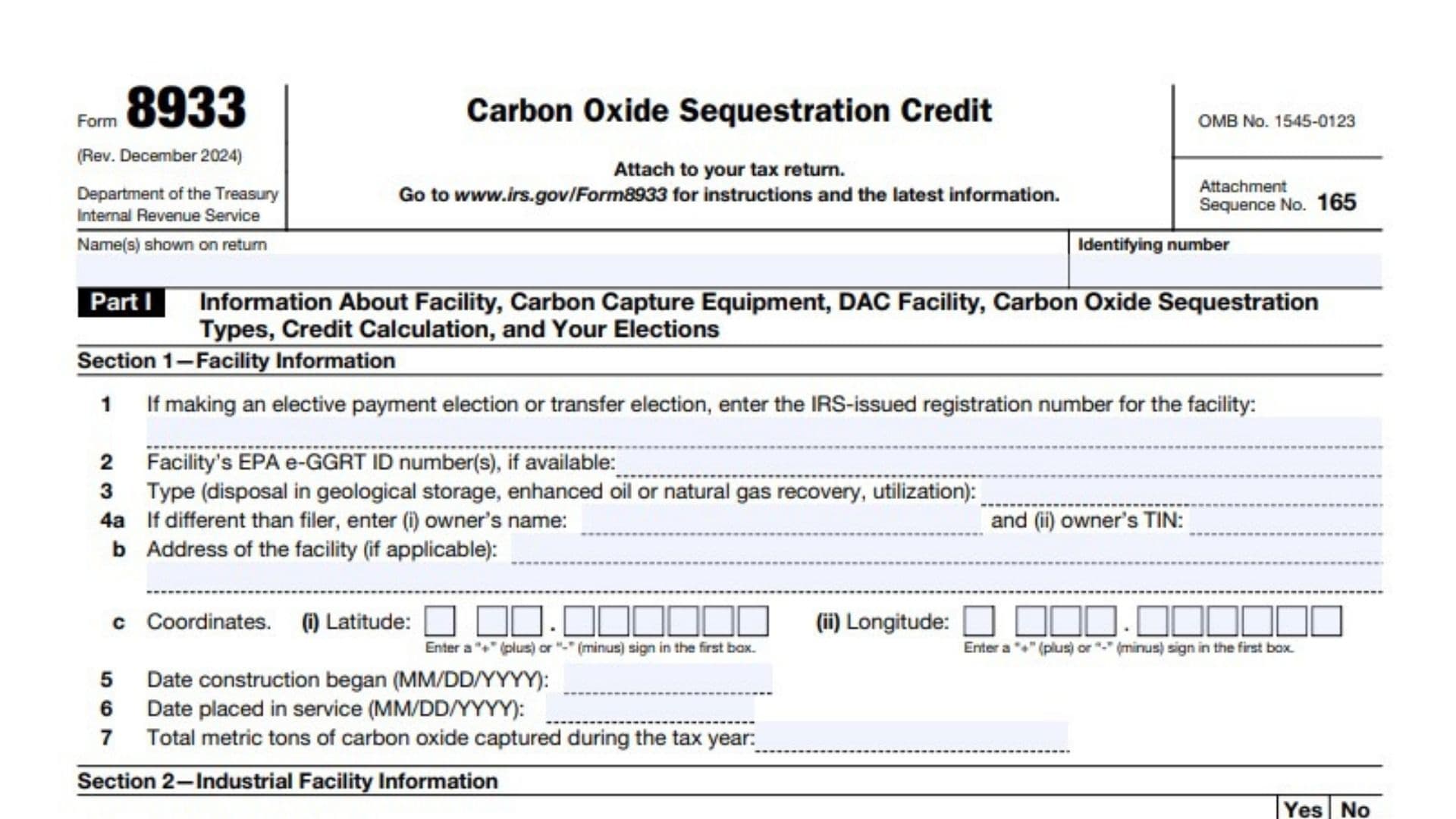

IRS Form 8933, officially titled “Carbon Oxide Sequestration Credit,” is a federal tax form used by businesses and individuals to claim credits for the capture and sequestration of carbon oxide (CO or CO₂) under section 45Q of the Internal Revenue Code. The form is required for those who own or operate facilities or equipment that capture and store carbon oxide through geological storage, enhanced oil or natural gas recovery, or utilization. Form 8933 collects detailed information about the facility, the type and amount of carbon oxide captured, the equipment used, and the elections made by the taxpayer. It’s a crucial document for ensuring compliance and maximizing your tax credit for environmentally beneficial carbon capture activities. The form must be attached to your federal tax return and is subject to IRS review, so accuracy and completeness are essential.

How to File Form 8933

- Download the latest version of Form 8933 from the IRS website or use the official PDF provided by the IRS.

- Complete the form following the instructions below.

- Attach the completed Form 8933 to your annual federal tax return.

- Keep copies of supporting documentation, such as contracts, engineering attestations, and emissions data, as the IRS may request them.

How to Complete Form 8933

Header Information

- Name(s) shown on return: Enter the name(s) as they appear on your tax return.

- Identifying number: Enter your EIN or SSN as listed on your tax return.

Part I: Information About Facility, Carbon Capture Equipment, DAC Facility, Carbon Oxide Sequestration Types, Credit Calculation, and Your Elections

Section 1—Facility Information

- IRS-issued registration number: If making an elective payment or transfer election, enter the facility’s IRS registration number.

- Facility’s EPA e-GGRT ID number(s): Enter the Environmental Protection Agency’s e-GGRT ID(s), if available.

- Type: Specify the sequestration type: disposal in geological storage, enhanced oil/natural gas recovery, or utilization.

- a. Owner’s name and TIN: If the owner is different from the filer, enter the owner’s name and taxpayer identification number.

b. Address: Enter the facility’s address, if applicable.

c. Coordinates: Enter latitude and longitude, including a “+” or “-” sign in the first box. - Date construction began: Enter the date construction started (MM/DD/YYYY).

- Date placed in service: Enter the date the facility began service (MM/DD/YYYY).

- Total metric tons captured: Enter the total metric tons of carbon oxide captured during the tax year.

Section 2—Industrial Facility Information

- Reserved for future use: Skip this line.

- Electricity-generating facility: Check “Yes” or “No.”

- Direct air capture (DAC) facility: If “Yes,” skip to line 16.

- Nature of facility: If not electricity-generating or DAC, describe the facility (e.g., ethanol production).

- Underground gas processing: Check “Yes” or “No.”

- a. Gas from CO₂ well or spring: If “Yes,” see line 12c.

- b. Facility qualification: If “Yes” to 12a, you cannot treat the facility as qualified for the processed gas.

- c. Commercially viable product exception: If “Yes” to 12a, attest if you meet the exception.

- d. Attestment letter: If “Yes” to 12c, confirm if an independent registered engineer’s letter is attached.

- Emissions during tax year: Enter total carbon oxide emissions (released + captured).

- a. Carbon dioxide amount: Enter the CO₂ portion.

- b. Carbon monoxide amount: Enter the CO portion.

- First-year emissions annualized: Check “Yes” or “No.”

- a. Annualized emissions: If “Yes,” state the annualized emissions and attach a calculation statement.

- Aggregation required: Check “Yes” or “No.”

- a. Aggregation statement: If “Yes,” attach a statement listing facilities and explaining aggregation.

Section 3—Carbon Capture Equipment and DAC Facility Information

- DAC facility capture: Check “Yes” or “No.”

- Reserved for future use: Skip this line.

- Equipment placed in service (2018–2022): Check “Yes” or “No.”

- Reserved for future use: Skip this line.

- Ownership of equipment: Check “Yes” or “No.”

- a. Authority for claiming credit: If “No,” state your authority.

- Reserved for future use: Skip this line.

- Capture capacity (post-2018): Enter the carbon capture capacity on or after Feb 9, 2018.

- Additional equipment installed (post-2018): Check “Yes” or “No.”

- a/b. Reserved for future use: Skip these lines.

- c. 80/20 rule date determination: If “Yes,” state if the placed-in-service date used the 80/20 rule.

- d. Investment in new/pre-existing equipment: If “Yes” to 23c, state your investment in both new and pre-existing equipment.

- e. Pipeline investment as new equipment: If 80/20 rule applies, did you include pipeline investment as new equipment? Check “Yes” or “No.”

- f. Pipeline investment amount: If “Yes” to 23e, state your investment in the pipeline.

- Total carbon oxide captured: Enter the total metric tons captured this tax year.

- a. CO₂ amount: Enter the amount of CO₂.

- b. CO amount: Enter the amount of CO.

- First-year emissions annualized: Check “Yes” or “No.”

- a. Annualized emissions: If “Yes,” state the annualized emissions.

Section 4—Credit and Elections

- Other parties ensuring disposal/injection/utilization: Check “Yes” or “No.”

- Elect to allow other parties to claim credit: Check “Yes” or “No.”

- Elect $10/$20 rates (section 45Q(b)(3)): Check “Yes” or “No.”

- a. If “Yes,” use $27.75 and $13.88 rates for 2024 (see instructions for later years).

- b. If “No” and equipment placed in service before 2023, use $43.92 and $30.07 for 2024.

- c. If “No” and equipment placed in service after 2022, use $17 and $12 (DAC: $36 and $26).

- Election under section 45Q(f)(6): Check “Yes” or “No.” If “Yes,” use rates from 28b.

- Disposal in secure geological storage: Check “Yes” or “No.” If “Yes,” use Part III, line 1.

- Tertiary injectant in oil/gas recovery and disposal: Check “Yes” or “No.” If “Yes,” use Part III, line 2.

- Utilization as described in 45Q(f)(5): Check “Yes” or “No.” If “Yes,” use Part III, line 3.

- Prevailing wage/apprenticeship requirement met: Check “Yes” or “No.” If “Yes,” you may qualify for increased credit.

Part II: Information About You

Check all boxes that apply:

- IRS-approved LCA analysis obtained

- Ensured capture of qualified carbon oxide

- Ensured disposal, injection, or utilization

- Elected to allow another taxpayer to claim the credit

- Another taxpayer elected to allow you to claim the credit

- Making the election under section 45Q(b)(3)

- Making the election under section 45Q(f)(6)

- Making the election under section 45Q(f)(9)

Part III: Credit Calculations

1. Credit for Disposal in Secure Geological Storage

a. Metric tons captured and measured at disposal point

b. Metric tons stored by you

c. Metric tons stored by another person

d. Add lines 1b and 1c

e. Metric tons stored by another person (credit allowed to them)

f. Subtract 1e from 1d

g. Credit rate or dollar amount (see instructions)

h. Multiply 1f by 1g

i. Increased credit (if PWA met): If “Yes” on Part I, line 33, multiply 1h by 5; otherwise, use 1h.

2. Credit for Use as Tertiary Injectant and Disposal

a. Metric tons captured and measured at injection point

b. Metric tons injected by you

c. Metric tons injected by another person

d. Add 2b and 2c

e. Metric tons injected by another person (credit allowed to them)

f. Subtract 2e from 2d

g. Credit rate or dollar amount (see instructions)

h. Multiply 2f by 2g

i. Increased credit (if PWA met): If “Yes” on Part I, line 33, multiply 2h by 5; otherwise, use 2h.

3. Credit for Utilization as Described in 45Q(f)(5)

a. Metric tons captured and measured at utilization point

b. Metric tons utilized by you

c. Metric tons utilized by another person

d. Add 3b and 3c

e. Metric tons utilized by another person (credit allowed to them)

f. Subtract 3e from 3d

g. Credit rate or dollar amount (see instructions)

h. Multiply 3f by 3g

i. Increased credit (if PWA met): If “Yes” on Part I, line 33, multiply 3h by 5; otherwise, use 3h.

4. Credits Elected to You by Another Taxpayer

a-c. For the three largest elections: Enter EIN, metric tons, credit rate, and credit elected.

d. Add lines 4a, 4b, and 4c (column iv)

e. Report all other credits elected to you

f. Add 4d and 4e

5. Credits from Partnerships and S Corporations

- Enter the amount from partnerships and S corporations.

6. Total Credit

- Add lines 1i, 2i, 3i, 4f, and 5. Partnerships and S corporations report on Schedule K; others report on Form 3800, Part III, line 1x.

7. Credit Recaptured

- Enter recaptured credit amount and attach Schedule D (Form 8933); report on the appropriate line of your return.

FAQs

What is IRS Form 8933 used for?

It’s used to claim the carbon oxide sequestration tax credit for capturing and storing carbon oxide.

Do I need to attach Form 8933 to my tax return?

Yes, always attach it to your federal tax return when claiming the credit.

What if I make a mistake on Form 8933?

Amend your return or consult a tax professional to correct errors and avoid IRS issues.