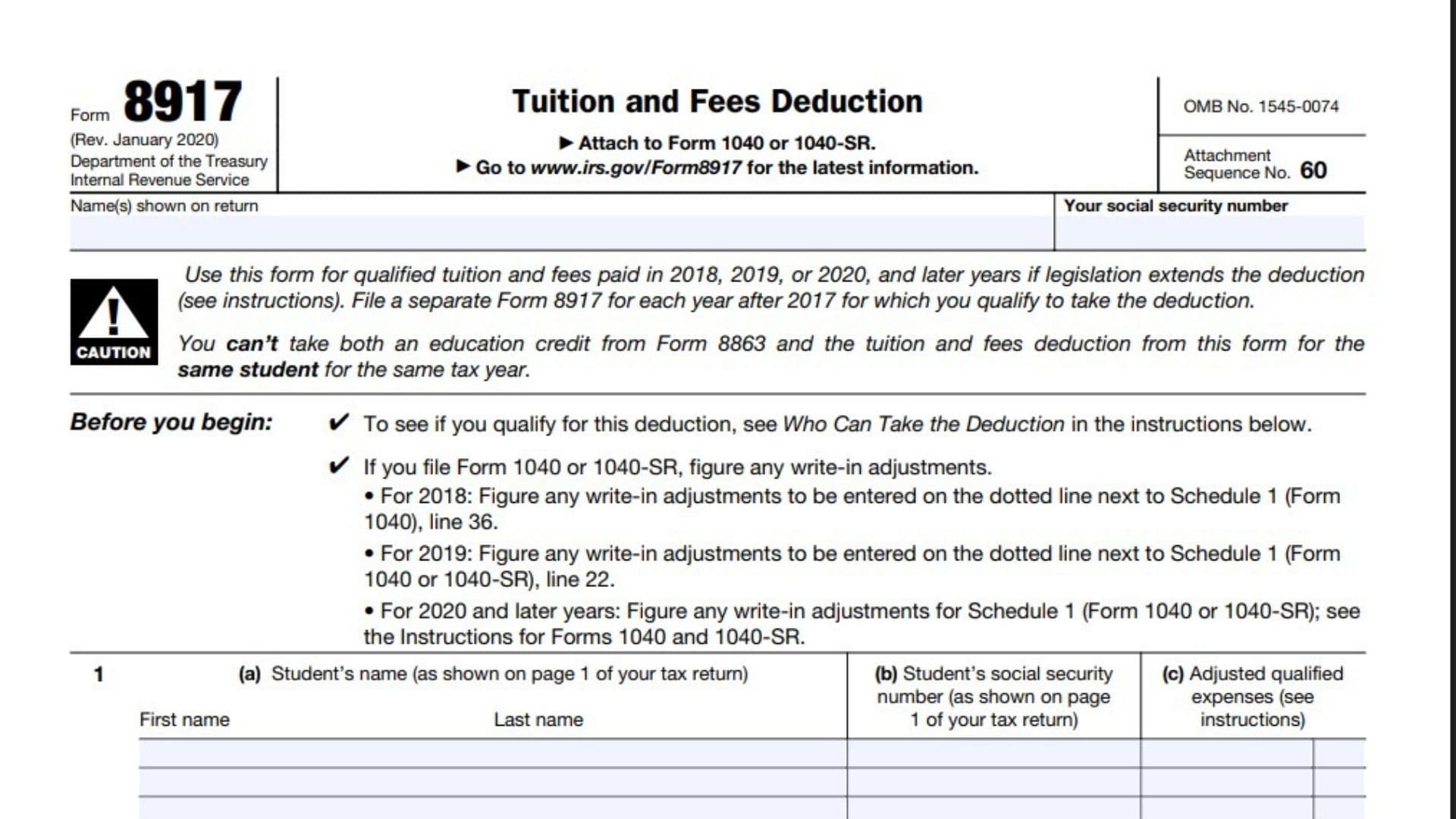

IRS Form 8917, officially titled “Tuition and Fees Deduction,” is a tax form that allows eligible taxpayers to deduct qualified education expenses paid for themselves, their spouse, or dependents. This deduction can reduce your taxable income by up to $4,000, making it a valuable benefit for students and families paying for college or other postsecondary education. The deduction is available for qualified tuition and required fees paid to accredited institutions for academic periods beginning in the tax year or the first three months of the following year. You cannot claim this deduction if your filing status is married filing separately, if someone else claims you as a dependent, if your income exceeds certain limits, or if you claimed education credits (like the American Opportunity or Lifetime Learning Credit) for the same student in the same year. Form 8917 is attached to your Form 1040 or 1040-SR and is updated only when legislation extends the deduction

How to File Form 8917

- Gather documentation: Collect records of qualified tuition and fees paid (receipts, Form 1098-T from your school).

- Check eligibility: Ensure you, your spouse, or your dependent attended an eligible institution and you meet the income and filing status requirements.

- Complete Form 8917: Fill out each line as detailed below.

- Attach to your tax return: Submit Form 8917 with Form 1040 or 1040-SR.

- Keep copies: Retain all supporting documents for your records.

How to Complete Form 8917

Header

- Name(s) shown on return:

Enter your (and spouse’s, if joint return) name exactly as it appears on your Form 1040 or 1040-SR. - Your social security number:

Enter your Social Security Number as shown on your tax return.

Line 1: Student Information

Complete columns (a) through (c) for each student for whom you are claiming the deduction.

- (a) Student’s name (First name, Last name):

Enter the full name of the student as it appears on your tax return. - (b) Student’s social security number:

Enter the student’s Social Security Number. - (c) Adjusted qualified expenses:

Enter the amount of qualified tuition and fees paid for the student in the tax year (see instructions for adjustments due to scholarships, grants, or refunds).

If you have more than three students, attach a statement with the same information for each additional student and write “See attached” next to line 1.

Line 2: Total Qualified Expenses

- Add the amounts on line 1, column (c), and enter the total.

This is the sum of all qualified expenses for all students.

Line 3: Total Income

- Enter the amount from your “total income” line of Form 1040 or 1040-SR.

This is your gross income before adjustments.

Line 4: Adjustments to Income

- For 2018: Enter the total from Schedule 1 (Form 1040), lines 23–33, plus any write-in adjustments on the dotted line next to line 36.

- For 2019 & 2020: Enter the total from Schedule 1 (Form 1040 or 1040-SR), lines 10–20, plus any write-in adjustments on the dotted line next to line 22.

- For later years: Check www.irs.gov/Form8917 for updates.

Line 5: Modified Adjusted Gross Income (MAGI)

- Subtract line 4 from line 3.

If the result is more than $80,000 ($160,000 if married filing jointly), you cannot take the deduction.

Line 6: Tuition and Fees Deduction

- If line 5 is more than $65,000 ($130,000 if married filing jointly):

Enter the smaller of line 2 or $2,000. - If line 5 is $65,000 or less ($130,000 or less if married filing jointly):

Enter the smaller of line 2 or $4,000.

Also enter this amount on the appropriate line of Schedule 1 (Form 1040 or 1040-SR) as directed in the instructions.

Additional Tips

- Form 1098-T Requirement: You generally must receive Form 1098-T from the school to claim the deduction, unless the school is not required to provide it (such as for nonresident aliens or fully scholarship-funded students).

- Cannot combine with education credits: You cannot claim both the tuition and fees deduction and education credits (Form 8863) for the same student.

- Eligible Institutions: Most accredited postsecondary institutions qualify, including some outside the U.S.

- Keep records: Maintain proof of payment, enrollment, and eligibility.