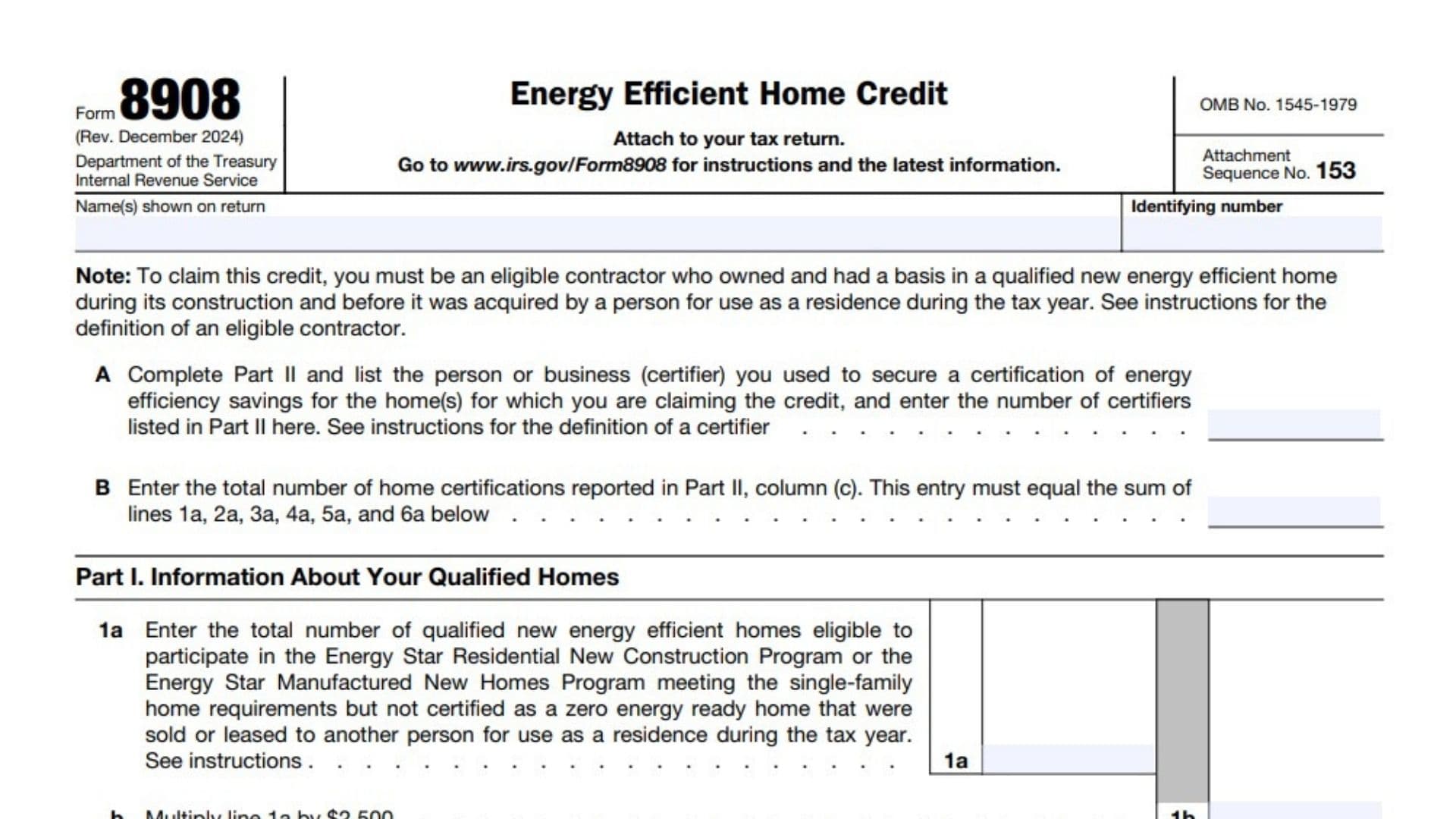

IRS Form 8908, titled “Energy Efficient Home Credit,” is a tax form used by eligible contractors to claim credits for constructing and selling energy-efficient homes. This form is designed for contractors who owned and had a basis in qualified new energy-efficient homes during their construction and before they were acquired for use as residences. The form allows contractors to calculate credits based on different types of energy-efficient homes, including those participating in Energy Star programs and those certified as zero energy ready homes.

How to File Form 8908?

To file Form 8908:

- Complete the form for the appropriate tax year.

- Attach Form 8908 to your tax return.

- Submit the forms together by the regular tax filing deadline or by the extended deadline if you’ve filed for an extension.

How to Complete Form 8908?

Identification Section

- Enter your name(s) as shown on your tax return.

- Provide your identifying number (SSN or EIN).

Item A

- Complete Part II, listing the certifiers used to secure energy efficiency savings certifications.

- Enter the number of certifiers listed in Part II.

Item B

- Enter the total number of home certifications reported in Part II, column (c).

Part I: Information About Your Qualified Homes

Line 1a: Enter the number of qualified single-family homes not certified as zero energy ready.

Line 1b: Multiply line 1a by $2,500.

Line 2a: Enter the number of qualified single-family homes certified as zero energy ready.

Line 2b: Multiply line 2a by $5,000.

Line 3a: Enter the number of qualified multifamily homes meeting prevailing wage requirements but not certified as zero energy ready.

Line 3b: Multiply line 3a by $2,500.

Line 4a: Enter the number of qualified multifamily homes meeting prevailing wage requirements and certified as zero energy ready.

Line 4b: Multiply line 4a by $5,000.

Line 5a: Enter the number of qualified multifamily homes not meeting prevailing wage requirements and not certified as zero energy ready.

Line 5b: Multiply line 5a by $500.

Line 6a: Enter the number of qualified multifamily homes not meeting prevailing wage requirements but certified as zero energy ready.

Line 6b: Multiply line 6a by $1,000.

Line 7: Enter energy efficient home credits from partnerships and S corporations.

Line 8: Add lines 1b, 2b, 3b, 4b, 5b, 6b, and 7.

- Partnerships and S corporations: Report this amount on Schedule K.

- All others: Report this amount on Form 3800, Part III, line 1p.

Part II: Certification Information

- List each certifier used, including name, identifying number, and number of homes certified.