IRS Form 8881 is used to claim a credit for small employer pension plan startup costs, auto-enrollment options, and contributions made for military spouse employees. This form helps small businesses and employers take advantage of specific tax credits that reduce the financial burden of offering retirement benefits to employees. These credits are designed to encourage small businesses to set up pension plans, implement auto-enrollment features, and include military spouses in their retirement plans. Specifically, Form 8881 includes three parts:

- Credit for Small Employer Pension Plan Startup Costs – This section is for businesses that have incurred costs related to setting up a retirement plan.

- Small Employer Auto-Enrollment Credit – Employers who offer auto-enrollment for their retirement plans may be eligible for this credit.

- Military Spouse Participation Credit – This section is for employers who make contributions to military spouse retirement plans.

These credits can help reduce the overall cost of retirement plan setup and maintenance, which can be a significant benefit for small businesses looking to provide more benefits to their employees.

How to Complete Form 8881?

Filing Form 8881 is relatively straightforward, but it’s essential to complete each section correctly to ensure that you claim the right credits. Below is a step-by-step breakdown of how to file and complete the form.

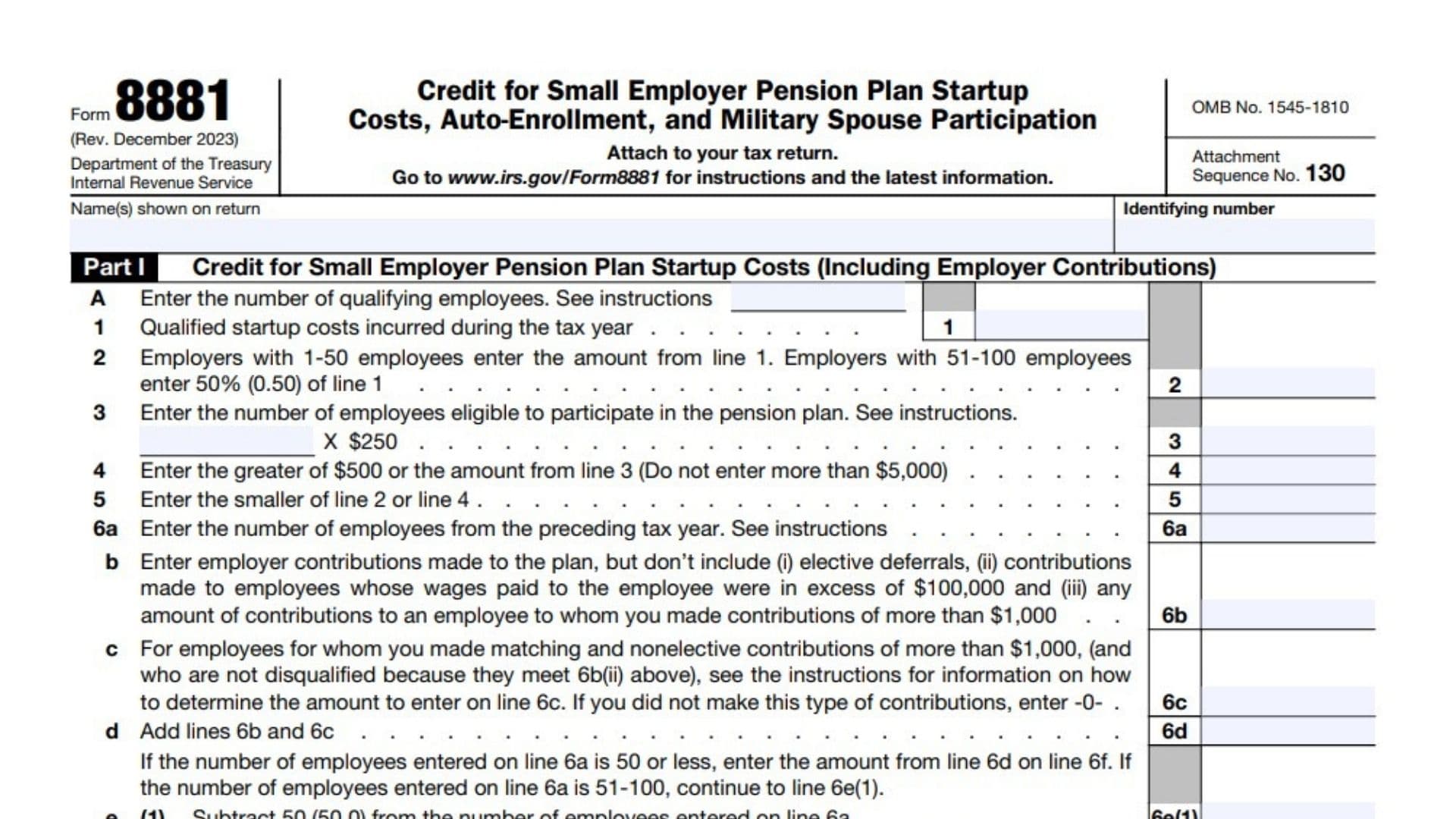

- Part I – Credit for Small Employer Pension Plan Startup Costs

- Line 1: Enter the total qualified startup costs incurred during the tax year.

- Line 2: For employers with 1-50 employees, enter the amount from line 1. For employers with 51-100 employees, enter 50% of the amount from line 1.

- Line 3: Enter the number of employees eligible to participate in the pension plan, then multiply this number by $250.

- Line 4: Enter the greater of $500 or the amount from line 3. However, do not enter more than $5,000.

- Line 5: Enter the smaller of the amounts from line 2 or line 4.

- Line 6a: Enter the number of employees from the previous tax year.

- Line 6b: Enter the employer contributions made to the plan, excluding certain contributions like elective deferrals.

- Line 6c: If you made matching contributions, enter the amount here.

- Line 6d: Add lines 6b and 6c.

- Line 6e: If you have 51-100 employees, calculate the appropriate amount following the steps in this section.

- Line 6f: If you did not complete line 6e, enter the amount from line 6d.

- Line 6g: Enter the applicable percentage depending on how long the plan has been in place (e.g., 75% for the third year of the plan).

- Line 7: For partnerships and S corporations, report the amount on Schedule K.

- Line 8: Add lines 5, 6g, and 7.

- Part II – Small Employer Auto-Enrollment Credit

- Line 9: Enter $500 if your retirement plan offers auto-enrollment.

- Line 10: For partnerships and S corporations, report the auto-enrollment credit on Schedule K.

- Line 11: Add lines 9 and 10.

- Part III – Military Spouse Participation Credit

- Line 12: Enter the number of military spouse employees participating in an eligible plan.

- Line 13: Enter the amount of contributions made by the employer for each eligible military spouse employee, up to $300 per employee.

- Line 14: For partnerships and S corporations, report the military spouse credit on Schedule K.

- Line 15: Add lines 12, 13, and 14.

Key Considerations When Completing Form 8881

- Eligible Employees: When calculating the number of employees, ensure that you accurately identify employees who qualify for the pension plan, auto-enrollment, and military spouse participation credits.

- Plan Year: Be mindful of whether the plan is in its first year, second year, or later, as the applicable percentage for the credit may change based on the number of years the plan has been in place.

- Documentation: Ensure that you have all the necessary records, including employee participation details and employer contribution amounts, as the IRS may request documentation to substantiate your claims.

FAQs

Q: What is the purpose of IRS Form 8881?

A: Form 8881 is used by small employers to claim credits for pension plan startup costs, auto-enrollment features, and military spouse participation.

Q: Can I claim a credit for auto-enrollment on Form 8881?

A: Yes, if your retirement plan offers auto-enrollment, you can claim a $500 credit for small employers under Part II of Form 8881.

Q: How do I calculate the pension plan startup credit?

A: The pension plan startup credit is based on your qualifying startup costs, the number of eligible employees, and your contributions to the plan. Follow the instructions on Form 8881 for accurate calculations.