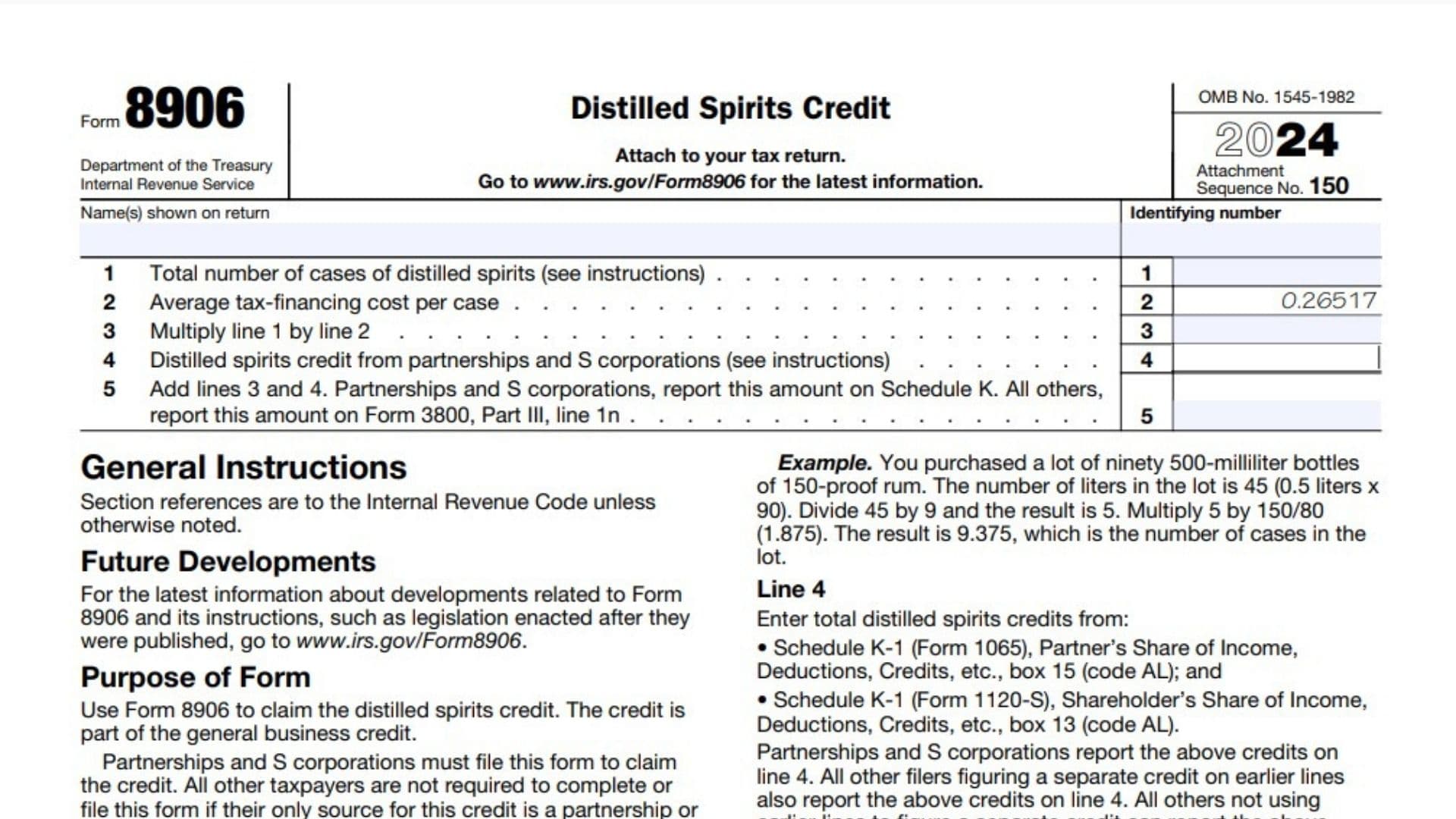

IRS Form 8906, also known as the Distilled Spirits Credit Form, is used by businesses to claim a tax credit for certain costs associated with storing distilled spirits. This form is part of the General Business Credit and helps offset federal excise taxes that wholesalers and certain other entities pay when purchasing or storing distilled spirits in the U.S. The credit is calculated based on the number of cases of bottled distilled spirits stored or purchased, multiplied by the average tax-financing cost per case. This incentive aims to support businesses dealing in distilled spirits by reducing their overall tax burden. Partnerships and S corporations must file this form to claim the credit, while other taxpayers who receive the credit from these entities can report it directly on Form 3800 (General Business Credit), Part III, Line 1n. Businesses that qualify for this credit include eligible wholesalers who purchase bottled distilled spirits directly from a bottler and those responsible for storing spirits under certain conditions specified by the IRS.

How to File Form 8906?

Step 1: Determine Your Eligibility

- You are eligible if you hold a wholesaler permit under the Federal Alcohol Administration Act and purchase bottled distilled spirits directly from a U.S. bottler.

- If you do not hold a wholesaler permit but are subject to IRS Section 5005, you may still qualify if the bottled distilled spirits are stored in a warehouse operated by, or on behalf of, a state or political subdivision where title has not passed on an unconditional sale basis.

Step 2: Gather Necessary Information

Before filling out the form, ensure you have:

- The total number of cases of distilled spirits you purchased or stored.

- The average tax-financing cost per case (provided by the IRS).

- Any distilled spirits credits received from partnerships or S corporations (reported on Schedule K-1).

Step 3: Attach Form 8906 to Your Tax Return

Once completed, attach Form 8906 to your federal tax return. If you are a partnership or S corporation, report the amount on Schedule K. Other taxpayers must report the amount on Form 3800, Part III, Line 1n.

How to Complete Form 8906?

Line 1: Total Number of Cases of Distilled Spirits

- Enter the total number of cases of bottled distilled spirits you purchased or stored during the tax year.

- A case is defined as twelve 80-proof 750-milliliter bottles.

- If your lot consists of different bottle sizes or proof levels, calculate the number of cases using the formula:

- Divide the total liters in the lot by 9.

- Multiply the result by (Stated Proof ÷ 80).

- The final number is the total cases for tax purposes.

📌 Example:

You purchase 90 bottles of 500-milliliter 150-proof rum.

- Total liters = 0.5 x 90 = 45 liters

- 45 ÷ 9 = 5

- 5 × (150 ÷ 80) = 9.375 cases

So, you would report 9.375 cases on Line 1.

Line 2: Average Tax-Financing Cost Per Case

- The IRS provides the average tax-financing cost per case annually.

- For 2024, the cost is $0.26517.

Line 3: Calculate the Credit

- Multiply Line 1 by Line 2.

- Example: If you reported 100 cases on Line 1, the calculation would be:

100 × 0.26517 = $26.52 - Enter this amount on Line 3.

Line 4: Distilled Spirits Credit from Partnerships or S Corporations

- If you received any distilled spirits credits from a partnership or S corporation, enter the amount reported on:

- Schedule K-1 (Form 1065), Box 15, Code AL (for partnerships).

- Schedule K-1 (Form 1120-S), Box 13, Code AL (for S corporations).

Line 5: Total Credit Amount

- Add Line 3 and Line 4.

- Partnerships and S corporations should report this amount on Schedule K.

- All other taxpayers should report this amount on Form 3800, Part III, Line 1n.