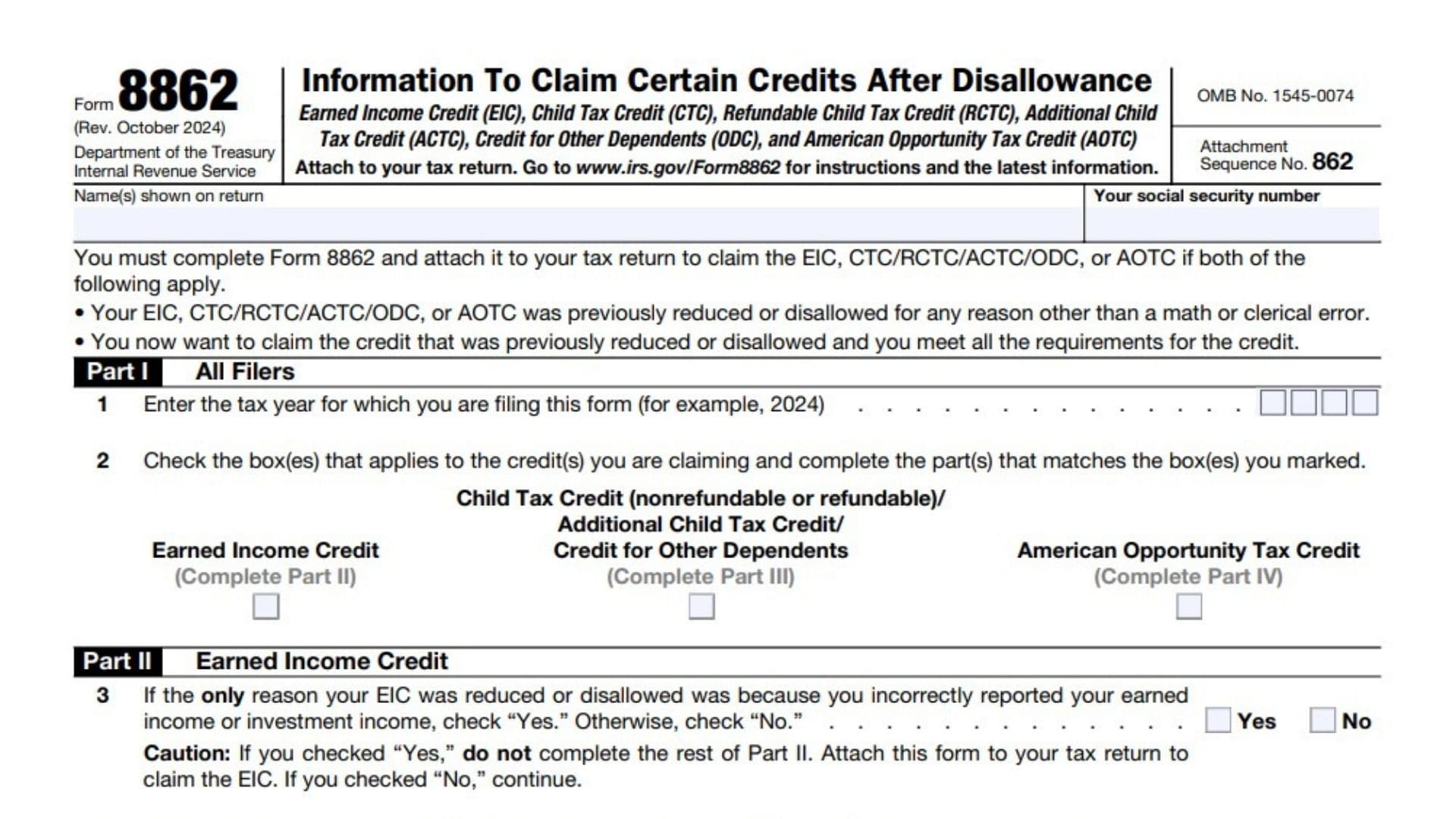

Form 8862, titled “Information to Claim Certain Credits After Disallowance,” is a crucial document for taxpayers who wish to reclaim specific tax credits that were previously disallowed. This form is primarily used for claiming the Earned Income Credit (EIC), Child Tax Credit (CTC), Refundable Child Tax Credit (RCTC), Additional Child Tax Credit (ACTC), Credit for Other Dependents (ODC), and the American Opportunity Tax Credit (AOTC). Taxpayers must complete Form 8862 if their claim for any of these credits was reduced or denied for reasons other than a math or clerical error. By filling out this form, individuals demonstrate that they now meet all eligibility requirements for the credits in question. The form includes sections that require taxpayers to provide information about their qualifying children, residency status, and any pertinent changes in circumstances since the prior disallowance. Completing Form 8862 accurately is essential for taxpayers to regain access to valuable tax benefits that can significantly reduce their tax liability.

How to Complete Form 8862?

Part I: All Filers

- Line 1: Enter the tax year for which you are filing this form (for example, 2024).

- Line 2: Check the box(es) that apply to the credit(s) you are claiming:

- Child Tax Credit (nonrefundable or refundable)

- Additional Child Tax Credit

- Earned Income Credit (Complete Part II)

- American Opportunity Tax Credit (Complete Part III)

Part II: Earned Income Credit

- Line 3: If the only reason your EIC was reduced or disallowed was due to incorrectly reported earned income or investment income, check “Yes.” If not, check “No.” If “Yes,” do not complete the rest of Part II; attach this form to your tax return.

- Line 4: Answer whether you (or your spouse if filing jointly) could be claimed as a qualifying child of another taxpayer for the year entered on Line 1. If “Yes,” you cannot claim the EIC.

- Line 5: For each child you are claiming for EIC, enter their names as Child 1, Child 2, and Child 3.

- Line 6: Indicate if your completed Schedule EIC shows that you had a qualifying child for the EIC.

- Line 7: Enter the number of days each child lived with you in the United States during the year entered on Line 1.

- Line 8: If a child was born or died during the year entered on Line 1, enter the month and day of birth or death.

Section B: Filers Without a Qualifying Child

- Line 9a: Enter the number of days during the year your main home was in the United States.

- Line 9b: If married filing jointly, enter your spouse’s number of days in the U.S.

- Line 10a: Enter your age at the end of the year on Line 1.

- Line 10b: Enter your spouse’s age at the end of the year on Line 1.

- Line 11a: Indicate whether you can be claimed as a dependent on another taxpayer’s return.

- Line 11b: Indicate whether your spouse can be claimed as a dependent on another taxpayer’s return.

Part III: Child Tax Credit and Other Credits

- Line 12: Enter the names of each child for whom you are claiming CTC/RCTC/ACTC.

- Line 13: Enter names of each person for whom you are claiming ODC.

- Lines 14-17: Answer questions regarding residency, relationship to you, and citizenship status for each child or dependent listed.

Part IV: American Opportunity Tax Credit

- Lines 18-19: Provide information about each student for whom you are claiming AOTC and answer eligibility questions.