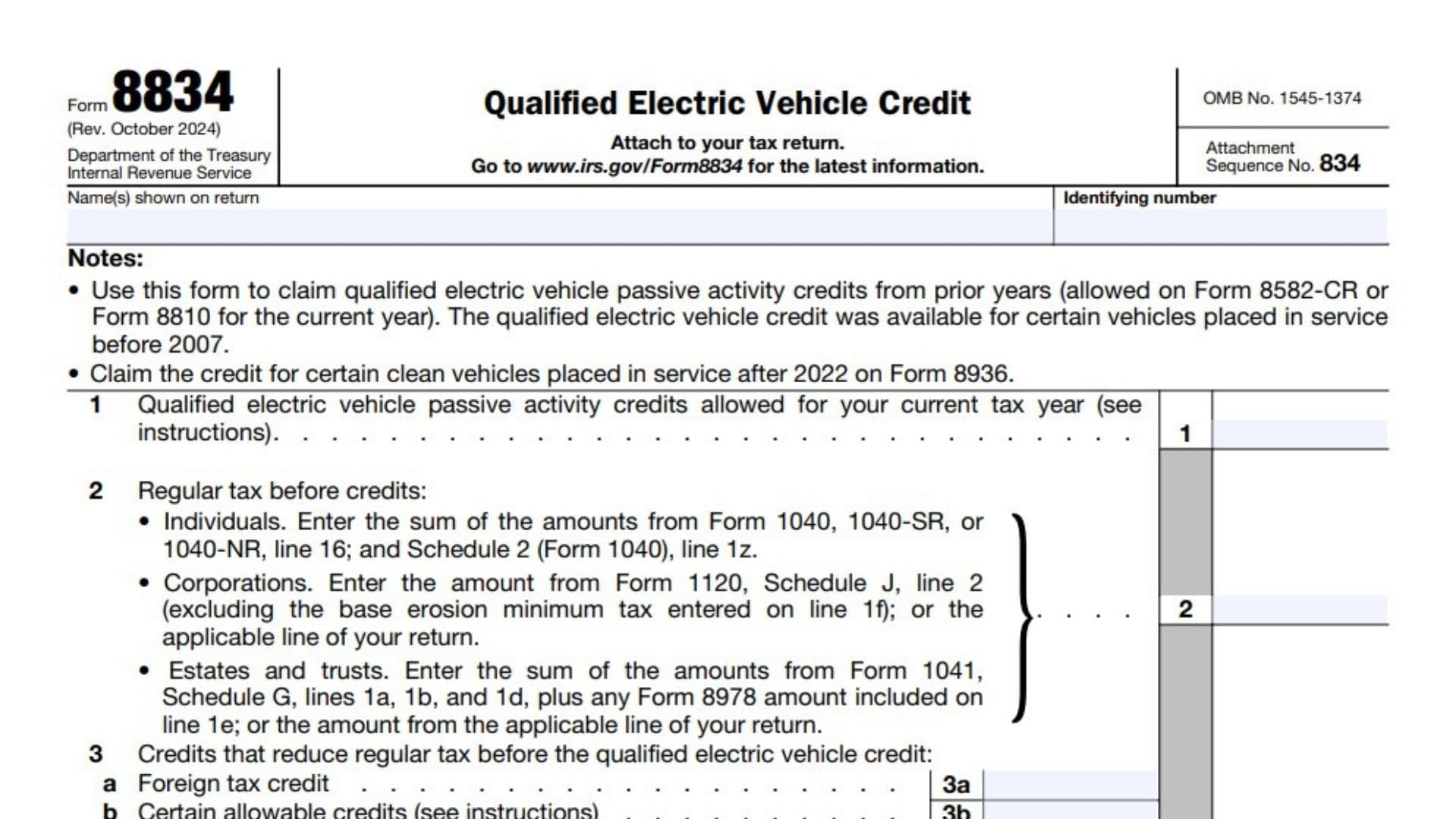

IRS Form 8834, officially known as the Qualified Electric Vehicle Credit form, is used by taxpayers to claim tax credits related to qualified electric vehicle (EV) purchases. However, this credit only applies to certain electric vehicles that were placed in service before 2007. If you’re looking for tax credits for clean vehicles placed in service after 2022, you should instead use Form 8936.

Form 8834 is primarily used to claim passive activity credits carried forward from prior years. These credits were originally available for taxpayers who purchased qualifying electric vehicles and met the program’s eligibility requirements. Now, taxpayers can only use this form to claim qualified electric vehicle passive activity credits allowed for the current tax year, which were limited in previous tax years due to tax liability restrictions. The form calculates the amount of credit you can apply to your taxes based on your regular tax liability, alternative minimum tax (AMT), and any other credits you are claiming.

How To Complete Form 8834?

Step 1: Enter Taxpayer Information

At the top of the form, provide:

✔ Your name (exactly as it appears on your tax return)

✔ Your identifying number (Social Security Number (SSN) for individuals, or Employer Identification Number (EIN) for businesses)

Line 1: Qualified Electric Vehicle Passive Activity Credits Allowed for the Current Tax Year

🔹 What to Enter:

- Enter the qualified electric vehicle passive activity credits that you are allowed to claim for the current tax year.

- You can find this information on:

- Form 8582-CR (Passive Activity Credit Limitations) for individuals, estates, and trusts

- Form 8810 (Corporate Passive Activity Loss and Credit Limitations) for corporations

🔹 Where to Get This Value:

- If you previously claimed the Qualified Electric Vehicle Credit but could not use the full amount due to tax liability limits, some of it may carry forward.

- Use the instructions for Form 8582-CR or Form 8810 to determine how much of this credit you can use this year.

✔ Write the allowable amount on Line 1.

Line 2: Regular Tax Before Credits

🔹 What to Enter:

- This line asks for your regular tax liability before applying any credits.

- The amount you enter depends on your filing type: Filing Type Where to Find This Value Individuals Form 1040, 1040-SR, or 1040-NR, Line 16 + Schedule 2 (Form 1040), Line 1z Corporations Form 1120, Schedule J, Line 2 (excluding base erosion minimum tax on Line 1f) Estates & Trusts Form 1041, Schedule G, Lines 1a, 1b, and 1d, plus any Form 8978 amount on Line 1e

✔ Write your total regular tax liability on Line 2.

Line 3: Credits That Reduce Regular Tax Before the Qualified Electric Vehicle Credit

This section accounts for other tax credits that you are claiming before applying the electric vehicle credit.

Line 3a: Foreign Tax Credit

🔹 What to Enter:

- Enter the amount of foreign tax credit you are claiming on your tax return.

✔ Write the foreign tax credit amount on Line 3a.

Line 3b: Certain Allowable Credits

🔹 What to Enter:

- This includes any other tax credits that reduce your tax liability, except the Qualified Electric Vehicle Credit.

- Use the instructions for your tax form to determine which credits apply. Filing Type Where to Find This Value Individuals Form 1040, Schedule 3, Lines 2–5, 7 (after adjustments for other credits) Estates & Trusts Form 1041, Schedule G, Line 2e (excluding alternative fuel vehicle refueling credit) Corporations Form 1120, Schedule J, Line 6 (excluding credits from Lines 5a, 5c–5e)

✔ Write the total of all other allowable credits on Line 3b.

Line 3c: Total Other Credits

- Add Line 3a (foreign tax credit) and Line 3b (other allowable credits).

✔ Write the total on Line 3c.

Line 4: Net Regular Tax

🔹 What to Enter:

- Subtract Line 3c from Line 2.

- If the result is zero or less, enter 0 (you will not be able to claim the credit).

✔ Write the result on Line 4.

Line 5: Tentative Minimum Tax (TMT)

🔹 What to Enter:

- This determines whether the Alternative Minimum Tax (AMT) affects your ability to claim the credit.

- The amount depends on your tax status: Filing Type Where to Find This Value Individuals Form 6251, Line 9 Corporations If subject to AMT, use Form 4626, Part II, Line 9. If not, enter 0. Estates & Trusts Form 1041, Schedule I, Line 52

✔ Write the appropriate AMT amount on Line 5.

Line 6: Adjusted Net Tax After AMT

🔹 What to Enter:

- Subtract Line 5 from Line 4.

- If the result is zero or less, enter 0 (you will not be able to claim the credit).

✔ Write the result on Line 6.

Line 7: Qualified Electric Vehicle Credit (Final Amount You Can Claim)

🔹 What to Enter:

- Compare Line 1 and Line 6.

- Enter the smaller of the two amounts.

- This is the final credit amount that you can claim on your tax return.

✔ Write the final credit amount on Line 7.

Where to Report This Credit on Your Tax Return:

- Individuals: Enter this amount on Schedule 3 (Form 1040), Line 6i

- Corporations: Enter on Form 1120, Schedule J, Line 5b

- Estates & Trusts: Report on the appropriate line of Form 1041

Important Notes

✅ If Line 6 is smaller than Line 1, you cannot use the full credit. The excess is lost (you cannot carry it forward).

✅ This credit only applies to qualified electric vehicles placed in service before 2007. For newer vehicles, use Form 8936.