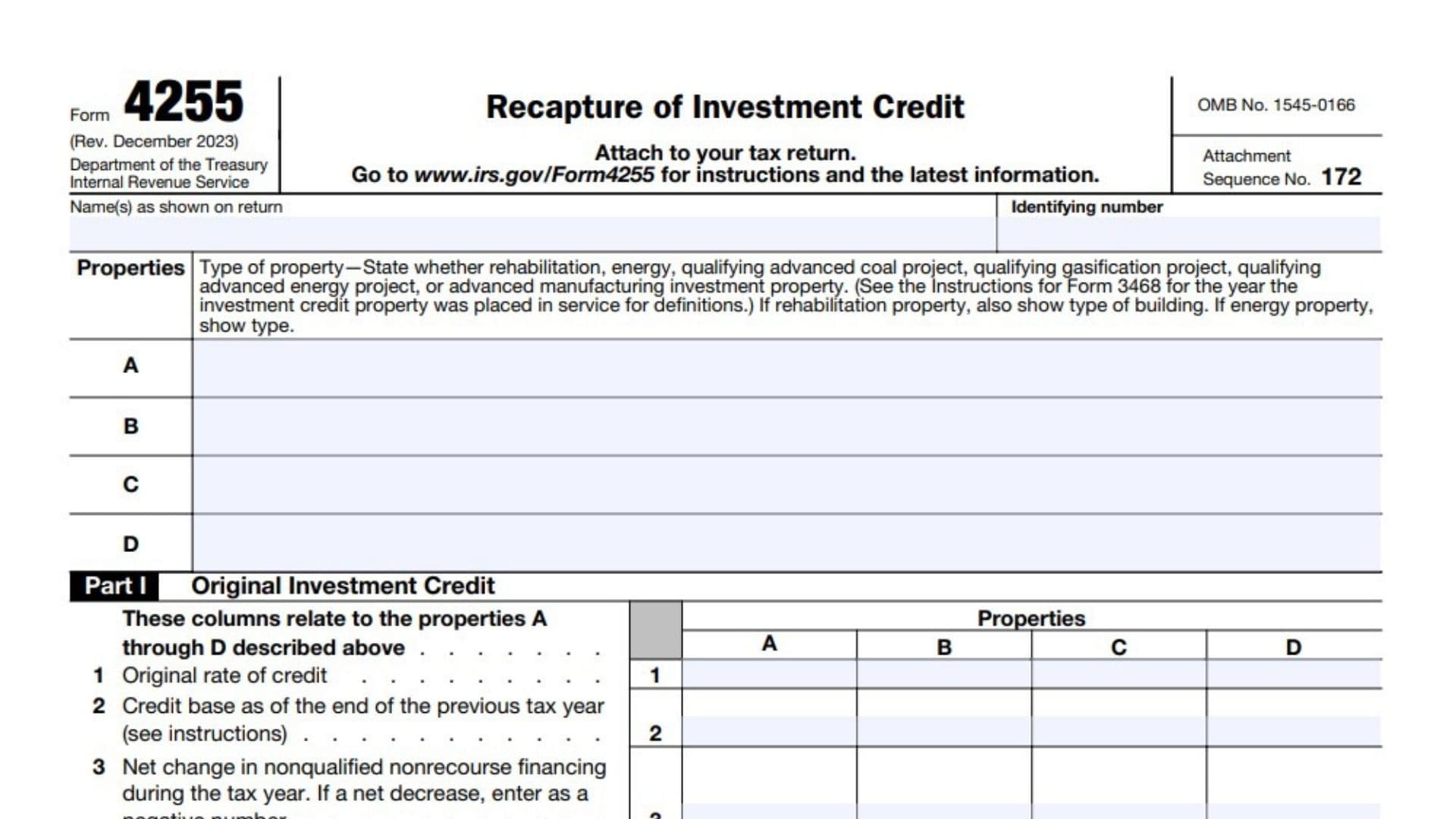

Form 4255, Recapture of Investment Credit, is used by taxpayers to recapture investment credit that was previously claimed on certain property if that property has been disposed of or ceased to qualify before the end of its recovery period. Properly managing this form ensures compliance with IRS regulations and helps accurately calculate and report the recapture amount, thereby adjusting the tax liability accordingly. The primary purpose of Form 4255 is to recapture the investment credit that was previously claimed on qualified property if the property is disposed of or otherwise ceases to qualify before the end of the specified recovery period. This form helps taxpayers calculate the portion of the investment credit that must be recaptured and added back to their tax liability. By using Form 4255, taxpayers ensure that any premature disposition or disqualification of the property is properly accounted for, and the corresponding tax adjustments are made.

Who Must File Form 4255?

Form 4255 must be filed by any taxpayer who has claimed an investment credit on certain property and then disposes of the property or it ceases to qualify before the end of the recovery period. This includes:

- Individuals and Corporations: Taxpayers who have claimed an investment credit on qualified property such as energy property, rehabilitation property, or other specified properties.

- Estates and Trusts: Entities that have claimed an investment credit on qualifying property and need to recapture the credit due to early disposition or disqualification.

The form must be filed for the tax year in which the property was disposed of or ceased to qualify.

How To File Form 4255?

Filing Form 4255 involves several steps and requires detailed information to ensure all necessary information is provided. The form must be filed along with the taxpayer’s annual income tax return.

- Obtain Form 4255: The form can be downloaded from the IRS website. Ensure you have the correct version for the tax year in which you are filing.

- Complete the form: Fill out Form 4255 with the required information, including details about the property, the investment credit claimed, and the recapture calculation.

- Attach supporting documentation: Gather all required documents, such as receipts, contracts, and records of the property disposition or disqualification.

- Submit the form: File Form 4255 with your annual income tax return (Form 1040, Form 1120, etc.). Ensure that the form and all supporting documentation are included in the tax return package.

How To Fill Out Form 4255?

Filling out Form 4255 requires accurate and comprehensive information about the qualified property and the investment credit previously claimed. The form is divided into several parts, each addressing different aspects of the recapture calculation.

Part I: Original Investment Credit

- Line 1 (Original rate of credit):

- Enter the original rate of the investment credit taken for the property (e.g., 10%, 20%).

- You can find this in the credit forms used when you first claimed the credit (e.g., Form 3468).

- Line 2 (Credit base as of the end of the previous tax year):

- Enter the credit base for the property at the end of the last tax year. The credit base is typically the cost or other basis of the property when the credit was originally claimed.

- Line 3 (Net change in nonqualified nonrecourse financing during the tax year):

- Report the net change in nonqualified nonrecourse financing during the tax year for the property.

- If there’s an increase, report it as a positive number; if it decreased, report it as a negative number.

- Line 4 (Credit base as of the end of the current tax year):

- Subtract Line 3 from Line 2 to get the current year’s credit base.

- Line 5 (Refigured credit):

- Recalculate the investment credit based on the current year’s credit base. Refer to the original credit rate on Line 1.

- Line 6 (Credit taken for this property on Form 3800 in prior years):

- Enter the amount of investment credit taken in previous years for this property, as reported on Form 3800.

Part II: Recapture From Increase in Nonqualified Nonrecourse Financing

- Line 7 (Credit subject to recapture due to a net increase in nonqualified nonrecourse financing):

- Subtract Line 5 from Line 6. If the result is zero or less, enter “0.”

- Line 8 (Unused general business credits):

- Calculate the general business credits that would have been allowed if the original credit was calculated using the current credit base. Enter this amount here.

- Line 9 (Recapture tax):

- Subtract Line 8 from Line 7. This is the recapture tax due to an increase in nonqualified nonrecourse financing.

Part III: Recapture From Disposition of Property or Cessation of Use as Investment Credit Property

- Line 10 (Date property was placed in service):

- Enter the original date the property was placed in service.

- Line 11 (Date property ceased to be qualified investment credit property):

- Enter the date the property stopped qualifying as investment credit property (e.g., when sold, or no longer used for the qualified purpose).

- Line 12 (Number of full years between Line 10 and Line 11):

- Calculate and enter the number of full years between the dates on Lines 10 and 11.

- Line 13 (Unused general business credits that would have been allowed):

- Enter the unused general business credits that would have been allowed had you not claimed the credit for this property.

- Line 14 (Subtract Line 13 from Line 6):

- Subtract Line 13 from Line 6 to calculate the amount subject to recapture.

- Line 15 (Recapture percentage):

- Enter the recapture percentage based on the number of full years between when the property was placed in service and when it ceased to qualify. See IRS instructions for the exact percentage.

- Line 16 (Multiply Line 14 by Line 15):

- Multiply the amount on Line 14 by the percentage on Line 15. This is the recapture amount due to the cessation of use or disposition of the property.

Final Calculation

- Line 17 (Add property columns A through D, Line 9):

- Add the amounts from Line 9 for all properties (columns A through D).

- Line 18 (Add property columns A through D, Line 16):

- Add the amounts from Line 16 for all properties (columns A through D).

- Line 19 (Reserved for future use):

- Leave this line blank.

- Line 20 (Total increase in tax):

- Add the totals from Line 17 and Line 18. This is the total recapture amount you must report as an increase in tax.

- Enter this amount on your tax return (typically on Form 1040, Schedule 2, or the appropriate business form).

Things to Consider When Filing Form 4255

Understanding the specific rules and implications of filing Form 4255 is essential for taxpayers needing to recapture investment credits.

Accurate Reporting: Ensure that all information reported on Form 4255 is accurate. Incorrect or incomplete information can lead to penalties and delays in processing by the IRS.

Supporting Documentation: Provide thorough and detailed supporting documentation to substantiate the property disposition or disqualification and the original investment credit claimed. This includes receipts, contracts, and records of the property transaction.

Recapture Calculation: Be aware of the rules for calculating the recapture amount, which depend on the percentage of time the property was held before disposition or disqualification. Accurately calculating this recapture amount is crucial for determining the correct adjustment to the tax liability.

Coordination with Other Tax Forms: Ensure that Form 4255 is accurately completed and filed with your annual income tax return. This form works in conjunction with other tax forms to report and calculate your total tax liability.

Record Keeping: Maintain accurate records of all qualifying investments and the recapture calculation. Proper record-keeping helps ensure compliance and can be crucial in case of an IRS audit.

Professional Assistance: Due to the complexity of the investment credit recapture and the specific reporting requirements, consider seeking assistance from a tax professional. A qualified advisor can help ensure that Form 4255 is completed accurately and submitted on time and can provide guidance on the implications of the recapture for your overall tax strategy.

Legal and Financial Implications: Understand the legal and financial implications of recapturing investment credits. This includes the impact on your financial planning, investment strategies, and potential financial gains or losses.