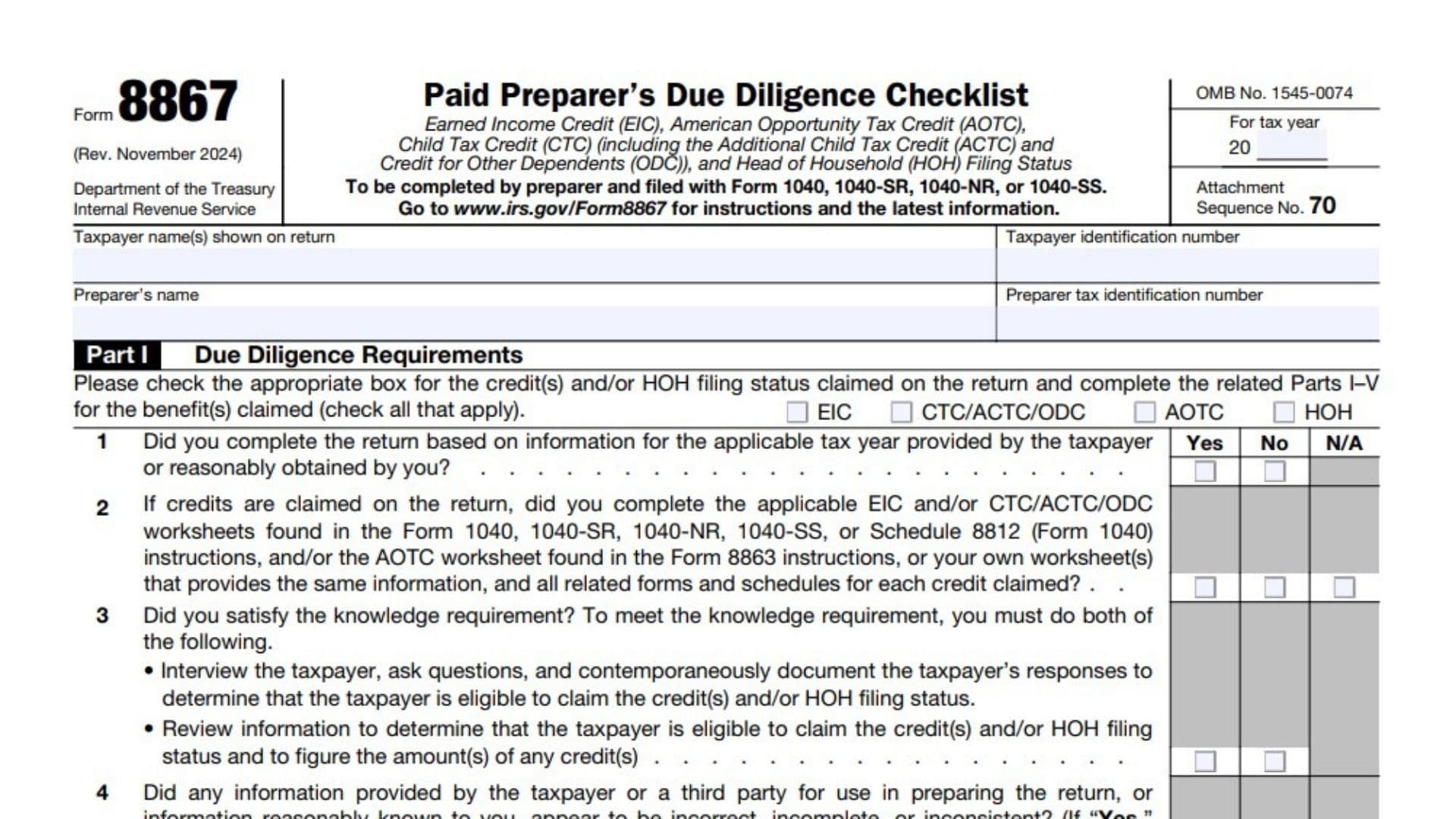

IRS Form 8867, titled the Paid Preparer’s Due Diligence Checklist, is a mandatory form used by paid tax preparers when filing returns that claim certain tax credits or Head of Household (HOH) filing status. The form serves to ensure preparers conduct due diligence by verifying taxpayer eligibility for credits like the Earned Income Credit (EIC), Child Tax Credit (CTC) including Additional Child Tax Credit (ACTC) and Credit for Other Dependents (ODC), and the American Opportunity Tax Credit (AOTC). Additionally, it confirms eligibility for HOH status. This requirement aims to reduce improper claims by formalizing interviews, documentation, and records retention, holding preparers accountable for accuracy. Form 8867 must be completed and attached to the taxpayer’s return (such as Form 1040, 1040-SR, 1040-NR, or 1040-SS) during filing and retained by the preparer for at least three years. Failure to comply can result in penalties for each improperly claimed credit or filing status.

How To File Form 8867?

Paid tax preparers must fill out Form 8867 electronically or on paper when submitting a tax return with any of the applicable credits or HOH status. It accompanies the taxpayer’s 1040-series tax forms filed with the IRS. If filing electronically, the form is included digitally; if paper filing, a paper copy is attached. Preparers must keep all supporting documentation referenced on the form for record retention requirements. Compliance audits by the IRS may review these records.

How to Complete Form 8867?

Part I: Due Diligence Requirements

- Check all boxes corresponding to the credits or HOH status claimed on the tax return: EIC, CTC/ACTC/ODC, AOTC, and/or HOH.

- Line 1: Confirm if the tax return was completed using information provided by the taxpayer or reasonably obtained. Answer “Yes,” “No,” or “N/A” (not applicable).

- Line 2: Verify if applicable worksheets for EIC, CTC/ACTC/ODC, or AOTC were completed as per instructions or equivalent worksheets.

- Line 3: Confirm knowledge requirement is met by interviewing the taxpayer, asking eligibility questions, contemporaneously documenting responses, and reviewing information for credit or HOH eligibility.

- Line 4: Indicate if any taxpayer or third-party information appeared incorrect, incomplete, or inconsistent: “Yes” or “No.” If yes, answer questions 4a and 4b below.

- 4a: Confirm reasonable inquiries were made to obtain correct and consistent information.

- 4b: Confirm inquiries and their details were contemporaneously documented (questions asked, to whom, when, information given, and impacts).

- Line 5: Confirm record retention requirement is met by keeping a copy of Form 8867, associated worksheets, copies of documents relied upon, and a record of how and from whom information was obtained.

- List documents relied on here if any.

- Line 6: Confirm taxpayer was asked if they can provide documentation verifying eligibility if audited.

- Line 7: Confirm taxpayer was asked about any disallowed or reduced credits on prior returns.

- If yes, note whether Form 8862 was completed for recertification.

- Line 8: For returns with self-employment income, confirm questions were asked to accurately prepare Schedule C (Form 1040).

Parts II – V: Due Diligence Questions For Specific Credits

- Part II (Line 9): EIC-specific questions:

- 9a: Confirm taxpayer eligibility for EIC based on qualifying children or without qualifying children.

- 9b: Confirm if taxpayer was asked whether the child lived with them for over half the year.

- 9c: Confirm if the taxpayer was explained the tiebreaker rules when a child is qualifying for more than one person.

- Part III (Line 10-12): CTC/ACTC/ODC specific questions:

- 10: Confirm qualifying persons claimed are eligible dependents and U.S. citizens or residents.

- 11: Confirm explanation given about child residency requirements for claiming credits.

- 12: Confirm explanation given about claiming credits for children of divorced or separated parents, including filing Form 8332 if applicable.

- Part IV (Line 13): AOTC-specific question:

- Confirm taxpayer provided substantiation like Form 1098-T or receipts for qualified tuition and related expenses.

- Part V (Line 14): HOH Filing Status question:

- Confirm eligibility for HOH status: unmarried or considered unmarried, providing over half of household costs for a qualifying person.

Part VI: Eligibility Certification

- Line 15: Preparer certifies all answers are true, correct, and complete to the best of their knowledge by marking “Yes” or “No.”