The primary purpose of Form 5695 is to enable taxpayers to claim residential energy credits for eligible energy-saving improvements made to their homes. These improvements include installing energy-efficient windows, doors, insulation, roofs, heating and cooling systems, and renewable energy technologies such as solar panels, solar water heaters, and small wind turbines. Homeowners who make qualified energy-efficient improvements to their primary or second home in the United States are eligible to claim Form 5695. The improvements must meet specific energy efficiency criteria outlined by the IRS, and taxpayers must have documentation to support their claims, such as receipts, manufacturer certifications, and energy ratings.

How to Complete Form 5695?

Below are detailed line-by-line instructions for Form 5695:

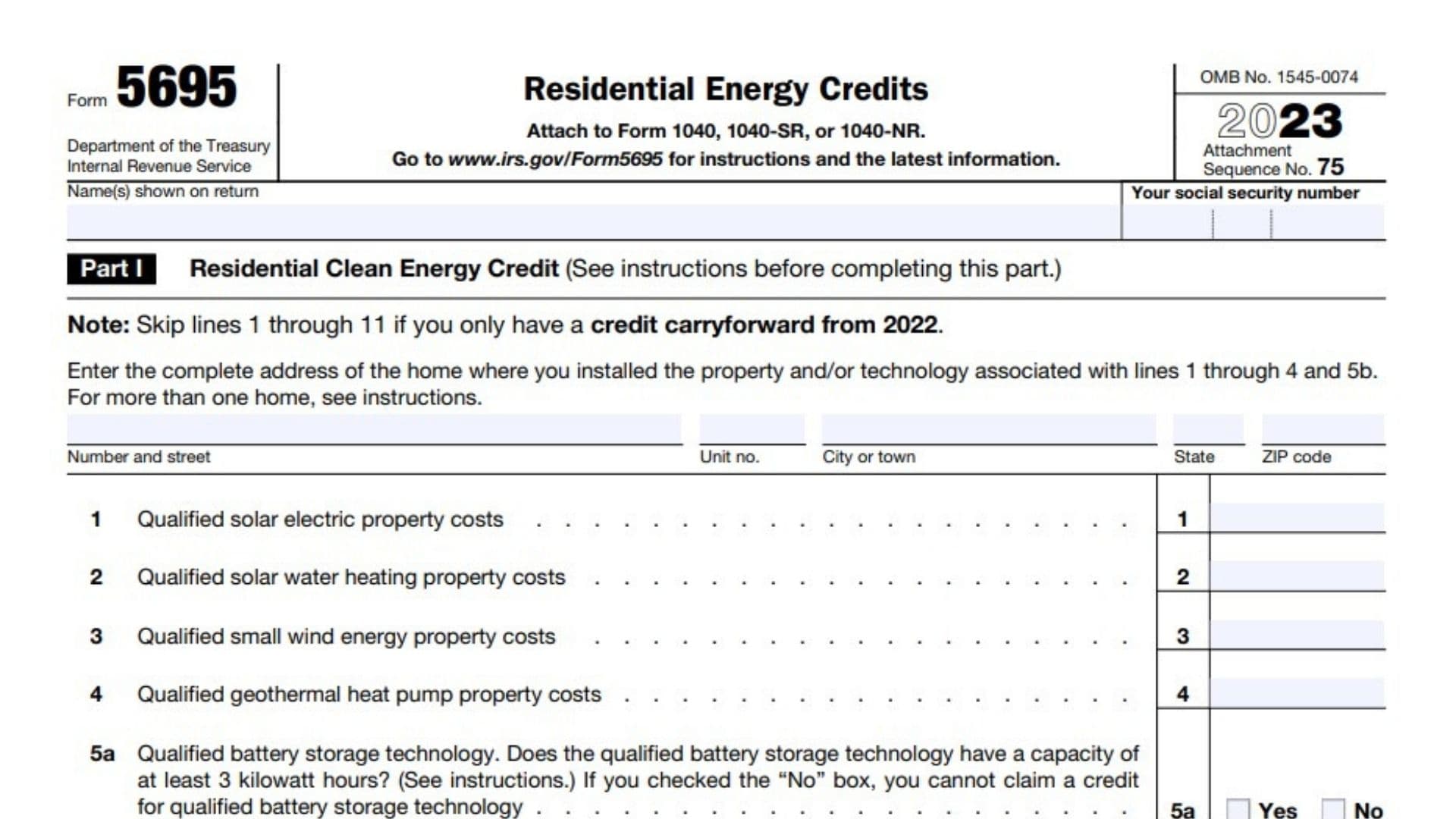

Page 1: Part I – Residential Clean Energy Credit

Header Information:

- Name(s) shown on return: Enter the name(s) listed on your tax return.

- Social Security Number (SSN): Enter the primary SSN listed on your return.

1. Qualified Solar Electric Property Costs

Enter the total cost of solar electric systems installed on your home during the tax year.

2. Qualified Solar Water Heating Property Costs

Enter the total cost of solar water heating systems. The system must be used for your primary or secondary home, and at least 50% of the home’s water must be heated by solar energy.

3. Qualified Small Wind Energy Property Costs

Enter the total cost of installing small wind energy systems (e.g., wind turbines) at your home.

4. Qualified Geothermal Heat Pump Property Costs

Enter the total cost of geothermal heat pump systems. These systems must meet federal energy efficiency requirements.

5a. Qualified Battery Storage Technology

If you installed a battery storage technology with a capacity of at least 3 kilowatt-hours, check “Yes.” Otherwise, check “No.” You cannot claim a credit if the battery has a capacity of less than 3 kWh.

5b. Qualified Battery Technology Costs

If you checked “Yes” in line 5a, enter the total cost of the qualified battery storage technology.

6a. Total Clean Energy Costs

Add up all the costs from lines 1 through 5b and enter the total on this line.

6b. Multiply Line 6a by 30%

Multiply the amount on line 6a by 0.30 to calculate 30% of the total cost.

7a. Qualified Fuel Cell Property

If you installed a qualified fuel cell property in your home, check “Yes.” If not, check “No.” You cannot claim a credit for fuel cell property if installed in any other home.

7b. Address for Qualified Fuel Cell Property

If you checked “Yes” in line 7a, enter the address where the fuel cell property was installed.

8. Qualified Fuel Cell Property Costs

Enter the cost of the qualified fuel cell property.

9. Multiply Line 8 by 30%

Multiply the cost of the fuel cell property by 0.30 to calculate 30% of the total.

10. Kilowatt Capacity of the Property

Enter the kilowatt capacity of the fuel cell property. Multiply this by $1,000 to calculate the allowable limit.

11. Enter the Smaller of Line 9 or Line 10

Compare the values from lines 9 and 10 and enter the smaller of the two.

12. Credit Carryforward from 2022

If you had any unused credits from the previous year, enter the amount here.

13. Total Credit

Add the values from lines 6b, 11, and 12 to get the total residential clean energy credit.

14. Limitation Based on Tax Liability

Use the Residential Clean Energy Credit Limit Worksheet to determine your limitation based on your tax liability. Enter the result here.

15. Residential Clean Energy Credit

Enter the smaller of line 13 or line 14. Also, include this amount on Schedule 3 (Form 1040), line 5a.

16. Credit Carryforward to 2024

If the credit on line 15 is less than the total from line 13, subtract line 15 from line 13 to calculate any unused credits you can carry forward to next year.

Page 2: Part II – Energy Efficient Home Improvement Credit

Section A: Qualified Energy Efficiency Improvements

17a. Installation in Main Home

Check “Yes” if the qualified energy efficiency improvements were installed in your main home in the U.S. If “No,” you cannot claim the credit.

17b. Original User

Check “Yes” if you are the original user of the improvements. If “No,” you cannot claim the credit.

17c. Expected Use

Check “Yes” if the components are expected to remain in use for at least five years.

17d. Address of Main Home

Enter the address of the home where the improvements were made.

17e. Related to Construction

Check “Yes” if the improvements were related to the construction of your main home. If “Yes,” you cannot claim the credit for construction-related improvements.

18a. Cost of Insulation or Air Sealing Material

Enter the cost of insulation or air sealing material specifically designed to reduce heat loss or gain.

18b. Multiply Line 18a by 30%

Multiply the amount on line 18a by 0.30, but do not enter more than $1,200.

19. Exterior Doors

- 19a: Enter the cost of the most expensive door.

- 19b: Multiply the amount in line 19a by 0.30, but do not exceed $250.

- 19c: Enter the cost of all other qualifying doors.

- 19d: Multiply the amount in 19c by 0.30.

- 19e: Add lines 19b and 19d, but do not exceed $500.

20a. Windows and Skylights

Enter the cost of exterior windows and skylights that meet Energy Star certification requirements.

20b. Multiply Line 20a by 30%

Multiply the cost of windows and skylights by 0.30, but do not exceed $600.

Section B: Residential Energy Property Expenditures

21a. Costs for Qualified Energy Property

Check “Yes” if you incurred costs for qualified energy property.

21b. Originally Placed into Service by You

Check “Yes” if the property was originally placed into service by you.

22-29

These lines cover specific costs for qualified central air conditioners, water heaters, furnaces, panelboards, and heat pumps. Enter the cost and multiply by 0.30. Each section has individual limits ranging from $600 to $2,000, depending on the property type.

27. Total Energy Property Costs

Add the credit amounts from lines 18b, 19e, 20b, and other sections for total energy property credits.

28. Maximum Credit

Enter the smaller of line 27 or $1,200.

29e. Multiply by 30%

Multiply the total for heat pumps and biomass stoves by 0.30, but do not enter more than $2,000.

30. Total Energy Efficient Home Improvement Credit

Add lines 28 and 29e to get the total credit for energy-efficient home improvements.

Page 3: Final Calculations

31. Limitation Based on Tax Liability

Refer to the Energy Efficient Home Improvement Credit Limit Worksheet for your limitation. Enter the result here.

32. Energy Efficient Home Improvement Credit

Enter the smaller of line 30 or 31. Include this amount on Schedule 3 (Form 1040), line 5b.

Additional Considerations

Maximum Credits: The maximum residential energy credit allowed varies by the type of improvement. For example, solar electric and solar water heating systems have different credit limits.

Phased-Out Amounts: The residential energy credits are subject to phase-out limits based on the year of installation and type of energy-efficient property.

Unused Credits: If the credit exceeds your tax liability, you may be able to carry forward unused credits to future tax years, subject to IRS guidelines.

IRS Guidance: Consult the latest IRS instructions and publications for detailed guidance on claiming residential energy credits and eligibility requirements.