The Additional Child Tax Credit (ACTC) is designed to provide a financial boost to families who qualify for the Child Tax Credit (CTC) but are unable to fully benefit due to insufficient tax liability. The ACTC allows these families to receive a refund even if their tax liability is zero, making it an essential tool for supporting household finances and ensuring the well-being of children. Form 8812 should be filed by taxpayers who:

- Have qualifying children under age 17.

- Did not receive the full amount of the Child Tax Credit (CTC) due to insufficient tax liability.

- Meet the income requirements for the Additional Child Tax Credit (ACTC).

How to File Form 8812?

To file Form 8812, follow these steps:

- Obtain the Form: Download Form 8812 from the IRS website or request a paper copy by mail.

- Complete and Attach: Fill out the form accurately with the required information and attach it to your annual tax return (Form 1040 or Form 1040-SR).

How to Complete Form 8812?

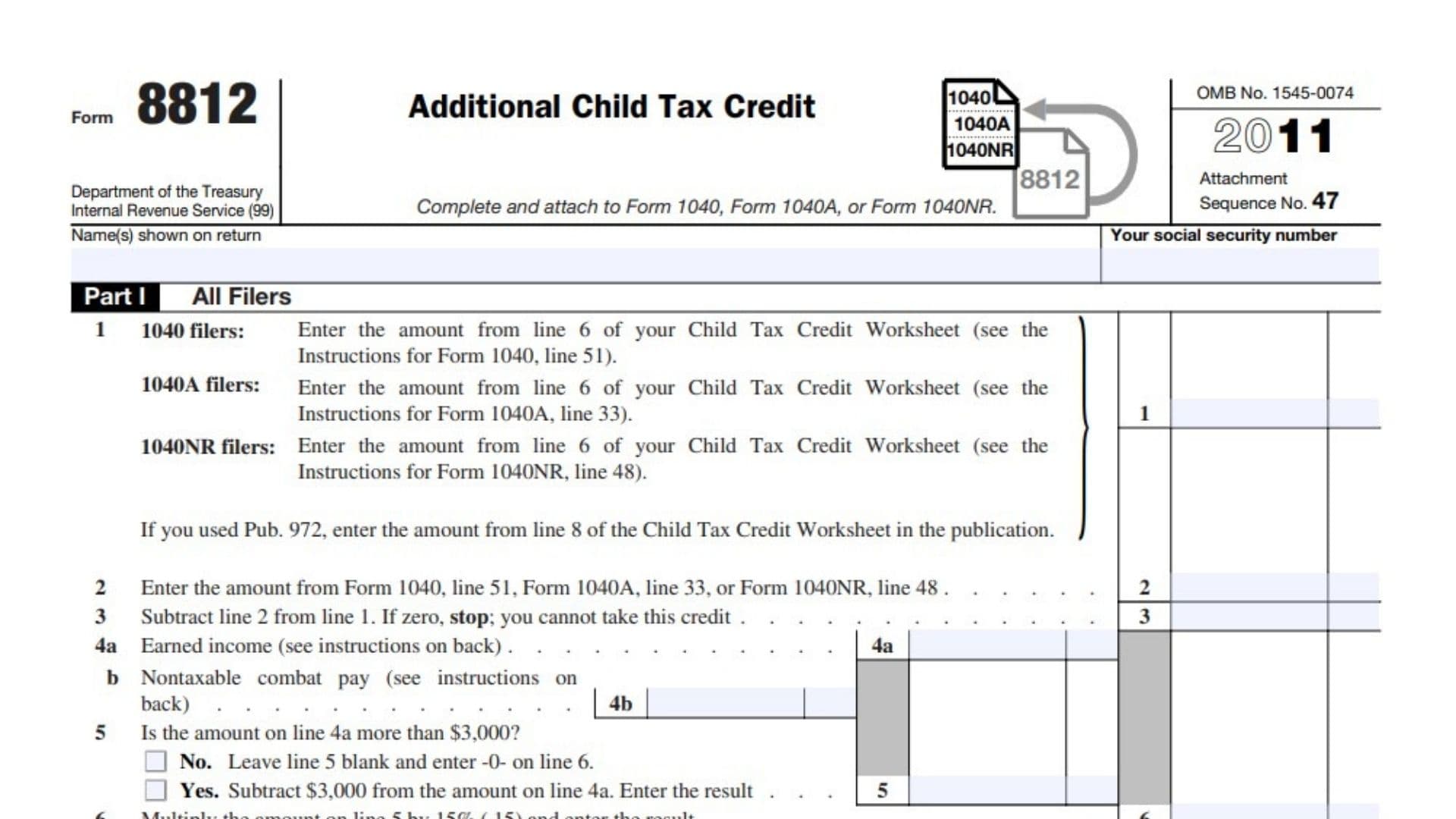

Part I – All Filers

- Line 1: Enter the amount from the Child Tax Credit Worksheet (specific line varies depending on the form you’re filing: Form 1040, 1040A, or 1040NR).

- Line 2: Enter the amount from the designated line of your tax return (Form 1040, 1040A, or 1040NR).

- Line 3: Subtract line 2 from line 1. If zero, you cannot take the credit and should stop.

- Line 4a: Enter your earned income.

- Line 4b: Enter any nontaxable combat pay.

- Line 5: If your earned income exceeds $3,000, subtract $3,000 from line 4a and enter the result. Otherwise, enter zero.

- Line 6: Multiply line 5 by 15% and enter the result.

- Decision Point: If you have three or more qualifying children and if line 6 equals or exceeds line 3, skip Part II and proceed to line 13. Otherwise, continue to Part II.

Part II – Certain Filers with Three or More Qualifying Children:

- Line 7: Enter the total Social Security and Medicare taxes withheld, including amounts for both spouses if filing jointly.

- Line 8: Enter specific taxes from your tax return (lines vary depending on the form you’re filing).

- Line 9: Add lines 7 and 8.

- Line 10: Enter certain taxes from your tax return (lines vary depending on the form you’re filing).

- Line 11: Subtract line 10 from line 9.

- Line 12: Enter the larger of line 6 or line 11.

Part III – Additional Child Tax Credit:

- Line 13: Enter the smaller of line 3 or line 12. This is your Additional Child Tax Credit, which should be transferred to the relevant line on your tax return.