Form 6765, commonly referred to as the “Credit for Increasing Research Activities” or the Research & Development (R&D) Tax Credit, is designed to encourage innovation and technological advancement within U.S. businesses. This tax credit is available to companies that engage in qualified research activities, providing a dollar-for-dollar reduction in income tax liability based on eligible expenditures related to research and development efforts. The credit aims to incentivize businesses of all sizes to invest in innovative projects that contribute to economic growth and competitiveness across various industries.

Who Must File Form 6765?

Businesses across multiple sectors, including manufacturing, technology, pharmaceuticals, and others involved in qualified research activities, may be eligible to claim the R&D tax credit using Form 6765. This includes companies that incur expenses for activities aimed at developing or improving products, processes, software, or other technological advancements. Eligibility criteria are stringent, requiring businesses to substantiate their research efforts with documentation demonstrating the nature, scope, and outcomes of their R&D activities.

How to Complete Form 6765?

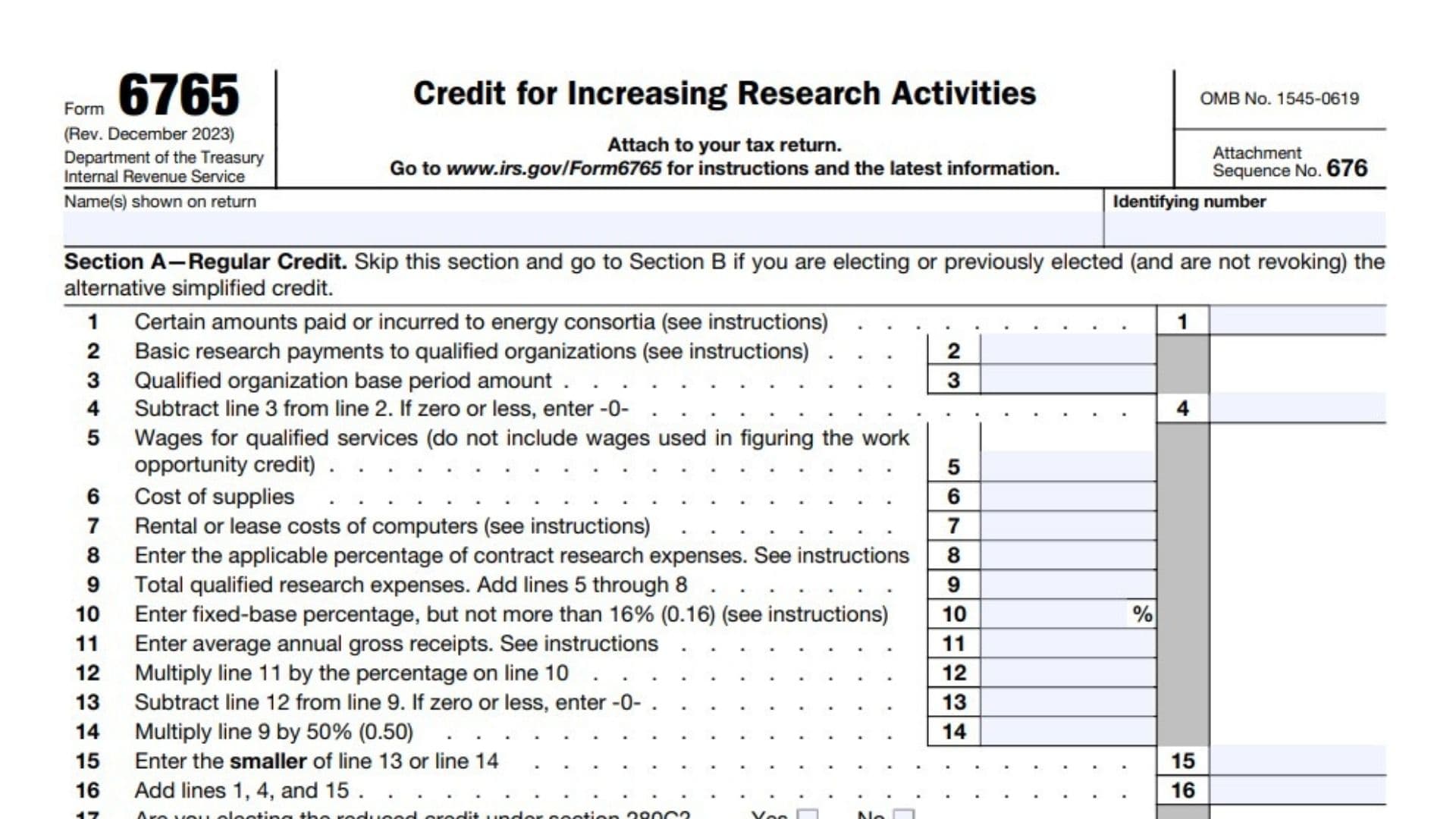

Section A – Regular Credit

- Line 1: Enter the amount paid to energy consortia.

- Line 2: Report basic research payments made to qualified organizations.

- Line 3: Enter the qualified organization base period amount.

- Line 4: Subtract Line 3 from Line 2 (enter zero if the result is negative).

- Line 5: Enter wages for qualified services (do not include wages used for the work opportunity credit).

- Line 6: Enter the cost of supplies used in research.

- Line 7: Report rental or lease costs of computers (follow instructions).

- Line 8: Enter the applicable percentage of contract research expenses (refer to instructions).

- Line 9: Add Lines 5 through 8 for the total qualified research expenses.

- Line 10: Enter the fixed-base percentage, but not more than 16%.

- Line 11: Report the average annual gross receipts (see instructions).

- Line 12: Multiply Line 11 by the percentage on Line 10.

- Line 13: Subtract Line 12 from Line 9 (enter zero if the result is negative).

- Line 14: Multiply Line 9 by 50%.

- Line 15: Enter the smaller of Line 13 or Line 14.

- Line 16: Add Lines 1, 4, and 15 for the total research credit.

- Line 17: If you are electing the reduced credit under section 280C, multiply Line 16 by 15.8%; otherwise, multiply by 20%.

Section B – Alternative Simplified Credit

- Line 18: Enter amounts paid to energy consortia.

- Line 19: Report basic research payments to qualified organizations.

- Line 20: Enter the qualified organization base period amount.

- Line 21: Subtract Line 20 from Line 19 (enter zero if the result is negative).

- Line 22: Add Lines 18 and 21.

- Line 23: Multiply Line 22 by 20%.

- Line 24: Report wages for qualified services.

- Line 25: Enter the cost of supplies used in research.

- Line 26: Report rental or lease costs of computers.

- Line 27: Enter the applicable percentage of contract research expenses.

- Line 28: Add Lines 24 through 27 for total qualified research expenses.

- Line 29: Enter total qualified research expenses for the prior three tax years.

- Line 30: Divide Line 29 by 6.

- Line 31: Subtract Line 30 from Line 28 (enter zero if the result is negative).

- Line 32: Multiply Line 31 by 14%; if Line 30 and 31 were skipped, multiply Line 28 by 6%.

- Line 33: Add Lines 23 and 32 for total research credit.

- Line 34: If you elect the reduced credit under section 280C, multiply Line 33 by 79%.

Section C – Current Year Credit:

- Line 35: Enter the portion of the credit from Form 8932, Line 2, attributable to wages also used to figure the credit on Line 17 or 34.

- Line 36: Subtract Line 35 from Line 17 or 34.

- Line 37: Enter credit for increasing research activities from partnerships, S corporations, estates, and trusts.

- Line 38: Add Lines 36 and 37.

Section D – Qualified Small Business Payroll Tax Election

- Line 41: Check this box if you are electing the payroll tax credit.

- Line 42: Enter the portion of Line 36 elected as a payroll tax credit (no more than $500,000).

- Line 43: Enter general business credit carryforward from the current year.

- Line 44: Enter the smaller of Line 36 or 42.