IRS Form 8825 is used by partnerships and S corporations to report income, expenses, and net gains or losses from rental real estate activities. This form allows these entities to provide detailed information about each rental property they own, including gross rental income, deductible expenses, and net rental income or loss. Partnerships and S corporations must attach Form 8825 to their respective tax returns, such as Form 1065 (U.S. Return of Partnership Income) or Form 1120S (U.S. Income Tax Return for an S Corporation).

The purpose of Form 8825 is to ensure proper reporting of rental activities that are considered “passive activities” under IRS guidelines. Passive activity limitations may apply to the income or losses reported, influencing the overall tax obligations of the partners or shareholders. It’s worth noting that Form 8825 is exclusively for rental real estate activities; income and expenses from other types of rental activities must be reported elsewhere.

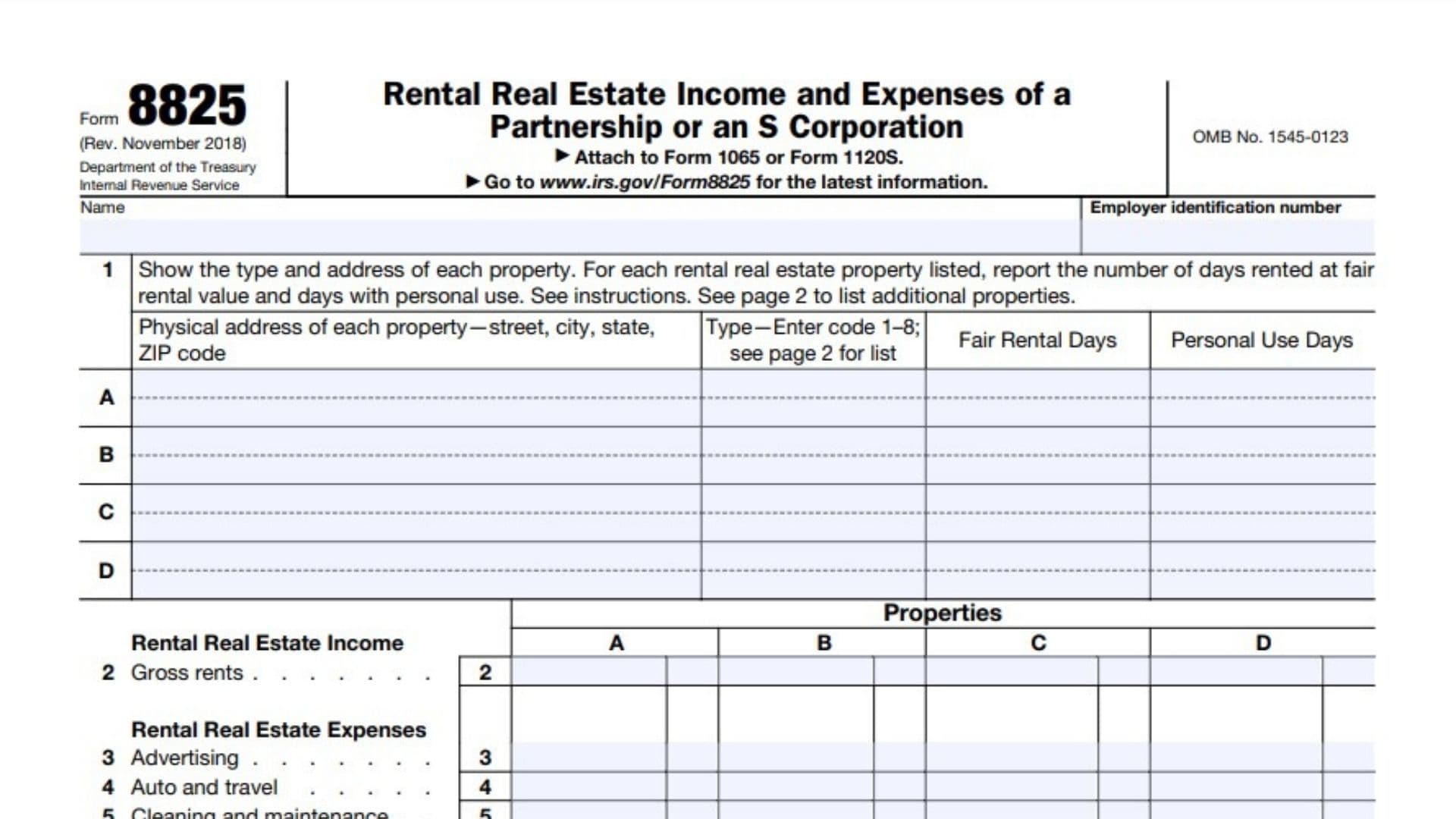

Form 8825 Key Notes

- Listing each rental property with its type and address.

- Recording the number of days each property was rented at fair market value versus personal use.

- Reporting specific rental income categories and detailed deductible expenses.

- Providing a consolidated overview of the entity’s total rental real estate income or loss.

Understanding and accurately completing Form 8825 is crucial for partnerships and S corporations to remain compliant with tax laws, avoid penalties, and ensure a clear record of rental real estate operations.

How to File Form 8825?

- Gather Necessary Information: Collect all relevant details about your rental properties, including physical addresses, property types, rental income, and expenses. Also, note the number of days each property was rented at fair market value and used personally.

- Obtain the Correct Version of the Form: Use the November 2018 version of Form 8825 or a later revision, as applicable to your tax year. Ensure you’re using the correct form version based on the IRS’s latest updates.

- Attach to the Right Tax Return: Form 8825 is not a standalone form. It must be attached to the partnership’s Form 1065 or the S corporation’s Form 1120S when filing.

- Follow Line-by-Line Instructions: Complete the form using accurate calculations and classifications. Enter each property’s details in separate columns, and report totals for income and expenses as instructed.

- Double-Check for Errors: Ensure all calculations, property details, and IRS instructions are followed precisely. Errors or omissions can result in penalties or require amendments later.

- File on Time: Submit the completed Form 8825 along with your entity’s main tax return by the IRS deadline to avoid late filing penalties.

How to Complete Form 8825?

Below are step-by-step instructions for completing each section of Form 8825:

Line 1: Property Details

- Purpose: Provide detailed information for each rental real estate property. Include type, address, and rental use.

- Instructions:

- Row A-D: Use these rows for listing up to four properties.

- Column 1 (Physical Address): Enter the complete physical address of the property, including street, city, state, and ZIP code. If the property is outside the U.S., include the postal code and country.

- Column 2 (Type): Specify the property type using one of the following codes:

- 1: Single Family Residence

- 2: Multi-Family Residence

- 3: Vacation or Short-Term Rental

- 4: Commercial

- 5: Land

- 6: Royalties

- 7: Self-Rental

- 8: Other (Include a description if using this code.)

- Column 3 (Fair Rental Days): Record the number of days the property was rented at fair rental value.

- Column 4 (Personal Use Days): Record the number of days the property was used personally. This is essential for calculating deductible expenses.

- Additional Properties: If there are more than four properties, attach additional pages or Forms 8825 to list them.

Part 2: Income and Expenses

- Line 2 (Gross Rents): For each property, enter the gross rental income received.

- Line 3 (Advertising): Enter the advertising costs incurred for each property.

- Line 4 (Auto and Travel): Record expenses related to auto and travel for managing the property.

- Line 5 (Cleaning and Maintenance): Enter costs for cleaning and maintaining each property.

- Line 6 (Commissions): Record any commission expenses.

- Line 7 (Insurance): Enter the insurance premiums paid for each property.

- Line 8 (Legal and Other Professional Fees): Include any legal or professional fees related to the property.

- Line 9 (Interest): Report interest expenses, ensuring compliance with IRS limitations for business interest deductions.

- Line 10 (Repairs): Enter costs associated with repairs for each property.

- Line 11 (Taxes): Record property taxes paid.

- Line 12 (Utilities): Enter utility expenses.

- Line 13 (Wages and Salaries): Include wages or salaries paid for property management.

- Line 14 (Depreciation): Calculate and record depreciation for the property. Attach Form 4562 if applicable.

- Line 15 (Other Expenses): List any additional expenses not covered in the above categories.

Part 3: Totals and Summary

- Line 16 (Total Expenses): Add lines 3 through 15 for each property.

- Line 17 (Net Income or Loss): Subtract Line 16 from Line 2 for each property.

- Line 18a (Total Gross Rents): Sum up gross rents (Line 2) across all properties.

- Line 18b (Total Expenses): Sum up total expenses (Line 16) across all properties.

- Line 19 (Net Gain or Loss): Enter net gains or losses from Form 4797, Part II, line 17, related to rental real estate activities.

- Line 20a (Net Income or Loss from Other Entities): Report income or loss from partnerships, estates, or trusts where the filing entity is a partner or beneficiary.

- Provide additional details for each entity on an attached schedule if needed.

- Line 21 (Net Rental Real Estate Income or Loss): Combine lines 18a through 20a. Report this result on Form 1065 or 1120S, Schedule K, Line 2.