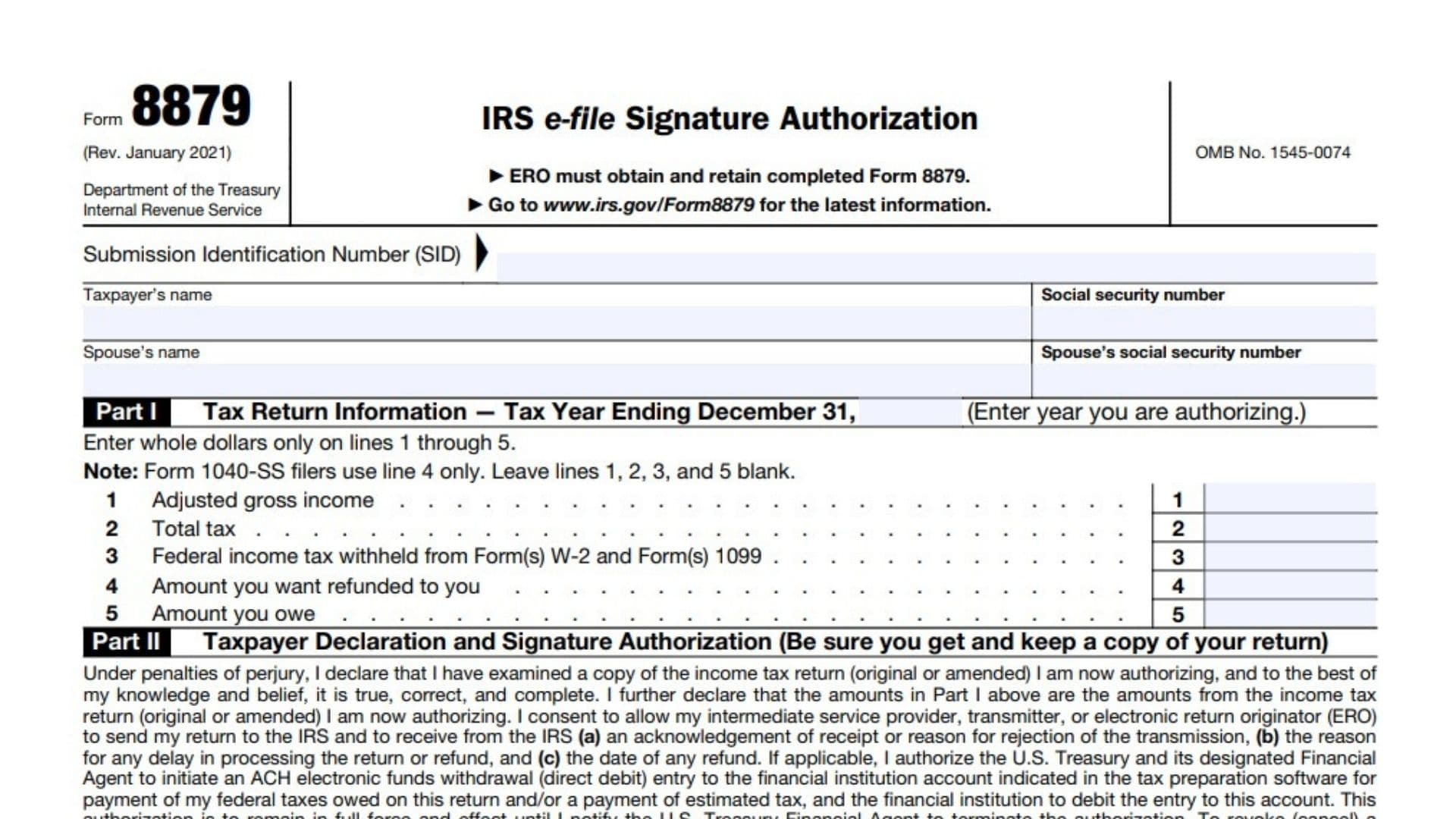

IRS Form 8879, IRS e-file Signature Authorization, is the declaration and signature authorization taxpayers use to approve the electronic filing of an original or amended individual return prepared and transmitted by an Electronic Return Originator (ERO), such as a tax professional or e-file software provider. It is required when the Practitioner PIN method is used or when a taxpayer authorizes the ERO to enter or generate the taxpayer’s Personal Identification Number (PIN) as the taxpayer’s electronic signature. The form applies to Forms 1040, 1040-SR, 1040-NR, 1040-SS, and 1040-X for tax years beginning with 2019. The signed Form 8879 is not sent to the IRS; instead, the ERO must retain it and associated records, typically for three years from the return due date or when the IRS receives the return, whichever is later, and must receive it before transmitting the return. Taxpayers must review a copy of the return, confirm amounts shown on Form 8879 match the return, sign (handwritten or supported e-signature), and return it to the ERO by hand, mail, private delivery, email, website, or fax.

How To File It

- Form 8879 is not filed with the IRS; it is retained by the ERO and produced only upon IRS request, so a correct process is to complete, sign, return to the ERO, and let the ERO keep it in records.

- The ERO cannot transmit the return until receiving the completed and signed Form 8879; transmission occurs only after taxpayer authorization via the PIN option indicated in Part II.

- The ERO associates the 20-digit Submission Identification Number (SID) with Form 8879 or retains Form 9325 with it, in line with MeF and retention guidance (Pub. 4164/Rev. Proc. 97-22 referenced in instructions).

Who Must Complete It

- Required when the Practitioner PIN method is used (with the ERO also completing Part III) or when the taxpayer authorizes the ERO to enter or generate the taxpayer’s PIN on the e-filed return.

- Not required if the Practitioner PIN method is not used and the taxpayer personally enters a PIN on the ERO’s system; in that case, different authentication in the electronic record is used per IRS rules.

Taxpayer Responsibilities

- Verify the accuracy of the prepared return, including refund and direct deposit information, before signing.

- Choose the PIN option in Part II, sign and date, and return Form 8879 to the ERO by an allowed method; a five-digit PIN other than all zeros is required when used as the electronic signature.

ERO Responsibilities

- Complete names/SSNs at top, complete Part I using amounts from the tax return, handle PINs as authorized, and enter the ERO firm name on the authorization line if entering the taxpayer’s PIN.

- Provide the taxpayer with Form 8879, obtain the signed form before transmitting, record or associate the 20-digit SID, and retain the signed Form 8879 for three years; do not send it to the IRS unless requested.

How to Complete Form 8879

Header Block (Top Of Form)

- Submission Identification Number (SID): Enter the 20-digit SID assigned to the electronically filed return or associate Form 9325 with this Form 8879 after filing; the SID may be entered by the ERO to tie the record to the filed return.

- Taxpayer’s name: Enter the primary taxpayer’s full legal name exactly as it appears on the tax return.

- Social security number: Enter the primary taxpayer’s SSN exactly as on the return.

- Spouse’s name: If married filing jointly, enter the spouse’s full legal name as on the return.

- Spouse’s social security number: If MFJ, enter spouse’s SSN exactly as on the return.

Part I — Tax Return Information — Tax Year Ending December 31, (Enter Year You Are Authorizing)

- Tax year field: Enter the calendar year of the return being authorized (for example, 2024), applicable to tax years beginning with 2019.

- Entry instruction: Enter whole dollars only on lines 1 through 5; for Form 1040-SS filers, complete line 4 only and leave lines 1, 2, 3, and 5 blank.

- Line 1 — Adjusted gross income: Enter AGI from the e-filed individual return; this must match the return being authorized.

- Line 2 — Total tax: Enter total tax from the return; this must match the return data.

- Line 3 — Federal income tax withheld from Form(s) W-2 and Form(s) 1099: Enter the total federal withholding shown on the return.

- Line 4 — Amount you want refunded to you: Enter the refund amount requested on the return; Form 1040-SS filers complete this line only.

- Line 5 — Amount you owe: Enter the balance due from the return; ensure consistency with any electronic funds withdrawal details in the software.

Part II — Taxpayer Declaration And Signature Authorization

- Declaration paragraph: The taxpayer declares under penalties of perjury that the examined return copy is true, correct, and complete and that Part I amounts match the return; this also provides consent for the IRS to send acknowledgements, reasons for rejection, processing delays, and refund dates to the transmitter/ERO.

- Electronic Funds Withdrawal Consent: If used, this authorizes the Treasury Financial Agent to initiate ACH debit(s) for taxes owed or estimated payments per the return; cancellation requires contacting 1-888-353-4537 at least two business days before the settlement date.

- Taxpayer’s PIN — check one box only:

- “I authorize [ERO firm name] to enter or generate my PIN … as my signature…” Select this if the ERO will enter or generate the taxpayer’s five-digit PIN (not all zeros) as the taxpayer’s electronic signature.

- “I will enter my PIN … Practitioner PIN method.” Select this only if the taxpayer will enter their own PIN under the Practitioner PIN method; the ERO must complete Part III below.

- PIN field: Enter a five-digit PIN (not all zeros) that will serve as the taxpayer’s electronic signature under the selected option.

- ERO firm name line: If authorizing the ERO to enter/generate the PIN, enter the ERO firm name (not the individual preparer’s name).

- Your signature: Taxpayer signs (handwritten or supported electronic signature) and dates; return cannot be transmitted until this signed form is received by the ERO.

- Spouse’s PIN — check one box only (if MFJ):

- “I authorize [ERO firm name] to enter or generate my PIN … as my signature…” for the spouse.

- “I will enter my PIN … Practitioner PIN method.” for the spouse under Practitioner PIN.

- Spouse PIN field: Enter spouse’s five-digit PIN (not all zeros) if applicable; spouses may authorize differently (one may authorize ERO entry while the other enters their own).

- Spouse’s signature and date: Spouse signs (handwritten or supported e-signature) and dates when MFJ.

Part III — Certification And Authentication — Practitioner PIN Method Only

- ERO’s EFIN/PIN: Enter the six-digit EFIN immediately followed by the ERO’s five-digit self-selected PIN; do not enter all zeros; this combined entry constitutes the ERO’s electronic signature on the return.

- ERO’s certification paragraph: By entering the EFIN/PIN, the ERO certifies use of the Practitioner PIN method and compliance with Pub. 1345 requirements for authorized e-file providers.

- ERO’s signature and date: ERO signs (rubber stamp, mechanical device such as signature pen, or computer software permitted per Notice 2007-79) and dates; this is required when the Practitioner PIN method is used.

Important Notes For EROs (From The Instructions Section)

- Do not send Form 8879 to the IRS unless requested; retain the completed form for three years from the return due date or IRS received date, whichever is later, and electronic retention is allowed per Rev. Proc. 97-22.

- Confirm the identity of the taxpayer(s); provide a copy of the signed Form 8879 upon request; provide a corrected copy if return data changes after taxpayer review.

- If not using the Practitioner PIN method, the Authentication Record for the e-filed return must include taxpayer date(s) of birth and either prior-year AGI or prior-year PIN (or both) from the originally filed return—not from an amended return or IRS math error.