IRS Form 8910, “Alternative Motor Vehicle Credit,” is used by taxpayers to claim a federal tax credit for purchasing or leasing certain qualified alternative motor vehicles. These vehicles include those powered by qualified fuel cell technology, compressed natural gas (CNG), liquefied natural gas (LNG), liquefied petroleum gas (LPG), or certified clean-burning fuels. The form is not for plug-in electric vehicles, which are reported on Form 8936. The credit incentivizes taxpayers to choose environmentally friendly vehicles by reducing their tax liability. To claim the credit, you must have placed a qualifying vehicle in service during the tax year and attach Form 8910 to your federal income tax return. The credit amount varies by vehicle type and is subject to limitations based on business or personal use.

How to File Form 8910

To file Form 8910, complete all relevant sections based on your use of the vehicle (personal or business/investment). Attach the completed form to your annual tax return (Form 1040, 1040-SR, or 1040-NR). If the vehicle is used for business/investment, coordinate with Form 3800. Partnerships and S corporations must report credits on Schedule K. Always use a separate column for each qualifying vehicle and total credits as instructed.

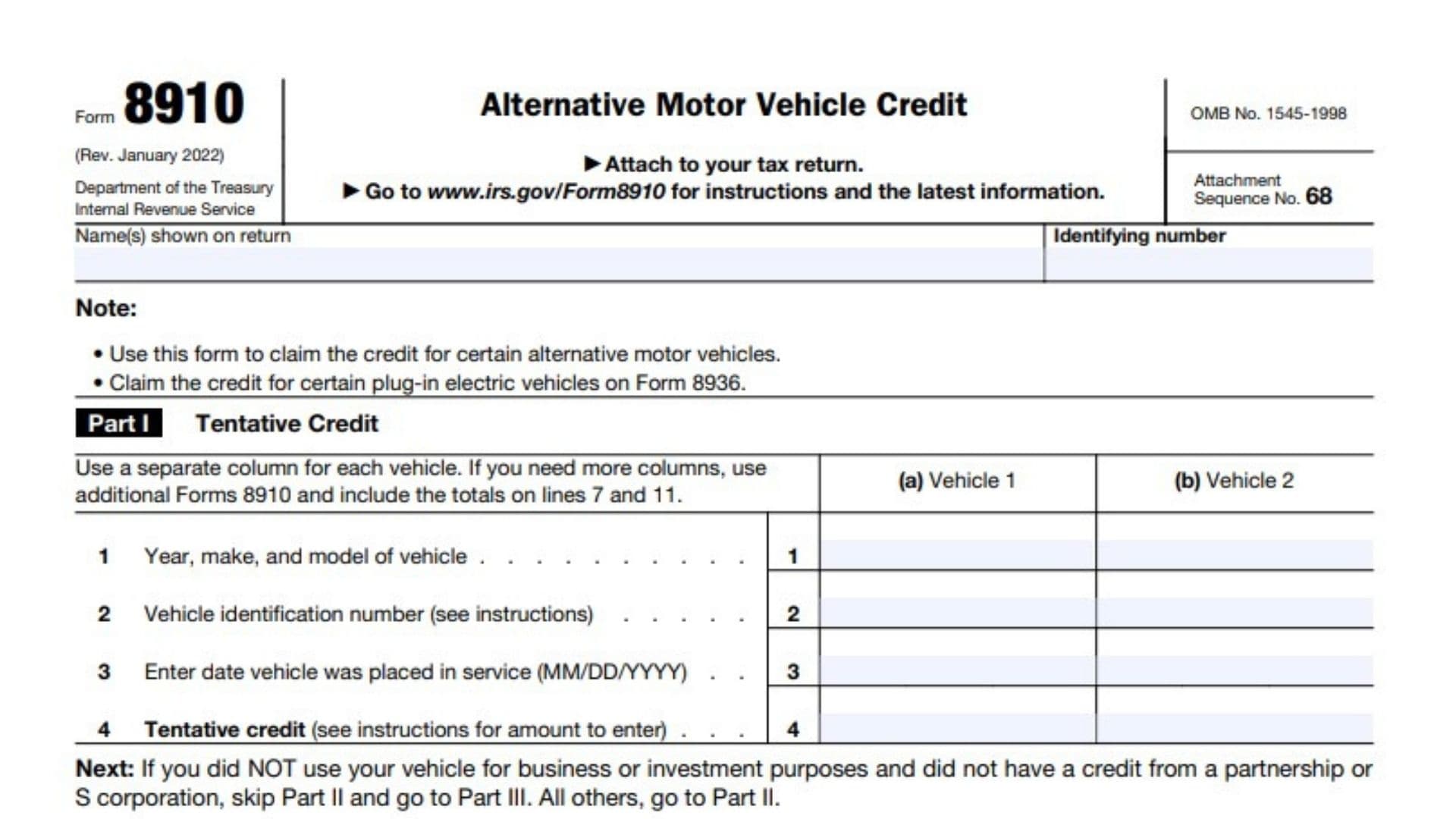

How to Complete Form 8910

Header

- Name(s) shown on return: Enter your name or your business’s name as it appears on your tax return.

- Identifying number: Enter your Social Security Number (SSN) or Employer Identification Number (EIN) as shown on your return.

Part I: Tentative Credit

Use a separate column (a) or (b) for each qualifying vehicle. For more than two vehicles, use additional forms and sum totals on lines 7 and 11.

Line 1: Year, make, and model of vehicle

Write the year, make, and model for each alternative motor vehicle you are claiming the credit for.

Line 2: Vehicle identification number (VIN)

Enter the VIN for each vehicle. This uniquely identifies your vehicle for IRS verification.

Line 3: Enter date vehicle was placed in service (MM/DD/YYYY)

Provide the exact date (month, day, year) you first placed the vehicle in service.

Line 4: Tentative credit (see instructions for amount to enter)

Enter the base credit amount for the vehicle as specified in IRS guidance, based on its fuel type and technology.

Part II: Credit for Business/Investment Use Part of Vehicle

Complete this section only if the vehicle was used for business or investment purposes, or if you have a credit from a partnership or S corporation. Otherwise, skip to Part III.

Line 5: Business/investment use percentage

Enter the percentage of business/investment use for each vehicle, as a percentage (%).

Line 6: Multiply line 4 by line 5

Multiply the tentative credit (line 4) by the business/investment use percentage (line 5) for each vehicle.

Line 7: Add columns (a) and (b) on line 6

Sum the business/investment use credits for all vehicles.

Line 8: Alternative motor vehicle credit from partnerships and S corporations

Enter any credits passed through to you from partnerships or S corporations.

Line 9: Business/investment use part of credit

Add lines 7 and 8. Partnerships and S corporations stop here and report this amount on Schedule K. All others, report this amount on Form 3800, Part III, line 1r.

Part III: Credit for Personal Use Part of Vehicle

Line 10:

If you skipped Part II, enter the amount from line 4. If you completed Part II, subtract line 6 from line 4 for each vehicle.

Line 11:

Add columns (a) and (b) on line 10 to get the total personal use credit.

Line 12:

Enter the amount from Form 1040, 1040-SR, or 1040-NR, line 18 (your total tax before credits).

Line 13:

Enter your total personal credits from Form 1040, 1040-SR, or 1040-NR (see IRS instructions for which credits to include).

Line 14:

Subtract line 13 from line 12. If zero or less, enter -0- and stop; you cannot claim the personal use part of the credit.

Line 15:

Personal use part of credit. Enter the smaller of line 11 or line 14 here and on Schedule 3 (Form 1040), line 6e. If line 14 is smaller than line 11, see instructions for possible carryforward or limitations.