Form 4136, Credit for Federal Tax Paid on Fuels, allows taxpayers to claim a credit or refund for federal excise taxes paid on certain fuels. This form is crucial for individuals and businesses that use these fuels for nontaxable purposes, such as farming, off-highway business use, or in certain types of motor vehicles and equipment. Properly managing this form ensures compliance with IRS regulations and helps recover costs associated with federal fuel taxes. The primary purpose of Form 4136 is to allow taxpayers to claim a credit or refund for federal excise taxes paid on fuels used for nontaxable purposes. These credits or refunds help offset the cost of fuel taxes paid on activities that are exempt from federal excise tax. By using Form 4136, taxpayers can report the amount of fuel used for qualifying purposes and calculate the credit or refund they are entitled to receive.

Who Must File Form 4136?

Form 4136 must be filed by individuals, businesses, and tax-exempt organizations that have paid federal excise taxes on fuels and are eligible to claim a credit or refund for those taxes. This includes:

- Farmers: Individuals and businesses that use fuel for farming purposes.

- Businesses: Companies that use fuel for off-highway business use, such as construction or mining.

- Tax-Exempt Organizations: Entities that use fuel in vehicles and equipment for nontaxable purposes.

The form must be filed with the taxpayer’s annual income tax return.

How To File Form 4136?

Filing Form 4136 involves several steps and requires detailed information to ensure all necessary information is provided. The form must be filed along with the taxpayer’s annual income tax return.

- Obtain Form 4136 from the IRS website. Ensure you have the correct version for the tax year in which you are filing.

- Complete Form 4136 with the required information, including details about the fuel purchases and the nontaxable uses.

- Gather all required documents, such as purchase receipts, logs of fuel usage, and other records that substantiate the claim.

- File Form 4136 with your annual income tax return (Form 1040, Form 1120, etc.). Ensure that the form and all supporting documentation are included in the tax return package.

How To Complete Form 4136?

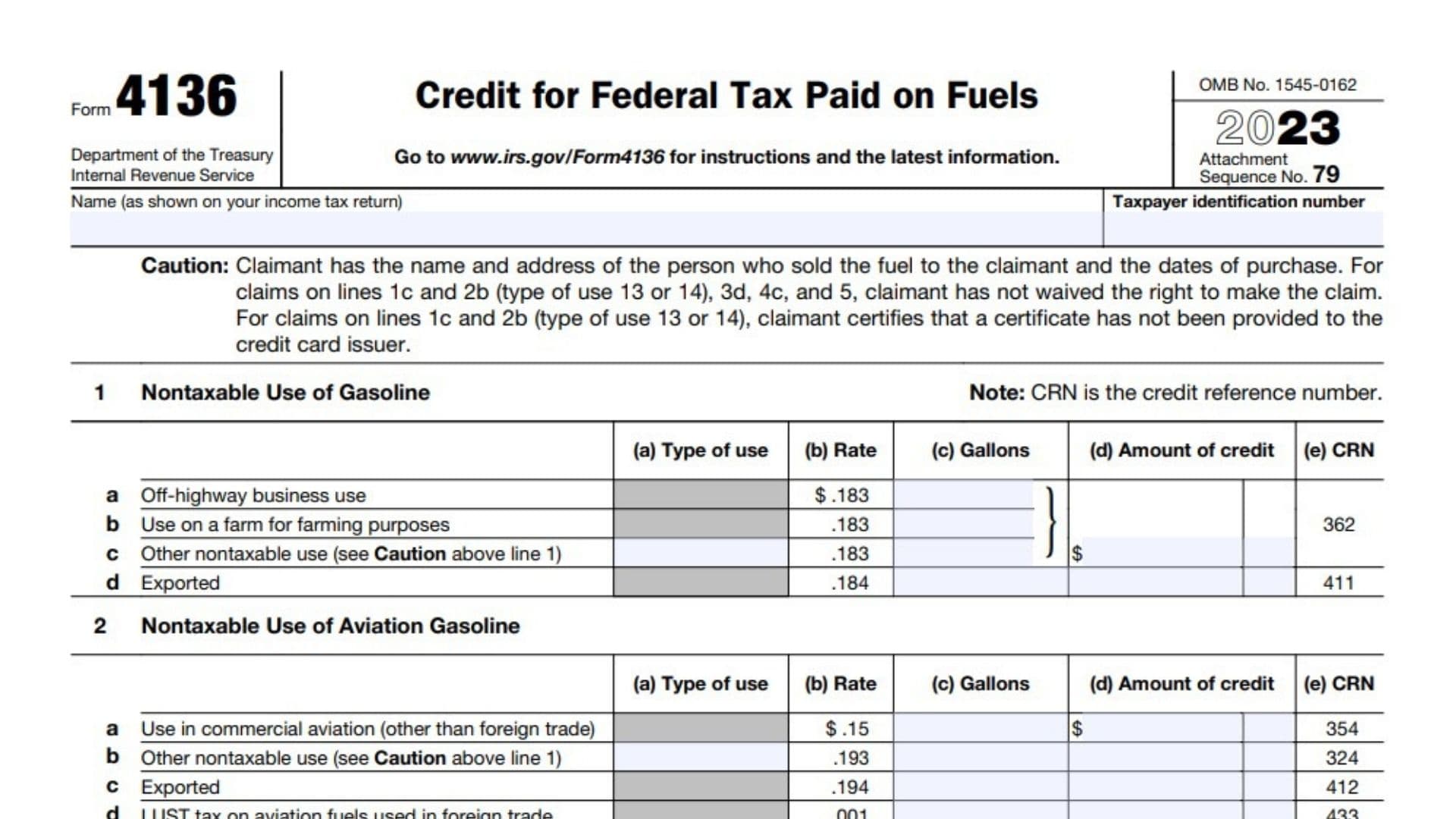

Filling out Form 4136 requires accurate and comprehensive information about the fuel purchases and their nontaxable uses. The form is divided into several parts, each addressing different aspects of the credit calculation. Here’s a step-by-step guide on filling out IRS Form 4136:

Part I: Basic Information

- Name and Taxpayer Identification Number

- Enter your name (as shown on your tax return) and taxpayer identification number (TIN or SSN) at the top of the form.

Part II: Nontaxable Use of Gasoline (Line 1)

- Line 1a:

- If you used gasoline for off-highway business use, enter the gallons and multiply by the credit rate of $0.183.

- Line 1b:

- If the gasoline was used on a farm for farming purposes, enter the total gallons and multiply by $0.183.

- Line 1c:

- For other nontaxable use of gasoline, input the gallons and calculate at $0.183.

- Line 1d:

- If the gasoline was exported, use $0.184 per gallon.

Part III: Nontaxable Use of Aviation Gasoline (Line 2)

- Line 2a:

- For use in commercial aviation, input the gallons and multiply by $0.15.

- Line 2b:

- For other nontaxable uses of aviation gasoline, calculate at $0.193 per gallon.

- Line 2c:

- For exported aviation gasoline, use $0.194 per gallon.

- Line 2d:

- If subject to LUST tax on aviation fuels for foreign trade, use $0.001.

Part IV: Nontaxable Use of Undyed Diesel Fuel (Line 3)

- Line 3a:

- For nontaxable use of undyed diesel fuel, multiply by $0.243.

- Line 3b:

- For farming purposes, the rate is also $0.243 per gallon.

- Line 3c:

- For use in trains, use $0.243 per gallon.

- Line 3d:

- If used in intercity and local buses, use $0.17.

- Line 3e:

- For exported diesel fuel, use $0.244 per gallon.

Part V: Nontaxable Use of Undyed Kerosene (Line 4)

- Line 4a:

- For nontaxable use taxed at $0.244, calculate the credit using $0.243 per gallon.

- Line 4b:

- For farming purposes, input gallons and multiply by $0.243.

- Line 4c:

- For intercity/local buses, use $0.17 per gallon.

- Line 4d:

- For exported kerosene, use $0.244 per gallon.

- Line 4e and 4f:

- For nontaxable use taxed at $0.044 and $0.219, multiply by $0.043 and $0.218, respectively.

Part VI: Kerosene Used in Aviation (Line 5)

- Line 5a:

- For commercial aviation, use $0.200 per gallon if taxed at $0.244.

- Line 5b:

- If taxed at $0.219, multiply by $0.175.

- Line 5c-5d:

- For nontaxable use, calculate with $0.243 or $0.218.

- Line 5e:

- For LUST tax, apply $0.001 for aviation fuel.

Remaining Sections

Continue with similar steps for other sections, ensuring that you:

- Use the proper rates for the fuel types.

- Calculate gallons accurately and fill in the correct Credit Reference Numbers (CRNs).

Finally, total your credits on Line 17 and transfer the total to your tax return.

Things to Consider When Filing Form 4136

Understanding the specific rules and implications of filing Form 4136 is essential for taxpayers seeking to claim a credit or refund for federal excise taxes paid on fuels.

Accurate Reporting: Ensure that all information reported on Form 4136 is accurate. Incorrect or incomplete information can lead to penalties and delays in processing by the IRS.

Supporting Documentation: Provide thorough and detailed supporting documentation to substantiate the fuel purchases and their nontaxable uses. This includes purchase receipts, logs of fuel usage, and other relevant records.

Eligible Uses: Be aware of the specific uses of fuel that qualify for the credit or refund. Common eligible uses include farming, off-highway business use, and use by tax-exempt organizations.

Coordination with Other Tax Forms: Ensure that Form 4136 is accurately completed and filed with your annual income tax return. This form works in conjunction with other tax forms to report and calculate your total tax liability.

Record Keeping: Maintain accurate records of all fuel purchases and usage. Proper record-keeping helps ensure compliance and can be crucial in case of an IRS audit.

Professional Assistance: Due to the complexity of the fuel tax credits and the specific reporting requirements, consider seeking assistance from a tax professional. A qualified advisor can help ensure that Form 4136 is completed accurately and submitted on time and can provide guidance on the implications of the fuel tax credits for your overall tax strategy.

Legal and Financial Implications: Understand the legal and financial implications of claiming fuel tax credits. This includes the impact on your financial planning, business operations, and potential financial gains or losses.