IRS Form 1041-QFT is the U.S. Income Tax Return for Qualified Funeral Trusts. This special tax form is designed specifically for trustees of qualified funeral trusts (QFTs)—legal arrangements funded to provide for future funeral and burial expenses. Trustees are required to file Form 1041-QFT to report the income, deductions, tax, and payments related to one or more funeral trusts they oversee. It ensures that QFTs meet their tax obligations with the IRS, separating funeral trust assets and income from the beneficiaries’ personal taxes. Filing this form is crucial for compliance, transparency, and maintaining the tax-favored status of these trusts, helping families plan ahead with peace of mind.

How to File Form 1041-QFT

- Determine eligibility: Only used by trustees of qualified funeral trusts.

- Gather trust and beneficiary info: Employer ID numbers, total number of QFTs, and all related tax records.

- Download the latest form: Use the current form and instructions from the IRS website.

- Complete each line carefully: Follow the detailed line-by-line guide below.

- Sign and date the return: The trustee, or authorized officer, must sign for submission.

- File with the IRS: Mail to the official IRS address (see instructions) or follow e-file procedures if available.

How to Complete Form 1041-QFT

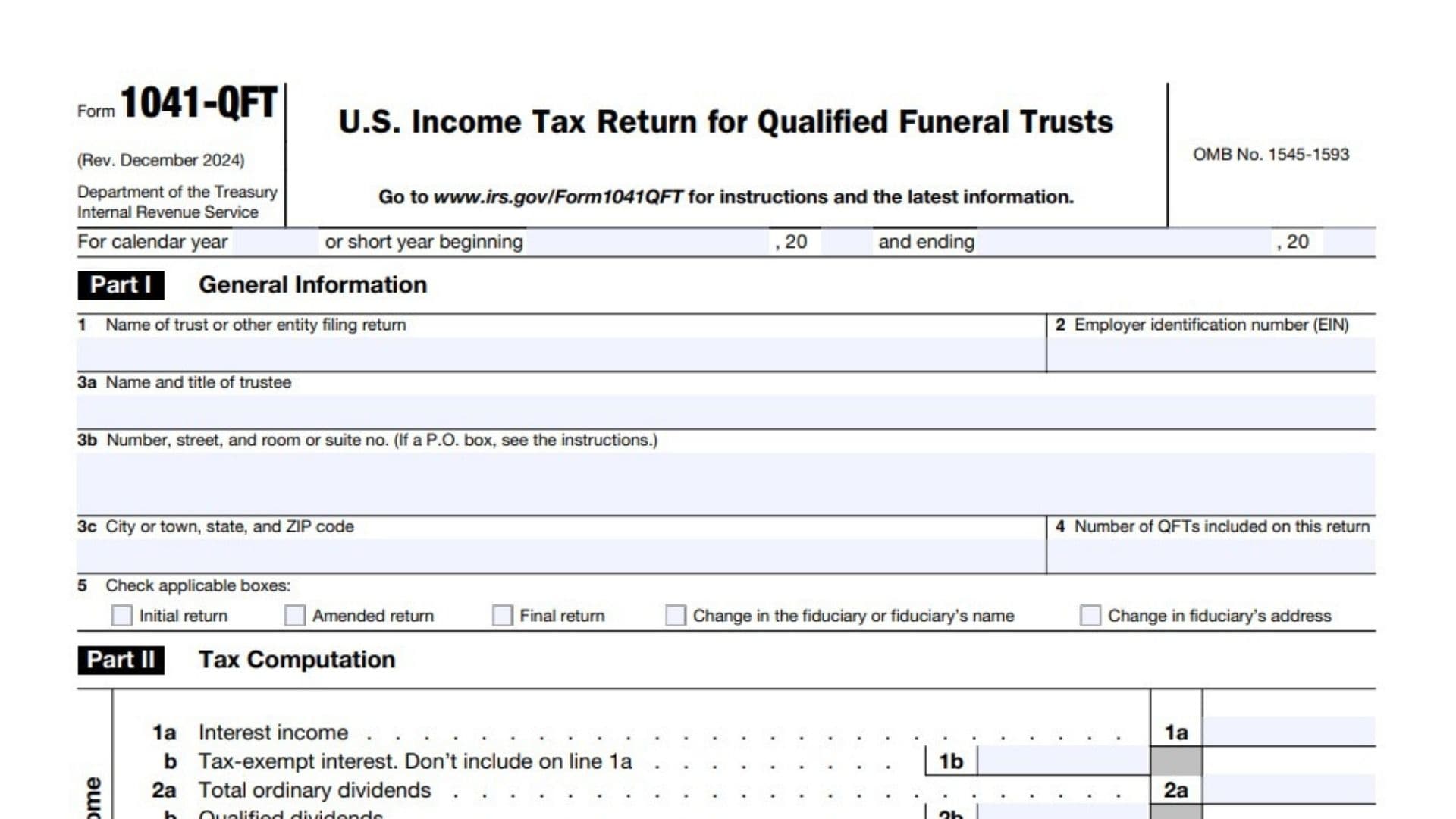

Part I – General Information

Line 1: Name of trust or other entity filing return

- Enter the legal name of the QFT or the entity filing the return.

Line 2: Employer identification number (EIN)

- Enter the EIN assigned to the trust or filing entity. Use the correct EIN, not an SSN.

Line 3a: Name and title of trustee

- Provide the full name and title (e.g., “Trustee”) of the individual responsible.

Line 3b: Number, street, and room or suite no. (If a P.O. box, see instructions.)

- List the physical street address. P.O. boxes are permitted only with justification.

Line 3c: City or town, state, and ZIP code

- Complete the mailing address for correspondence.

Line 4: Number of QFTs included on this return

- State how many separate QFTs are being reported with this composite return.

Line 5: Check applicable boxes:

- Mark all that apply from the following:

- Initial return

- Amended return

- Final return

- Change in the fiduciary or fiduciary’s name

- Change in fiduciary’s address

Part II – Tax Computation

Income

Line 1a: Interest income

- Enter all taxable interest income received for the trusts.

Line 1b: Tax-exempt interest (Don’t include on line 1a)

- Enter total tax-exempt interest earned; DO NOT include this in line 1a.

Line 2a: Total ordinary dividends

- Enter the sum of all ordinary dividends received.

Line 2b: Qualified dividends

- Enter portion of above that qualify as “qualified dividends.”

Line 3: Capital gain or (loss) (attach Schedule D (Form 1041))

- Report the net of capital gains/losses and attach Schedule D if necessary.

Line 4: Other income. List type and amount

- Specify the source (such as rents or royalties) and dollar amount.

Line 5: Total income. Combine lines 1a, 2a, 3, and 4

- Add taxable interest, total dividends, capital gain or loss, and other income for total.

Deductions

Line 6: Taxes

- Enter any deductible taxes paid by the trust(s), such as state/local taxes.

Line 7: Trustee fees

- List fees paid to the trustee for administration.

Line 8: Attorney, accountant, and return preparer fees

- Enter professional fees for legal, accounting, or tax preparation.

Line 9: Other deductions

- List and describe any other allowable deductions (see instructions).

Line 10: Total deductions. Add lines 6 through 9

- Sum these lines for the total deductions amount.

Tax and Payments

Line 11: Taxable income. Subtract line 10 from line 5

- Subtract total deductions from total income to determine taxable income.

Line 12: Tax. (If this is a composite return, check here ☐)

- Compute the tax liability for the QFT(s)—check the box if this is a composite return.

Line 13: Credits (see instructions). Specify the credits claimed

- Enter all allowable credits (identify each type and amount clearly).

Line 14: Subtract line 13 from line 12

- Subtract total credits from tax to determine the net tax liability.

Line 15: Net Investment Income Tax from Form 8960, line 21

- Report NII tax here if applicable (see Form 8960 instructions).

Line 16: Total tax. Add lines 14 and 15

- Combine to get total tax owed after credits and NII tax.

Line 17: Payments (see instructions)

- Enter all payments already made (e.g., estimated tax payments, withholding).

Line 18: Elective payment election amount from Form 3800

- Enter elective payment amount from Form 3800 if claiming bonus credits.

Line 19: Tax due. If the total of lines 17 and 18 is smaller than line 16, enter amount owed

- If total payments and elective payment are less than total tax, enter the amount due.

Line 20: Overpayment. If the total of lines 17 and 18 is larger than line 16, enter amount overpaid

- If total payments and elective payments exceed total tax, enter amount overpaid.

Line 21: Amount of line 20 to be:

- a Credited to next year’s estimated tax

- b Refunded

- Indicate how the overpayment should be applied: as a credit for next year or refunded.

Sign Here

- The trustee or a representative officer must sign and date the completed form, certifying accuracy and completeness.

- Check “Yes” or “No” to indicate if the IRS can discuss the return with the paid preparer.

Paid Preparer Use Only

- If the return is prepared by a paid professional, they must complete:

- Print/type name, signature, and date

- Self-employed checkbox if applicable

- PTIN (Preparer Tax Identification Number)

- Firm’s name, address, phone, EIN

FAQs

Q: Who needs to file IRS Form 1041-QFT?

A: The trustee of a qualified funeral trust must file Form 1041-QFT to report the trust’s annual income and tax.

Q: Can one 1041-QFT return cover multiple trusts?

A: Yes, trustees can file a composite return for multiple QFTs and must specify the number included.

Q: What if the trust overpays tax?

A: Indicate on line 21 if you want the overpayment credited to next year’s estimated tax or refunded.