IRS Form 8804, Annual Return for Partnership Withholding Tax (Section 1446), is used by partnerships to report and pay withholding taxes on income allocated to foreign partners under Section 1446 of the Internal Revenue Code. Partnerships engaged in a U.S. trade or business must withhold taxes on effectively connected taxable income (ECTI) allocable to foreign partners, and Form 8804 calculates the total liability, payments, penalties, and refunds. The form must be filed annually alongside Forms 8805 (for partner-level allocations) and 8804-C (for certified partner-level adjustments). Failure to file or inaccuracies can result in penalties, making it critical to understand each section thoroughly.

How to Complete Form 8804?

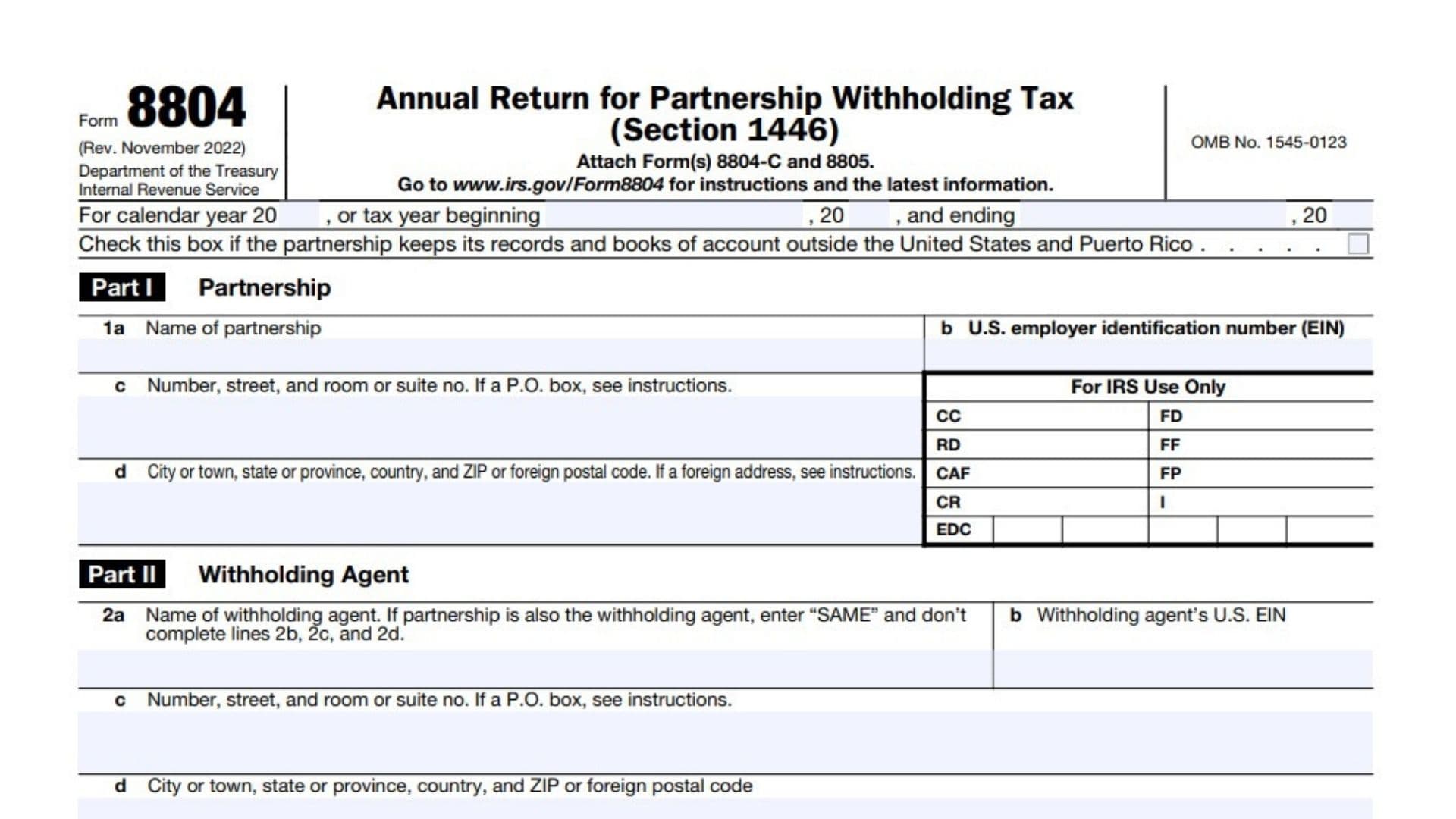

Part I: Partnership Information

- Line 1a: Enter the legal name of the partnership.

- Line 1b: Provide the partnership’s U.S. Employer Identification Number (EIN).

- Line 1c: List the partnership’s street address (no P.O. boxes unless specified in instructions).

- Line 1d: Include the city, state, ZIP code, or foreign postal code if applicable.

Part II: Withholding Agent

- Line 2a: If the partnership is the withholding agent, write “SAME.” Otherwise, list the agent’s name.

- Line 2b: Provide the withholding agent’s EIN (if different from the partnership).

- Lines 2c–2d: Include the agent’s street address and location details.

Part III: Section 1446 Tax Liability and Payments

Lines 3a–3c: Foreign Partner Details

- Line 3a: Total number of foreign partners.

- Line 3b: Number of Forms 8805 attached.

- Line 3c: Number of Forms 8804-C attached to Forms 8805.

Lines 4a–4t: Effectively Connected Taxable Income (ECTI) Breakdown

- Line 4a: ECTI allocable to corporate partners.

- Line 4b: Reduce line 4a by state/local taxes paid (per Reg. 1.1446-6).

- Line 4c: Subtract certified foreign partner adjustments (via Form 8804-C).

- Line 4d: Net ECTI for corporate partners = 4a – 4b – 4c.

- Line 4e: ECTI allocable to non-corporate partners (excluding lines 4i, 4m, 4q).

- Lines 4f–4h: Repeat reductions for non-corporate partners (state/local taxes, Form 8804-C).

- Lines 4i–4t: Special allocations for unrecaptured section 1250 gain, adjusted net capital gain, etc., with corresponding reductions.

Lines 5a–5f: Gross Section 1446 Tax Liability

- Line 5a: Multiply line 4d by 21% (corporate rate).

- Line 5b: Multiply line 4h by 37% (non-corporate ordinary income rate).

- Line 5c: Multiply line 4l by 28% (unrecaptured section 1250 gain rate).

- Line 5d: Multiply line 4p by 25% (section 1250 gain rate).

- Line 5e: Multiply line 4t by 20% (adjusted net capital gain rate).

- Line 5f: Sum lines 5a–5e for total tax liability.

Lines 6a–6g: Payments and Credits

- Line 6a: Section 1446 tax paid during the year (including extensions).

- Line 6b–6g: Taxes withheld by other partnerships, Section 1445/1446(f) taxes, etc. (attach Forms 8805, 1042-S, or 8288-A).

Lines 7–15: Final Calculations

- Line 7: Total payments = 6a + 6b + … + 6g.

- Line 8: Estimated tax penalty (attach Schedule A if applicable).

- Line 9: Total owed = 5f + 8.

- Line 10: Balance due = Line 9 – Line 7 (attach payment if positive).

- Line 11: Overpayment = Line 7 – Line 9 (if positive).

- Line 12–15: Allocate overpayment to partners (Form 8805), request refund, or credit to next year.

Key Tips for Filing Form 8804

- Deadline: File by the 15th day of the 4th month after the partnership’s tax year ends (April 15 for calendar-year filers).

- Attachments: Include Forms 8805 (per foreign partner) and 8804-C (for certified adjustments).

- Penalties: Late filing or underpayment incurs fees up to 25% of the tax due.

- Extensions: Use Form 7004 for a 6-month extension (does not extend payment deadlines).

FAQs

Q: Who must file Form 8804?

A: Partnerships with foreign partners earning effectively connected taxable income (ECTI) in the U.S.

Q: How are tax rates determined for Section 1446?

A: Rates vary by income type: 21% for corporate partners, 37% for ordinary income, and lower rates for capital gains.

Q: Can overpayments be refunded?

A: Yes, line 14 allows refund requests, or credit the amount to next year’s taxes (line 15).