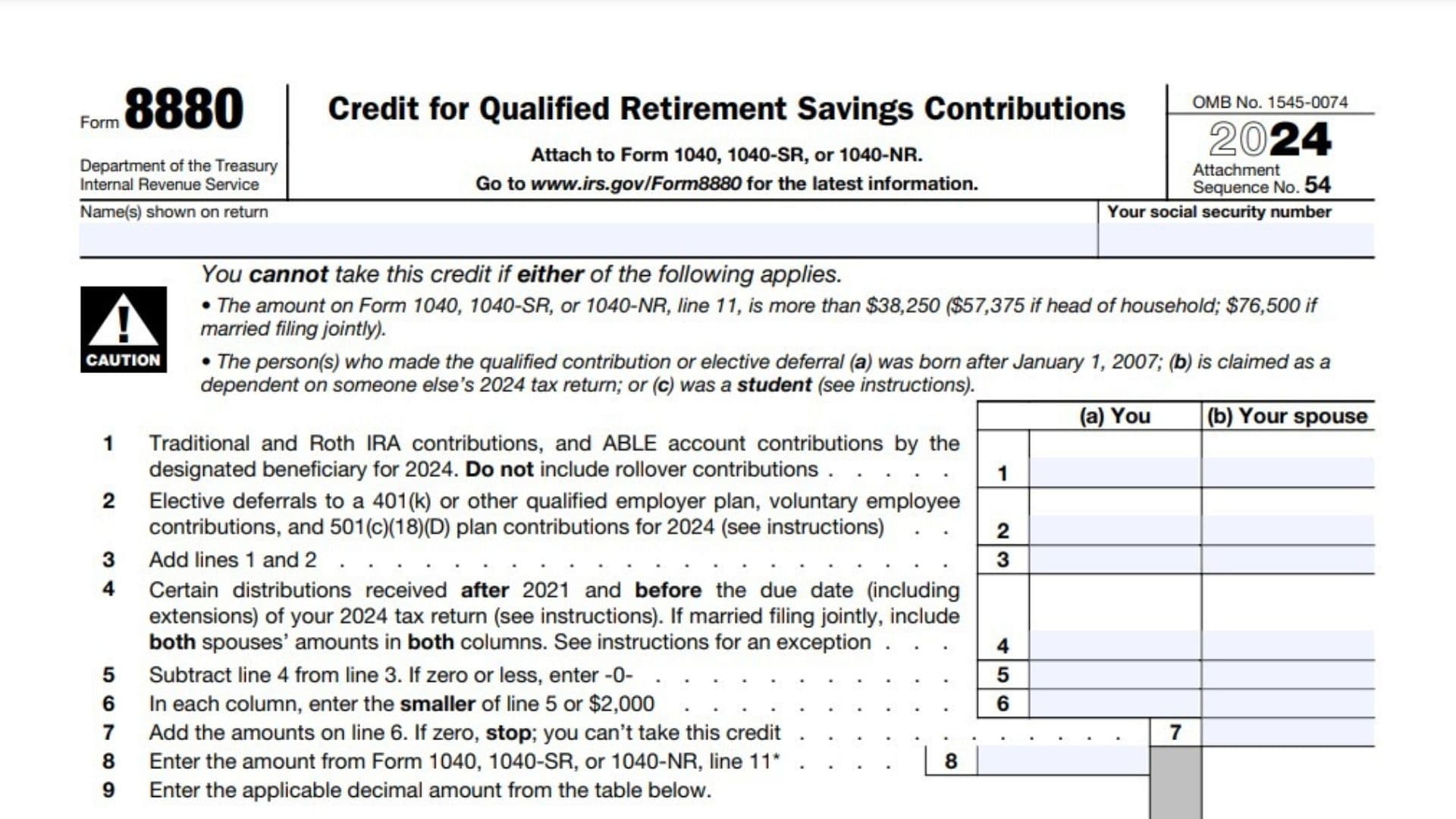

The IRS Form 8880 is used to calculate and claim the Saver’s Credit, which rewards eligible taxpayers for contributing to retirement savings accounts like IRAs, 401(k)s, or ABLE accounts. This credit can reduce your tax liability by up to $1,000 ($2,000 if married filing jointly), making it a valuable incentive for low- and moderate-income earners to save for retirement. However, not everyone qualifies for this credit—eligibility depends on your income level, filing status, and whether you meet specific criteria such as age and dependency status. Below, we’ll guide you through understanding the form and completing it correctly.

What Is IRS Form 8880?

Form 8880 is designed to calculate the Saver’s Credit, a nonrefundable tax credit that encourages individuals to save for retirement. By contributing to qualified retirement savings accounts—such as Traditional or Roth IRAs, 401(k) plans, or ABLE accounts—you may be eligible for a credit worth up to 50% of your contributions. The exact percentage depends on your adjusted gross income (AGI) and filing status.

Who Can Claim the Saver’s Credit?

To qualify for the Saver’s Credit:

- Your AGI must fall below specific thresholds:

- $38,250 for single filers or married filing separately (2024).

- $57,375 for head of household (2024).

- $76,500 for married filing jointly (2024).

- You must be at least 18 years old.

- You cannot be a full-time student during any part of five calendar months in the tax year.

- You cannot be claimed as a dependent on someone else’s tax return.

If you meet these requirements, Form 8880 allows you to calculate your credit based on your contributions.

How to File IRS Form 8880?

Form 8880 must be attached to your federal income tax return (Form 1040, 1040-SR, or 1040-NR). Follow these steps to file it:

- Complete your federal tax return up to the point where you calculate your taxable income.

- Gather documentation of your retirement contributions (e.g., Form W-2 box 12 codes D, E, G; IRA contribution statements).

- Use Form 8880 to calculate your Saver’s Credit.

- Attach Form 8880 to your tax return and file electronically or by mail.

How to Complete Form 8880?

Part I: Contributions and Distributions

This section determines your eligible contributions after accounting for any distributions.

- Line 1: Enter the total contributions made to Traditional IRAs, Roth IRAs, or ABLE accounts in the tax year. Do not include rollover contributions.

- Line 2: Add elective deferrals from employer-sponsored plans like a 401(k), SIMPLE IRA, or SEP IRA. These amounts are typically shown in box 12 of your W-2 with codes D, E, G, etc.

- Line 3: Add lines 1 and 2 together. This is your total eligible contribution amount.

- Line 4: Subtract any distributions received from retirement accounts after December 31 of two years prior through the due date of this year’s return (e.g., January 1, 2022–April 15, 2025). Exclude rollovers and certain other exceptions listed in the instructions.

- Line 5: Subtract line 4 from line 3. If the result is zero or less, enter “-0-” and stop here—you are not eligible for the credit.

Part II: Calculating the Saver’s Credit

This section determines how much of your contributions qualify for the credit.

- Line 6: In each column (a) and (b), enter the smaller of line 5 or $2,000. This limits eligible contributions to $2,000 per person.

- Line 7: Add the amounts from line 6 in both columns. If zero, stop—you cannot claim this credit.

- Line 8: Enter your AGI from Form 1040 line 11.

- Line 9: Refer to the table on Form 8880 to find the decimal percentage that corresponds to your AGI and filing status (e.g., .5 for married filing jointly with AGI under $23,000). If zero applies here based on income limits, stop—you are not eligible for the credit.

- Line 10: Multiply line 7 by line 9. This is your tentative credit amount.

Part III: Limitation Based on Tax Liability

This section ensures that your credit does not exceed your total tax liability.

- Line 11: Limitation based on tax liability. Enter the amount from the Credit Limit Worksheet in the instructions

- Line 12: Enter the smaller of line 10 or line 11. This is your final Saver’s Credit amount.

About Form 8880, Line 11

Here’s how the Credit Limit Worksheet works for Line 11:

- Start with your total tax liability: This is found on Form 1040, 1040-SR, or 1040-NR, line 18.

- Subtract other credits: Add up the credits you’re claiming from Schedule 3 (Form 1040), lines 1 through 3, 6d (e.g., credit for the elderly or disabled), and 6l.

- Calculate the remaining amount: Subtract the total of these credits from your total tax liability (line 18). Enter this result on Line 11 of Form 8880.