IRS Form 8586, Low-Income Housing Credit, is used to claim tax credits for qualified low-income housing projects. This credit is available to property owners who provide affordable housing under specific guidelines set by the IRS. The credit is generally taken over a 10-year period for new or substantially rehabilitated residential rental buildings. Partnerships, S corporations, estates, and trusts may also claim this credit, but individual taxpayers whose only source of the credit comes from these entities should report it directly on Form 3800, General Business Credit. The tax credit is limited to residential buildings that meet the minimum set-aside tests and comply with the 15-year compliance period. If a building’s qualified basis decreases during this period, part of the credit may have to be recaptured using Form 8611, Recapture of Low-Income Housing Credit. Property owners must maintain records of Form 8586 and related documents for at least three years after the compliance period ends.

How to File Form 8586?

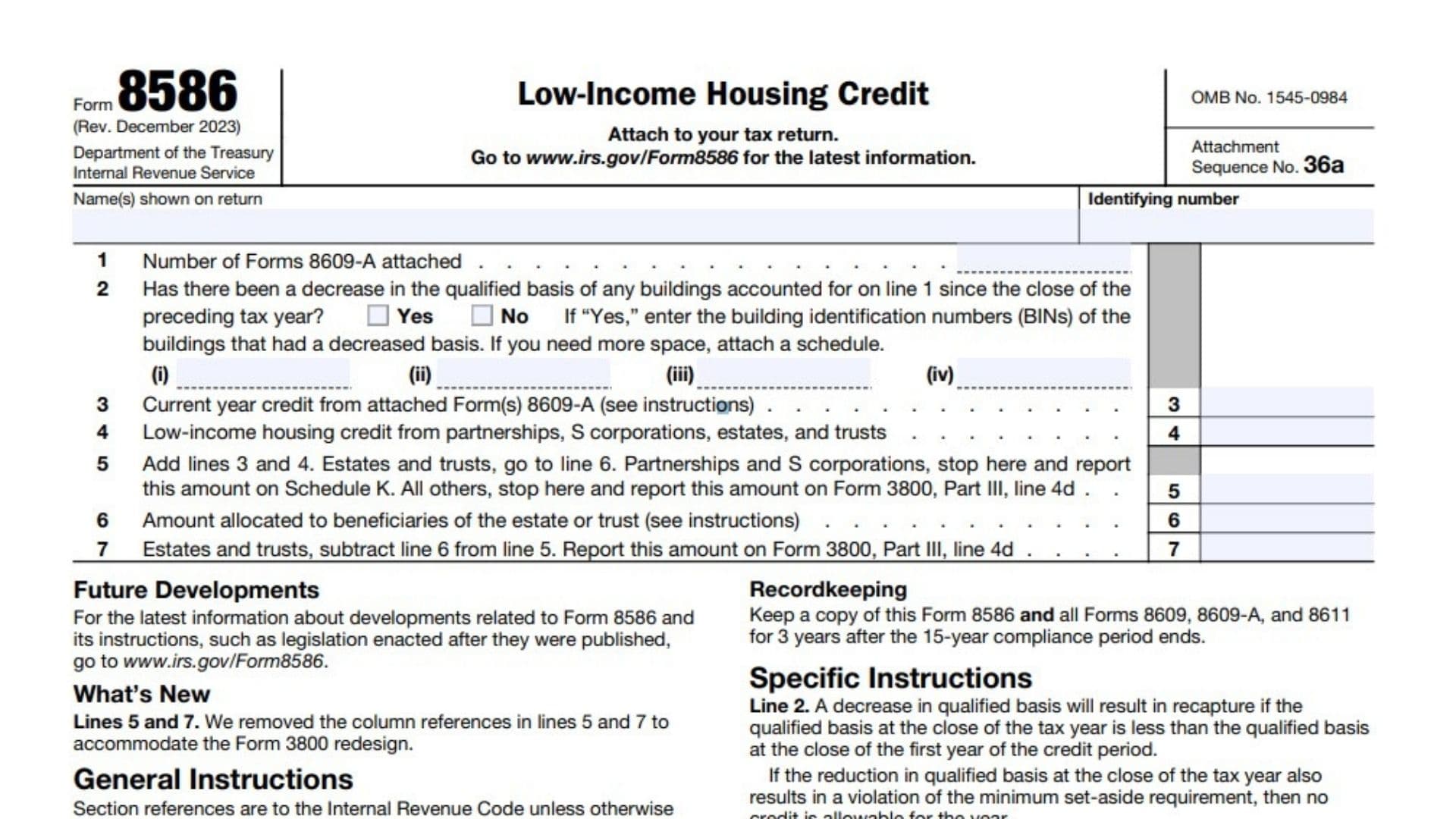

- Obtain Form 8586 – Download the latest version from IRS.gov.

- Attach Required Documents – Include Form 8609-A (Annual Statement for Low-Income Housing Credit) for each building.

- Complete Form 8586 – Follow the step-by-step instructions below.

- File With Your Tax Return – Attach the completed form to your federal tax return.

How to Complete Form 8586?

- Name(s) and Identifying Number

- Enter your name as shown on your tax return.

- Provide your Taxpayer Identification Number (TIN).

- Line 1: Number of Forms 8609-A Attached

- Enter the total number of Form 8609-A attachments.

- Line 2: Has There Been a Decrease in Qualified Basis?

- If any building’s qualified basis has decreased since the previous tax year, check “Yes.”

- Enter the Building Identification Numbers (BINs) of affected buildings.

- If more space is needed, attach a separate schedule.

- Line 3: Current Year Credit from Form(s) 8609-A

- Sum the credits from all attached Forms 8609-A and enter the total.

- Line 4: Low-Income Housing Credit from Pass-Through Entities

- Enter the credit amount received from partnerships, S corporations, estates, or trusts.

- Line 5: Total Low-Income Housing Credit

- Add Line 3 and Line 4.

- If you are a partnership or S corporation, stop here and report the total on Schedule K.

- If you are an estate or trust, proceed to Line 6.

- If you are any other entity, report the amount on Form 3800, Part III, Line 4d.

- Line 6: Amount Allocated to Beneficiaries of an Estate or Trust

- If applicable, allocate the credit among beneficiaries in proportion to income distribution.

- Line 7: Estates and Trusts Credit Amount

- Subtract Line 6 from Line 5.

- Report the result on Form 3800, Part III, Line 4d.

Key Points to Remember

- Compliance Period: Maintain eligibility for 15 years to avoid recapture.

- Recordkeeping: Keep Forms 8586, 8609, 8609-A, and 8611 for at least three years after the compliance period.

- Tax-Exempt Bonds: If 50% or more of the building’s financing comes from tax-exempt bonds, the credit may not need an allocation.

- Form 8611: Use this form if you must recapture any portion of the credit.