Form 8882, also known as the Credit for Employer-Provided Childcare Facilities and Services, is a tax form used by employers to claim a credit for qualified childcare facility and resource and referral expenditures made during the tax year. This credit is part of the general business credit and helps offset the costs incurred by employers who provide childcare services to their employees. The form is applicable to businesses, and some pass-through entities like partnerships, S corporations, estates, and trusts. The credit is based on specific childcare-related expenses, including those for acquiring, constructing, or expanding childcare facilities, operating these facilities, or contracting with childcare providers. The maximum credit allowed per tax year is $150,000.

To figure the credit, employers can claim 25% of qualified childcare facility expenditures and 10% of qualified childcare resource and referral expenditures. However, it’s important to note that the credit can’t exceed $150,000. Taxpayers who are part of a pass-through entity, like an S corporation, may not need to complete the form themselves but report the credit directly on Form 3800.

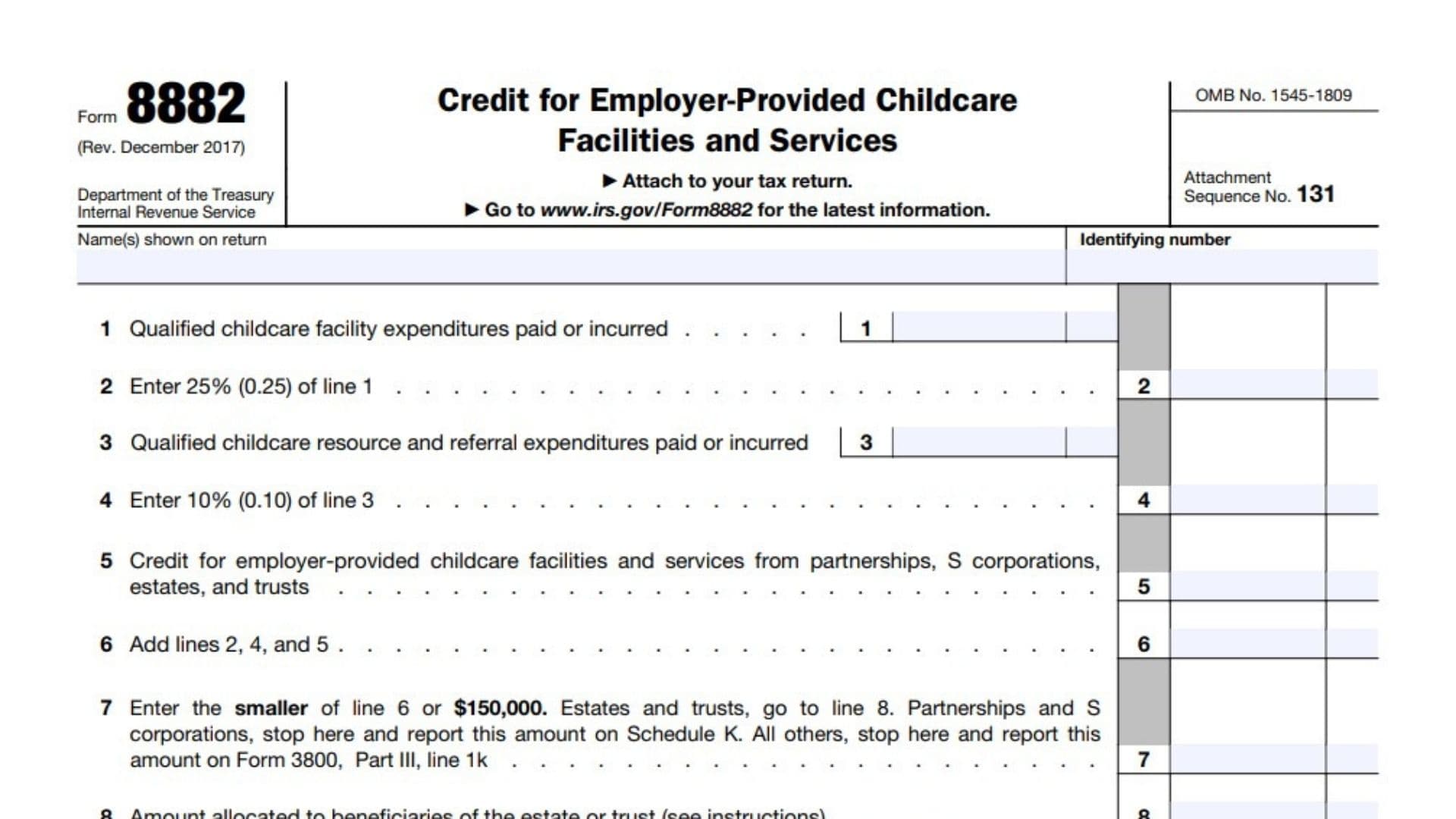

How to Complete Form 8882?

- Line 1: Enter the total amount of qualified childcare facility expenditures that were paid or incurred during the tax year. This could include costs for acquiring or improving a childcare facility, as well as operational expenses.

- Line 2: Multiply the amount from Line 1 by 25% (0.25). This figure represents the portion of the childcare facility expenditures eligible for the credit.

- Line 3: Enter the total amount of qualified childcare resource and referral expenditures paid or incurred during the tax year.

- Line 4: Multiply the amount from Line 3 by 10% (0.10). This represents the eligible portion of the childcare resource and referral expenditures.

- Line 5: Enter any credit for employer-provided childcare facilities and services from partnerships, S corporations, estates, and trusts. This figure will be provided from the respective entities.

- Line 6: Add the amounts from Lines 2, 4, and 5 to calculate the total credit for employer-provided childcare facilities and services.

- Line 7: Enter the smaller of the amount on Line 6 or $150,000. This is the total amount of the credit that can be claimed. Estates and trusts should proceed to Line 8, while partnerships and S corporations will stop here and report the amount on Schedule K.

- Line 8: If you are an estate or trust, allocate the credit between the estate or trust and its beneficiaries based on how income was allocated. Enter the beneficiaries’ share on this line.

- Line 9: For estates and trusts, subtract the amount on Line 8 from Line 7. The remaining amount should be reported on Form 3800, Part III, line 1k.

The form also includes additional instructions on specific situations like the recapture of credit if the childcare facility ceases to operate as such or changes ownership, as well as rules for controlled groups and businesses under common control. Taxpayers should not claim this credit if they’ve already received a similar benefit from other credits. The recapture of credit is necessary if the childcare facility stops operating as a qualified facility within 10 years.