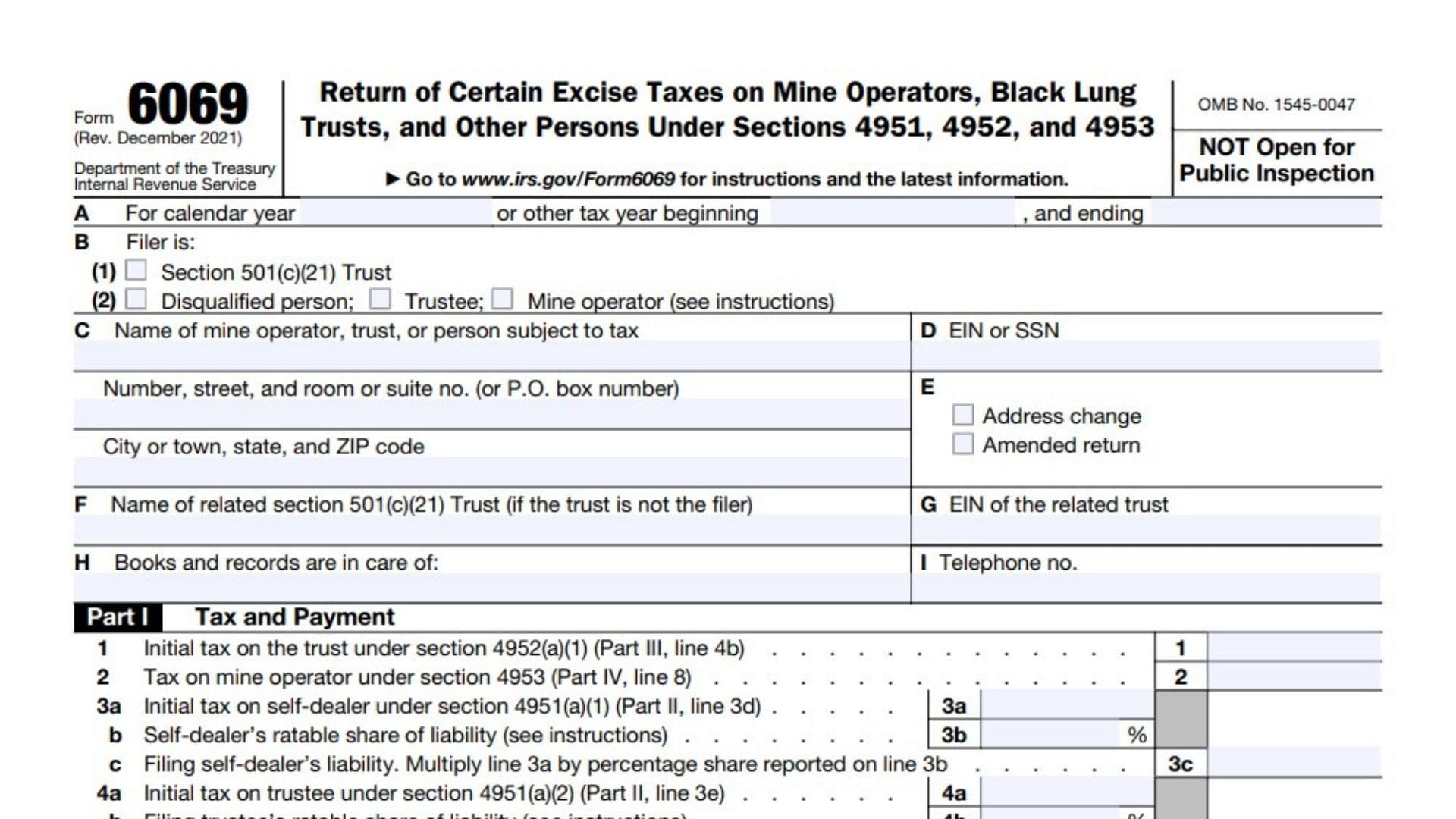

IRS Form 6069, officially titled “Return of Certain Excise Taxes on Mine Operators, Black Lung Trusts, and Other Persons Under Sections 4951, 4952, and 4953,” is a specialized tax form used primarily by coal mine operators, section 501(c)(21) black lung benefit trusts, trustees, and self-dealers. The form serves several purposes: it helps coal mine operators determine their maximum allowable income tax deduction for contributions to black lung benefit trusts under section 192, and it is used to report and pay excise taxes imposed under sections 4951 (self-dealing), 4952 (taxable expenditures), and 4953 (excess contributions). For tax years beginning on or after January 1, 2021, Form 6069 is also used by black lung benefit trusts to report and pay excise taxes related to self-dealing and taxable expenditures. The form ensures compliance with the Black Lung Benefits Revenue Act of 1977, which imposes these excise taxes to fund medical benefits for coal miners affected by black lung disease. Filing Form 6069 is mandatory for any entity or individual incurring liability under these sections, and the form must be submitted by the 15th day of the fifth month after the end of the tax year. Failure to file can result in penalties and interest, so understanding how to complete Form 6069 accurately is crucial for affected organizations and individuals.

How to File Form 6069?

- Who Must File:

- Coal mine operators with excess contributions to black lung trusts.

- Section 501(c)(21) black lung benefit trusts with excise tax liability.

- Trustees and self-dealers liable for excise taxes under sections 4951 or 4952.

- When to File:

- By the 15th day of the fifth month after the end of your tax year (e.g., May 15 for calendar year filers).

- Where to File:

- Mail to:

Internal Revenue Service Center

333 W. Pershing Road

Kansas City, MO 64108.

- Mail to:

- Extensions:

- Use Form 8868 to request an extension if needed.

How to Complete Form 6069?

Heading and Identification

- Name and Address:

Enter the name and address of the filer (coal mine operator, trust, trustee, or self-dealer). - Taxpayer Identification Number (TIN):

Enter your EIN or SSN as applicable. - Amended Return:

Check this box if you are filing an amended return and attach a statement explaining changes. - Trust Information:

If reporting for a trust, enter the trust’s name and EIN. - Books and Records Contact:

Enter the name, address, and phone number of the person who keeps your books and records.

Part I: Tax Computation

- Total tax imposed (from Parts II, III, IV):

Enter the total tax amount calculated in subsequent parts. - Payments:

Enter the total payments made, including amounts paid with Form 8868. - Tax due:

If line 1 exceeds line 2, subtract line 2 from line 1 and enter the amount owed. - Overpayment:

If line 2 exceeds line 1, subtract line 1 from line 2 and enter the amount to be refunded.

Part II: Initial Taxes on Self-Dealing (Section 4951)

- Acts of Self-Dealing:

- (a) Act number: Assign a number to each act.

- (b) Date of act: Enter the date each act occurred.

- (c) Description of act: Briefly describe each act of self-dealing.

- Computation of Initial Tax:

- (a) Act number: Refer to the act listed above.

- (b) Self-dealer(s): Enter the name(s) of the self-dealer(s).

- (c) Amount involved: Enter the dollar amount for each act.

- (d) Initial tax on self-dealer: Calculate 10% (0.10) of column (c).

- (e) Tax on trustee (if applicable): Calculate 2.5% (0.025) of column (c).

- Totals:

- Add up the amounts in each column for all acts listed.

- Corrective Action:

- (a) Act number: Refer to the act.

- (b) Has corrective action been taken? Check Yes or No.

- (c) FMV of amount recovered: Enter the fair market value of the amount recovered.

- Attach a detailed statement describing corrective actions taken or explaining why none were taken.

Part III: Initial Taxes on Taxable Expenditures and Tax Computation (Section 4952)

- Taxable Expenditures:

- (a) Item number: Assign a number to each expenditure.

- (b) Name and address of recipient: Enter details for each recipient.

- (c) Description of expenditure and purpose: Describe the expenditure and its purpose.

- Taxable Expenditures by Section 501(c)(21) Trust:

- (a) Item number: Refer to the item above.

- (b) Date paid or incurred: Enter the date.

- (c) Amount: Enter the dollar amount.

- (d) Trustees: List trustees involved.

- Computation of Initial Tax:

- (a) Item number: Refer to the item.

- (b) Tax imposed on trust: Calculate 10% (0.10) of line 2, column (c).

- (c) Tax imposed on trustee: Calculate 2.5% (0.025) of line 2, column (c).

- Totals:

- Add the amounts for all items.

- Corrective Action:

- (a) Act number: Refer to the act.

- (b) Has corrective action been taken? Check Yes or No.

- (c) FMV of amount recovered: Enter fair market value.

- Attach a detailed statement describing corrective actions taken or explaining why none were taken.

Part IV: Tax on Coal Mine Operators Under Section 4953

- Enter the amount necessary to fund (with level funding) the remaining unfunded liability for claims filed or expected to be filed:

- a. Based on the average remaining working life of miners currently employed.

- b. Based on 10 tax years.

- c. Based on any other funding period prescribed or approved by the Secretary of the Treasury.

- d. Enter the larger of line 1c or 1d.

- a. Enter the amount necessary to carry out section 501(c)(21)(A) purposes for the tax year.

- b. Enter the fair market value of the trust’s assets.

- c. Subtract line 2b from line 2a. If zero or less, enter -0-.

- a. Contributions made to section 501(c)(21) Trust for operator’s tax year.

- b. Operator’s maximum allowable deduction under section 192 for tax year. Enter the larger of line 1e or line 2c.

- c. Subtract line 3b from line 3a. If zero or less, enter -0-.

- d. Excess contributions carried over from the preceding tax year.

- e. Total. Add lines 3c and 3d.

- Amount that current year’s contributions are less than the maximum amount deductible:

- Subtract line 3a from line 3b. If zero or less, enter -0-.

- Amount of previous year’s excess contributions that were returned to the contributor during the current tax year.

- Total:

- Add lines 4 and 5.

- Excess contributions for current year:

- Subtract line 6 from line 3e. If zero or less, enter -0-.

- Tax imposed on mine operator:

- Enter 5% (0.05) of line 7 here and in Part I, line 21.

Signatures

- Trustee or Responsible Party:

- Sign and date the form.

- Include title and organization if applicable.

- Paid Preparer (if used):

- Enter name, signature, date, PTIN, firm’s name, EIN, address, and phone number.

FAQs

Who must file IRS Form 6069?

Any coal mine operator, black lung benefit trust, trustee, or self-dealer with excise tax liability under sections 4951, 4952, or 4953 must file this form.

When is IRS Form 6069 due?

It is due by the 15th day of the fifth month after the end of your tax year (e.g., May 15 for calendar year filers).

What happens if I make an error on Form 6069?

File an amended return, check the “Amended return” box, and attach a statement explaining the changes.