IRS Form 8885 is used to claim the Health Coverage Tax Credit (HCTC), which provides financial assistance to eligible individuals for the purchase of qualified health insurance coverage. The HCTC is intended to help reduce the cost of healthcare premiums for certain individuals who are receiving Trade Adjustment Assistance (TAA), Alternative TAA (ATAA), Reemployment TAA (RTAA), or Pension Benefit Guaranty Corporation (PBGC) benefits. It also extends to qualifying family members of individuals in these categories. The form ensures that eligible recipients can reduce the financial burden of paying for health insurance premiums by claiming a percentage of the costs back as a tax credit. This credit can be applied to health insurance coverage, but specific criteria must be met for eligibility.

Who Should File Form 8885?

Form 8885 should be filed by individuals who qualify for the Health Coverage Tax Credit. This includes:

- TAA, ATAA, and RTAA recipients who are enrolled in eligible health insurance programs.

- Individuals receiving PBGC benefits.

- Qualifying family members of eligible individuals, such as spouses or dependents, who were covered by qualified health insurance.

- You cannot claim the credit if you are enrolled in Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), or if you are a federal employee with health benefits under FEHBP.

How to Complete Form 8885?

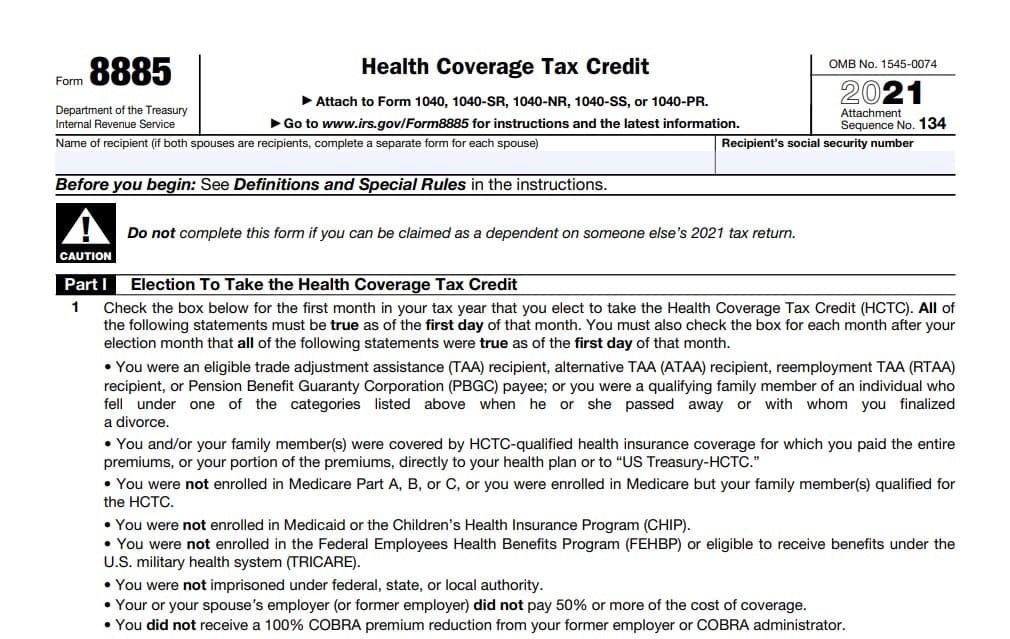

- Part I: Election to Take the Health Coverage Tax Credit

- Line 1: This section asks you to check the box for the first month in your tax year that you elect to take the HCTC. To qualify, the following must be true as of the first day of that month:

- You or a family member must be an eligible TAA, ATAA, RTAA recipient, or PBGC payee.

- You must have been covered by a qualified health insurance plan and paid premiums directly to your insurer or the U.S. Treasury-HCTC.

- You were not enrolled in Medicare, Medicaid, CHIP, or any federal health programs like TRICARE.

- You did not receive a 100% COBRA premium reduction from your former employer.

- You must ensure that the conditions listed on the form are met for each subsequent month that you claim the credit.

- Line 1: This section asks you to check the box for the first month in your tax year that you elect to take the HCTC. To qualify, the following must be true as of the first day of that month:

- Part II: Health Coverage Tax Credit Calculation

- Line 2: Enter the total amount you paid directly to your health plan for HCTC-qualified coverage during the months you selected in Line 1. Be sure to exclude any insurance premiums paid to the U.S. Treasury-HCTC, advance monthly payments, or reimbursements for HCTC.

- Line 3: Enter any distributions from Archer MSA or health savings accounts that were used to pay for the HCTC-qualified health insurance.

- Line 4: Subtract the amount entered on Line 3 from Line 2. The result represents the total amount of premiums you paid for health coverage eligible for the tax credit.

- Line 5: Calculate your Health Coverage Tax Credit by multiplying the amount on Line 4 by 72.5% (0.725). This is the percentage of the premium costs you can claim as a tax credit. Enter the result here, and transfer it to the appropriate line of your tax return, such as Schedule 3 on Form 1040, or Form 1040-SS or Form 1040-PR.

- Required Documentation:

- Attach any required documents, including the necessary evidence of premium payments, to substantiate your claim for the HCTC. Failure to include the required documentation may result in the denial of your credit.

- Signature:

- Sign and date the form under penalties of perjury, declaring that the information provided is accurate to the best of your knowledge.

Important Considerations:

- Advance Payments and Reimbursement: If you received advance monthly payments or reimbursements for the HCTC during the year, be sure to follow the instructions for Line 5 carefully to account for those amounts.

- Eligibility Verification: Be cautious in verifying your eligibility for the HCTC before filing, as individuals who are eligible under the TAA or PBGC programs must ensure they are not also enrolled in any disqualifying programs, such as Medicare or Medicaid.