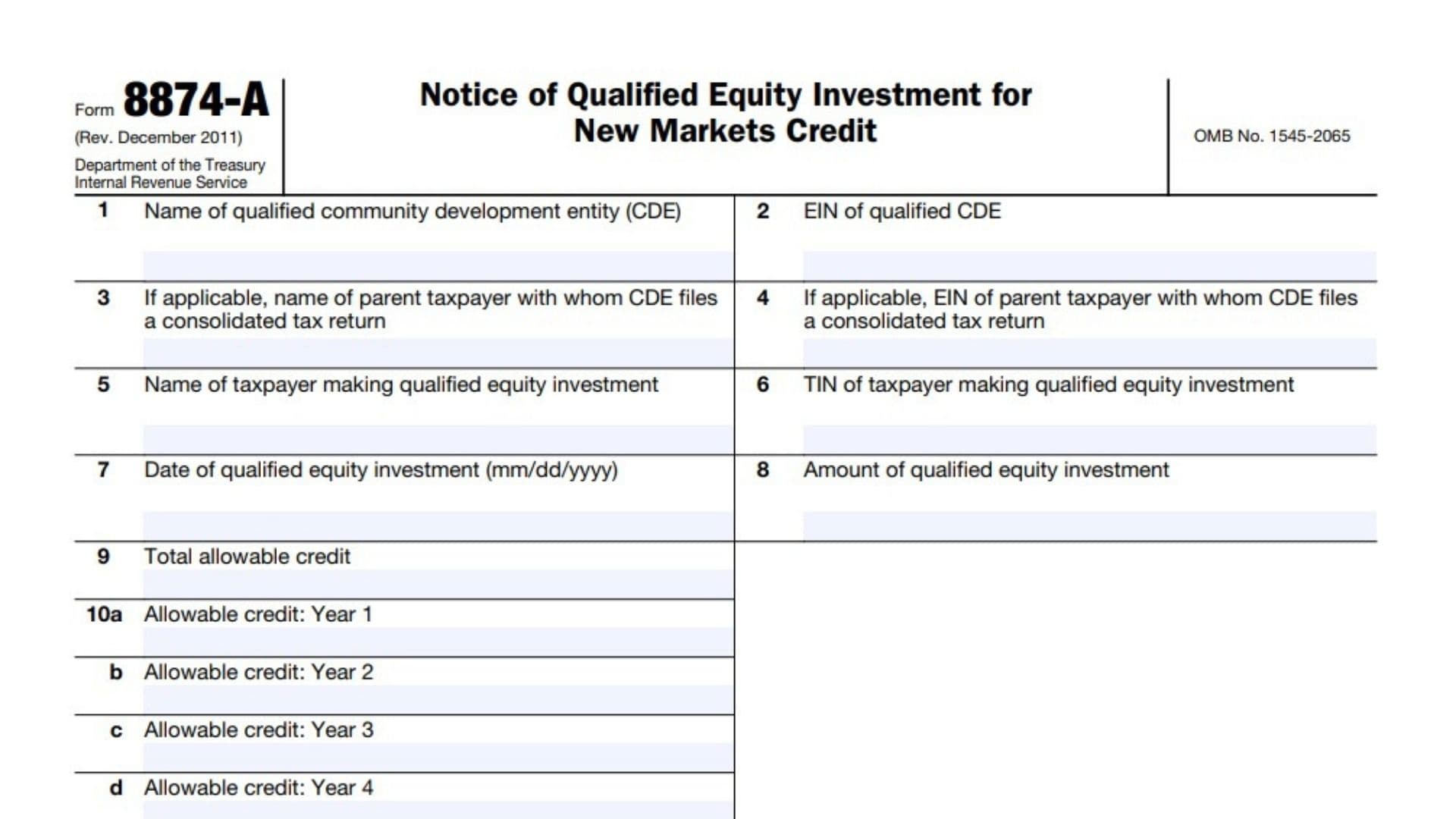

IRS Form 8874-A, “Notice of Qualified Equity Investment for New Markets Credit,” is used by qualified community development entities (CDEs) to notify taxpayers and the IRS when a taxpayer acquires a qualified equity investment (QEI) in the CDE at its original issue. This form is essential for taxpayers seeking to claim the New Markets Tax Credit under Internal Revenue Code section 45D. The CDE must provide this notice to the taxpayer within 60 days of the investment and send a copy to the IRS in Philadelphia. Each qualified equity investment requires a separate Form 8874-A. The form ensures that the taxpayer’s investment is recognized as a QEI, making them eligible for the associated tax credit. Accurate completion and timely filing of this form are crucial for compliance and for the taxpayer to claim the credit.

How to File Form 8874-A

- Who files: The qualified community development entity (CDE) that receives a qualified equity investment.

- When to file: The CDE must provide the original signed form to the taxpayer no later than 60 days after the investment is made and send a copy to the IRS at:

Department of the Treasury

Internal Revenue Service Center

Philadelphia, PA 19255-0549 - How to file: Complete all lines of the form, sign, and distribute as required. Keep a copy for your records.

How to Complete Form 8874-A

Line 1: Name of qualified community development entity (CDE)

Enter the full legal name of the CDE that received the qualified equity investment.

Line 2: EIN of qualified CDE

Enter the employer identification number (EIN) for the CDE.

Line 3: If applicable, name of parent taxpayer with whom CDE files a consolidated tax return

If the CDE files a consolidated tax return with a parent company, enter the parent taxpayer’s name. If not applicable, leave blank.

Line 4: If applicable, EIN of parent taxpayer with whom CDE files a consolidated tax return

If Line 3 is completed, enter the parent taxpayer’s EIN. If not applicable, leave blank.

Line 5: Name of taxpayer making qualified equity investment

Enter the name of the taxpayer (individual or entity) who made the qualified equity investment in the CDE.

Line 6: TIN of taxpayer making qualified equity investment

Enter the taxpayer identification number (TIN) of the investor listed on Line 5.

Line 7: Date of qualified equity investment (mm/dd/yyyy)

Enter the exact date the qualified equity investment was made, using the month/day/year format.

Line 8: Amount of qualified equity investment

Enter the total dollar amount of the qualified equity investment made by the taxpayer.

Line 9: Total allowable credit

Enter the total New Markets Tax Credit allowable for this qualified equity investment.

Line 10a: Allowable credit: Year 1

Enter the amount of credit allowable for the first year following the investment.

Line 10b: Allowable credit: Year 2

Enter the amount of credit allowable for the second year.

Line 10c: Allowable credit: Year 3

Enter the amount of credit allowable for the third year.

Line 10d: Allowable credit: Year 4

Enter the amount of credit allowable for the fourth year.

Line 10e: Allowable credit: Year 5

Enter the amount of credit allowable for the fifth year.

Line 10f: Allowable credit: Year 6

Enter the amount of credit allowable for the sixth year.

Line 10g: Allowable credit: Year 7

Enter the amount of credit allowable for the seventh year.

Signature Section

- Signature of authorized official of CDE:

The authorized official of the CDE must sign the form, certifying under penalties of perjury that the qualified equity investment was received by the CDE identified above. - Date:

Enter the date the form is signed. - Type or print name:

Clearly print or type the name of the authorized official signing the form.

Additional Tips

- Provide a separate Form 8874-A for each qualified equity investment.

- Retain a copy for your records.

- For more details, consult Form 8874, section 45D, and the official IRS resources or www.cdfifund.gov.

By following these line-by-line instructions, you can ensure Form 8874-A is completed accurately and filed in compliance with IRS requirements.