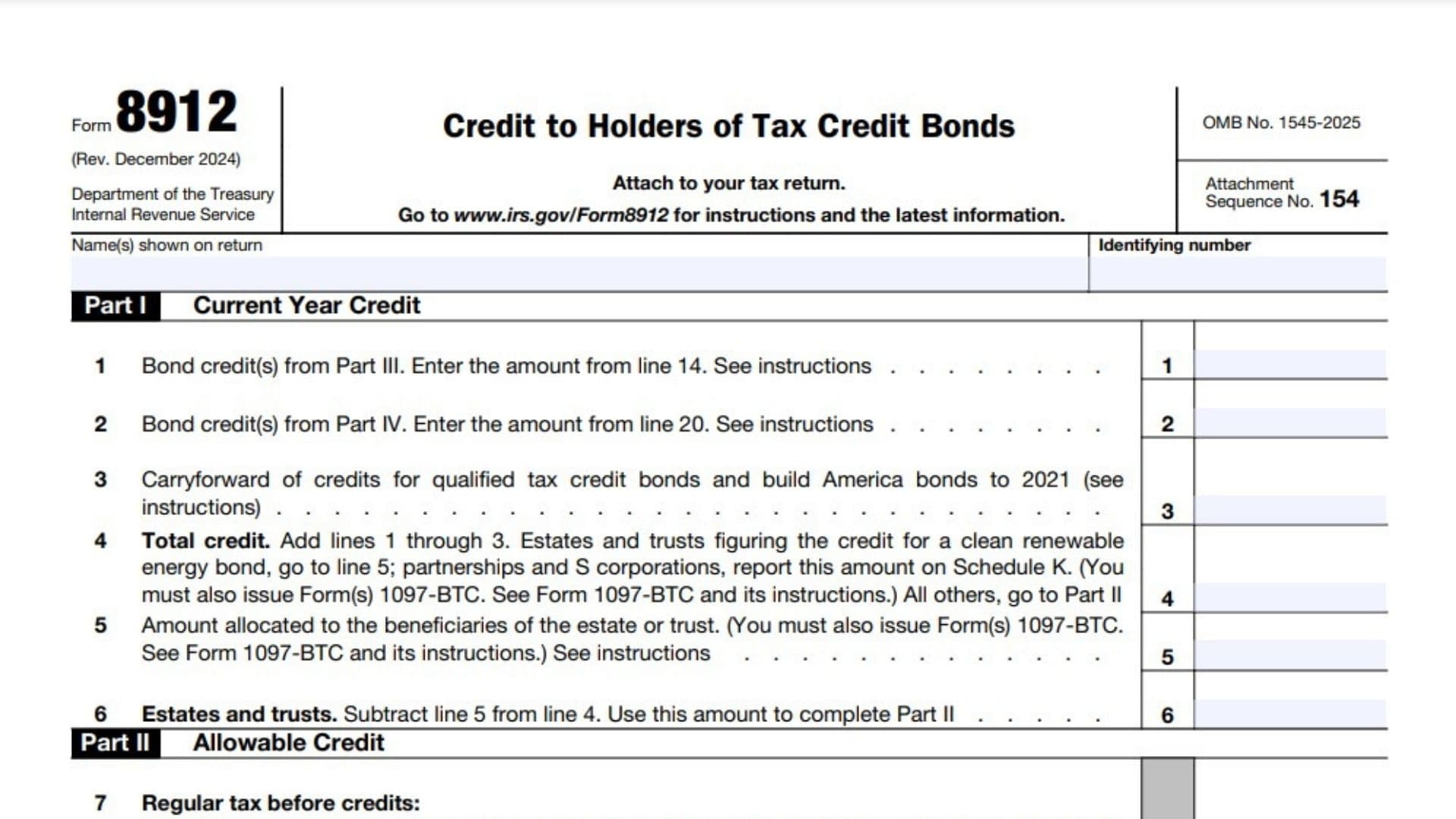

IRS Form 8912 is used to claim a credit for certain tax credit bonds. These bonds include qualified tax credit bonds, Build America Bonds (BABs), and certain other types of bonds issued by state or local governments. This credit is designed to offset the tax liability of bondholders. This guide will walk you through each line of the form, explaining the required information.

How to File Form 8912?

Attach Form 8912 to your tax return. Do not file it separately.

How to Complete Form 8912?

Part I – Current Year Credit:

- Line 1. Bond credit(s) from Part III: Enter the amount from Part III, Line 14. This is for bond credits reported to you on Form 1097-BTC.

- Line 2. Bond credit(s) from Part IV: Enter the amount from Part IV, Line 20. This line is for credits from bonds you hold directly that were not reported on Form 1097-BTC.

- Line 3. Carryforward of credits: Enter any amount carried forward from previous years. The instructions indicate this is for credits related to qualified tax credit bonds and BABs carried forward to 2021. (This is specific to the form version provided and may no longer be relevant.)

- Line 4. Total Credit: Add lines 1 through 3. Partnerships and S corporations report this amount on Schedule K-1 and issue Form 1097-BTC. Estates and trusts, proceed to line 5. All others, go to Part II.

- Line 5. Amount allocated to beneficiaries: (Estates and trusts only) Enter the amount of the credit allocated to beneficiaries. Issue Form 1097-BTC to beneficiaries.

- Line 6. Estates and trusts: Subtract line 5 from line 4.

Part II – Allowable Credit:

- Line 7. Regular tax before credits: Enter your regular tax liability before credits, as specified in the form instructions based on your filing status (individual, corporation, estate, or trust).

- Line 8. Alternative minimum tax: Enter your alternative minimum tax (AMT) from the appropriate form (Form 6251, Form 4626, or Schedule I (Form 1041)).

- Line 9. Add lines 7 and 8.

- Line 10a-d. Credits: Enter amounts for other credits, such as foreign tax credit, certain allowable credits, general business credit, and credit for prior year minimum tax. Refer to the instructions for specifics on which credits to include.

- Line 10e. Add lines 10a through 10d.

- Line 11. Net income tax: Subtract line 10e from line 9.

- Line 12. Credit allowed for the current year: This is the smallest of line 4 (or line 6 for estates and trusts), line 11, or the amount as limited by the formula in the instructions. Report this amount on the applicable line of your return as specified in the instructions.

Part III – Bond Credit(s) Reported to You on Form(s) 1097-BTC:

- Line 13. Information from Form 1097-BTC: Complete the columns with the information from any Form(s) 1097-BTC you received.

- Line 14. Total: Add the amounts in column (c) of line 13. Enter this total here and on Part I, line 1.

Part IV – Bond Credit(s) From Bonds Held by You and/or Your Nominee(s) Not Reported to You on Form(s) 1097-BTC:

- Lines 15-17. Bond Information: Provide details about the bond, including the issuer’s name and EIN, issue date, maturity date, and disposal date (if applicable).

- Line 18. Bond Details: For each bond, enter the CUSIP number (or principal/interest payment dates), outstanding principal (or interest payable for BABs), credit rate, and then calculate the amounts in columns (d), (e), and (f) according to the instructions.

- Line 19. Total: Add the amounts in column (f) of line 18.

- Line 20. Calculation for certain bonds: If this applies to you (as described in the instructions), perform the required calculation. Enter the result here and on Part I, line 2.

This information is for guidance only. Consult a tax professional for advice. Remember to refer to the official IRS instructions for the most up-to-date information.