IRS Form 8609, Low-Income Housing Credit Allocation and Certification, is used by property owners to claim the Low-Income Housing Tax Credit (LIHTC) for residential rental buildings that qualify under Section 42 of the Internal Revenue Code. This form is issued by a state or local housing credit agency to property owners, certifying the building’s eligibility for the tax credit. The form includes crucial details like the Building Identification Number (BIN), applicable credit percentage, and the maximum allowable credit amount. Property owners must complete Part II (First-Year Certification) in the first year of claiming the credit. LIHTC incentives encourage the development of affordable rental housing by providing a tax break over a 10-year period. Owners must ensure compliance with set-aside requirements and rent restrictions to retain eligibility. Failure to meet compliance rules may result in credit recapture, requiring Form 8611, Recapture of Low-Income Housing Credit. Property owners must keep accurate records, including Forms 8586, 8609-A, and 8611, to ensure compliance and avoid penalties.

How to File Form 8609?

- Obtain Form 8609 – Download the latest version from IRS.gov.

- Complete Part I – This section is completed by the housing credit agency.

- Complete Part II – The building owner fills out this section for the first year of the credit period.

- Attach to Tax Return – Submit the completed form with your federal tax return.

- Maintain Records – Keep copies for at least three years after the compliance period ends.

How to Complete Form 8609?

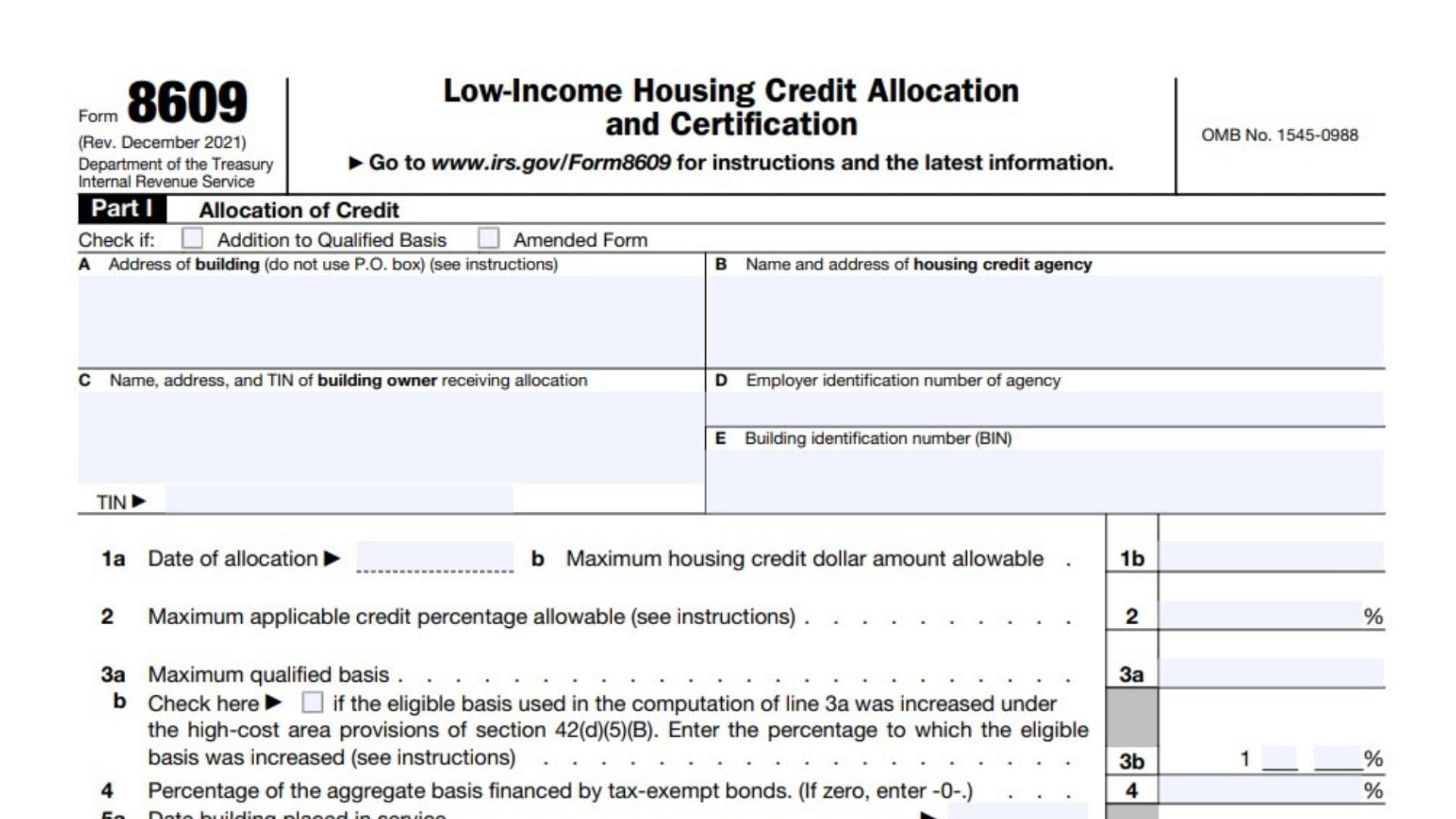

Part I: Allocation of Credit (Completed by Housing Credit Agency)

- Box A: Address of the Building

- Enter the complete physical address (no P.O. boxes allowed).

- Box B: Name and Address of Housing Credit Agency

- Enter the name and location of the agency issuing the credit allocation.

- Box C: Name, Address, and TIN of Building Owner

- Provide the owner’s legal name, mailing address, and Taxpayer Identification Number (TIN).

- Box D: Employer Identification Number (EIN) of the Agency

- The housing credit agency must provide its EIN.

- Box E: Building Identification Number (BIN)

- The agency assigns a unique identification number to each building.

- Line 1a: Date of Allocation

- Enter the date the credit was allocated.

- Line 1b: Maximum Housing Credit Dollar Amount Allowable

- The agency records the maximum tax credit amount allowed.

- Line 2: Maximum Applicable Credit Percentage

- Enter the applicable percentage as per Section 42 regulations.

- Line 3a: Maximum Qualified Basis

- Enter the total eligible basis for credit calculation.

- Line 3b: High-Cost Area Basis Increase

- If the building is in a high-cost area, check the box and enter the percentage increase.

- Line 4: Aggregate Basis Financed by Tax-Exempt Bonds

- Enter the percentage of the building’s basis financed by tax-exempt bonds.

- Line 5a: Date Building Placed in Service

- Enter the date the building was placed in service.

- Line 5b: Qualified Disaster Zone

- Check the box if the building is in a qualified disaster zone.

- Line 6: Allocation Type (Check all applicable boxes)

- Newly constructed and federally subsidized

- Newly constructed and not federally subsidized

- Existing building

- Section 42(e) rehabilitation expenditures (federally or non-federally subsidized)

- Allocation subject to nonprofit set-aside under Section 42(h)(5)

- Signature of Authorized Housing Credit Agency Official

- The official must sign and date the form.

Part II: First-Year Certification (Completed by the Building Owner)

- Line 7: Eligible Basis of the Building

- Enter the total eligible basis of the building.

- Line 8a: Original Qualified Basis at the End of the First Year

- Enter the qualified basis at the end of the first credit year.

- Line 8b: Multiple Building Project Election

- Select Yes or No if the building is part of a multiple-building project.

- Line 9a: Election to Reduce Eligible Basis Under Section 42(i)(2)(B)

- Check Yes or No if electing to reduce the eligible basis.

- Line 9b: Election to Reduce Basis Due to Market-Rate Unit Costs

- Check Yes or No if reducing basis for disproportionate costs.

- Line 10a: Election to Begin Credit Period in the First Year After Placed in Service

- Select Yes or No for credit timing election.

- Line 10b: Election Not to Treat Large Partnership as Taxpayer

- Check Yes if the building is owned by a large partnership and they elect not to be treated as the taxpayer.

- Line 10c: Minimum Set-Aside Election (Choose One)

- 20-50 Test: 20% of units are rent-restricted for tenants at 50% AMI.

- 40-60 Test: 40% of units are rent-restricted for tenants at 60% AMI.

- Average Income Test: Units are averaged at 60% AMI.

- 25-60 Test (NYC only): 25% of units for tenants at 60% AMI.

- Line 10d: Election for Deep Rent Skewed Project

- If applicable, enter 15-40%.

- Signature of Building Owner

- The building owner must sign and date the form.

Notes

- Housing Credit Agency Approval: Only buildings approved by the housing credit agency qualify.

- Compliance Period: Maintain 15 years of compliance to avoid credit recapture.

- Multiple Building Projects: Owners must specify if their building is part of a multi-building project.

- Irrevocable Elections: Selections made on Line 10 cannot be changed later.

- Attach to Tax Return: Submit Form 8609 with your federal tax return.

What This Article Is About (Short Description):