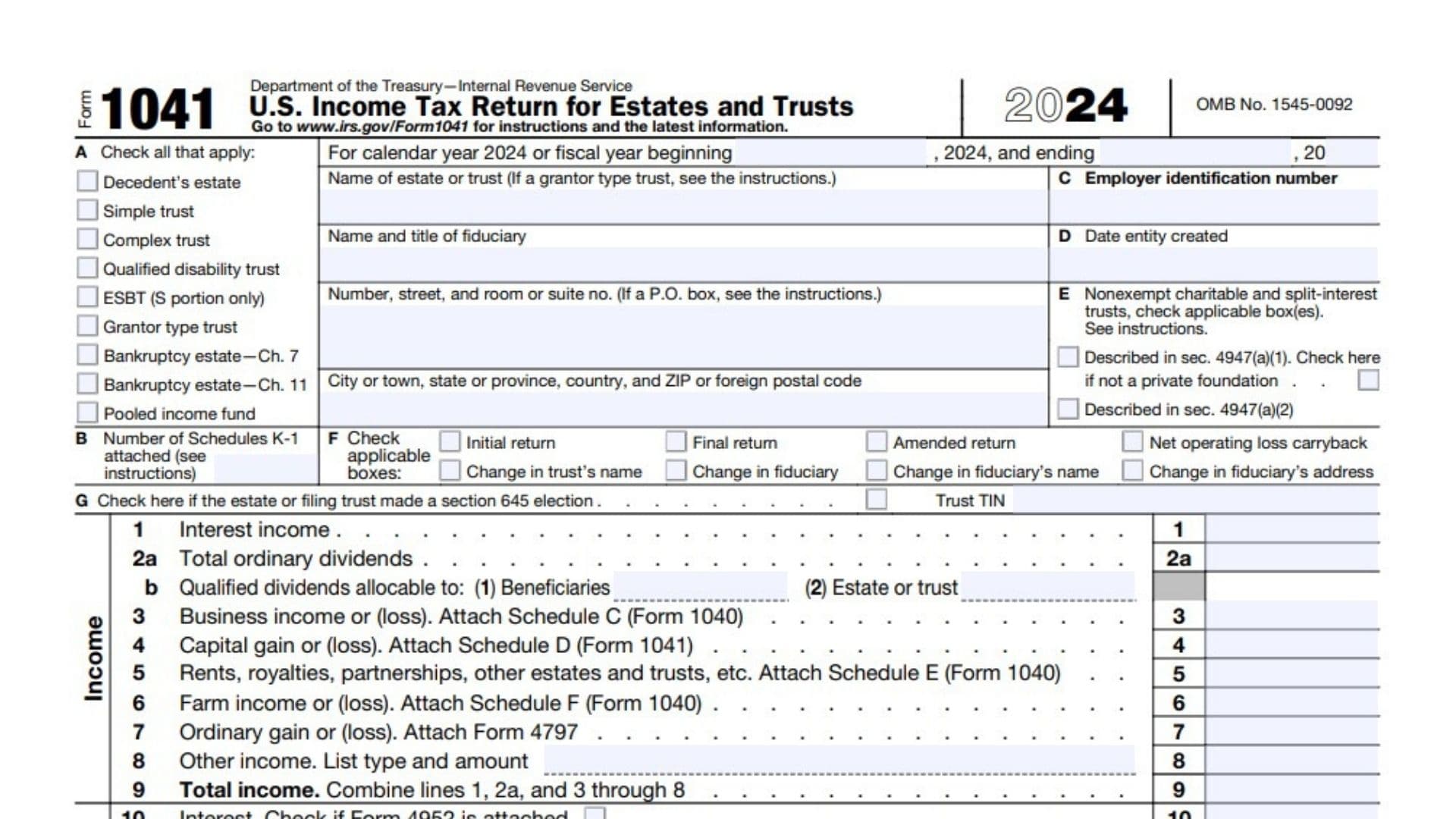

IRS Form 1041 is the U.S. Income Tax Return for Estates and Trusts. This form is used to report income, deductions, gains, and losses from the operation of estates and trusts. It is filed by fiduciaries (the individuals or institutions that manage estates or trusts) for the tax year of the estate or trust. The form also reports the income distributions made to beneficiaries, who may then use the information to file their personal tax returns. Form 1041 ensures that estates and trusts comply with federal income tax laws and accurately allocate income and deductions to the respective parties involved. If a trust or estate is required to file this form, it must also issue Schedule K-1 (Form 1041) to beneficiaries to report their share of income, deductions, and other items from the trust or estate.

How to File Form 1041?

- Gather Estate or Trust Information:

- Ensure that the entity’s details, such as name, EIN, and creation date, are available. The fiduciary must also provide their own contact details, including name, title, and address.

- Select the Correct Type of Entity:

- Box A allows the fiduciary to check the applicable entity type, such as decedent’s estate, simple trust, complex trust, or others.

- Determine Income for the Estate or Trust:

- Report income from various sources such as interest, dividends, business income, capital gains, rents, royalties, and farm income. All income is added up on line 9 to get the total income.

- Deductions:

- Report deductions for interest, taxes, fiduciary fees, charitable deductions, and other allowed expenses. Add all deductions on line 16 and subtract them from the total income to get the Adjusted Total Income or (Loss) on line 17.

- Income Distribution Deduction:

- If income is distributed to beneficiaries, report the income distribution deduction on line 18. This deduction is based on Schedule B and the distribution amount calculated in the trust’s governing instrument.

- Tax Computation:

- Subtract the total deductions (line 22) from the adjusted income (line 17) to calculate Taxable Income on line 23. The total tax liability is then computed on line 24, and any applicable credits or penalties are added to determine the final tax due or overpayment.

- Payments:

- Report estimated tax payments, payments from Form 7004, any withholding on line 14, and other tax payments. Subtract these payments from the total tax owed on line 9 to determine the balance due or overpayment.

- Sign the Form:

- The fiduciary must sign the form under penalties of perjury, verifying the information is correct.

- Schedule K-1 (Form 1041):

- Attach Schedule K-1 to Form 1041 for each beneficiary, reporting their share of income and deductions.

- File the Form:

- Submit Form 1041 to the IRS by the deadline (typically April 15 for calendar year filers, but may vary). If you are filing for a fiscal year, use the correct dates on the form.

How to Complete Form 1041?

Part I – Income

- Line 1 – Interest income:

- Report interest income earned by the estate or trust.

- Line 2a – Total ordinary dividends:

- Report the total ordinary dividends received.

- Line 2b – Qualified dividends allocable to: (1) Beneficiaries (2) Estate or trust:

- Report qualified dividends that are allocated to the beneficiaries or retained by the estate or trust.

- Line 3 – Business income or (loss). Attach Schedule C (Form 1040):

- Report any income or losses from a business operated by the estate or trust. Attach Schedule C if applicable.

- Line 4 – Capital gain or (loss). Attach Schedule D (Form 1041):

- Report capital gains or losses. Attach Schedule D for details.

- Line 5 – Rents, royalties, partnerships, other estates and trusts, etc. Attach Schedule E (Form 1040):

- Report income from rents, royalties, and partnerships. Attach Schedule E if applicable.

- Line 6 – Farm income or (loss). Attach Schedule F (Form 1040):

- Report any income or losses from farming activities. Attach Schedule F if applicable.

- Line 7 – Ordinary gain or (loss). Attach Form 4797:

- Report any ordinary gains or losses, such as from the sale of property. Attach Form 4797 if needed.

- Line 8 – Other income. List type and amount:

- Report any other income not already included in the above categories.

- Line 9 – Total income. Combine lines 1, 2a, and 3 through 8:

- Add the amounts from lines 1, 2a, and 3 through 8 to calculate the total income.

Part II – Deductions

- Line 10 – Interest. Check if Form 4952 is attached:

- Report interest expenses here. If applicable, check the box to indicate that Form 4952 (Investment Interest Expense Deduction) is attached.

- Line 11 – Taxes:

- Report any taxes paid, such as state or local income taxes, real estate taxes, or other taxes incurred by the estate or trust.

- Line 12 – Fiduciary fees. If only a portion is deductible under section 67(e), see instructions:

- Report fiduciary fees. If the fee is partially deductible under Section 67(e), ensure the correct amount is reported.

- Line 13 – Charitable deduction (from Schedule A, line 7):

- Report any charitable deductions from Schedule A. Only certain trusts and estates qualify for this deduction.

- Line 14 – Attorney, accountant, and return preparer fees. If only a portion is deductible under section 67(e), see instructions:

- Report fees for legal, accounting, or preparation services. If only part of the fees are deductible under Section 67(e), follow the instructions.

- Line 15a – Other deductions (attach schedule). See instructions for deductions allowable under section 67(e):

- Report other allowable deductions. Attach a detailed schedule if needed.

- Line 15b – Net operating loss deduction. See instructions:

- If applicable, report the net operating loss deduction.

- Line 16 – Add lines 10 through 15b:

- Add the amounts from lines 10 through 15b to calculate total deductions.

- Line 17 – Adjusted total income or (loss). Subtract line 16 from line 9:

- Subtract the total deductions (line 16) from the total income (line 9) to calculate adjusted total income or loss.

- Line 18 – Income distribution deduction (from Schedule B, line 15). Attach Schedules K-1 (Form 1041):

- Report the income distribution deduction. Refer to Schedule B, line 15, and attach Schedule K-1 for each beneficiary.

- Line 19 – Estate tax deduction including certain generation-skipping taxes (attach computation):

- Report the estate tax deduction, including certain generation-skipping taxes. Attach a detailed computation.

- Line 20 – Qualified business income deduction. Attach Form 8995 or 8995-A:

- If applicable, report the qualified business income deduction. Attach Form 8995 or 8995-A for details.

- Line 21 – Exemption:

- Report any exemptions that apply to the estate or trust.

- Line 22 – Add lines 18 through 21:

- Add the amounts from lines 18 through 21 to get the total deductions.

Part III – Tax and Payments

- Line 23 – Taxable income. Subtract line 22 from line 17. If a loss, see instructions:

- Subtract the total deductions (line 22) from the adjusted total income (line 17) to calculate taxable income. If the result is a loss, follow the instructions.

- Line 24 – Total tax (from Schedule G, Part I, line 9):

- Report the total tax calculated on Schedule G, Part I, line 9.

- Line 25 – Current year net 965 tax liability paid from Form 965-A, Part II, column (k) (see instructions):

- If applicable, report the current year’s net 965 tax liability from Form 965-A.

- Line 26 – Total payments (from Schedule G, Part II, line 19):

- Report the total payments made, as calculated on Schedule G, Part II, line 19.

- Line 27 – Estimated tax penalty. See instructions:

- Report any penalty for underpayment of estimated taxes.

- Line 28 – Tax due. If line 26 is smaller than the total of lines 24, 25, and 27, enter amount owed:

- If total payments (line 26) are less than the tax liability (lines 24, 25, and 27), enter the amount of tax due.

- Line 29 – Overpayment. If line 26 is larger than the total of lines 24, 25, and 27, enter amount overpaid:

- If total payments (line 26) exceed the total tax liability, enter the amount overpaid.

- Line 30 – Amount of line 29 to be: a. Credited to 2025; b. Refunded:

- Indicate how the overpayment (line 29) should be handled: applied as a credit to 2025 taxes or refunded.

Signature Section

- Signature of fiduciary or officer representing fiduciary:

- The fiduciary or authorized representative must sign the form, declaring it to be correct and complete under penalties of perjury.

Schedule A – Charitable Deduction

- Line 1 – Amounts paid or permanently set aside for charitable purposes from gross income:

- Report any charitable contributions made by the estate or trust.

- Line 2 – Tax-exempt income allocable to charitable contributions:

- Report any tax-exempt income that is allocated to charitable contributions.

- Line 3 – Subtract line 2 from line 1:

- Subtract the tax-exempt income from the gross charitable contributions.

- Line 4 – Capital gains for the tax year allocated to corpus and paid or permanently set aside for charitable purposes:

- Report any capital gains allocated to the trust’s corpus and used for charitable purposes.

- Line 5 – Add lines 3 and 4:

- Add the results of lines 3 and 4 to determine the total charitable deduction.

- Line 6 – Section 1202 exclusion allocable to capital gains paid or permanently set aside for charitable purposes:

- Report any exclusions related to Section 1202 capital gains.

- Line 7 – Charitable deduction. Subtract line 6 from line 5. Enter here and on page 1, line 13:

- Subtract any Section 1202 exclusion from the total charitable deduction. Enter the final charitable deduction on page 1, line 13.

Schedule B – Income Distribution Deduction

- Line 1 – Adjusted total income:

- Report the adjusted total income from page 1, line 17.

- Line 2 – Adjusted tax-exempt interest:

- Report the adjusted tax-exempt interest for the estate or trust.

- Line 3 – Total net gain from Schedule D (Form 1041), line 19, column (1):

- Report the net gain from Schedule D.

- Line 4 – Enter amount from Schedule A, line 4 (minus any allocable section 1202 exclusion):

- Report the amount of capital gains from Schedule A.

- Line 5 – Capital gains for the tax year included on Schedule A, line 1:

- Report the capital gains from Schedule A.

- Line 6 – Enter any gain from page 1, line 4, as a negative number. If page 1, line 4, is a loss, enter the loss as a positive number:

- Report any gain or loss from page 1, line 4.

- Line 7 – Distributable net income:

- Combine the amounts from lines 1 through 6 to calculate the distributable net income (DNI).

- Line 8 – If a complex trust, enter accounting income for the tax year:

- If applicable, report the accounting income for a complex trust.

- Line 9 – Income required to be distributed currently:

- Report the income required to be distributed to beneficiaries in the current year.

- Line 10 – Other amounts paid, credited, or otherwise required to be distributed:

- Report any other amounts required to be distributed to beneficiaries.

- Line 11 – Total distributions:

- Add the amounts from lines 9 and 10 to determine the total distributions.

- Line 12 – Enter the amount of tax-exempt income included on line 11:

- Report the tax-exempt income included in the total distributions.

- Line 13 – Tentative income distribution deduction:

- Subtract line 12 from line 11 to calculate the tentative income distribution deduction.

- Line 14 – Tentative income distribution deduction. Subtract line 2 from line 7:

- Subtract line 2 from line 7 to calculate another version of the tentative income distribution deduction.

- Line 15 – Income distribution deduction:

- Enter the smaller of line 13 or line 14 here and on page 1, line 18.

Schedule G – Tax Computation and Payments

Part I – Tax Computation

- Line 1a – Tax on taxable income:

- Report the tax on taxable income. This is calculated based on the taxable income reported on Line 23 of the main form (Form 1041). Follow the instructions to compute this tax amount, using the appropriate tax rates.

- Line 1b – Tax on lump-sum distributions. Attach Form 4972:

- If the estate or trust has made any lump-sum distributions, calculate the tax on those distributions using Form 4972. Enter the resulting amount here.

- Line 1c – Alternative minimum tax (from Schedule I (Form 1041), line 54):

- If applicable, report the alternative minimum tax (AMT) computed on Schedule I (Form 1041), line 54. This tax applies if the estate or trust has certain tax attributes that are subject to AMT.

- Line 1d – Amount from Form 4255, Part I, line 3, column (q):

- If applicable, report the amount from Form 4255 (Recapture of Investment Credit), Part I, line 3, column (q). This is used for any recapture of credits related to investment or rehabilitation credits.

- Line 1e – Total. Add lines 1a through 1d:

- Add the tax from lines 1a, 1b, 1c, and 1d to compute the total tax owed.

Part II – Payments

- Line 10 – Current year’s estimated tax payments and amount applied from preceding year’s return:

- Report the estate or trust’s estimated tax payments made for the current tax year, plus any amount carried over from the previous year’s return.

- Line 11 – Estimated tax payments allocated to beneficiaries (from Form 1041-T):

- Report any estimated tax payments made that were specifically allocated to beneficiaries. These amounts come from Form 1041-T.

- Line 12 – Subtract line 11 from line 10:

- Subtract the amount reported on Line 11 (allocated to beneficiaries) from the total payments reported on Line 10 (current year’s payments and prior year’s carryover). This will show the amount of estimated tax payments attributable to the estate or trust.

- Line 13 – Tax paid with Form 7004:

- Report any taxes paid with Form 7004 (Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns).

- Line 14 – Federal income tax withheld. If any is from Form(s) 1099, check here:

- Report any federal income tax withheld during the tax year, such as withholding from Form 1099 or other applicable forms. If the withholding is from Form 1099, check the box to indicate that.

- Line 15 – Current year net 965 tax liability from Form 965-A, Part I, column (f) (see instructions):

- Report the current year’s net Section 965 tax liability (which applies to foreign earnings) as calculated on Form 965-A, Part I, column (f).

- Line 16 – Payments from Form 2439:

- Report any payments made from Form 2439 (Notice to Shareholder of Undistributed Long-Term Capital Gains).

- Line 17 – Payments from Form 4136:

- Report any payments made from Form 4136 (Credit for Federal Tax Paid on Fuels).

- Line 18a – Elective payment election amount from Form 3800:

- Report the elective payment election amount made from Form 3800 (General Business Credit), if applicable.

- Line 18b – Other credits or payments (see instructions):

- Report any other credits or payments not listed above. This could include any other allowable payments made during the year that reduce tax liability.

- Line 19 – Total payments. Add lines 12 through 18b. Enter here and on page 1, line 26:

- Add up all the payments from Lines 12 through 18b to get the total amount of payments made. Transfer the total to Page 1, Line 26.

Certainly! Here is the “Other Information” section from IRS Form 1041:

Other Information

- Question 1 – Did the estate or trust receive tax-exempt income? If “Yes,” attach a computation of the allocation of expenses. Enter the amount of tax-exempt interest income and exempt-interest dividends:

- If the estate or trust received any tax-exempt income (such as from municipal bonds), check “Yes” and attach a detailed computation showing how expenses were allocated against the tax-exempt income. Report the total amount of tax-exempt income, including exempt-interest dividends, on the line provided.

- Question 2 – Did the estate or trust receive all or any part of the earnings (salary, wages, and other compensation) of any individual by reason of a contract assignment or similar arrangement?:

- If the estate or trust received earnings or compensation (such as salary or wages) from a contract assignment or similar arrangement, check “Yes” and provide the details as instructed in the form.

- Question 3 – At any time during the calendar year 2024, did the estate or trust have an interest in or a signature or other authority over a bank, securities, or other financial account in a foreign country?:

- If the estate or trust had an interest in, signature authority over, or any other authority regarding a foreign financial account during the year, check “Yes” and specify the foreign country. This is important for compliance with FinCEN Form 114 (FBAR) reporting requirements.

- Question 4 – During the tax year, did the estate or trust receive a distribution from, or was it the grantor of, or transferor to, a foreign trust? If “Yes,” the estate or trust may have to file Form 3520.:

- If the estate or trust received a distribution from, or was the grantor or transferor to a foreign trust, check “Yes.” The estate or trust may be required to file Form 3520 (Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts). Follow the instructions for this filing requirement.

- Question 5 – Did the estate or trust receive, or pay, any qualified residence interest on seller-provided financing? If “Yes,” see the instructions for the required attachment:

- If the estate or trust received or paid any qualified residence interest on seller-provided financing (such as for property transactions), check “Yes” and follow the instructions to attach the required documentation.

- Question 6 – If this is an estate or a complex trust making the section 663(b) election, check here.:

- If the estate or complex trust is making the Section 663(b) election (election to treat income distributed in the current year as if it were distributed in the previous year), check “Yes.” This election affects the timing of income distributions for tax purposes.

- Question 7 – To make a section 643(e)(3) election, attach Schedule D (Form 1041), and check here.:

- If the estate or trust is making the Section 643(e)(3) election (election to treat capital gains as part of distributable net income), attach Schedule D (Form 1041) and check this box.

- Question 8 – If the decedent’s estate has been open for more than 2 years, attach an explanation for the delay in closing the estate, and check here.:

- If the decedent’s estate has been open for more than two years, attach a written explanation for the delay in closing the estate and check the box.

- Question 9 – Are any present or future trust beneficiaries skip persons?:

- If the estate or trust has any “skip persons” (individuals who are two or more generations below the grantor, such as grandchildren), check “Yes” and provide the relevant information. This could be relevant for generation-skipping transfer (GST) tax purposes.

- Question 10 – Was the trust a specified domestic entity required to file Form 8938 for the tax year?:

- If the trust is a specified domestic entity (a trust that holds foreign financial assets) and is required to file Form 8938 (Statement of Specified Foreign Financial Assets), check “Yes.” The instructions for Form 8938 will help determine whether this applies.

- Question 11a – Did the estate or trust distribute S corporation stock for which it made a section 965(i) election?:

- If the estate or trust distributed S corporation stock for which it made a Section 965(i) election (to defer tax on foreign income), check “Yes.”

- Question 11b – If “Yes,” did each beneficiary enter into an agreement to be liable for the net tax liability?:

- If the estate or trust made the Section 965(i) election for S corporation stock, check “Yes” if each beneficiary has agreed to be liable for the net tax liability arising from the distribution.

- Question 12 – Did the estate or trust either make a section 965(i) election or enter into a transfer agreement as an eligible section 965(i) transferee for S corporation stock held on the last day of the tax year?:

- If the estate or trust made the Section 965(i) election or entered into a transfer agreement regarding S corporation stock, check “Yes” and ensure the appropriate documentation is attached.

- Question 13 – At any time during the tax year, did the estate or trust (a) receive (as a reward, award, or payment for property or services); or (b) sell, exchange, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?:

- If the estate or trust received or disposed of a digital asset (such as cryptocurrency), check “Yes” and follow the instructions for reporting this activity.

- Question 14 – ESBTs only. Does the ESBT have a nonresident alien grantor?:

- If the estate or trust is an Electing Small Business Trust (ESBT) and it has a nonresident alien grantor, check “Yes.”

- Question 15 – ESBTs only. Did the S portion of the trust claim a qualified business income deduction?:

- If the S portion of the ESBT claimed a qualified business income (QBI) deduction, check “Yes.”